As mentioned in earlier posts, I think it’s a human tendency to focus on our successes, but often it’s the failures that are more instructive. To be fair and balanced, this post will be about one of my failures.

Flyke International is one of my failed investments. I first initiated a position in Flyke in 2011, ultimately putting about $30k of capital into the company.

Flyke International is a HK listed, shoe soles making company. They also manufacture their own line of apparel and shoes, and own retail shops selling apparels such as the lower margin sportswear and a higher margin casual wear. They also help other brands to manufacture shoe soles, which they then export.

Income statement

By all metrics, Flyke was a value investor’s dream when I first initiated a position… well if you look strictly and only at the financials.

The PER was <4, price to book was around 0.4, NPM was unusually high at 13.9% (I’ll later come to realise that is really ridiculously high for a apparel retailer).

Return on equity, which is one of my favorite metrics if the company employs little debt, is also ridiculously high at around 25%-28% for FY10 and FY11, and much higher (>40%!) in the years prior. ROE becomes an inaccurate valuation metric if the company employs a lot of debt though, as the equity portion becomes artifically bloated.

In any case, if one looks at the numbers and ONLY the numbers alone, this is a very compelling case for a value investor.

On top of all this, just before I invested, the company had issued a ton of stock options to a private investor at an exercise price that’s much higher than my purchase price.

And the ultimate cherry is that the company itself did share buybacks, again at a price that is much higher than my purchase price. All very confidence boosting eh?

So… dirt cheap valuations, high returns for the past 5 years, a business that is vertically integrated (they manufacture for themselves, export to other retailers, and have their own retail stores), management consists of family members. This should be a home run, isn’t it?

The 1st sign of trouble came in end 2012. Even then it didn’t look too bad.

The company released a profit warning, saying they’re expecting reduced profitability due to blahblahblah, and that they’d reduce stores, closing unprofitable ones and consolidating in strongholds etc.

Reduced profitability. That’s no big deal. Which company doesn’t experience reduced profitability from time to time?

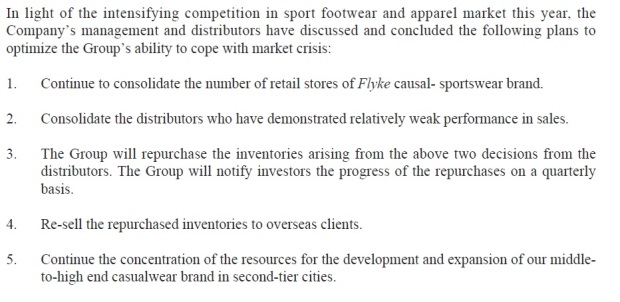

The company quickly went down hill from there onwards. The financials deteriorated at an alarming rate and the company came up with a plan, which, to their credit, was clearly spelt out to shareholders:

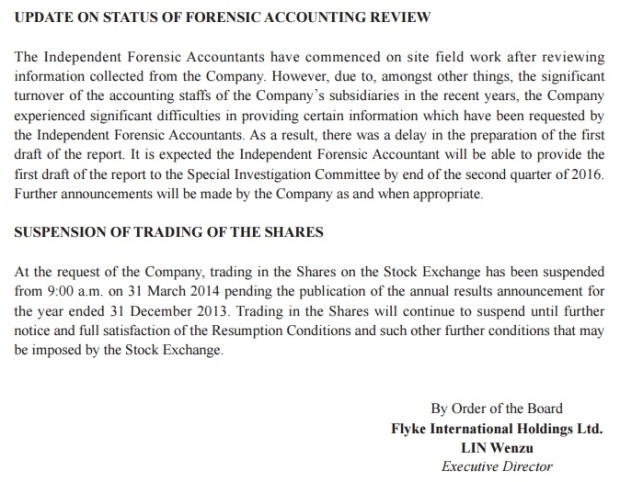

Finally, the worst came in early 2014 when the company failed to file it’s financials, citing missing funds that are unaccounted for. The shares had their listing suspended, while an “internal investigation” was carried out. I won’t go into details except to say that since then, it has just gotten even worse. The external forensic accounting company that was hired actually resigned, citing a lack of cooperation and payment.

In short, this whole thing has blown up. In my mind, this is a fraud company. Flyke, it turns out, is a fluke. (pun intended)

The rot starts at the top, with the management being unable to account for certain funds. Although the company is listed on the HKEx, this is primarily a chinese company with operations mostly in China. After multiple “forensic accounting” and “investigations”, all of which ran into problems, Flyke is still currently suspended on the HKEx.

As of now, this is the latest development:

BLAH.

Aftermath

I have since written off my entire investment in Flyke. Fortunately $30k is not a huge proportion of my portfolio. Painful nevertheless, but not fatal. If, and when, the shares ever become available for trading again, I’d be selling my entire stake in Flyke at any price available. I don’t think that’s going to ever happen though.

Lessons learnt

Now, what can I do better?

To be honest…. not much in this instance.

I certainly did my due diligence. Aside from dirt cheap financials, I did a qualitative assessment of the shoe and apparel market before I invested. Although Flyke was nowhere near the top and the most popular brands in China, they did move towards “westernizing” the brand. The Chinese consumers are also notoriously ficklet minded and I didn’t want to pay a premium for a top brand which may fall wayside quickly.

There was also certainly a valuation moat.

OK, there are some small tell tale signs. For example, their company secretary changed just before the entire company got suspended. This by itself though, wouldn’t be a big sign as secretaries change all the time isn’t it?

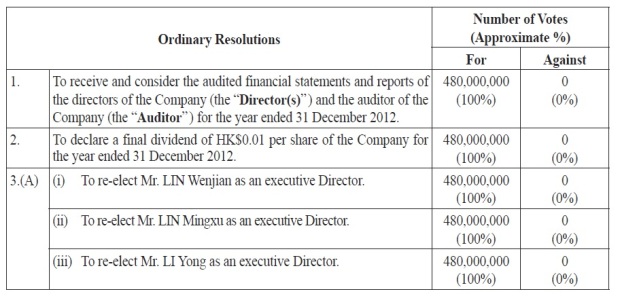

This though, is a bigger warning sign:

If these jokers can pass resolutions and get 100% approval, (which is basically just themselves), they must feel like they can get away with anything.

The ultimate lesson I have learnt though, is that despite all due diligence that one can do, sometimes, the vagaries of life are such that a successful investment may still not materialize no matter what you do.

Many things in investing are out of our control. Detailed analysis only swings the odds into your favor, not guarantee that the investment will be a hit. Over the long run, the hardworking, detailed analyst will outperform one that hasn’t done any work. In a single sample though, (a single investment) anything can happen.

It’s like going to the casino competing against a professional gambler. The professional who has prepared, studied and analysed, over several bets, will win the layman who is leisurely placing a bet. In any single hand though, the layman has every chance of beating the professional gambler.

This is where some diversification comes into play. My portfolio has always been intended as a concentrated one, but still, a certain diversification is required. Since this debacle, I’ve always looked at every company and considered: “Is this a Flyke?”

Current Musings

On a different note, since my divestment of Hock Lian Seng, I’ve started looking at places to deploy my capital. I’ve concluded that I’d likely keep most of the capital liquid, as I am generally rather pessimistic on the outlook. I’m also likely to build a short position at some point on S&P index, and possibly the Nikkei as well. I may find some ridiculously over valued company to short as well.

I did deploy some capital in the past couple of weeks though. I’ll likely do a comprehensive post on the company soon, and if I have the time, I’ll try to make it the most detailed one I have done thus far.

There are many value traps in Hong Kong stock exchange. I fell into a few and lost a few thousand dollars.

LikeLike

Hmmm one of the points I didn’t mention is that the companies who are obviously chinese companies, with operations in china and are sufficiently small, are the most dangerous ones as one must question why they are listed in HK and not in SSE. Similarly, most of us are familiar with the S chip problems in SGX.

Value traps indeed.

LikeLike

The financial ratio all that are so good yet selling at dirt cheap is itself a sign. Why would the market miss it for 5 years ?

LikeLike

There are currently, several companies both in HKex and SGX which have equally low financial ratios, and for several years too. I don’t think that by itself can be a sign. Markets do, routinely, value companies at very low valuations for prolonged periods of time.

LikeLike

I lost about S$50k for Spore-listed S chip Hong Sing. Till today it is still suspended. When the hype ‘China Rising- must not miss the boat’, I rushed in without much due diligence when it first listed in Spore.

LikeLike

Hi Fred, sorry to hear that. Generally, I am against buying IPOs. The whole IPO process revolves around getting as high a price as possible from the markets. All company executives will say that they are raising funds for expansion but in reality, many view IPOs as an exit strategy: to convert their asset into a quotable one, with a view to exit eventually. If it’s an S-chip, the risks are magnified greatly. Unless the management is reliable, all financials go out of the window.

Of course, we all hear of situations where those who subscribe to IPOs, double their money in a single day during the good times. Again, that’s the “Greater fool theory” that I mentioned before… not a great way to invest.

LikeLike