This has been incredibly difficult to write. King Wan holds the distinction of being one of my worst investments thus far. Probably the worst in fact. It is always easiest to reflect upon the successes, but the pain from the losses…

It is also the one company which I am least optimistic about in the short -mid term. I currently hold 1,000,000 shares of KW bought at an average cost of $0.28 or so, after accounting for dividends.

Upon reflecting though, I thought that KW is a fine example of incompetent management + my own emotions having clouded my judgement. The emotion part is particularly frustrating as I have flagged up many concerns in my investing thesis prior to investing, these concerns have now been realised and yet, at that point in time, I went ahead to buy 1,000,000 shares, HAVING done the due diligence.

I have no explanation, or excuse, for doing that. I must’ve been possessed.

The entire process, from my initial investment, together with how things have played out, my correspondence with KW’s management, and my view on how things will develop from here, should be rather entertaining to read though, assuming one has no teeth in the game.

This is KW’s official corporate profile:

“Established in 1977, King Wan Corporation Limited is a Singapore-based integrated building services company with principal activities in the provision of Mechanical and Electrical (M&E) engineering services for the building and construction industry.

Over the past three decades, King Wan has grown from strength to strength to expand beyond its core business, and successfully ignited new growth engines to propel the Group for greater shareholders’ value. The Group operates through its network of subsidiaries and associates in Singapore, China and Thailand.”

Please read the 2nd paragraph again, so that you’d understand how ridiculous that sounds as we progress.

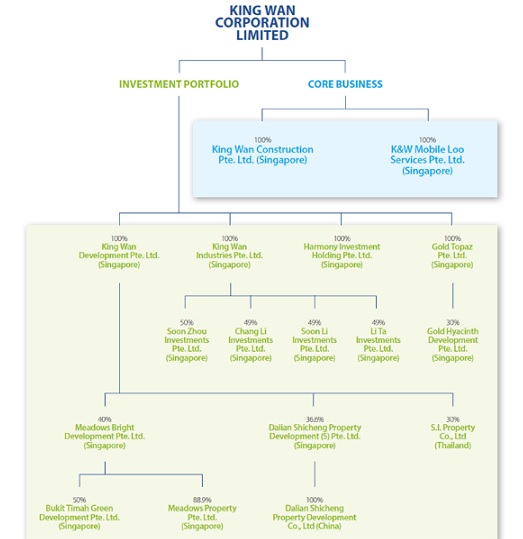

KW divides it’s businesses into a core business and an investment portfolio. The core business is where management has executive functions, overseeing the operations of the businesses on a daily basis.

Under their investment portfolio, KW mainly invests the cashflow generated from the core businesses in the form of loans to associates or joint ventures. They also act as the guarantor for bank loans that these associates/JVs get.

If this works out, it is a very powerful structure (Somewhat similar to Berkshire’s), where the core business is stable and FCF generative, and the FCF is invested into higher growth businesses or businesses that are undervalued temporarily by the markets.

Unfortunately, there’s no WB in KW. That is the main mistake I made: Judging that the management are investing gurus.

To simplify the above structure, I’d classify KW’s entire existing business into 5 categories:

The manufacturing segment (highlighted in red) has been divested and has since been IPO-ed and listed on the thai stock exchange.

As you can see, KW has invested it’s CF in many different industries. It’s core competency is in M&E for the construction industry.

Sure, one can make the case for the property segment and the worker’s dormitory segment to be related industries. But the vessel segment? and the manufacturing segment? KTIS is now a sugar company listed on the Thai stock exchange. KW has absolutely no business meddling in these 2 industries, yet they do.

I’ll breakdown and analyze each of these 6 segments later.

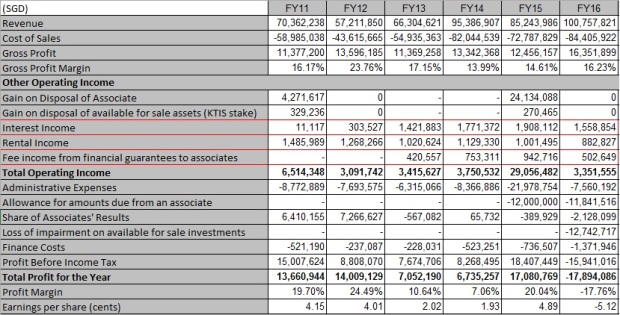

Here is the consolidated multi year income statement:

KW’s troubles started showing up in the later part of FY15 (the company has a March year end) when it has to recognise an impairment of $12mil due to soured loans to it’s associates. (Parked under “Allowance for amounts due from an associate”)

In FY15 though, due to the large 1 off gain from the sale and subsequent listing of the manufacturing segment (which became listed as KTIS), the company recognised a large $24mil gain on disposal, and this big fat gain masked the ugly impairment. (“Gain on disposal of available for sale assets)

Still, the 1 off gain was expected. The impairment loss, to begin with, was not 1 off, and it was certainly not expected by the markets. Guess you’d be able to guess what happened to the share price with that announcement.

Prior to FY15, KW’s valuations were actually rather compelling. Although earnings has dropped in FY13 and FY14, the one off gain alone would’ve added a massive 6.9 cents to the earnings!

What should’ve been a red flag to me, is the “interest income” and the “Fee income from financial guarantees to associates” (Highlighted in red)

To be fair, I did notice it and it made me sufficiently uncomfortable enough to contact KW’s management to enquire. KW’s IR is rather responsible. Their CFO, Mr Francis Chew, did reply promptly and rather clearly. This is my exact email to KW, completely unedited except to take out my name.

Pls see the 2nd question. This correspondence took place sometime in end 2015.

Here is the exact reply:

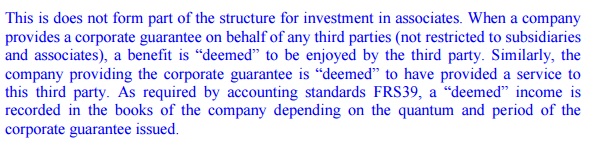

Basically what he is saying is that this is “required by financial reporting standards”. I am no accountant but being a skeptic, I did verify this FRS39 rule and sure, he’s right. I totally do not understand the logic behind this but that’s how the high powers decide financial reporting should be done.

Now at this point in time, what I should have done is to eliminate these earnings. Take is as 0. But I didn’t. That’s a dumb mistake.

These earnings are earnings only because the FRS rules say so. KW has not collected any $$$ on these loans, and by their own admission, would not be collecting any $$$ anytime soon. In fact, the loans kept increasing and increasing and increasing and increasing EVERY QUARTER.

KW just kept sending $$$ to their associates without any collection. Not the principal, not the interests, nothing.

I kept monitoring the CF statement every quarter, hoping against hope to see some $$$ collection. Nothing. To date, nothing has been collected.

Now to draw an analogy, imagine we are friends. You loaned me $10,000 and I said ok, I’d owe you an additional $1k every quarter for this. So after every quarter my debt becomes $11k, then $12k then $13k etc. But not once would you see a single cent repaid by me.

Would you be concerned after a few quarters?

Which was what I brought up. (Read question 1. above)

“These loans have increased rapidly from $17.4mil in FY12 to the current figure. KW has increasingly taken on bank loans or guarantees the bank loans of associates, this has increased the debt to equity ratio to 0.49, and current asset:current liabilities is now 0.54. Is management comfortable with the current balance sheet, and are we likely to see this “non current receivables” balloon further in the coming year?“

His reply:

“As you have correctly pointed out, the increase in debt equity ratio was due mainly to the Group’s extension of loans to associates, in particular, associates which are property developers and where the funding requirement is usually higher. The balance sheet will improve upon the completion of the respective ongoing development projects in the next few years.”

As we will see as I continue, this is an outright lie. The balance sheet did NOT improve in the “next few years”, and instead, the bulk of these loans kept getting written off. (ok yes, technically it improved because it’s been written off but I don’t think that’s what he meant!)

Manufacturing segment

When KTIS was divested and subsequently listed on the Thai stock exchange, it generated a lot of hype for KW. Many analysts were scrambling to cover the company (none of them are still covering the company right now. See a pattern here?)

For a sugar (commodity) company, I thought the valuations were rather rich. The PER at IPO was around 24. KW’s MD, Chua Eng Eng gave many interviews, suggesting that KW could slowly divest its KTIS stake for cashflow. Many ridiculous extraordinary dividends were suggested, and Ms Chua did not refute them either.

Here, judge it for yourself:

I’ll quote:

“Asked to comment on analyst reports by SIAS Research and OSK-DMG about King Wan being able to pay special dividends for several years, management said the analysts had studied King Wan’s cashflows and track record of rewarding shareholders with special dividends.

“We don’t think their assumptions are wrong.”

OSK-DMG analyst Lee Yue Jer has noted in a report that the M&E business currently contributes S$5m-7m of cash, which easily pays for the 1.5 cent ordinary dividend totaling S$5.2m.

The analyst said if King Wan wanted to, it could sell the KTIS shares gradually and be able to pay 1.5 cent a share as special dividend annually over 10 years — assuming the sale price is S$48 million in aggregate.

“This doubles the dividend to a juicy 9.7% yield sustainable for the next 10 years,” according to the analyst.”

Unfortunately, their assumptions are wrong. Very wrong.

KW has distributed dividends of 1.5 cents annually from FY12 – FY14, and with the listing of KTIS, the dividend increased (very slightly!) to 1.7 cents in FY15. In FY16, the dividend was completely eliminated.

That’s right. 0 cents in FY16.

Now, I understand that it is hard to give long term projections. Nobody knows how the business environment will be like in the next 2 years. But how the heck would an analyst (who is supposed to provide an expert opinion), conclude that there’d be a 1.5 cent special dividend annually over the next 10 years is beyond my understanding.

Mind you, he is talking about a SPECIAL DIVIDEND. This means he thought it’d be 1.5 cents (ordinary dividend) + 1.5 cents (special dividend) = 3 cents every year for the next decade.

Even for a company that I have thoroughly analyzed, I don’t have much visibility over how the company would perform in the next 3 years, much less over 10 years. I’d never dare to give a 10 year projection to such detail.

What is most disappointing to me, is that the MD Chua did not refute this. She did not temper expectations. “We don’t think their assumptions are wrong.”

I’m not saying all this due to hindsight bias. To be fair, I too, did not predict the subsequent crash (obviously, or I wouldn’t have invested), but when I read the report then, I was very skeptical of it’s conclusions. For the record, this is what I wrote in my personal investing thesis then (reproduced exactly without any editing):

“osk dmg analyst reported a likely increase of dividend to $0.03 from FY15. He’s expecting the KTIS stake to be divested gradually and a special dividend to be given out every year. UNLIKELY. PROB CASH RETENTION FOR MORE DEALS. EXPECT DIVIDEND TO INCREASE TO $0.02 INSTEAD.”

Looks like I’m wrong too.

Since it’s IPO, KTIS share price looks like this:

Outright ugly.

Again, to be fair, KW did divest some KTIS shares at a higher valuation when it continued rising for about 6 mths after its IPO. Currently, the KTIS stake is carried in the balance sheet at 7.30 THB.

This KTIS stake is carried in the balance sheet at market value. This means that every quarter, KW would recognise a profit/loss depending on whether the value of this stake has increased or decreased. I don’t think it’s important to look at it in the short term, but unfortunately it does affect earnings and the markets do react according to the earnings news.

In this case though, my personal take is that there wont be too much write offs regarding KTIS anymore. I have analyzed KTIS financials and I am confident now, the valuations are ok. (not fantastic. I wouldn’t buy it individually from the thai exchange, but I wouldn’t sell it now either)

I won’t be analyzing KTIS here because the analysis is not as thorough and because that’d really divert into another 2-3 posts.

Now, just to be clear, I’m not faulting the analysts for getting this call wrong. Nobody gets it right all the time. Not even WB. Not Munger, not Icahn, not Soros, not Ackman and certainly not some analysts.

My beef is where are they now? Don’t run away! Stand up and say it’s wrong, update your analysis, issue a new call or simply say you have no idea. Put the spotlight on management. Pressure them to be accountable for their actions.

Wouldn’t your track record as an investor be fantastic if one can just forget about your mistakes, while hyping up your wins?

Honestly, I have no idea why I seem to be the only one who’s frustrated with this. This is an issue with only the local investing scene. In the US markets, a lot more spotlight is on the management and no management can quietly slink away after making a public statement.

That’s why they’re paid an obscene amount. If you say something, you better work your ass off to make sure it comes true. Otherwise, expect some heat from analysts and shareholders.

Unfortunately, in SG, the analysts will run away, and the shareholders are only interested in the buffet. Nobody questions the management. Nobody (except me) seems to be upset.

A reader who has emailed me recently shared these concerns with me too. In fact, he said that’s why he mainly invests in the US markets instead of SG. (you know who you are). This is perhaps one of the better examples justifying his opinion.

Let me end this segment regarding KTIS, the analysts coverage and the “loans to associates” with this self explanatory image:

Alright, I’m stopping here as I’m supposed to be on holiday, and writing about failures doesn’t make one feel relaxed.

In the 2nd part, I’ll continue with how the investment has regressed from a bad one to a terrible one.

I promise it’s just as entertaining, or even more so than this one.

Thanks for sharing, mate.

I have my fair share of mistakes in my fishing-in-the-storm investment.

The general theme of my mistakes usually boils down to incapable/dishonest Managements.

Ironically, I still occasionally love to deep dive in deep value specuvesting, which by and large come with the incapable Managements, BBR is one of them.

LikeLike

Thank you for your comment.

Yes, I’d agree with you that BBR’s management is not the best, I’ve written about my reservations in my BBR investing thesis too.

I am still vested as the valuations are very very compelling, and in my experience, it is hard for even an incapable management to destroy this amount of value when it is so deeply undervalued.

I have assess it to be different from my investment in KW, where the hype made the company fairly and even slightly over valued then, with the subsequent destruction of value by management.

LikeLike

Hi Thumbtack Investor, thank you for writing this post. i find your quality amongst the best of the bloggers in Singapore. When the DMG report came out on that 10% yield for 10 years, i was very attracted after the price shot up from 19 cents to 24 cents, i was confused and find it hard to value whether there are any meat left. I came to a conclusion current price then takes into consideration the listing of the sugar subsidiary.

So what happens is they didn’t sell of all the shares.

During then, my thought about them is that , they seem to have build alot of bolt on acqusitions. could they be the shrewd capital allocators. how a little times change can put them in a different light.

LikeLike

Hi Kyith, your comment:”I came to a conclusion current price then takes into consideration the listing of the sugar subsidiary.” hit the nail on the head.

I came to this conclusion too then, and I wrote it clearly in my investing notes in caps.

In other words, there wasnt much of a MOS when I invested. It’s one thing to NOT analyze and miss it, but it’s a completely different thing to analyze, recognize the danger AND still proceed to invest.

Like I said, I must’ve been possessed.

I too believed that they could be good capital allocators. An additional note is that KW is very largely owned by insiders. Their family members are heavily vested, and normally, it’s a good thing. In Part II, I’ll discuss about why this may not be a good thing in this instance.

Thanks for your compliment btw.

LikeLike

Hey TTI,

I think i made some of these psychological mistakes as well. We actually are hopeful that the good hunches outweigh the bad ones. It will be very different if they made some little allocating decisions correctly.

Don’t be surprise after i wrote so much on how questionable croesus is and i went straight to invest in it.

I look forward to part 2. while i am not vest since that DMG report i always look over the shoulder for this and Neratel. I hope that if you have seen neratel in the past what you like and not like a bout it you could give your 1 cent. I am not vested but always trying to build up my competency there.

Best Regards,

Kyith

LikeLike

It’ll be very different if they just did absolutely nothing and distributed the CF if they don’t know what to do with it.

LikeLike

Hi TTTI

Thanks for the good detailed post on your thoughts.

I was earlier vested in this too and luckily managed to get out before it turns badly sour.

I thought the listing of the thai associates was great but they do have signs of a problem there start surfacing when it appears that the seemingly juicy dividend had to come from divesting those stake bit by bit. In any case, they did got beaten down hard at the end due to impairment to the commodity share price and god knows what happen to their associates on the other side with their property side.

I like how you mentioned and noticed the debt for the associate part. That’s something which didnt struck me.

The dmg report was bad when it gave those recommendation. I knew the time they do that there was high potential they would fail to meet the expectations and the result came scorching down the tunnel after that.

It’ll be interesting to see if this could ever, EVER at all be a turnaround play from here. They still have respectable amount of backers willing to back the companies and I reckon they better get themeselves out fast before it turns uglier and more prominent like noble did.

Good job analysing anyway.

LikeLike

Hi Bhalimking,

thanks for your comments. Good that you bailed on this burning ship.

“It’ll be interesting to see if this could ever, EVER at all be a turnaround play from here. ”

This is exactly what I’m trying to figure out.

At this juncture, KW is incredibly difficult to analyze. I say this because the main thing to analyze is not it’s core business, the M&E business. Rather, what determines it’s future is it’s investment holdings and here we have investments in various industries across various countries. Also, the investments involve both capital investments in associates, as well as (mainly) loans and loan guarantees. It is taking me a very long time to go into the minute detail of each investment with a fine comb.

I believe you’d find Part II rather interesting to read.

LikeLike

Hi, yr part 1 & 2 are very interesting. Just curious, why didn’t you sell the position, when you realize that you bought it despite your red flags & the results are turning out worse than you expect?

Or simply, why didn’t you get out, when you realise that your reason to buy the stock is no longer valid?

LikeLike

Like I mentioned in the posts, the writedowns came at a time when I was very busy and didn’t update my analysis. My only work then revolved around questioning management, and I had to take their word when they said to expect the BS to improve upon completion of projects. Bear in mind that a thorough analysis in KW is very complicated due to it’s investment holdings nature. That means I’d have to analyze each investment. I think KW is best viewed by a SOTP methodology. The KTIS stake itself would easily take a mth. Selling out just because the share price has dropped isn’t good either, as I might end up selling at the bottom. So the proper thing to do is to re-analyze (Which I didn’t then), and reassess from a brand new perspective, meaning consider myself as a non-shareholder, and decide if I’d invest or not invest at that stage.

I have now pretty much completed my reassessment, which is why these posts are so belated.

LikeLike