As mentioned previously, I’ll continue following certain companies even after divesting them as I think my in-depth knowledge about them is a competitive advantage. Also, I believe it’s far more advantageous to understand a company very well, rather than several companies on a superficial basis. In short, quality over quantity.

I have previously explained my reasons for divesting HLS (Post-mortem of Hock Lian Seng Divestment)

To summarize, the main points that I mentioned are:

- “There are some signs that convinced me to divest. For starters, HLS has lost their dorm as the lease is up. Earnings from this dorm accounted for almost 20% of gross profit in FY12 and FY13. That works out to be about $5mil of gross profit.”

- ” I expect HLS earnings to normalize to the 4.5-6.5 cents range.”

- “the gross profit from civil engineering has already dropped from FY16Q1 compared to FY15Q1…. I believe HLS will show margin compression compared to previous years.”

- “There are also no major catalysts to earnings from now till FY18. In the meantime, HLS has to spend money to continue to build it’s Tuas industrial project. Property development, like the property market, moves in cycles. This is the time when HLS has to invest and build, without getting any returns yet.”

- “The Shine@Tuas South industrial project will be an “investment” of sorts for HLS. They’d have to pump in resources to build, and revenue recognition is only expected sometime in 2018.”

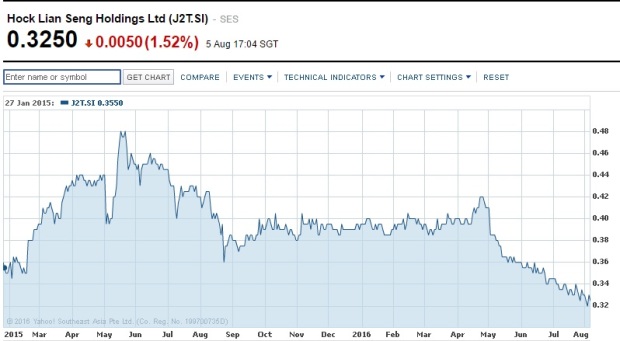

- “I noted the bearish signal from a TA perspective… Moving forward, the trend is still a downtrend, although I think it’ll form a base around the $0.35 mark.”

With the recent release of FY16Q2 results, I went to analyze the results to have a sense of how the company is performing, and whether my predictions are on track. If they aren’t, I’d update my thoughts on the general direction of the company.

The good thing is that HLS’s financials are very easy to understand. Nothing complicated, and HLS makes the effort to explain certain movements in their balance sheet and items in their income statement.

Thus far, HLS’s financial performance, and the subsequent share price movement, is exactly how I’d anticipated it would be. No surprises here.

Earnings has dropped with the expiry of the dorm, and without any contribution from property development. EPS as of FY16Q2 is 2.44 cents, compared to 4.10 cents as of FY15Q2. This is on track to be within my full year earnings forecast of 4.5-6.5 cents.

As expected, revenue from civil engineering forms pretty much the entire revenue, with almost nothing from property development and investment properties (dorm).

The margin compression that I was expecting also came true. GPM for the civil engineering is 5.44% as of FY16Q2, vs 8.96% as of FY15Q2.

There have been no positive surprises, or catalysts in FY16Q2. HLS continues to invest in the Shine@Tuas South dorm project, pumping in $8.7mil as of FY16Q2:

Finally, from a TA perspective, HLS share price continues to fall, albeit at a very gradual pace. Since my divestment at an ave of $0.375, HLS has dropped very gradually to the current $0.320.

I have no idea if it will continue falling, but barring any major contract wins, the share price is unlikely to rise substantially in the short to mid term.

The book value has dipped slightly to the current 43.4 cents as of FY16Q2. Although the valuations currently are not demanding, in my experience, builders generally can have such low valuations indefinitely.

On top of all this, what caught my attention is the “Results from a joint venture”

This relates to The Skywoods project. As one can see, of the $12.87mil in PBT, $10mil comes from The Skywoods project. The Skywoods project TOPs in end 2016, and as this projection is recognised on a POC basis, there would be minimal or no contribution from this JV after end 2016.

This item is also interesting to me because the other partner in this JV is King Wan, and having seen such a strong contribution from Skywoods, this gives me some visibility on the contribution for King Wan as well.

It’s like many pieces of the jigsaw puzzle falling in place, giving me an idea of how the overall picture would look like.

The one potential catalyst for the share price would be an announcement of a major contract win, beefing up the order books. Here, I am not optimistic that HLS will announce any major contract addition though.

Although the order books has dropped from $450mil in FY14, to $382 mil in FY15 and finally to $330 mil currently, HLS has seen years with much much lower order books.

History of order books for civil engineering projects (year end)

FY10 – $350 million

FY11 – $227 million

FY12 – $130 million

FY13 – $48 million

FY14 – $450 million

FY15 – $382 million

From my experience in years of analyzing this company, HLS is a different animal from other typical builders. They focus on maintaining margins (which is what I loved about them in the first place), and are financially prudent.

However, this means that there will be troughs in the cycle where HLS suffers from a decimated order book, and instead invests for the future while awaiting projects which require their expertise and that they can capitalize on by demanding certain margins.

If you look at the share price chart since 18 mths ago, it sure looks like HLS has formed a bottom:

A word of caution for those who may try to bottom fish, if one looks at the big picture though, HLS suddenly doesn’t look like it’s that cheap anymore:

OTHER INDICATORS

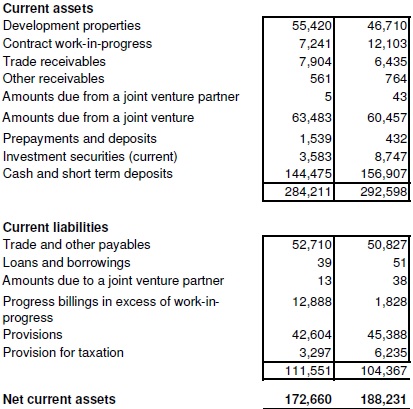

As of FY16Q2, the net of “contract work in progress” has turned negative.

The net work in progress is now -$5.6mil, compared to $10.3mil 6 months ago. This means that HLS has billed ahead of what they have completed building. This will have to be built in the coming quarters with no further billings / contribution to earnings.

Yet another indication of this “reinvesting” phase that I speak of is this 1 line in the statements:

“Increase in prepayment of $1.1 million was mainly relate to the advance payment of a land parcel acquired for construction of workshop for own use. The acquisition would be completed in August 2016.”

I consider this capex in nature. Meaning HLS has to invest to build up infrastructure, which would eventually somehow add to their earnings in future. Again, it does mean suffering in the short-mid term though.

CONCLUSION

Thus far, my initial hypothesis that the property sector moves in cycles and that HLS is currently in the “reinvesting” phase, stands true. There are no visible catalysts on the horizon, and I think the earnings will either drop below my predicted range after FY16 (without The Skywoods contribution), or barely maintain in the 4.5 – 6.5 cent range (I’m expecting contribution from Civil Engineering projects to pick up as the projects enter the “active” phases).

The risk:reward profile currently remains unfavorable for me to reinvest in HLS. I’ll be looking out for contract wins, but from the current industry climate, and from my understanding on the profile of projects that HLS goes for, I’m not expecting any such announcement anytime soon.

As yet, I’m staying on the sidelines while waiting for the markets to recognize these headwinds, and for the share price to accurately reflect that.

Again, I’m constantly reminded that my focus (which has only been rather recent, in 2015 actually), is now on DEEP VALUE and on CONTRARIAN situations. Only longer term data will tell if this approach is truly successful for me.

Wow! So impress with such detail analysis ! Bravo and great post !

LikeLike

Hi STE

Thank You for your comment.

I love the book list you have compiled on your blog, and will be adding it to my blog roll.

Cheers

LikeLike

Hi TRIT!

Thanks! I hv long list of book list. .hope not bother u… I really like your way of analysing stock in detail. .cheers! !

LikeLike

Hi SG thumbtack investor, thanks for the detail write up. If the full year result is 4.5 cents EPS, and based on HLS payout ratio of 30%, dividend is actually quite good income. What do you think? I have never owned this company in the past and have recently added when the price came down because of poor prospect. You commented that the company is financially prudent, besides that, can you also share what you know about the management. Thanks in advance

LikeLike

Hi millionfaith,

IMO, the dividend is likely to fall back to 1.8 – 2 cents.

FYI, the dividend history:

FY09 – 1.5 cents

FY10 – 1.625 cents

FY11 – 2 cents

FY12 – 1.8 cents

FY13 – 1.8 cents

FY14 – 4 cents

FY15 – 2.5 cents

If you have recently added at say 33 cents or so, and based on my estimated 2 cent div, that’ll be a approximate 6% div. You can decide if that’s good or not. It depends on your individual way of investing.

I personally do not place too much emphasis on the dividend yield. I view dividends as just a way for the company to distribute excess cashflow that they otherwise cannot invest and get a high enough ROIC. If the company can generate a ROI that’s higher than my historical returns, I’m happy if management keeps the money to grow the business. I will comment though, that a 6% yield is generally considered pretty good in this environment.

I have just recently (As of 2015) changed my style to focus on deep value, contrarian investments. From my previous years of investing, I have generally outperformed the market, the returns are good, but not spectacular. By focusing on deep value opportunities, basically I’m hoping to get double digit returns in all my endeavors, this means though, finding unique opportunities and not just one that gives a “pretty good” dividend, or a company that’s going to do “ok”. Deep value means finding situations where I think the markets are wrong, and taking a position that’s different from consensus. This also means that in some years I may experience horrible results, and in others, hopefully, spectacular ones. In short, more volatility.

About HLS’s management, I generally have a very good opinion of them. The company is in safe hands with the Chua family.

You can read my earlier posts about HLS, particularly the investing thesis:

https://thumbtackinvestor.wordpress.com/category/companies/hock-lian-seng-group/

Basically HLS focuses on protecting their margins. This is something that’s very difficult to do in the construction industry. This also sets HLS apart from the competition.

I’ll add that I did not sell because I think the company is going to do poorly. They are not going to report losses. However, from an investment perspective, the share price will not likely rise in the near to mid term. HLS is also no longer as undervalued as before, and I’d prefer to keep my powder dry for the next opportunity I unearth.

Hope this helps.

TTI

LikeLike

Hi TTI, Thanks for the reply, I did not expect to see a long reply, hence really appreciate the time you took to advise me. You have provided me with a clear idea what I should do with HLS moving forward. Happy to learn the company is in good hands, that is important for me. All the best to your investment.

LikeLike

Hi millionfaith

You’re most welcome

TTI

LikeLike

I love your analyses…you can try to apply to value investors club with them. Especially your one on BBR.

LikeLike

Hi Joel

Thanks for the compliment.

I have visited the value investors club website like you suggested, to take a look, and it seems to focus mainly on foreign stocks, particularly US ones. Most of my portfolio would still revolve around SGX listed companies for now, so it may not be appropriate.

LikeLike

They seemed to have made a lot of provisions for the Ark@Gambas upon TOP in 2014. Noticed that there don’t seemed to be much utilization to date, so they may have the option to start slowly reversing that to bump up the accounting profits during this period where they cannot recognize much accounting profits from their ongoing property development activities. Suspect the Ark@KB will have some excess provisioning as well to pad their accounting profits through to 2018.

LikeLike

Hi blackbox

That’s a very sharp observation, yes, the provisions rose from $7mil in 2013 to $45.4mil in 2014, and barely dipped to $42.6 mil currently.

In the meantime, the defects liability period for both projects are over. Meaning HLS would no longer be liable.

For eg. Ark@Gambas TOP is on the 21st Nov 2014, the liability period is for 1 year, meaning it’s over on the 20th Nov 2015.

From the AR: “The provisions for maintenance and warranties represent the best estimate of the Group’s legal or constructive

obligations at the balance sheet date. The majority of the costs is expected to be incurred over the applicable

warranty periods. The assumptions used to estimate maintenance and warranties provisions are reviewed

periodically in light of actual experience.”

I think any writeback in provisions will take place in Q4 of this year, as they will still incur costs for rectification works for problems brought up before the deadline, but are no longer liable for new complaints. I also agree that the provisions are too much; as I mentioned before, HLS management is generally very conservative and prudent. These add-backs will add to earnings while reducing the liabilities part in the BS.

Thanks for bringing this point up.

LikeLike

Hi TTI,

With the surprise JV contract win, does that change your perspective on HLS in the short term?

Thanks for your thoughts, really good analysis, thanks very much for sharing.

LikeLike

Hi JustBe,

Thank you for your comment.

I wouldn’t exactly describe the contract win as a surprise. Aren’t all contract wins surprises then? I mean, builders do not release a statement to give guidance to say that they’d possibly be winning a contract soon right? So, in this regard, nobody can predict when contracts are won (unless you are part of management).

I don’t really think about how HLS will perform in the short term. If you’d notice in my analysis, I spend time talking about how it’d perform in FY17, 18 and beyond, because there’s data to support that sort of thinking. How would HLS perform next week or next month or next quarter? I honestly have no idea, and even if I give you my thoughts, you should give it as much importance as coffeeshop banter. If HLS announces a $10bil contract win tomorrow, the share price will go through the roof, so how does one predict how it’d do in the short term? If a hedge fund or someone with deep pockets and whom is crazy enough decides to take up a huge position, the share price will also go crazy.

I did hazard a guess in my post (Post-mortem of Hock Lian Seng Divestment on 10 June 2016) when I divested a few months ago, that the share price will hover around the $0.35 mark. This is a calculated guess and thus far, it seems to be around there. I’d still stand by this guess.

In the mid term, I’d expect the earnings to come down, margins to be compressed compared to earlier years, but the company will still be profitable. Metrics like ROE will likely come down too (anyway it was artificially buffeted by their industrial projects)

In the longer term, I’ve always maintained that this is a great company with real competitive advantages. That’s why I’m still monitoring it. If it gets to the stage where it falls off the radar of investors, and it stops getting media coverage, and the share price shows a gap between value and price again, then I’d take up a sizable position again.

When I first invested 3-4 years ago, the share price was languishing, and nobody has heard of this company. Nobody talks about it even when it announces contract wins. I couldn’t find a single analyst report, no bloggers/commentors with any opinion on this company. I’m hoping it’d get to that stage sometime soon again. (although that’s unlikely)

LikeLike

Hi TTI, don’t mind if I tap into your brain and ask what you think the NPM of this airport JV contract is likely to be?

LikeLike

Hi Chew

I am not sure how I’d get the NPM figures, my best guess is somewhere between 5-15%.

FYI,

GPM (not net!) for civil engineering division only:

FY12: 30.1%

FY13: 39.0%

FY14: 65.3%

FY15: 14.2%

As you can see, the figure varies greatly year on year. This is because it depends on the part of the cycle of the project. If you have a year when all your projects are in the middle phase when the bulk of the billings are done, the GPM increases a lot compared to other years when projects are at the start. Also, obviously the GPM for every project varies.

IMHO, the best way to gauge in this kinda situations, is to just take the total and use the power of averages to get an idea.

Hence, total revenue from FY12-15 (For civil engineering only) = $306.1mil

Gross profit = $106.8mil

GPM = 34.9%

The NPM would be much lower, to account for other costs such as manpower and taxes, as well as the fact that margins have generally come down a lot (FY15: 14.2%), hence, I estimate it to be around 10% (5-15%)

LikeLike

Thank you TTI

With the bulk of its earnings at the moment coming from civil engineering (order book 980 mio) which I casually estimate to be over an average 5 years, its annualised earnings based on 10% NPM is about 20 mio. Add in the contribution from its investment properties, we are looking at around 4.5 cents EPS as a baseline? How much more capacity do you think it has to take on more civil engineering projects? Do you also have a view on the likelihood of it taking on more property development projects?

LikeLike

Hi chew

I do not think it is possible to try to predict the EPS as a baseline. This is because there’d be a lot of inaccuracy built into the estimated NPM to begin with. As I mentioned in an earlier reply (not to you, I think), the actual margins are very hard to predict, and even the management themselves, may find that the margins realized are completely different from the margins they have projected in any given tender.

Management of another construction company has previously explained to me the reasons for the difference between their projected margins and the actual realized margins. Some of the reasons include:

“Fluctuations in costs of labour, materials and equipment, breaches or non-delivery by our sub-contractors, labour shortages and other unanticipated construction constraints give rise to delays and cost overruns …..”

That reply is reproduced in its entirety without any editing.

Hence, what I am saying is that they start with a certain margin in mind during tendering, and it is difficult to get a wide margin because there’d be competing tenders. Over the course of the project, which takes several years, there can be many scenarios that is impossible for the management to predict. The rising foreign worker’s levy is a good example.

So trying to estimate a NPM is very difficult. I gave an estimate based on past figures, but that is not reflective of how it’d be like going forward. Generally the longer the project, the more such risks it faces (as the company cannot project the conditions so far ahead into the future)

I don’t think HLS would be tendering any more civil engineering projects anytime soon. Perhaps not even for the entire FY17. To begin with, the tendering process is very competitive. And HLS focuses on margins (which is what I like about them). But focusing on margin when there is fierce competition does not work, unless you have certain competitive advantages that your peers do not. HLS has demonstrated this. I have noted in my updates that this project is an extension of their cooperation with CAG. This is how HLS won the tender.

However it’d be difficult for them to win unrelated tenders if they insist on maintaining margins, which HLS does. Also, in any case, their order books is now $980mil. It is the highest it has been since FY09 and probably earlier (FY09 is the earliest data I have studied)

I also do not think they will take on any more RESIDENTIAL property development. Property development is a tough game currently, the measures have been here far longer than any of the players expect it, and I think it’d be here yet longer. HLS’s experience with The Skywoods, although now fully sold, has been less than smooth.

The project suffered from very poor response initially, until the price was cut. Any residential projects starting off now, would be in a worse position.

They do have an ongoing industrial property development project. The initial sales figures have been very poor, but it’s not unexpected.

IMO, if i were to hazard a guess, this order books is what they’d be dealing with for the next 2 years, until FY18 at the minimum. They won’t be looking at any more projects.

LikeLike

Looks like HLS has divested most of their other investment and keeping only its Core – Civil Engineering. Could it be the right time to privatize this company?

LikeLike

Hi

Not sure what you mean by divested most of their other investments. They only had a property development arm, which was doing The Skywoods project. The project has obtained TOP and the development is mostly sold out with profits largely recognised, so it’s not really a divestment. They only have civil engineering projects on hand currently.

IMO, it is highly highly unlikely for it to be privatized right now, or anytime soon for that matter.

LikeLike

*civil engineering projects + the industrial property project

LikeLike