I did initial reports on both companies earlier, so this post will not go into the superficial stuff, but look deeper at these 2 steel middlemen, and what I feel some investors may have misunderstood about the industry’s characteristics. Here are the earlier posts:

Asia Enterprises Holding Ltd Analysis – August 2016

In this post, I aim to highlight:

- How investors with different level of competencies will analyse these 2 companies

- Clarify why even though I’m a deep value investor, I’ve previously said that with regard to these 2 companies, the global macro picture and the resulting steel price is more crucial currently, rather than valuations

- The weighted average price of inventory and how it accentuates profits/losses

- The FCF utilization of LTC Corporation

For the purpose of simplicity, I’ll describe 3 levels of investor competencies. Of course, in reality, all investors are divided via a bell shaped curve, with the bulk of us, by definition, being mediocre and average. There’d be a small minority of “below average” and “above average” investors.

The novice or “below average investor” has an idea of what AEH and LTC does. He understands what the business is involved in roughly and can describe it. He’d of course, know that the industry is in the doldrums currently, and probably know if the companies have made a profit last year. Many will spend a disproportionately long amount of time looking at the share price, and eventually coming to conclusions such as “the share price has fallen a lot already”.

The average investor, on the other hand, is a bit more sophisticated. Aside from understanding the business better, he’d have looked at multi year data. He’d have keyed in some data to work out some valuation metrics. Stuff like book value, or the discount to it, PER, P/B, CAGR etc. He’d have peered into specific items in the balance sheet, probably looking at the amount of cash the company holds, and trying to relate that to what he has read in investing books. Concepts like net-net companies, like FCF generation etc. He may even have looked more in depth to find out more about supply and demand issues. He’d also have inaccurately (I’ll explain why it’s inaccurate) looked at some of the widely available charts on steel prices to form some type of substantiation for his opinion.

These valuation metrics would’ve then formed a basis for an investment or non-investment decision.

The above average investor, now, goes even further. He’s somewhat of an expert in the industry that the company is in. Aside from the valuation metrics, he’d have gone a step further to understand the specific details of the company. It’s hard to describe that in detail as that would vary for each company, but suffice to say, such detail cannot be easily derived. Perhaps he’s even working in that particular industry. That’d surely help.

IMO, in the current and likely foreseeable future, the global investing climate is likely to be plagued by a low interest rate, high liquidity environment, marked by frequent periods of high volatility. This makes it very tough for investors as there’s so much capital chasing that few assets. Mispricing (on the high side) will be common, and indeed, may persist for a prolonged period of time.

In this type of environment, in the mid to long run, the above average investor will likely show much much better returns than the average one.

Using AEH and LTC Corp as examples, having examined the latest FY16Q4 results of LTC Corp in particular, I hope to show how an above average investor would derive a competitive edge. Again, this is a continuation of earlier reports, so I’ll dive right in.

In the earlier AEH report, I’ve mentioned how disgustingly cheap AEH is. Yet, I think investors should not be focusing on the valuations, but on the steel prices and the FCF of the company. Let me explain.

The common argument for investing in AEH or LTC right now, would be based on valuations. There’s no doubt the figures indicate that valuations are depressed for the steel middlemen currently. Let’s look at the numbers:

AEH: Share price is currently $0.173 as I write this. Book value as of mrq, is $0.270, meaning it’s trading at a mere 64% of BV.

The company holds cash of $68mil, which works out to be $0.199/share. There is no debt.

This means today, you can buy a single share of AEH for $0.173, and you’d get back $0.199 in cash plus some other assets (to make up $0.270)!

What is the market missing?

These valuations are at distressed levels, yet the company is here to stay. The balance sheet is also simple and easy to understand, nothing arcane, so I don’t think it’s something that’s misunderstood.

How about LTC Corporation?

LTC has other related businesses besides steel trading, but let’s forget about those in this article. Anyway, the steel division accounts for the bulk of revenue (not profits though)

LTC’s share price is now $0.55. Book Value is $1.6078, meaning it’s trading at 34% of BV. That’s right. 34% of BV!

The company has $17.5mil of cash, with minimal debt. Backing out the miniscule debt, both current and non current, the cash holdings would be 11.2 cents/share.

Comparing the 2 companies, we know that AEH has more of it’s valuation backed by cold hard cash compared to LTC, but LTC is valued more cheaply when viewed as a discount from the book value.

But both companies have ridiculously low valuations, either way you cut it.

Why then, am I dismissing these low valuations and instead, tagging the investability of these companies to a more global macro benchmark, the steel prices?

The answer is because of how their weighted inventory costs impact on their earnings in a downturn, and their low to nil earnings is what the markets are discounting in their share price.

When viewed from a PER perspective, the companies are not cheap. AEH had a net loss last year, whereas LTC avoided losses because of it’s other divisions. It’s steel trading business suffered a net loss.

Both companies buy steel from steel mills or suppliers, store them, and sell them to end clients. They earn from the spread. There are some slight differences: AEH sells to more varied customers, particularly the offshore marine sector, whereas LTC deals mainly with rebar steel, which is sold to the construction sector.

AEH’s selling price is set by the markets and/or how much they can sell relative to other competitors. LTC’s selling price for rebar steel is controlled. The selling price is set by BCA, which in turn uses some algorithm which relies on the global steel price index.

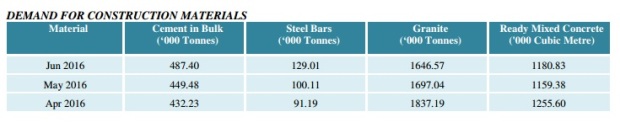

For comparison purposes, the rebar steel market price was about $900/tonne in 2011. Almost twice of current prices. Here is the latest data from BCA:

Inventory Accounting

Both companies account for their steel inventory via a weighted average price method or net realizable value, whichever is lower. In the event that prices are falling so rapidly that it outpaces what the weighted average price can incorporate, the companies take a write off to mark the inventory to net realizable value.

What does this mean? Let me illustrate this weighted average price method with a hypothetical example.

Let’s assume this is how steel prices behave in recent times. It has dropped A LOT, and after a period of stabilization, starts recovering.

At point A, let’s assume LTC Corp holds 50 tonnes of rebar steel, carried in it’s inventory at $900 / tonne.

At point B, LTC Corp decides to buy 30 tonnes of rebar steel as prices have dropped quite a fair bit, at $750 / tonne.

At point C, LTC Corp manages to sell this exact same 30 tonnes of rebar steel at the market price, which by now, is at $500 / tonne.

So how much losses did LTC Corp incur from selling this 30 tonnes of rebar steel?

If you have answered $(750 – 500) x 30 = $$7,500… that’d be the logical, but the wrong answer.

It’d have been correct if the inventory is accounted for via a LIFO method. But since the rebar steel is homogeneous, and they presumably have a very very long shelf life, LIFO doesn’t make sense as you’d incorporate huge volatility in your accounts. (For eg. some inventory could be bought at $100/tonne, some at $1,000/tonne) It’d also be very difficult to track which inventory is bought at what price. So that doesn’t make sense.

In reality, at point B, after purchasing 30 tonnes, LTC would record the inventory in it’s BS as having 80 tonnes at $843.75 / tonne. (Weighted average)

Thus when the same 30 tonnes were sold, the loss incurred would actually be:

$(843.75-500) x 30 = $10,313

What this means is that in an environment of falling steel prices, losses get magnified.

One can work out the effect if LTC bought during a recovery, at point D, and sold at point E.

The converse is true: in an environment of rising steel prices, gains get magnified.

This is why I have previously mentioned that the low valuations, are low for a reason. They are low because the earnings have been decimated (they’re negative in fact), the equity that these companies have, will constantly generate low returns. The tonnes of steel sitting in pretty warehouses aren’t going to generate any returns sitting there. Yet, the companies need to stock up on all these steel.

AEH themselves describe this nicely in their AR:

“Typically, we receive purchase orders from our customers at short notices. We do not have any substantial long term contracts with our customers and thus, are not able to predict their requirements. On the other hand, our suppliers normally take up to two (2) or three (3) months from the order date to deliver the products to us. Given the short lead time given to us by our customers and the relatively longer delivery times required by our suppliers, we need to place advance orders with a view to secure continuous supply of substantial and varied steel products to meet the needs of our diverse customer base and provide just-in-time delivery. Consequently, our inventory turnover (days) is usually high.”

The low valuations, are thus a symptom, of low ROEs, which is also as much a symptom of low returns, as well as the high equity that’s needed as a part of working capital.

In other words, the companies cannot improve their productivity or their ROEs too much. The ROE will always have a high equity part (need to maintain inventory, warehouses etc), and the “R” part is in the case of LTC Corp, constricted by fixed pricing set by BCA.

Earlier, I’ve mentioned it’s a mistake to simply look at the steel price index. Why?

Current multi year steel price data looks like this:

The drubbing in prices since 2015 has taken its toll on both companies. Since the start of 2016 though, steel prices have recovered somewhat, especially in Q2 when prices rallied.

Yet, LTC Corp has not managed to enjoy any of this rally. Look at the prices they could sell their rebar steel for, as set by BCA. (See chart above)

$548 in May, $493 in June and $490 in July. No increase at all.

FCF generation

A quick recap: Thus far, I have shown evidence for 2 important concepts:

- What the ave weighted inventory prices mean for the earnings of these 2 steel companies

- Valuations for these 2 steel companies are low…… they’ve always been chronically low due to the nature of the business. The “equity” that needs to be maintained is constantly high.

Knowing this, IMO, what is more important for these steel companies currently, is not valuation per say, but the FCF generation. The earnings are not accurate (artificially depressed because of the ave weighted method above). The FCF is the true yardstick in this current environment.

Afterall, FCF is a function of:

- How much steel is sold, how quickly it’s sold and the price it’s sold at

- How much cold hard cash is collected (billings, receivables and debt collection)

- And finally, the capital expenditures.

1 nice thing that I like about these 2 companies is the amount of free cashflow it generates. When I was first vested in AEH some years back, the FCF generation caught my eye. I wasn’t as thorough an investor then, and I thought that with this type of FCF generation, I surely had a winner on my hands. It’s only much later when I realised that this is an industry characteristic. Comparable peers also generate +ve FCF.

It’s not difficult to understand why. These companies do not have much capex to spend on. Aside from some machinery to I guess, lift the steel, stock them etc, there isn’t much to spend on. These machinery can typically last a decade. It’s unlike the manufacturing industry where there’s constant capex every year.

Here is AEH’s multi year FCF records and their subsequent cash holdings. By definition, FCF here = operating cashflow – capex

As we can see, the company has +ve FCF every single year. The cash they hold on to, has also been increasing every year, and is at an all time high since FY07, and probably earlier. I’ve only analyzed data going as far back as FY07.

The company is highly conservative, which gives them the ability to tide over long periods of downturn, and yet still dole out dividends every year.

Based on the FCF data above, I prefer using DCF models to value AEH:

I’ve assumed a 10% increase in FCF every 5 years or so.

My conclusion regarding AEH: well, I don’t think much has changed since my previous report on AEH. I’ll just cut and paste my conclusion then:

“I’d still be keeping an eye out for AEH, but at the current price of $0.182, I do not think it fits my criteria of DEEP VALUE.

I’ve always maintained that it’s a fool’s game to try to accurately predict share price movements in a specific manner in the short term. Still, I’d attempt to be a fool by stating that my best guess is that AEH’s share price will remain within a tight range of between $0.17-$0.19 thereabouts for a long time. Perhaps till the end of 2017.

Looking at the chart above, if one makes an investment in AEH sometime in late 2009/early 2010, you’d have seen almost no real capital appreciation since almost 7 years ago.

I’d reassess the company again if the share price approaches $0.165, before determining whether to take a position in the company.

Finally, I’d like to stress that I do not have a negative view on the company per say. I just don’t think there’s sufficient MOS at this price for me. The company may do ok, or even moderately well in the short to mid term. All I am saying is that this isn’t the deep value, contrarian opportunity that I’m hunting for. If I already own shares in AEH, I wouldn’t be selling out at this level either.”

Since the previous report though, the company has commenced share buybacks (albeit only a tiny amount), and the share price has dropped further. It is still within my predicted range of $0.17-$0.19, and as mentioned, I’ll be reassessing this again when it goes below $0.17. It is pretty close to going below $0.17, which is why I have started reassessing and comparing this to LTC.

I’ll reiterate that I do think the bulk of the lows are in. I’m pretty confident AEH is not going to go much lower from here. But then, neither am I confident that the share price is going to recover much or rally much from here anytime soon.

Alright, since I’ve brought up these 2 steel companies for analysis, the last part of this report is logical: Why am I vested in LTC Corp currently then?

Well, aside from the obvious 70% discount to BV (how much lower can it go?! If it goes just a bit more to 80% discount to BV, I’ll start sending letters out to LBO firms and funds to encourage them to privatise!), my answer lies in the FCF again.

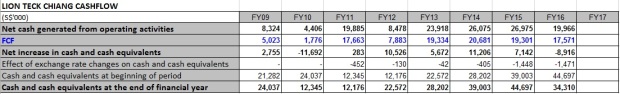

As we can see, LTC does generate +ve FCF every year. The difference between LTC and AEH though, is the amount of cash the company holds at the end of the year.

Most of AEH’s FCF generated flows straight down to the cash they hold every year. The figures add up almost perfectly. (see the table for AEH above). i.e. the difference in cash holdings at the start and the end of the year, is approximately = the FCF the company generated for that year. This is because AEH traditionally has minimal to no debt.

In LTC’s case though, although the cash holdings have similarly been increasing from FY10 to date, the rate of increase is not = the FCF generated. It’s been much lesser.

Where did the $$$ go?

Answer: Partly to pay down debt. The rest is accounted for by other operations as LTC has a property development arm, and just recently, added a retail arm as well.

As we can see here, LTC has been paying down debt over the years, from a massive $58mil in FY09, to almost $0 currently.

Going forward, the FCF is literally just that: free for LTC to utilize. What will they utilize it for? I have no idea. But my personal opinion is that management should accumulate and eventually use it for:

M&A. Throughout history, M&As typically occur when the industry is in a severe downturn. Weaker players get gobbled up by the financially sound players. Yet, in the steel industry, this is not necessarily the case. My guess is that the dynamics of the industry meant that such consolidation doesn’t make sense, unless the company being acquired is going bankrupt.

Once, I asked an executive why don’t the company (construction company) utilize their cash by doing acquisitions. His reply was that in the construction business, it doesn’t make sense to do so as everyone has similar know how and equipment. What’s the value of paying money for that? If you want, you can hire more workers to take on more or larger projects. Or absorb workers of the companies that go bankrupt. Why waste money to acquire?

I’m not sure if that’s the case here, but it possibly could be similar. The steel inventory is generic (in my earlier post about AEH, I have also described why the price will always be at a substantial discount to BV), the set up is simple and easily copied, and in any case, the potential acquiring company already has a similar set up.

The only thing of value, in my mind, is the clientale. Still, if the company goes bankrupt, the clientale would’ve to go somewhere else, and you can just position yourself to capitalize.

On top of that, with such low valuations, it is difficult to see how M&A can happen. Nobody’s gonna offer a price at BV to acquire, and nobody wants to sell and be accountable at a price far below BV either.

Increase dividends. LTC currently gives out a paltry dividend of 1 cent annually. Even at the current depressed share price, that’s a yield of only 1.8%. I’m happy if management has a way to utilize cash effectively, but otherwise, raising the dividend will provide an immediate boost to the share price.

Buy Earnings. I really hesitate to put this down. Thus far, any company that has tried to increase their EPS and ROEs by buying unrelated businesses have always failed.

Unless management is a very smart capital allocator, which I don’t think is the case here, they otherwise should only stick to what’s already been done.

Here, we see evidence of this. LTC has acquired a controlling stake (50% with OTP for another 1%) in the company that owns the departmental chain SOGO in Malaysia. Although the new business did make a micro contribution to earnings in FY16, I am not overly enthusiastic. I think LTC overpaid for the acquisition. I’ve previously explained why I think it’s an asinine move in my earlier analysis.

Share Buybacks. At 70% discount to BV, this is kinda obvious isn’t it. The low liquidity is an issue to consider.

Invest In Property. LTC already has a property rental arm, by virtue of the freehold industrial buildings they own. They also develop and own industrial properties in Malaysia. It is no secret that the industrial property sector has dropped substantially in 2016.

After accumulating cash for a few more quarters, it may be an opportune time for LTC to hunt in this sector. That’s something they have experience in.

Another point that I didn’t add in my earlier post (or did I???) is the key management’s remuneration. I’m lazy to put the figures here, but seeing that it’s public information, anyone should be able to dig up this information easily from the ARs.

LTC’s key management pays themselves very reasonably. The remuneration (Given in bands), as a proportion of revenue or market cap, is much much much lower than AEH. I think in one of the years I was vested in, AEH’s key management’s remuneration accounted for almost half of the entire profits.

I’m not against paying big fat remuneration packages, but the results must reflect that. The problem is that many top management these days are happy collecting fat remuneration packages, with little oversight.

The most motivated management, are those with comparatively low remuneration, but a high proportion of their personal net worth locked up in the company’s equity.

Just to sidetrack a bit:

Case in point: Johnny Liu of Dutech. This little note was in my personal investing thesis before I first vested in Dutech almost 2 yrs ago:

“+ Chairman and CEO Johnny Liu compensation for 2014 is only $200k, $370k in 2013. Management team draws reasonable salaries”

*** BTW Johnny Liu, if you ever happen to read this, I, together with I believe many other shareholders, would be happy if you decide to pay yourself a bit more. Dutech can afford it.

Conclusion

In the most recent conference call (or is it the one before that), FF Wong of Boustead Singapore (whose track record is something that I have immense respect for) said that the beauty about “bottom fishing”, is that even if one makes a mistake, the effects are diminished.

My add on to that is that if one gets it correct, the effects are accentuated.

My view is that both these companies are eligible for “bottom fishing”. I’ve stated my preference for LTC due to the elimination of debt, and the subsequent accumulation of CF. I think the market has not priced this in yet.

If one invests now though, it must be for the mid to long term as I don’t think steel prices, and by extension, earnings, will come roaring back anytime soon. The downside may be limited, but the upside may be a long time coming.

At this stage I remain vested, but am not adding on to my stake. (Anyway, the low liquidity and wide spread makes it frustrating to add.)

P.S. Although I said that I’m in the midst of finalizing my dd on the next deep value investment I’m intending to make, I’d still very much welcome ideas. Please throw any deep value ideas my way and share them generously with me, as I have with you. Preferably with a catalyst in sight please.

hi TTI, excellent analysis as always. i have to profess i have not taken a look at LTC but will take a look now. I was previously invested in AEH. My take is that it is a family run business and what are the probability that they will be privatise. i think listing it is a way for their family members to get out so it might be listed for a while.

as a business i would prefer it to be like what you said, have free cash flow. it used to give a nifty 4-5% dividend. right up my alley.

LTC seem to have some industrial properties that can be unlocked. however the family’s motivation to share with minority shareholders come into the question.

one question: stockist is a challenging business. how do they operate in an expensive singapore?

LikeLike

Hi Kyith,

Thanks.

I was previously invested in AEH as well, and yes, the dividend previously was great. I think it is highly unlikely that AEH will be delisted, I havent even considered that scenario. In any case, seeing how much the share price has dropped, I reckon many shareholders wouldn’t be happy with an offer even if it’s just slightly above the current price, and as I mentioned in the article, there is no way anyone wants to buy over at book value. It has to be below that.

I’ll admit that LTC’s management is an enigma. I have no idea why the Cheng family didn’t unlock value by simply doing a sale and leaseback a couple of years ago. The sale ALONE, would account for the entire market cap! I’m waiting to see what they’d do as the FCF accrue in the coming quarters.

The steel stockist business is highly capital intensive as mentioned in my article. That’s why ROE figures are at best, in the high single digits. These 2 stockists are somewhat shielded as they own the storage facilities where the inventory is kept. Thus the key for the stockists, is inventory management; how to predict what type and the quantity of the various steel products to stock up. (less so for LTC, as they mainly buy/sell the generic rebar steel only)

LikeLike

Thanks for the detailed write up. It provided me with some good insight on AEH business model. I just dont see how AEH can be fairly valued at current prices if its trading below net cash and constantly generates free cashflow with low capex requirement. True low ROE below cost of equity destroys shareholder value over long term but ROE is based on accounting earnings rather than cashflows which is a more appropriate way to measure the efficiency of steel stockists such as AEH. Logically, if FCF is always positive, discount this back and adding the current excess cash which is more than its market cap, valuation will be substantially higher than current market price.

Thanks

Nicholas

LikeLike

Hi Nicholas

Thanks for your comment on the DCF model.

LikeLike

Impressive analysis and appreciate the sharing. I can’t comprehend why would LTC invest in retail and I doubt there is any synergy. Many companies making loss on investments that is not their forte.

I didn’t go into detail of LTC property investments. If majority in Malaysia should we be concern on the weakening currency?

LikeLike

Hi Capricon

Thanks for the compliment.

The controlling family, the Chengs, do have investments in retail related businesses in malaysia, that is the only “synergy” i can find in my DD.

LTC’s exposure to Malaysia is mainly via the industrial properties, and to a small extent, the SOGO retail. In FY16, revenue from Malaysian operations was $31.1mil out of total rev of $130mil, just under 25%, so it’s not really that large an exposure. In any case, the currency has already weakened since several quarters ago, so the forex risks has already been priced in. It’s hard to see MYR-SGD dropping much further from here.

LikeLike