Firstly, let me say Happy New Year and a BIG thank you to those who have recently subscribed to SG TTI. There was a sudden surge in subscriptions since my previous post (ThumbTack Investor’s Random Musings – Selling Property, Hand Foot Mouth Disease, Gold, New Blog Links, Advice For Beginners. Yes, It’s Random.)

Thanks for supporting good deep value research and content. I promise to continue to share my work here as timely as I can.

I’ve previously shared my investing thesis on Dutech Holdings:

Dutech Holdings Investing Thesis

In fact, I was actually a bit surprised that I’ve only written 1 post on Dutech, seeing that Dutech Holdings is a company that I’ve done a ton of work on, and it is currently and will likely be one of my core positions longer term, making up 26% of my portfolio.

Just to recap: I took up a position of 570,000 shares in Dutech Holdings back in April 2015, at an average price of $0.275.

Since then, the share price has rallied strongly, particularly in 2016, giving me a paper gain of approximately 74.55% or a profit of $117,000 in 18months.

The share price has since retracted somewhat from it’s highs.

2 months ago, when the share price was around $0.48, I found myself facing the inevitable question most people think of when one of their holdings has risen this much this fast.

What’s next?

Should I divest and pocket the $117,000? Hold and wait for further gains? Double down and add to my stake?

What would you do if you’re faced with such a scenario? A happy one, no doubt.

Anecdotally, I think most people would choose to divest and pocket the money. Some may hold out and wait further if they’re optimistic. Few will double down and add further. So on this note, I consider my decision to be very contrarian.

Having studied the data in detail, I’ve made the decision to double down, adding another 30,000 shares at $0.465, and yet another 30,000 shares at $0.445.

(See transactions record: transac)

This means that I currently hold 630,000 shares at an average of $0.2908.

I don’t rule out deploying more capital and adding yet more if the price vs my perceived intrinsic value gap widens further. In the short – mid term, this may very well be the case as the TA data for Dutech is bearish, the price has been trending down and is currently below both 50 and 150 DMAs. There’s also no reliable support level currently. I’m mindful of all that as I keep some powder dry.

I don’t take a decision to “double down” lightly though, so here I’ll share my thoughts and my DD on why I’ve opted to add.

As always, since this is an update on an investing thesis, I won’t bore you with the basic details, but will dive right into the fun parts. So, what makes me optimistic about Dutech’s long term prospects?

In the same vein as my previous post, (ThumbTack Investor’s Random Musings – Selling Property, Hand Foot Mouth Disease, Gold, New Blog Links, Advice For Beginners. Yes, It’s Random.), I’ll use the 4 points suggested by Tom Gayner to illustrate this. (https://www.nextinsight.net/story-archive-mainmenu-60/938-2016/11215-investor-guru-thinking-differently-from-when-i-first-started-out)

- Long term track record of profitability, stellar ROIC with minimal debt utilisation

FY14’s large jump in EPS is mainly due to a one off gain of RMB55.9mil from the acquisition of loss making DTMT.

Basically, Dutech’s modulus operandi is to deploy it’s consistent +ve FCF to make acquisitions of distressed but related companies, bring them under the Dutech family, integrate operations and work on the turnarounds.

By buying distressed companies, they get to buy them on the cheap, and subsequently, recognize the difference between the price paid and the book value of the company as one off extraordinary gains.

Of course, it’d be prudent to strip away these one off gains to assess the true operating profitability of the company. Even without the one off gain though, FY14 recorded a very respectable EPS of 24.34RMB cents.

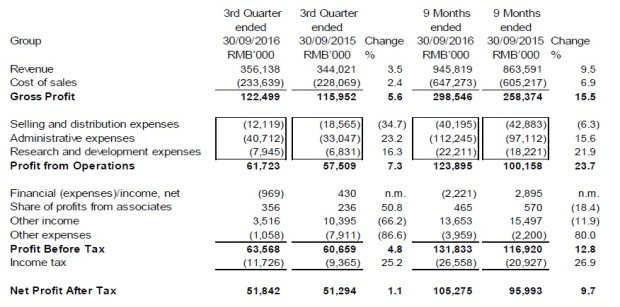

As of FY16Q3 (latest quarter), Dutech’s results are still pretty impressive, showing y-o-y gains:

NP grew almost 10% at the 9M mark, and this growth in earnings is the best type of growth: by growing the topline while limiting the expenses incurred to achieve this growth.

This is in contrast to companies that show profit growth, but if one looks in greater detail, the growth is attained by cutting expenses.

Administrative and R&D expenses rose, in line with the acquisitions that Dutech undertook. I’m actually glad to see a moderate rise in R&D expenses. My current thoughts, and I’ll substantiate this probably in Part II, are that Dutech is no longer merely a typical manufacturer, but has evolved into an integrated business solutions provider. This means controlling the entire supply chain from the manufacturing process, installation of intelligent terminals and providing maintenance, troubleshooting, consultancy and other related services.

Recently, there have been huge changes aka challenges within the global ATM market, and I’m hoping Dutech’s R&D will provide it with the competitive edge to deal with these challenges. More on this in Part II.

Selling and distribution expenses actually dropped, and that’s a surprise to me. It does tell me that Dutech is integrating/has already integrated the manufacturing, the distribution channels and probably the sales force for the acquired companies: DTMT and Krauth.

From a CF perspective, Dutech’s business is also extremely free CF generative, a parameter that I place a lot of emphasis on regardless of which company I am analysing.

My calculation of FCF is particularly conservative, as I subtract purchases of land use rights and even development costs out of CF from operations (on top of the usual PPE), classifying them as part of the costs needed to maintain operations to generate the required CF.

Still, we can see that over a multi year record, the cash horde that Dutech holds has been steadily building up, despite having deployed cash to acquire 3 companies in the past 3 years!

As of mrq (9M16), the cash hoarde has continued to build up to RMB 313.5mil, from RMB240.3mil as of FY15.

This set of impressive results over the past 6 years, was also achieved with minimal debt:

As we can see, the total borrowings is kept very low: Cash and cash equivalents could’ve easily covered the total amount of borrowings in any 1 year.

The available for sale financial assets are mainly liquid bonds and equivalents, and are thus considered as cash equivalents.

As of 9M16, the total debt rose to RMB108.7mil, a >100% rise from FY15. The rise though, is attributed to the acquisition of Krauth. I’m expecting total debt to rise further in the near term, as the acquisition of Metric is completed in 4Q16.

Still, all this is very palatable for Dutech:

Dutech did not borrow and take on new debt to make acquisitions; the rise in debt is due to the debt on the books of the acquired companies.

This is an important point to note, because it’s obviously very different from a company having to borrow money to make acquisitions.

Over time, Dutech’s efficient machine will grind away at the debt in the acquired companies.

Alright, just to recap: so we know that the company has been doing well on the earnings front, and the EPS trend is generally upwards. We also know that the business is extremely FCF generative. And finally we know that all this is achieved with minimal debt over the past years. How about the ROE figures? Cos that’d tell us how efficiently the management utilizes the equity of the company to generate a return for shareholders.

Long Term ROEs:

| FY11 | 10.08% |

| FY12 | 11.16% |

| FY13 | 21.69% |

| FY14 | 24.05% |

| FY15 | 17.01% |

The extraordinarily high ROE figure in FY14 is due to 1 off gains from acquisition. Still, we can infer that the core ROE figure would be in the high teens to early 20s+ % range. Pretty impressive.

2. Capability and Integrity of Management

Even now, Dutech gets wrongly classified (in my opinion) as an “S-chip”. My issue with that is that S-chips (justifiably so), have a negative connotation to them.

What exactly constitutes an S-chip anyway?

Dutech’s listed on SGX. Sure, they have manufacturing plants in China and are headquartered in Shanghai, but only 23% of the sales are in China. Of this 23%, the bulk of it is exported eventually.

Dutech also has operations in US, Europe (particularly Germany) and now, with the acquisition of Metric, UK as well.

Dutech’s clients are all major, international players like Diebold, Wincor (they just merged btw), Hitachi, Liberty Safe etc. This stands in stark contrast to other chinese players which do not have any international presence; they can’t even if they tried to, because they don’t have the certification (UL and UEN) that Dutech has.

CEO Johnny Liu is Chinese, but educated in the States. I highly doubt he’d usurp money and run away.

Dr Johnny Liu’s total pay remuneration in 2013, 2014 and 2015 is $370k, $200k and $410k respectively. All very reasonable considering the performance of Dutech. I don’t think these figures are reflective of someone who’s overriding concern is his own personal interests and not the company’s.

The company’s top 5 shareholders are all dominated by management, with the exception of Mr Robert Stone. In fact, I kinda wished they wouldn’t own so much of the company. Collectively, the top 5 own 75.66% (as of AR 15) of the company. That doesn’t leave much shares floating around for the public. (TTI alone owns 0.18% of the company……)

CEO’s brother is part of the management team as well.

Dr Johnny Liu also comes with an illustrious career. Check out this chinese piece on him talking about his entrepreneurship:

http://www.1000thinktank.com/zl/4323.jhtml

The point I’m driving at is that Dutech’s CEO has as much skin in the game as anyone else. Not just because the bulk of his fortune is aligned with that of Dutech, but what’s probably more important is his reputation.

Still think Dutech is a “S-chip”?

Dutech doesn’t even look like a SG company to me. They’re global. Period.

3. Price vs the intrinsic value

No matter how great the company is, there’s always a price range, past which the investment no longer makes sense.

So let me try to relate the price to my perceived value here. For my calculations, I’ll assume the share price is $0.445 cos that’s the current price as of writing this. (And that’s the price my most recent accumulation is at)

Based on FY15’s core earnings (excluding one off, extraordinary gains) of 31.3 RMB cents, the PER is currently 6.8 times.

That is misleading though, as FY16’s earnings is likely to exceed FY15 very substantially. Earnings at the 9M mark is already 10% higher than the corresponding period in FY15 and as I’ll show in Part II of this discussion, Dutech’s 4Q16 results are likely going to be a blowout quarter, such that FY16 performance would be >>> that of FY15.

As of mrq, Dutech’s book value is RMB 223.19 cents, which works out to a P/B ratio of 0.96.

All these valuation metrics by themselves, are not very useful. We need to compare to industry peers to have an idea of what’s the norm.

In this space, Dutech doesn’t really have any peers to compare against. I don’t consider the myriad number of local safe manufacturers in China as Dutech’s peer.

The closest is Stockholm listed Gunnebo Group, which manufactures safes as well as cash management systems, although they have other dissimilar segments as well, such as entrance security.

For FY15, Gunnebo’s EPS = 2.18 SEK, with a BV of 22.65 SEK. ROE figures work out to be 9.9%.

As of 9M2016, Gunnebo’s EPS = 1.35 SEK, with a BV of 22.42 SEK. ROE = 11.1%

Based on the share price of 39.60 SEK, this works out a PER of 18.2, and a P/B of 1.77 times.

In comparison, Dutech’s PER of 6.8 tiimes and P/B of 0.96 looks comparatively cheap.

Here are the related FS for Gunnebo:

gunnebo-third-quarter-report-2016

Despite the massive run up in Dutech’s share price in 2016, it is still some way away from matching the valuation of peers.

On top of that, Dutech is in the growth phase. CFs are growing y-o-y, whereas Gunnebo is a mature company, and growth has been stymied in 2016. Dutech is also generating much higher rates of return on it’s equity compared to Gunnebo.

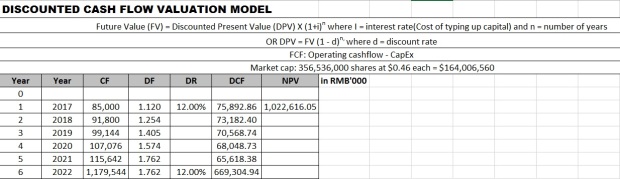

My personal favorite valuation technique though, is the discounted cash flow modelling. The concept behind DCF makes perfect sense to me. As with all modelling techniques though, the input parameters are the key.

And since we’ll have to rely on a bunch of assumptions, we can’t expect the CFs to be iron clad. Still, I find it to be a great tool to get some idea of valuation. Sides, one can monitor the CFs and update the DCF model quarterly to see how it’s progressing and tweak it accordingly.

CIMB has worked out a DCF model in one of their reports. I really wished they’d give more details though, it took me a long time to figure out the numbers. Even now, I still don’t get why they have such high CF figures past FY18:

I get that they’re probably expecting a significant dip in FY17 CFs due to consolidation expenses from the recent acquisition of Metric. I thought it’s a bit too aggressive a drop.

But following FY17, they’re expecting a massive jump in CFs from FY18 onwards, particularly from FY18 to FY19, with a massive 17% jump. Don’t quite get how they came up with this.

Interestingly, I used my own DCF modelling, with somewhat different figures and assumptions, and it didn’t come out to be too far from CIMB’s TP either.

TTI’S DCF:

I started out being more aggressive than CIMB, by expecting that CFs are not that greatly impacted in FY17.

I also assumed that the WACC is 12%, and that the CF growth rate in the 1st 5 years is 8%. Long term growth rate is 2%. (Much more conservative than CIMB’s massive jump)

Using the Gordon Growth Model, the Terminal Value I got is RMB 1,179,544,000

Adding all that up gives us an Enterprise Value of RMB 1,022,616,000

Net cash and cash equivalents as of FY16Q3 = RMB 222,426,000

Fair Value = RMB 1,245,042,000

Equity value / share = 0.72 SGD

Illiquidity discount = 15% (CIMB used 20%. 20%-30% is typically used for private, illiquid companies, but since Dutech is listed and not that illiquid, I opted for 15%)

TTI’s DCF Target Price = 0.612 SGD

Which is not too far from CIMB’s 0.65 SGD TP.

I’ll leave point 4, which analyzes Dutech’s scalability and prospects going forward, to Part II as it is really long.

Please share your thoughts and comments with me in the comments section, or via email, especially if you’re familiar with Dutech’s operations.

Great write up. I have still thinking to add to my position. The main concern I have is m&a seems to be a corner stone of their strategy as you can see Johnny Liu has been acquiring companies. It seems to indicate to me organic growth is slow in this industry and m&a is the way to go. With the acquisition of Krauth and Metrics plus increased in r&d expense I am expecting to see new product lines. At current valuation while it is not expensive there are questions unanswered to allow me to have the confidence to increase position. Being cautious as usual.

LikeLike

Hi XL

I dont think Johnny Liu makes M&A a cornerstone of his strategy. As in, I don’t think Dutech specifically sets out to keep acquiring companies. One of the tell tale signs of a serial M&A is that the valuations get richer as each acquisition gets larger, and there are less targets.

Rather, all these M&A occur because there are just opportunities to do so. The acquired companies are all in distress when they are acquired, and Dutech used it’s +FCF to buy them on the cheap.

Also, I like the M&A because the recent ones allow Dutech to expand into related fields that Dutech didn’t have the expertise in. This is very different from just buying earnings. Many M&A buy earnings, that is, they just buy out their competitors in the exact field competing for the same clients.

Dutech’s acquisition allowed them to expand into other fields which they previously had no presence in. That’s very different from a serial M&A company.

Lastly, I also noted that their M&A thus far focuses on the “Business Solutions” segment. (DTMT, Krauth and now Metric)

I like this segment better than just providing ATMs and safes because this segment has recurring revenue, and a stronger competitive moat because of the know how needed.

There are some potential headwinds (USD-RMB Fx, coiled steel price in China, Metric integration costs, potential china regulation costs) for Dutech in 2017 that I am monitoring, but on the balance of things, I’m optimistic for 2017 and coming years.

LikeLiked by 1 person

Great write up, very detailed as usual. I learned quite a bit about Dutech! I am now really looking forward to part 4.

My initial thoughts are that on a very macro level, it seems that Dutech’s business might suffer from a transition towards a cashless society.

LikeLike

Hi Dan O

“My initial thoughts are that on a very macro level, it seems that Dutech’s business might suffer from a transition towards a cashless society.”

Ah that’s one of the 1st things I looked at. On the contrary, the global ATM market is growing, and at a rapid clip, particularly so in emerging markets and in China.

Also, while it may seem that as we all use less cash, there’s a reduced need to withdraw cash, in reality ATMs now and increasingly so in the future, are going to be points for transactions, not just to withdraw cash.

Even large mature banks are increasingly shifting as much of their operations to these ATMs as opposed to having bank tellers. And it makes perfect sense: much lower costs, ATMs are relatively more reliable and most importantly, you can provide services to your clients 24/7. Here’s some additional reading about this:

http://blog.dieboldnixdorf.com/the-end-of-the-beginning-whats-next-in-migrating-transactions-to-the-atm/#.WHIMi_l97IU

There’s an interview with Diebold CEO specifically about this, but I can’t find it right now. Basically he talks about how the new ATMs with added functions actually stimulate more transactions for Diebold’s bank clients, and their clients are increasingly asking for more functions for their ATMs

LikeLiked by 1 person

Hi TTI,

just a quick question on your TV – what’s the expected growth rate in perpetuity used?

Thanks!

LikeLike

Hi marchent

“I also assumed that the WACC is 12%, and that the CF growth rate in the 1st 5 years is 8%. Long term growth rate is 2%.”

2%. I assumed longer term perpetual growth rate at 2% which is very conservative.

LikeLike

Hello can i find out why did you assume a wacc of 12%? Isn’t wacc a weighted average of cost of debt and cost of equity? It will be great if you share a little on the thought process behind it.

LikeLike

Hi…

It’ll be a post by itself if I go into exactly how did I get a DF of 12%…

Here’s a quick summary.

WACC definition:

http://thatswacc.com/wacc-formula.php

The ave cost of Dutech’s debt can be found in AR15 page 74/75. They break down the different loans and the different rates, I used a weighted average according to the loan quantum. I ignored “Loan 1” as it has since been repaid (repayable by Jan 2016)

Sure, this is not 100% accurate as the loan is not current (as of mrq), but they do not provide a quarterly breakdown so you’ll have to rely on the most recent AR. I don’t think any difference is significant anyway.

Corporate Tax rate = 17%

Cost of equity (You can use either dividend capitalization model or the capital assets pricing model). If using dividend capitalization… the figures are widely available. If using CAPM: the beta is 0.91, risk free rate (= 3mth treasury bill rate) which is 0.5% currently, and for historical rate of return, I used 7.5%.

I actually got a DF of <12% in my calculations. But since the CIMB report in Nov 2016 used 12%, I stuck to that cos it's more conservative using a higher DF isn't it?

Cheers

TTI

LikeLike

In your excel for your calculation, did you mean DPV = FV / (1+D)^n, or was it another method you are talking about when you say DPV = FV (1-d)^n?

LikeLike

Hi

Different formulae but they’re the same thing. Hard to show the math here, but if you work out the relationship between discount rate and interest rate and input inside, you’ll see they’re the same thing.

The 2nd equation is probably easier to understand:

DPV = FV (1-d)^n

The present value is a discounted factor of the number of years of the calculated future value.

That’s also the formula that the excel spreadsheet I used has embedded in it.

Cheers

TTI

LikeLiked by 1 person

Oh, just to be clear on definitions, in your question:

D = interest rate / cost of tying up capital

d = discount factor

n = number of years

LikeLike

vested too, interestingly i hold this counter thru my own analysis.

one thing, i’m unclear about is: RMB depreciation, though business is not just in China.

LikeLike

Hi Bruce

RMB depreciation is good for Dutech, cos their production costs are all in RMB while their revenue is all in USD.

LikeLike

Tqvm for your write up. The Dutech management had been very occupied these last few years. Is there any opportunity for them to hold their next AGM in Singapore?

LikeLike

Hi mark20108,

You’re welcome.

Actually, their AGM is usually held in Singapore. FY15’s AGM was at Suntec City.

AGM is probably the only time for shareholders to have real communication with Dutech’s management.

Their IR is non existent.

As long as they go about continuing to generate value for shareholders, I’m not complaining. But granted, Dutech isn’t big on constant shareholder communication.

LikeLike

Hi TTI,

Thank you so much for your detailed write-up on Dutech and I get to know more about this growth stock and vested. Appreciate your sharing and looking forward for more updates from you.

LikeLike

Hi Grace

You’re welcome

Thanks for reading!

LikeLike

hi tti,

how do you derive the figures for future cash flows? do you use the average of historical cash flows? and how did you conclude 8% growth rate for cash flows?

i find predicting cash flows a challenge, there are just too many factors affecting these assumptions. how do i estimate these figures with conservatism while not being too pessimistic on future growth?

LikeLike

You can look at historical FCF to estimate if the business is growing very steadily

If there’s an acquisition, u can predict by adding the CFs to the acquiring business, and subtract a certain amount to account for temporary loss from integration

8% for 1st 5yrs n 2% long term is quite conservative cos Dutech has grown CF much faster

Past 5yrs, always assume a basic long term rate that doesn’t have much of a growth component, cos we can’t really project so far out

Every yr, depending on whether the CFs match up to your expectation, u can tweak the data

LikeLike

appreciate your response.

if a business has unpredictable cash flows eg: construction. Besides order book, how do you estimate cash flows for 5 years?

LikeLike

You can estimate cashflow for construction companies actually, like you said, by looking at the order book and guesstimate when they can collect cash. Of course, nobody is going to be very accurate, but the estimated CFs by itself, actually allow for a fairly large margin of error.

In my experience, it is the discount factor that makes a big difference to your end result.

I guess you are just trying to get a very high level of accuracy, but DCF is really a tool that’s exposed to rubbish in rubbish out. It’s hard to get it very accurately. But then again, being somewhat correct, is much better than being completely wrong.

LikeLike

you’re right. DCF is really a tool that’s exposed to rubbish in rubbish out. I watched a video presentation by prof aswath damodaran of nyu, where he mentioned his emphasis on cash flows rather than “offsetting” it with a high discount rate. so that’s why i was curious to know.

LikeLike

Oh yes I saw that video as well.

If you can predict the CF with high certainty, sure, why not.

In that video, he describes how he charts a distribution curve of the various CFs. You can modify the DCF modelling whichever way you want.

Personally, I try my best to predict the CF, and update it each time there’s new data (quarterly earnings)

It’s a tool that gives you an idea about valuation IF you assumptions are right, or at least around the ballpark.

LikeLike

thanks for responding to my queries. have a good weekend. cheers!

LikeLike

Sure ironsight, you’re welcome.

Also, over time, you’d prob figure out the characteristics of the industry and which companies are more accurately valued with DCF. The specific naunces can only be determined after one has owned the company for sometime and understands the characteristics.

LikeLike

Thorough Analysis, valuable insights.Management competence and integrity key.

Perhaps consider looking at

-reliance on contract manufacturing( entry barriers?e.g . Patents, accreditations?)

-customer concentration (higher after diebold merger)

– hardware versus software (growth outlook?)

– exports to the U.S. ( after Trump?)

In parts 2 .to 4.

PGL

LikeLike

Hi Peter

Thanks for your comment.

– I’ve already described the entry barriers, the UL and UEN certifications etc in an earlier post back in June 2016:

– Yup, for sure the single large client dieold nixdorf would represent some concentration risk if anything happens to this collaboration. I think the China incident has already shown that. Dutech is diversifying more into the Business Solutions space, so with time, I think this concentration will be reduced. It is hard to eliminate this concentration completely though, because the safe and ATM space is a niche industry to begin with, and Diebold Nixdorf IS the largest player now. Besides the 2 large players in this space, there isn’t any other significant players, so there’s no way to completely avoid client concentration.

– I’ve also described the hardware vs software portion, I personally prefer and am glad to see Dutech expanding in the Business Solutions space, which has more of the software and services component in it, rather than pure hardware.

– Dutech is an upstream supplier, so they don’t do direct sales. Their end client is such that geographically, most of their sales was in Europe previously. In FY15, 41% of sales was to Europe while 25% was to US. I don’t think this will change too much, and if anything Europe will still be the main area for sales, particularly since their acquisitions of late, are all located in Europe and have sales mostly in Europe as well.

The Trump effect is such that any US manufacturer with foreign supply chains have to be careful, but I don’t this will have any effect on Dutech. To begin with, the ATM and safe industry is rather niche. It flies under the radar of Trump. On top of that, even if Diebold wants to, it’s going to be hard to get the same reliability, coupled with the same cost savings to get the supply chain relocated to US. That’s where the competitive advantage of Dutech comes in.

Cheers

TTI

LikeLike

Thanks! Will stay vested and monitor results and startegic moves carefully. PGL P.S.Asuume Exchange rate Renmimbi/U.S dollar and perhaps even Renmumbi/Euro will work in Dutech`s favour at least short term?

LikeLike

FX is notoriously hard to forecast, and I try not to take into consideration the effects of FX. Unless the likely effect of Fx is negative for the company, in which case, I’ll factor a wider MOS in my calculations to account for that.

A strong USD/RMB, (and I assume Euro/RMB) will work in Dutech’s favour. USD/RMB did weaken a bit of late, but the effects of all these are small compared to the large general trend of an appreciating USD/RMB. I think the general trend will work in Dutech’s favour, because interest rates are most certainly set to either rise, or stay the same. Hard to see more rate cuts here.

The only scenario where rate cuts may come in, is if the US economy suddenly contracts rapidly. And even if that happens, we have seen that rate cut may not necessarily mean a weaker USD, because the USD is viewed as a safe haven and ironically, as the economy tanks, people start buying USD, lending strength to the currency.

Having said all that, I generally don’t put too much emphasis on the +ve effects of Fx.

LikeLike

What an astute investor you are. I invested in Dutech last year and made a nice profit. After reading your really brilliant analysis, I have reinvested and is waiting for more opportunities to increase my holdings. Would love to heard your views on LHN and TTJ. Keep up the amazing service to the investment community and I am sure many readers are waiting in great anticipation for your next big review.

LikeLike

Hi T.Chan

Many thanks for your kind comments.

Dutech remains one of my core positions, and I’m excited to scrutinize the Q1 results to see how the integration of Metric is progressing.

Will keep LHN and TTJ in mind, but I have a long list of companies that I told fellow readers I’ll look into eventually…

Thanks for reading

Regards

TTI

LikeLike