Last week, I sat down with a super investor one evening, who took the time to look at TTI’s strategy and results thus far, and shared his thoughts on how to “improve my productivity” (As he so gently and succinctly put it)

Long time readers would know who I’m talking about. Apparantly, his friends are readers of SG TTI too.

I can tell the said super investor spent some time understanding what I’ve done, as well as thought about what’s appropriate for me going forward. (Not every good strategy is appropriate!)

That’s something I appreciate greatly.

Subsequently, I’ve had the entire weekend to ponder about the discussion, and trying to figure out some stuff. I drew up a list of follow up questions initially, but curiously, the more I thought about it, I found myself answering these same questions.

It does require some “major surgery” with regard to my thoughts though.

The suggested strategies for me going forward, isn’t difficult to understand. No high science here (I suspect the said super investor purposely made it so). In fact, the large bulk of it, is what I’ve already been doing.

But I did overlook 1 important caveat.

And that relates to my options strategies. Instead of choosing something stable and relatively predictable, I did the exact opposite, thinking the high implied volatility would mean higher premiums. To make things worse, I compounded the mistake by opting for options that are far out of the money ONLY.

On hindsight, that’s literally like taking 2 steps forward and 3 steps back, isn’t it?

OK, I’m not supposed to talk about what’s been discussed here, or share it freely, so I shall stop here. All I can say is that going forward, I’ll be adapting these new thoughts, and it seems like my activities in the US markets will be taking an increasingly important role.

It’s all been very enlightening, and very good fun, to be honest.

This week saw the 1st trading day of a hotly anticipated IPO: UnUsUaL

MM2 Asia hived off this division in an IPO on catalist. And the share price simply went ballistic on the 1st trading day:

I don’t really bother with IPOs usually.

But I was reading this week’s TheEdge and a paragraph in an article about UnUsUaL jumped out at me:

“For the nine months to December last year, UnUsUaL’s revenue fell 28% to $16 million. Earnings, however, grew 38% to $3.8 million. Revenue was lower as the group had organised more one-off events in 2015 during the SG50 celebration period. But earnings rose as gross profit margins improved owing to less outsourcing for projects. It also recorded a $1.6 million gain, mainly from equipment sales.”

I pulled out my calculator and did some quick calculations.

Earnings grew 38%, this means it was $2.75 million before.

This current $3.8 million in earnings though, includes a $1.6 million gain from equipment sales.

Since UnUsUaL isn’t in the business of buying and selling equipments, I’m assuming this is a one off gain. So normalized earnings (backing out one off gains) would thus be $2.2 million.

This means that true earnings actually DROPPED y-o-y from $2.75 million to $2.2 million.

Revenue dropped y-o-y as well, as they’ve acknowledged.

But dropping revenue and earnings do not make for a good IPO story. So it’s time to cue for some “equipment sales”, which changed the earnings picture from a drop y-o-y to a very respectable “Earnings, however, grew 38% to $3.8 million.“

Wonder if anyone bothered to ask why the equipment sales has to occur JUST BEFORE IPO?

Yet, despite all that, the share price jumped more than 100% in a single day. PE now is something like 50 times! That’s a fact. It happened. Period.

So perhaps even if one KNOWS this fact about the earnings, it’d have been smart to still get into this IPO madness.

Just don’t be the last one holding onto the bomb when the music stops. Ah, the craziness of the markets.

Of course, my thoughts above are just from reading a single article. No DD. So perhaps there’s something that I don’t know about, something that’d justify paying PE 50 times earnings, and if so, please feel free to correct me.

As stated here, I took up a position in S i2i about 2 weeks ago:

TTI’s New, Puny Position – S i2i

It’s not a game changing idea because of the small quantum, but as I wrote previously, I’m looking at the ROI, % wise. Not the quantum. And I’m hoping this would turn out to be the 3rd big winner for me in a row, following the successes of Dutech Holdings and Geo Energy.

Thus far, things are going as expected as the share price has appreciated 6%+ since just 2 weeks ago, and looks set to continue to race towards the target price I’ve mentioned, in order to exit the watchlist.

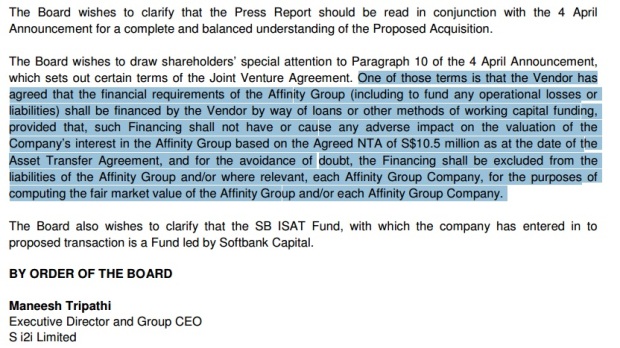

Interestingly, the company released an announcement:

Now, I’d admit, I was initially negative about the proposed acquisition of the E-commerce business. But as more details are revealed, increasingly, it seems like the management managed to pull off a coup.

The acquisition is an “asset transfer” as the prior announcement put it. No cash involved, just equity dilution.

But this announcement is what got me puzzled.

Even after the asset transfer is completed, the vendor SB ISAT Fund, which is transferring the E-commerce business to Affinity, a subsidiary of S i2i, is responsible for taking care of the financial requirements of the Affinity Group.

Huh? That sounds like a very good deal for S i2i.

The financing (to be taken care by SB ISAT Fund), cannot dilute S i2i’s stake, and in fact, is totally excluded from the liabilities of the Affinity Group. This basically means that the E-commerce’s business funding, will probably come in the form of some loan from the SB ISAT Fund to the Affinity Group.

SB ISAT Fund takes on the risks and liabilities of the loan effectively, since the loans cannot dilute S i2i’s stake so there shouldn’t be any convertibility attached to them.

All this is very interesting; S i2i’s management continues to come up with weird, innovative deals. Ultimately though, the execution and subsequent results would be the key.

I’m still holding on to my puny stake while I grab some popcorn and watch the show. Dr Modi himself has continued with his share purchases, so he’s definitely putting his money where his mouth is.

TTI is off travelling for the Easter weekend coming up (again!) and I’m really looking forward to it.

Time with family is always precious.

Overheard : “Someone wise told me that 90% of stock investors lose money, while 95% of forex investors lose money. So I choose stocks.”

LOL. That gave me a good chuckle.

Hello TTI! Just wanted to say that your post never fails to perk my curiousity on the perspective you have while looking at an investment opportunity.

However im really curious about what you mention about the Option strategies that u might be streamlining. Cos I’m also testing on option via selling higher IV options which is around 70-80% out of money with a timeline of 3 weeks out to expiry. Especially during earning period whereby some shares exhibit huge drop in IV after earnings.

So im just perk about how your current option strategies gonna differ! #CuriousFace

Anyway enjoy yr trip!

LikeLike

Hi Zandelicious

My experience with far out of the money options is that the premiums are not really worth it. You try to compensate that by selling higher IV options, but the typical scenario would then be that a single big move in the wrong direction wipes out the premiums accumulated by selling many far out of the money options.

The high IV is high for a reason afterall.

I wish I can share more, but I can’t.

All the best

TTI

LikeLike

Oic Im sure you have your reasons for not sharing! Anyway for your criteria of far out of money would it mean like 90% out? So looking at it from your reply is it that maybe ure looking more of a credit spread/ iron condor or maybe even an iron butterfly strategies whereby the risk is define? In doing so it wont lock up yr exisiting capital so can sell more trades?

LikeLike

“Oic Im sure you have your reasons for not sharing!”

I’m specifically told by my friend not to talk about what’s been shared with me, and not to teach it in any courses or stuff like that. And in fact, not even to write about him.

Like I said, he’s a private, low profile kinda guy.

Now, my personal definition of “far out of the money” doesn’t have a fixed parameter. But yea, 90% out is definitely “far out”.

I don’t bother with the iron condors or the straddles or stuff. Fancy names, but I think just common sense would work better.

Also, I think what’s more important is understanding the underlying security’s nature, and how your option strategy fits the security. That’s what I missed previously, and am glad that someone pointed it out to me. In other words, I don’t think 1 single option strategy works for everything, regardless of the underlying security. We are talking about derivatives here afterall. So a particular option strategy may work very well for say… Allergan. But not work so well for Shake Shack for example.

LikeLiked by 1 person

If you are selling options, you should aim to sell in the money options or sell short duration options.

We should not be afraid of being assigned but the caveat is that the exercise price must make sense to exercise.

If it gets assigned, we get the exercise price.

If not, we get the premium

How do you even lose in this scenario?

LikeLike

Hmm I guess thats assuming that you are selling options on a counter that you wishes to keep. Maybe at a price which is below its interinsic value factoring in the Margin of Safety. Then it pays you a premium while we wait for the price we want to buy.

However say eg. If the price drop way beyond the exercise price. Eg Market price $10, we strike at $8. Before expiry market price tank to $6. We are effectively converted at $8 and lost $2 as the new market price is $6. However if its something u wish to hold long term then it doesnt really affect us in long term la. and u get a premium for waiting!

But i guess some people do option strategies for trading than wanted to be converted?

LikeLike

Yup, that’s true.

But then, in this scenario, you get to sell an option contract only once.

This is because after it gets converted at $8, and you have the share price at $6, what next?

If you sell call option at $8, the premiums would be almost negligible.

If you sell in the money options or closer to $6, you collect higher premiums but risk it being exercised and the capital loss would exceed the total premiums you’ve collected.

I’ve just started implementing/trying out my new thoughts. It’s really not that different from what I’ve been doing. But the results are tremendously different.

Sometimes, we just need something/someone to point in the right direction, and make small modifications.

LikeLike

Hi Gary,

Good explanation.

I’ll add that I think the key is the underlying security.

TTI

LikeLike

Hi TTI,

I like your last sentence,,,yah 90 % of stocks investors lose money ! Also as German super-investor Andre Kostolany said ” Psychological create 90% of market ” …especially trading,,,

Anyway,,,enjoy your holidays and family bonding,,,yes !!! Time with family is always precious! Well said … :-)👏🏽👏🏽

Cheers !!👍👍

LikeLike

Wa STE

You just revamped your blog?

I almost thought I went to the wrong site, suddenly look so different!

Cheers

TTI

LikeLike

Yah! I change the template…looks more contemporary and “in” right ? Hahaha 😀😀, but contents remain the same…my thoughts of my journey..

Cheers!

LikeLike

Hi TTI,

Any new thoughts about BBR’s lastest acquisition proposal? Thanks.

Reagrds,

William

LikeLike

Hi William

I’m on holiday now, so not really up to the date with the news.

Your comment, is the 1st time I’m hearing of this acquisition, so I spent the past 30mins looking at the announcement superficially.

Generally, I think the acquisition of the remaining 20% is a neutral to slight positive event.

BBR’s malaysian operations has always been profitable, although it is affected by the strengthening SGD against the MYR.

My investing thesis has always been that their general construction arm would stop bleeding in FY17.

Thus far, this is holding true and the share price has been appreciating.

So BBR is consolidating their malaysian operations such that they become fully owned subsidiaries. That is not a bad thing.

On top of that, although the purchase consideration seems to be at a premium to the NTA, I noted that:

1) The price is paid in equity, not cash.

2) The consideration price is $0.31, which is at a huge premium to the current price. And the current price has already risen substantially.

This tells me that the seller of the 20% stake, has confidence that the share price of BBR would rise to >> $0.31.

I haven’t taken the time to work out the specifics of the deal, mainly, what is the REAL purchase price taking into the premium price paid, the equity dilution, and the premium in the price consideration vs the current share price.

Also, bear in mind that the share price has been rising, yet the discussions for such an acquisition would’ve taken some time to complete. This means that at the time of discussion, the seller was looking at a lower BBR share price and yet he considered $0.31 to be acceptable.

The reason why I said it is only a slight positive, is simply because it’s only a 20% stake in an existing subsidiary. Not really an earth shattering kind of move.

Cheers

TTI

LikeLike