June was a really tough month work wise, so updates have been few in between. I’ve only just realized how busy I was, when my lunch buddy noted that I’ve only had 2 weekday lunches the entire month, and had to work through all the other lunches.

Anyway, busy is good. I love busy. Time passes quickly when one is busy.

Speaking of which, I’ve also been busy on the options front. Busy fighting fires that is.

Over the past month, Valeant’s share price shot up rapidly.

Unfortunately, I sold a bunch of call options just prior to the rapid increase, and those got exercised. The good news part is that I took quick remedy actions, and sold several put options, and since the share price has continued rising unabated, all of the options have expired or are expiring, while I’m keeping the fat premiums (Fat because the volatility has been just cazy here!)

As a continuation of previous results (Geo Vs GEAR! + Options Update), here’s the most recent month’s activities:

Total cashflow received from 16/06/2017 – 14/07/2017: US$13,404.41

wow. I never expected it to be so consistent thus far. It’s curious, because every contract is different, with different premiums and stuff. Yet on a monthly basis, the total CFs attained has been rather consistent:

Total cashflow received from 12/04/2017 – 12/05/2017: US$13,657.25

Total cashflow received from 13/05/2017 – 13/06/2017: US$13,911.82

Total cashflow received from 16/06/2017 – 14/07/2017: US$13,404.41

Anyway, what’s significant in the past month, is divestments in my positions in WFC and EWZ.

Both positions were built up in prior months mostly via the exercising of sold put options, and partially by direct purchases. I would classify both as deep value, opportunistic purchases.

The WFC stake was bought after the WFC accounts scandal, which claimed its CEO John Stumpf’s job. Having had prior experience with WFC, I was fairly comfortable building up a sizable stake in the midst of all the controversy. Anyway, I’d be happy selling options on both sides, both puts and calls. As it turned out, the share price has recovered much faster than I expected.

EWZ was also bought on the back of the Brazilian political scandal. I sought an ETF in this case, as I didn’t have the time to analyze any specific Brazilian company. In any case, I figured that’d be the safest. Since then, the share price has rallied somewhat, and I’ve pocketed both the premiums, as well as the capital appreciation.

I’d add that the total divestment gains of approximately $6.8k USD are NOT part of the CFs tabulation above. The CFs specifically only includes nett premiums from options activities.

The total CFs received is still a tad below that of last month’s, but I’m definitely pleased.

What’s important is a repeatable, successful process. As long as it’s fairly repeatable, I can see how it’d work out to be very favorable in the long run. It’d also give me confidence to increase my allocation.

I’ve also been building up positions in an arbitrage situation:

CenturyLink’s acquisition of Level 3 Communications.

Some background here: CenturyLink is a telecommunications company in the US, probably similar to Singtel. It is the 3rd largest in the US, behind AT&T as well as Verizon.

CenturyLink has a presence throughout US, but is strongest in the west coast, as well as the states in the middle. It also operates data centres in Europe and Asia Pacific markets.

http://www.centurylink.com/index_a.html

Late last year, CenturyLink announced their intention to acquire Level 3 Communications. Well, although it’s an acquisition, in essence, it’s actually a merger of sorts, since equity of CenturyLink will feature in the purchase of Level 3.

Recently, the acquisition has achieved approval from all remaining states, so the deal is definitely going through.

There are 2 major, clear benefits to this merger:

- Synergies. The 2 companies clearly are quite different and have complementary businesses. Level 3 has an extensive fibre network that’s currently underutilized. CenturyLink on the other hand, would suddenly have access to an additional 200,000 miles of fibre optic networks, and can cross sell services to their much larger customer base, with better connectivity and better access. Level 3 Communications also have a much larger global presence that CenturyLink can tap upon. Particularly so in Latin America and EMEA.

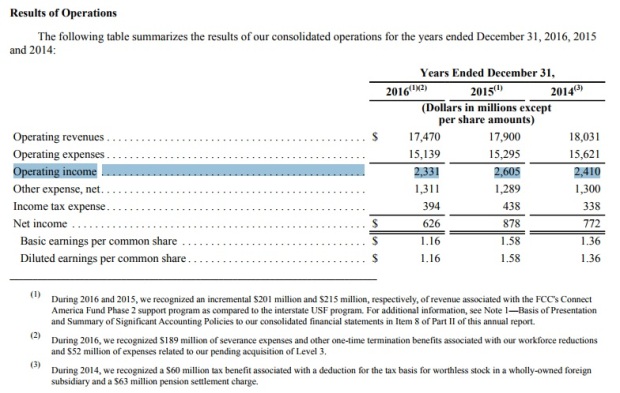

- Tax! Having spent the cash in prior years to build the extensive network, Level 3 Communications have a gigantic amount of tax losses that the combined enterprise can utilize to offset future taxes. How significant is this tax benefit? Very significant apparantly! Level 3 has nearly $10bil worth of net operating losses in it’s books, waiting to be utilized to offset future taxes. To put things in perspective, CenturyLink’s net operating income in the 3 years prior are between $2.3bil to $2.6bil

This also means that post-merger, the future CFs for the company will be significantly increased (since they have tax credits for the next few years) The company has already indicated that they’d use less than $2bil worth of operating losses as tax credits, so the combined entity will likely pay next to nothing on taxes for the next 5 years.

Seeing that the tax expense for 2016 was $394mil… this means that the company will have at least $400mil extra cold hard cash than prior years, since it wouldn’t have to pay this amount as taxes.

So where’s the arbitrage in this?

The deal is fairly complex. (It has to be, otherwise it’d be priced 100% correctly all the time)

CenturyLink will buy Level 3 Communications for $26.50 per share, and give 1.4286 CenturyLink shares for each Level 3 Communications share.

The deal is expected to close fairly soon, before the end of the year.

Now, at the time of writing this, Level 3 Communications share price is now $58.12

CenturyLink’s share price is around $23.

For each Level 3 Communications share, shareholders stand to receive the equivalent of $59.36 worth of “value”

Whereas Level 3’s share price has been fairly constant, CenturyLink’s has fluctuated fairly significantly of late, hence there has been arbitrage opportunities to acquire Level 3 shares at a discount to what the deal would entail.

Of course, it all depends on the ultimate share price of the combined entity.

So, how am I building my long position?

I currently have sold multiple in the money put options on both Level 3 Communications, as well as CenturyLink. These are likely to be exercised. Simultaneously, I have also sold far out of the money call options on all positions that I’ve built, as well as those that would likely be built upon assignment of the put options.

This, IMO, is the best way with the lowest risk and highest chances of success. The premiums I’ve received on both call and put options are significant, and if everything goes as planned, I’d have significantly reduced my purchase price of the combined entity CenturyLink.

As an added sweetener, CenturyLink pays a hefty dividend. The company has already committed to maintaining their dividend of $2.16.

That works out to be a yield of 9.4%!

And since dividends are paid quarterly, technically it’s slightly higher since I can utilize the cash. With my options strategies, time is of an essence. I’ve only allocated a relatively small portion of my portfolio, and yet I’m already seeing the effects of time whilst using such a strategy.

In the long run, this difference may well work out to be worth several tens of thousands of dollars every month!

Now, seeing that CenturyLink’s CF will not only be maintained, but IMPROVED significantly post-merger, there’s no reason why the dividends cannot be maintained. At 9.4% yield…. I think that’s a significant buffer.

Long time readers of SG TTI would also understand how much emphasis I place on CFs. That is a true barometer of the success of the business in the long run. (In the short run though, earnings is what makes headline news)

I am keeping an eye on the other operating metrics of the company though. As of FY17Q1, financials deteriorated slightly, with earnings coming in at $163mil, vs $236mil for FY16Q1.

Core revenue also dropped, offset only partially by a corresponding drop in operating expenses.

In short, it’s not all rosy, as the operating metrics seem to have gotten weaker.

Post-merger, I’ll be monitoring to see that the management team executes on their state synergistic goals. I’ll probably continue selling call options on my positions, although I haven’t quite decided on the exact strategy i.e. what strike price options do I sell and how close, relative to the share price.

Since the dividends are significant, ex-dates will also play a significant role in determining the premiums of the option contracts.

Alright, that’s it for this post.

As always, good luck hunting!

Hi,

1) I have been reading your blog and is interested in your ideas for option. When you mention CF on option for each month, is it the profit you have gained for each month?

2) Are there any books or online resources that wil be good to learn a good foundation for options?

Thanks so much!

LikeLike

Hi Raymond

You’re up early on a Sun morning!

1) Hmmm close, but not exactly. CF is the actual cash received. But since some of the contracts are still outstanding at the point of tabulation (those are the unshaded ones in the table), technically not all can be counted as pure profit as yet. Also, the CFs don’t include capital gains. So for eg, for the most recent one, the actual profit would be higher than the CFs mentioned, because of divestment gains on WFC and EWZ.

2) Ah, I get this question A LOT. Like really a lot. I don’t have any specific recommendation.

Everything I know is self taught. I read a book that I borrowed from the library, nothing fancy, just the basics (for serious reading, I still prefer hard physical books, can’t do online reading). There are several online sites as well. Investopedia explains nicely too. IMHO, there’s no need for anything complicated, just learn the basics…. and be guided by common sense.

LikeLike

Hey thanks so much for the clarification. Yeah it can get a bit confusing. I have started working for 4 years and thus make it a habit to gain more knowledge over the weekend. Shall explore some books from the library to learn more! Kudos to your performance too. It’s indeed an inspiration!

LikeLike

Yea, you need to at least understand how Options work first, otherwise you might find my answers even more confusing.

It’s not that difficult to understand the basics….

and fortunately, the basics are all we really need IMO.

Just borrow 1 or 2 specialized books, and understand the front part.

IMO you can and actually should, skip the complex stuff and jargons. They’re not necessary.

LikeLike

Hi TTI, i am also in the mid 30,started options 2 months ago. Based on your cashflow,I think u have deep pockets. Btw,would u considered futures options like WTI?

LikeLike

Hi Steven

Not really, I’ve approximately $240k USD in the options part. Is that considered “deep pockets”? I’d allocate more after reviewing the data for another 3 months.

Total portfolio AUM including SG equities is approximately $1.2mil.

No, not considering WTI futures. I don’t think its necessary or beneficial to do too many different things. It’s better to do a few things, but constantly find ways to do it better.

Similar to how I’d prefer a concentrated portfolio with only a few companies.

TTI

LikeLike

That’s why I said you are doing well. It’s quite rare to find somebody in Singapore that is making money and being so humble at the same time. Your portfolio is pretty transparent, I would see you more an equity investor while collecting premiums to lower your average cost in deep value stocks. Do you usually sell credit with naked calls and puts? For undefined risks,I understand there is more volatility play and more premiums collected compared to credit spreads as hedging limits our potential gain and losses.

LikeLike

Hi Steven

Well, I know many guys who do much much much better than me, some of whom are reading this blog right now so… I wouldn’t dare to be presumptuous about how well I’m doing…

Yes, I focus on equities, mostly. Options are derived from the value of the underlying equity too, so any option activity is grounded on a FA of the underlying equity.

I do sell naked calls and puts, but those are far out of the money options. Premiums are low, they’re not the main thing I do. I’m very careful with selling naked options on credit, which is why I’d only do so for far OTM, low probability contracts.

The way I structure the option contracts really depends on the underlying equity. For eg. CHK is my absolute favorite right now, because the oil prices go up and come down and ultimately, they stay in a fairly predictable range. CHK is similar. The share price goes up rapidly and comes down rapidly but you can almost draw a median line smack through. This means I can and have been, selling ITM contracts, and the premiums are really fat and juicy. I can get like $0.25 premium on a contract with exercise price $5, expiring in just 2 weeks. This means it’s a return of 5% in just 2 weeks. Annualized return is…….. crazily high. (Of course I don’t think this situation will last indefinitely)

To top if off, because it’s hovering around rapidly, I can sell both ITM call and put options at the same time, so the premiums is actually appoximately doubled.

Whereas for VRX, the share price has risen and will keep rising. But the rise is not uniform. With any piece of news on their debt pay down, the share price spikes up rapidly. So I’m not so keen on selling far OTM call options, because the premiums are low yet there’s a real chance they may be exercised. I’m happy to sell put options, and even some naked puts on it.

So in short, I don’t have a single 1 size fits all strategy, it really depends on the underlying derivative. And to understand what to do means the usual FA and deep value analysis of the underlying derivative applies.

TTI

LikeLike

Hi TTI, steven here, It is my pleasure to be able to learn so much from you, it’s so hard to find like-minded person, luckily I got introduced by google on your site last night. Just a question, I hope you can help me. If you sell both ITM call and put options, call option get exercised to sell stock and put gets assigned to buy stock, would these 2 options offset each other akin to a stock being treated as a purchase and sales simultaneously?

LikeLike

Hi Steven,

I’m assuming you are referring to both options having the same expiry date. From your question, it also sounds like you mean that both have the same strike price?

In which case than not necessarily, the scenario that you painted may not happen i.e. it doesn’t result in both contracts being exercised simultaneously and being nett off.

For eg, if you had sold both call and put option with strike price say $2, at the expiration date, if the share price is $2 exactly, the buyer/holder of the contracts that you sold have the right to buy or sell to you at $2.

So the put option may get assigned, or the call option may get assigned, or both may get assigned, or both may NOT get assigned.

In my experience, in this kinda scenario, usually it doesn’t get assigned and the contract expires. If I’m not wrong, that’s the default.

But it may not 100% be the case because the holder of the contract has the right to still get it assigned. So you may end up with the scenario whereby the call option gets assigned and you have to sell, while the put option doesn’t and it’s not sold to you. (and vice versa)

TTI

LikeLike

In that case, I think I just stick to cash secured put. For selling calls, I either have to stock to face assignment (covered calls) or do a credit call spread. Is the margin a lot higher for naked calls?

LikeLike

Margin requirement depends on how many contracts, how far ITM or OTM the strike price is, the expiry dates etc, so I can’t tell you whats the margin needed for naked calls. It depends on which specific one.

As I mentioned earlier, I think the key is to relate what you do to the underlying derivative and what’s going to happen. Not so much what you do exactly per say. There’s no 1 size fits all kinda strategy. They same thing done on different derivatives can be suicidal or highly successful.

For eg, you mentioned selling cash covered puts. If you did that for VRX sometime last year, when the share price was in free fall, you’d be skewered. Not a good idea at all, even though it sounds “safe”.

So the key at the end of the day, is still a deep value FA.

Cheers

TTI

LikeLike

At my level, I can only widen my spread. More cash capacity is required for selling cash covered puts. VRX sounds “safe” because you’ve done deep value FA. You are quite an inspiration and reminds us how lucky we are to have an edge over others with our options knowledge if well harnessed.

LikeLike