Value investing as a concept, has really taken off in the past couple of decades.

Graham came up with the science behind it, but Buffett single handedly popularized it and made it mainstream by showcasing results that became the fantasy of investors-wannabe all over the world.

Let me play the devil’s advocate here, and put forth a key concept question:

If information is now ubiquitous, and assuming most retail investors have access to the same type of information, at the same time, how does one truly find value and capitalize on it?

If there’s a real discrepancy between the intrinsic value and the price, wouldn’t the numerous eyeballs in the investing realm quickly identify this gap, and take the appropriate action, either by going long or short, such that the net results of their actions would quickly nullify this discrepancy?

Let’s not forget that WB and Graham resided in a very different world from the world today.

Information was not ubiquitous. One could get a real advantage by receiving information faster. Hence, the scuttlebutt method of investing works. Going down to the base level, kicking tyres and doing good old investigative work gives one a true operating advantage. That’s hardly true these days.

Here’s TTI’s answer to my own question.

There are still opportunities because true value investing is simply… difficult. Most people would not be willing to put in the work required to find these opportunities. It’s human nature.

OK, this post is inspired by 2 recent incidents in my life.

1) Dad excitedly called me up one fine day to tell me that his buddy recommended him to purchase a trading program. All he had to do was to input the ticker symbol of the stock, and it’d track the share price and tell him when to buy and when to sell. The program apparently has a “very high success rate”.

I was disgusted.

1stly, I’ve been taught from young, that nothing comes to you on a platter without pure hard work. (unless it’s a one off lucky incident type like the US powerball winner…)

2ndly, common sense tells me that if such a program was indeed that successful, in which case the only limiting factor to the path of riches would be the capital deployed. And there are many ways one can do that. The inventor of such a program would not need to be peddling it to the masses. (And guess how much such a program costs? I would consider even $300mil to be cheap if that’s true). Yet, it costs $300. What a joke.

3rdly, common sense also tells me that if it is indeed such an all powerful program, and if indeed the inventor is so altruistic as to pass such a program around for a mere $300, then logic tells us that many people would buy it, many people (including TTI!) would use it, and if a sufficient number of people use it, then the program itself would become useless! It’s a self defeating mechanism incorporated into such schemes. I would assume the said program relies on TA to spot certain levels and come out with buy calls etc. And if it truly worked, then the price would never deviate far from the intrinsic value. Or, if taken to extremes, the program could set the market price in itself, as when it gives a buy recommendation, everyone would start buying and with sufficient players, it’d presumably reach the “sell” range in a split sec.

In short, it’s just simply not possible.

2) Almost 2 decades ago, my mother in law got into a serious traffic accident through no fault of hers. To cut a long story short, she received a tidy sum of just over $500k as compensation, and subsequently quit her low paying job, intending to live on the returns of this initial capital.

Being a layman with minimal education, she followed almost exclusively, the recommendations from 2 sources: Her broker and analysts’ reports, particularly those that she heard over the radio or read about in the news.

Mind you, we’re talking about someone who strictly followed these recommendations, whenever possible. In fact, she even paid the higher “broker-assisted” commission fee of 0.5%, because she doesn’t even know how to use the online/mobile apps to transact on her own.

So what’s the result after 15 years?

How much of the $500k remains?

ZERO.

Well technically it’s not zero. It’s NEGATIVE. Cos she put in more of her own savings aside from the $500k compensation.

And this result is “achieved” in a period of time when all indices worldwide have pretty much been on an upward tear. If you do the relative comparisons…..

Yup. True story. She’s lucky because her kids have done well in life and send her fat allowances every month.

How many other gullible aunties are there out there, who cannot afford this folly?

Talking about this really makes my blood boil. My wife has been asking me to manage my MIL’s funds for ages, but managing your MIL’s funds, especially if she’s not privy to what’s happening, is suicidal.

I’ve more than enough work to do as it stands anyway.

And that’s it. It amazes me how it’s precisely the lower educated or those with poorer earning power, that treats their “investments” in such a cavalier manner.

Those who are most ill-afforded to lose money, are usually the ones who treat their investments like it’s a gamble. They can save up every cent here and there, but when it comes to investing, throw their money in a stock because someone else says so, because the news says it’s good, or because some squiggly lines on a chart tell them to do so.

Illogical and without basis.

Yet, that’s the case throughout history, and it’d never change.

Why?

Cos it’s easy to do so. The allure of riches without effort is strong enough to overcome human logic. Hell, even I feel like participating in the US Powerball after reading the news!

As the title suggests, I’m gonna make the case for the TRUE value investor.

I use the word “true”, because I don’t think there are many true value investors.

There are many value investors because of WB’s popularity… but there aren’t many who can truly claim to seek out value.

Since SG TTI was set up, I have had the fortune of making friends with and discussing investment ideas with several of my readers. Amongst them, I’d highlight 3 of them as true, blue value investors. And their results (those that I can verify) have been truly stunning.

It’s a pity that I cannot share too much information about 2 of them, as they have both declined to be identified or spoken about at length.

The 1st guy is an UHNW individual, based in HK. Made his fortune at a relatively young age, and now runs a home office managing his own fortune. He shared just 1 idea with me sometime in mid 2016, it’s been slightly over a year, and the ROI sits pretty at 28% right now. (Incidentally, I just recently found out one of my friends works for him. It’s a freaking small world)

The 2nd guy is also based in HK, works in the fund management industry, and although I am not sure what the results of his fund look like, but the 1 idea he shared with me, also sometime last year, has returned close to 32% to date. I can understand why he doesn’t want to be featured, I guess there are all those non-disclosure stuff to consider in his line of work.

The 3rd guy, ah, and now I can showcase verifiable results, is Alain T, and he has contributed a post sometime ago here:

Please go and read that post again before you proceed. Please. It’s important, so that one can understand what it means to be a true value seeker. Go take a look at his work.

Note the date of that post: 29th October 2016

So how did his idea do thus far? I’ll quote a paragraph I wrote in a follow up post after his:

“On top of that, at the end of June, the company did a 1-off capital reduction exercise and returned a cool $ 0.729/share to each shareholder. So if one took up a position then, the returns now would’ve been a real pretty sight. I won’t even do the math here, but if you’d just add ($0.729 + capital gains of about $0.1) / intial vested price of around $1.65, and then annualize the return…. the ROI figure should be eye popping.”

And that was in October 2016.

I won’t even bother to do the math if one had invested before June (I believe Alain did because he brought this idea to me before that). The returns would be several hundred % by now. Yes, several hundred %.

Let’s be critical and assume that one had vested in S i2i at the point the post was published, and not earlier. How had the share price performed?

Share price rose from $1.75 to $3.08 at the time of writing this.

That’s a 76% return in just under 1 year!

And that’s achieved by buying and going to sleep in the market and not doing anything but waiting and sitting tight. No reading and shouting “UP UP UP” everyday. Nothing. Just doing nothing.

I have never seen anyone using squiggly lines prove their long term results to me like this. And I’ve an open mind.

Right now, we can all agree that this kind of returns is outstanding. Anyone would be proud of it.

But what does it entail? Again, as I’ve mentioned above, go read that post again:

This is the type of effort and work needed to attain the confidence and arrogance to invest AND stay vested in the face of opposing views.

And that, my friends, is what I call true blue value investing.

Still not convinced?

Recently, with the release of LTC Corporation’s FY17Q4 results, I was updating my thoughts while going through the financials, when I suddenly remembered that Alain T sent me his investing thesis on LTC Corporation as well.

I searched for it on SG TTI and couldn’t find it, before I finally realized that I forgot to post it here! It was sitting in my mailbox after I read it.

Again, it’s a piece of art.

Instead of copying and pasting here, I’ll just attach the report in it’s entirety here.

LTC Corp Thesis by Alain T 10112016

Do download it and take a look. Note the date: 10th Nov 2016.

So how has this idea done?

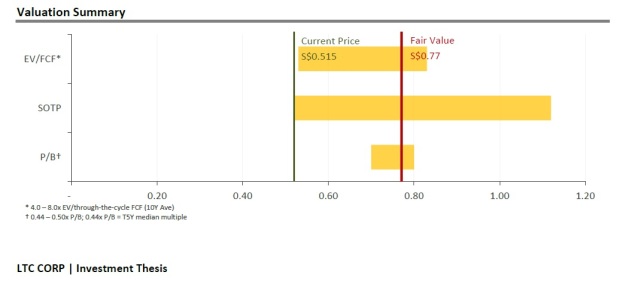

Share price then was $0.55, today’s it sits pretty at $0.685, giving a return of 24.5% in just under 10 months!

But in reality, his thesis was written way earlier. I’ll just cut and paste the concluding segment:

So if one bases it on the $0.515 entry price, his returns right now would be even higher at 33%.

At this point, I’ll squeeze in my updated analysis on LTC Corporation.

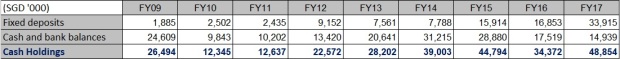

Both Alain T and myself were in agreement then, that LTC’s superior FCF generation ability meant that their debt would be quickly eliminated, and in subsequent quarters, without having to pay off debt, LTC would be extremely cash rich.

I’ve opined about that in several posts, but this is the most recent one:

LTC Corporation – FY17Q2 Results. Let’s Analyze…

Thus far, FY17Q4 results have confirmed that our thesis remains on track.

Total debt was pretty much eliminated with a single year’s FCF in FY16, and that has been brought down to a negligible $6k as of FY17.

The excess cash has accrued in the balance sheet:

At $48.9mil of cash and cash equivalents, it’s at its highest since FY09, and at the same time, debt is at it’s all time low (or rather, zero)

Of course, the key risks lies in the utilization of this cash. Management has not been great managers of cash. ROE figures remain in the low single digits, and while earnings have improved, they haven’t been great.

In his thesis, Alain was kind enough to give management some time to prove the USP acquisition would be successful. I’ll quote from his report:

“Potential for poor capital allocation to destroy value. The fact that LTC is cash rich and could begin to rapidly accumulate even more cash as debt repayments subside makes management’s capital allocation abilities pivotal going forward. The first use of said cash was to add a new retail business segment last year. While the jury is still out on that investment (see Appendix for further analysis), management’s use of cash is an important metric to track going forward as it weighs heavy on LTC’s future intrinsic value.”

Well, I ain’t so kind.

I’ve railed at how asinine that move was ever since it was announced and very unfortunately, I’m still right. Oh boy, how I wish I can eat my words.

Despite paying a nice premium to acquire a struggling RETAIL business, our total returns from it thus far has been a loss after 2 years.

Still, we bet that with the tremendous amount of FCF that builds up in LTC’s balance sheet each quarter, the share price simply HAS to increase. It’d be ridiculous not to.

Even now, the book value is 162.82 cents, while the share price is 68.5 cents. LTC trades at a 58% discount to book value! To top it off, this 68.5 cents comprises 31.2cents of cash and cash equivalents.

The company is severely undervalued, and as long as the FCF generation holds up, this undervaluation has to be corrected. If the management maintains at status quo, logically, the share price has to rise in tandem with the cash that builds up in the balance sheet.

If the management wakes up tomorrow and decides to be more shareholder friendly, the share price can shoot through the roof.

It is hard to see the share price dropping, as the amount of cold hard cash in its books acts as a floor.

This is the type of dynamics that I like. Draw or win. There’s no lose. Not a bad deal.

But then, this post is not about LTC or S i2i.

It’s about true value investing.

I’d encourage anyone who wants to make their next investment, to go stare at the 2 investing theses above, and think about this for a moment. There are guys like these 3 folks out there, doing this kinda work. (I wish I can share the other 2’s)

They are looking at the same things as you are.

Since the stock market is a negative sum game, you’re technically stepping in the ring to compete with them, figuratively, each time you make an investment (or punt, in some cases)

What makes you think you can win?

I don’t have to beat them (the 3) or you.

I just need to beat the aunties. (Aunties reading should be very worried)

#harshtruth

LikeLike

Hi WJ,

LOL!

I can’t say that logic is wrong.

Aunties wouldn’t be reading this though.

LikeLike

Hi TTI, your posts always give me food for thoughts..thanks!

Back to LTC, in your opinon..what sort to timeframe should we give company management to see if they can generate real shareholder returns. I am a bit concern that 1yr can become 2yr, 2yr can become 3…etc…which becomes more like a value trap. I have a small capital base, just worry about opportunity cost especially when market is on uptrend.

LikeLike

Hi mslee888

I don’t think one should have a time frame in mind, cos then, you’re likely to be disappointed! We know from the track record that management has not been great compounders of value, neither do they generate a high ROE on their equity base. And it’s precisely this reason why the share price is at a massive discount to the book value. Basically the market recognizes that the company is worth $1.62 per share technically, but the market also realizes that the management earns a low return by managing/investing this $1.62 per share.

I am not expecting the management to suddenly do miracles or turn shareholder friendly and distribute excess capital.

I think the share price has room to run up further because the long term track record of the business is such that is generates a ton of FCF. It’s not necessary a reflection of how great the management is, it’s the nature of the business. I will say that over the long term, they probably have had good clients because debt collection has never been much of a problem. Also, it is important to note that they supply rebar steel to the construction sector, not so much to the marine and offshore sectors (obviously higher credit risk right now).

Can it be a value trap? Possible, if you buy at too high a price. As Alain T’s thesis has shown, at the right price, you’d be riding on the accumulation of cash each quarter as the FCF generation continues.

Going forward, I’d be looking out for continued FCF generation, and to continue to watch what they’re doing with the cash that’s generated. They have used it partially by investing in GEM, a residential and commercial mixed development in the state of Penang, but on the main island. I’m not sure why this is not announced on SGX, but it’s in their website. I discussed about this briefly on valuebuddies, but not here thus far.

The jury is still out on this development, but at least for this, I view it more favorably than the USP acquisition. (I don’t like retail)

Regards

TTI

LikeLike

Hi TTI, attended LTC AGM..a lot of shareholders were asking for increase dividend payout. Management is conservative..keeps saying that company capital base is not as much as what we think. Steel trading biz is capital intensive and GEM project in Penang also needs quite a bit of money down the road. Fortunately retail business will be self sustaining and will not require funding from the group. Going forward, it seems to be another unexciting year for LTC.

LikeLike

Hi mslee,

Thank you once again, for sharing.

I did not attend LTC’s AGM.

The GEM project is just barely taking off, it is certainly capital intensive at this stage. That’s true for all property developments.

I am a bit surprised though, to hear that the SOGO business is “self sustaining” and will not require funding. I am skeptical of this.

There’s no way we would know cos the financials are consolidated, so I can’t look at the specific breakdown of the cashflows for the retail.

Could you share if anyone asked any questions, and their replies pls?

Unexciting may not be bad. The share price is depressed so much from the NAV, as their NAV rises each quarter, there will naturally be an upwards pressure on the share price.

TTI

LikeLike

Hi TTI…let me clarify a bit, the SOGO business is “self sustaining” and will not require group funding. It will be from Sogo internally generated funds. It is an asset light business. As in the annual report, the group has disclosed that “the retail team has signed up 6 new locations to operate new stores in the next 5 years wherein the 2nd Sogo store in Malaysia is expected to open in early 2019 in Shah Alam”. So if they have every intention to expand from Sogo internally generated funds, this hopefully will not be a drag to the group capital expenditure. How will the retail business contribute to LTC bottom remains to be seen.

On their Arumugam properties..personally I believe the rental income will either maintain at current levels or dip down a bit going forward. Some are a bit run down and difficult to command good rental despite its gd location (near MRT). Unlikely to do any asset enchancement since LTC already maximise the current plot ratio. Management will wait for the next URA masterplan revision and see the gov developmental plans for this area. If it can be rezone to residential or commercial use, then it will make this piece of land much more valuable. Again this requires shareholder to hold a long term view of LTC. …If I can recall any more value or meaningful discussions during the AGM, I will be most happy to share with you.

LikeLike

Yes, regarding the retail operations, knowing that they are expanding with 6 new locations, I am a bit surprised to hear that it’d be self sustaining.

I would have thought that one needs to commit capital to develop the new locations (renovations, transportation, new staff, rent, marketing etc). If it can grow internally by using their own cashflows, that’d be very good indeed.

As for the Lion Buildings, I don’t expect any growth there. Never did.

I expect it to just generate regular cashflows from rental. Occupancy is still close to full occupancy, and the rents haven’t dropped. They did recognize a small impairment on the value, that’s about it.

Thanks for sharing, would appreciate if you share anything else that you recall.

TTI

LikeLike

wow how in the world does someone master the time and effort to draft a whole full thesis, while having another FT job?

LikeLike

Everyone needs a hobby I guess.

If you want to do it, it becomes a priority, and you’d find the time to do it somehow.

LikeLike

Hi TTI,

Well said! Not many would be dedicated enough to put the effort in to develop their expertise.

I’m reminded of the following quote:

It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.

LikeLike

Hi UN

Nice quote!

TTI

LikeLike

I have seen quite a few of your posts on LTC. If current/future reailisable cashflow and assets is your main focus, why not look at one of their related companies Lion Asiapac instead? Their current net cash of almost $70m is already much higher than market cap of $43m and they seem to be in divestment mode in the last few years.

I would think it is more palatable to invest in a company that already has the cash compared to one that is only likely to generate the cash in future.

LikeLike

Hi Farmer

I briefly looked at Lion Asiapac before, but skipped it because I have no knowledge on lime manufacturing: not just the manufacturing, but the end clients or the uses of calcium hydroxide.

Just based on the fact that I think I understand the steel industry (from my earlier DD on Asia Enterprises), and that its related to their construction arm, that’d make LTC more palatable (as you put it) to me.

Their financials are actually somewhat similar, share prices trading at high discounts to book value, relatively low ROEs, and as a result, relatively high PERs.

Also, I don’t think it’d be “more palatable to invest in a company that already has the cash…”

I think it all depends on the share price that you can buy it at.

A company that already has the cash realised and sitting on its balance sheet, would have the share price reflecting that as the markets can see it.

Investing is all about staying ahead of the game. Doesn’t it make more sense to invest before the cash comes in, and the investing thesis is that the cash would increase, and if that plays out, the markets would realize it accordingly?

VS your scenario of investing when you see the cash already in the BS. If so, then you’d need to ask the golden question: What am I seeing that the markets are not seeing?

If you ask me that about LTC, I’d say I’m seeing that the debt is transient and getting paid down from the FCF generation and when this plays out, the markets will realize it.

Lion Asiapac now trades at around 47% discount to book. LTC trades at 61% discount to book… and that’s after it has risen because my investing thesis on cash building up has played out over a couple of quarters. Prior to that, it was over 70% discount to book.

Earnings for both companies are relatively low, PE for AsiaPac looks very low at <3, but that's coming from a divestment they just made. If we strip off the extraordinary earnings, from their divestment, Lion Asiapac actually was loss making in their most recent financial year.

So they are technically loss making cos of their lime manufacturing. Like I said, I don't know enough about calcium hydroxide to make an intelligent guess on how it's going to play out.

So these are my thoughts when I did the comparison some time ago. As it stands, just purely comparing between the 2, I'm still more comfortable with LTC than Lion Asiapac.

Regards

TTI

LikeLike

I do not disagree that both LTC and Lion Asiapac are deeply undervalued, trading at steep discounts to book. However, I do think that that with cash, the quality of the assets is definitely higher than say an investment property which needs to trigger event like a sale to realise the full value.

As to whether the market has already fully valued the existing cash in Lion Asiapac or the cash that is about to come into LTC, I don’t think there is any conceivable way to determine for sure. You could also say that the market has already priced in whatever cash that is about to come into LTC just as you have assumed the same for Lion Asiapac. So let’s just agree to disagree here.

I also have doubts over LTC being valued on a FCF basis since most of FCF from the last two years is from the sale of its completed properties (16m for FY17 and 25m for FY16). Take these out and the rest of the group generates little to no FCF.

And if you look at the completed properties on the balance sheet, it’s down to 13m from 28m last year. Presumably all of it will be recognised in the next two quarters and converted into cash with the sale of the properties. I assume cash could come in at around 50m+, or whatever figure that might be, say 2 quarters from now. From then on, with just the steel trading and retail busineses as the main drivers, I would think it challenging for the company to come close to the FCF generation track record it has over the last few years and add a lot more to its cash pile. In fact, your friend Alain T says as much in his thesis that the company is now in a harvest mode with regards to its property development.

LikeLike

Hi, my quick replies:

1) Sure, cash would be preferred. But like I said, it all depends on the price.

Comparing the 2 scenarios that you have painted: cash already on BS and FCF generation, obviously the former scenario would be more likely to be fully valued by the markets. Cos the cash is sitting on the BS already isn’t it. Whereas for FCF generation, there can be a multitude of things that can derail this, so there was some uncertainty.

2) FCF was bulked up in the past 2 years by sale of properties. But the FCF has been positive dating back to FY09, I’ve already included the table. In fact, FCF was higher in FY13-FY15 than the last 2 years that you have mentioned.

3) Your last point is that half of their completed properties are sold so going forward in future, there would be less to recognize.

Yes, Steel will be their main driver, but no, not retail.

It seems you are also not aware of this annoucement, so I’ll cut and paste here:

“The Board of Directors of LTC Corporation Limited (the “Company”, and collectively with its subsidiaries, the “Group”) wishes to announce that the Company’s indirect wholly-owned subsidiary, Greenpoint Capital Sdn. Bhd. (“GCSB”), has entered into a Shares Sale Agreement (the “SS Agreement”) with Belleview Sdn. Bhd. (the “Vendor”) for the acquisition of 200,000 ordinary shares (the “Sale Shares”), representing 40% equity interest in the share capital of Regata Maju Sdn. Bhd. (“RMSB”) (the “Transaction”). RMSB is incorporated in Malaysia with an issued and paid up share capital of RM500,000.00 divided into 500,000 ordinary shares, and it is currently undertaking a mixed development comprising 2 blocks of 38-storey 978 units SOHO with 15 units shoplots at Sebarang Prai, Penang (the “Project”).”

The announcement is NOT in the normal annoucement page of SGX. Don’t ask me why. Perhaps that’s why you are not aware.

So yes, they have sold previously developed properties, but they are recycling cash into new projects. If you want, you can now argue about whether this new project (GEM residences) will be profitable or continue to be FCF generative, and where along the development path we are currently at, blah blah etc, but clearly, we can at least establish that it’s too simplistic to think that we can back out the “completed properties” and assume that future earnings will be only from steel and retail.

That’s kinda like saying that Wing Tai is going to go bankrupt after they have finished selling all their completed properties on hand………

LikeLike

Hi,

LTC is a better proposition at this point also because of their rental income, which is recurring. This helps to cushion the earnings volatility of the steel division and lumpy earnings from the property division. Lion Asiapac only has loss making business now. This can destroy shareholder value and weaken the BS if they still cannot find a new profitable business venture soon.

LikeLike

It all depends on what Lion does now

If they spend their cash wisely, they can turn it around

If they can’t, they should distribute it to shareholders n close the company

So you’re right: Lion can destroy shareholder value from here

I don’t know enough to guesstimate how capable management is

LikeLike

well, 7 months on from our discussions, LTC is getting delisted by the Chengs, the share price has risen 40% since then, while Lion Asiapac’s share price has done absolutely nothing since then.

Seeing that both are controlled effectively by the Chengs, it speaks volumes as to which is more undervalued then, and/or has better prospects going forward, that the Chengs opted to delist LTC instead of Asiapac.

LikeLiked by 2 people

You mean this announcement?

http://infopub.sgx.com/FileOpen/LTC_SGX_JV_GCSBFinal.ashx?App=Announcement&FileID=450266

It is on SGX’s announcement page and yes, I have seen it. I didn’t mention this because it is almost not going to be generating any cash during the development period. As an investment in an associate company undertaking property development, the cash usually goes in at the beginning, gets stuck in there for the building period and mostly only gets returned after the properties have been sold and completed in a few years’ time. You can reference any of the numerous sgx listed companies that have taken similar stakes in property projects to see how the cashflow works.

Anyway, I will let the FCF issue rest for now as we clearly have different views on this.

LikeLike

Hi Farmer

If you may, pls don’t “let the issue rest” if you do have anything else to add.

I greatly appreciate all views, in fact, particularly so for differing ones

In order to contribute more intelligently, I just spent some time looking at the recent Lion financials to update myself

So this is my summary:

Lion is indeed v attractive solely from a balance sheet perspective.

Of the 99cents NAV, 85cents is in our cash after their divestment

To top it off, one can buy it for a mere 55cents!

How can it be possible to buy 85cents of cash with 55cents?

The reason is that the business itself is loss making, so there’s a massive discount here

Not comparing to LTC, just looking at Lion, the key question is: what happens next?

If the company decides to close down n distribute capital, this would b a very attractive investment indeed

I don’t think that’s likely though, based on the track record of the chengs

So the company has to utilize its cash to do something, buy new businesses? Try to turn ard it’s lime manufacturing?

Like I said, I don’t know what they’d do, neither do I know enough about the lime business.

Since we are making this comparison against LTC, LTC too has a ton of cash in its books, albeit not as much (as a percentage of NAV) as Lion. I think that’s what you were referring to when u say that the FCF is less of an attractive vs Lion having already divested and having the cash on hand

So strictly from a balance sheet perspective, Lion > LTC

From an earnings perspective, of course LTC > Lion, that much we can agree right?

So I guess if one has to really put capital into only 1 of these 2, the key evaluation is what Lion will do with its cash hoard.

I don’t know the answer, do u?

The share price is indeed heavily discounted, and that reflects the uncertainty around its business going forward

If I want to buy Lion now, I’d work out it’s operating losses, multiply that by 5years, and discount that from its cash net price. So my safety margin is 5yrs of the company bleeding money.

That should b a good enough MOS

I wouldnt simply look at the cash and think that I would pay a penny for a penny

In short, I honestly wouldn’t be able to tell straight up which represents a better investment opportunity right now.

I understand steel and I think I can tell what LTC is going to do. It’s relatively easy to do so in fact.

Mslee’s comment above about recurring income is an example, it may drop, but it’s relatively stable.

So if u can fairly accurately predict what Lion will do moving forward with a ton of cash but loss making businesses, then sure, it’d be the better investment

I can’t tell.

Regards

TTI

LikeLike

Finally, just as good for thought, what happens if LTC now follows the path of Lion and starts on a divestment path?

LTC’s business components are all profitable except the newly acquired retail

But that is an insignificant part of the business

So they have steel trading, property development and property leasing

If they start divesting, the share price would easily triple

Even if they divest at book value, it’d triple

(I don’t think it’d happen, just sayin)

TTI

LikeLike

Your edge in this game is the way you think.

U have to be more different in your way of thinking and right in your way of thinking.

Eg Housing crisis and everyone is fearful.

U can be contrarian and buy housing stocks but just because you are different does not mean you will succeed. U need to be right as well.

So, your best chance of success if u succeed at all is to focus on the ugly stocks, and among these choose the ones that will likely succeed

LikeLike

Yes Gary

That’d require:

1) Above average information/knowledge of the subject matter. That’s where your extent of due diligence comes in

2) Superior judgement of the data

Cheers

TTI

LikeLike

Hi Sir,

Understand you had divested in Metro, but still following it. It has been creeping up to a all time high. Any views?

Personally am still vested. Keen to hear your views as there was a reported recently that it could be a take over target (which I doubt so, cos it is tighly held). Tks

LikeLike

Hi Winston Stalin

Yes, I’ve divested my large stake in Metro.

On hindsight, I’d have done better holding on to it, but no regrets as I’ve recycled capital and that’s been ok too.

I still follow Metro, but not as intensely as before. I did read some reports about a potential take over but honestly, I don’t think that’s going to happen. Metro is still undervalued on a SOTP basis. I doubt anyone buying would pay a premium. Also, like you said, despite the demise of JO, the Ong family still holds sway. Unless they allow, Metro won’t be acquired.

I’d write about it at a later stage when I update my thoughts on Metro.

And congrats btw.

Regards

TTI

LikeLike

Hi TTI,

I only chanced upon your blog post today and would like to share some of my opinions. Hope I’m not too late ^_^

I believe that true value investing is not just being able to analyse companies, but it comprises of having good emotional welfare. Most of the time, we have to think in contrast to the majority and invest in what we strongly believe in, since it is seldom reflected in the stock price. Being far too emotional in the stock market will not be rewarding enough and you might end up making silly decision. You would probably be better off not trying to beat the market. Patience is also another virtue that is hard to come by, and we really need a lot of that as a stock can be bleeding for many years with their true intrinsic value not realized. But when it does, it will be very rewarding. :)

I would like to think that value investing is also going towards the solution of capital preservation. That is what makes it so different because it doesn’t make you think of winning. It stops you from losing, or rather your loss will be somewhat mitigated by considering margin of safety.

LikeLike

Hi Miss Niao

Can’t disagree with all that you’ve said!

Cheers

TTI

LikeLike