Traditionally, towards the end of the year, me and my wife would discuss travel plans for the next year. We each get to choose 1 destination, and we’d fill in the spots with nearer, easier to get to places as and when time (and mood) permits.

Here’s my pick for 2018:

Make a guess where this is.

It’s frequently listed on every “Top 10 places to see before you die” YouTube videos.

Plus I absolutely love places with a rich history. It makes my skin tingle when I’m there, thinking that several hundred years ago, in a totally different world from now, someone has touched that same stone wall as me. It’s like a tiny part of me gets transported into that era, and I love that experience. It’s fascinating.

Maybe that’s why I was good at history as a kid. It’s a series of fascinating stories to me. I even kept my sec 1 History book prize envelope till today! So that envelope, is at least 23 years old. (I Did Something Fun As A Kid… And Now It’s Worth 6 Digits!!!)

SGX Bull Charge is this coming Friday, and I’ve collected my race pack.

The kids are going completely bonkers about the bull cap.

Plus who doesn’t like freebies?

I have earlier mentioned that I’m liquidating some positions to redeploy capital into another idea: (TTI’s Portfolio Updates – November 2017)

True to the nature of SG TTI, this new position is a contrarian, deep value one.

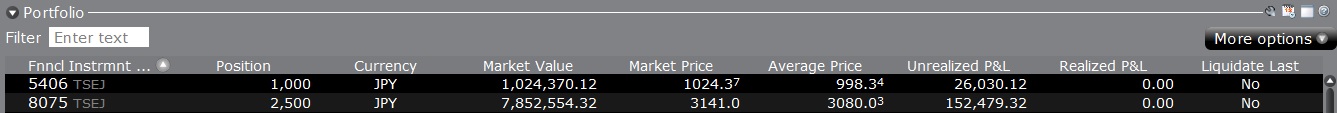

I currently own 2,500 shares in Shinsho Corporation, a position worth approximately 7.86mil JPY or SGD 94,000.

I also own 1,000 shares in Kobe Steel, a position worth approximately 1.02mil JPY or SGD 12,000.

Both positions have risen in value since my entry price.

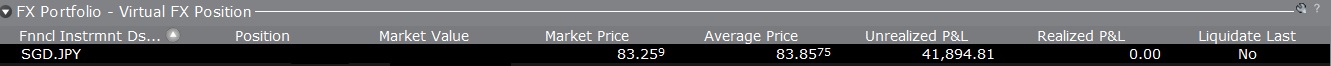

On top of that, it was also somewhat fortuitous that I entered into some currency swaps right after the recent japanese elections. Abe was re-elected, and the markets were expecting his policy of easy money and stimulus to continue, hence the JPY weakened considerably. I was able to do swaps at rather favorable forex rates:

About a month ago, Kobe Steel was forced to come out in the open and admit that they’ve been faking data to make it seem like some of their products have met specifications required by clients, when the products have not in reality.

Initially, they said that the affected products were mainly aluminium and copper products that accounted for only 4% of the division’s sales last year. 4% didn’t seem too bad, but it got my interest enough to investigate.

However, things went downhill real fast. On the 11th October 2017, the company announced that some of their steel products were also affected, and the dishonesty could’ve extended as far back as a decade ago, affecting 500+ clients, both local and international ones.

The shit really hit the fan, and Kobe Steel’s share price tanked 41% within 1 week!

The collapse of the share price reflected the uncertainty revolving around the scandal. Kobe Steel, being an upstream supplier of raw materials for many, many products used all over the world, could potentially have almost unlimited liabilities arising from this scandal.

Their client list includes a list of who’s who of mega companies. Think of all the jap automakers, airlines and even nuclear power plant makers. Using materials that did not meet specifications, could potentially be disastrous.

A fine, parallel case study is the recent air bag scandal with Takada. The company was forced to declare bankruptcy eventually, stemming from the numerous lawsuits. In that case, lives were even lost.

I thought that the scandal was over hyped though, and after doing my DD, I decided to allocate the bulk of my capital to Shinsho corporation, and a small token portion to Kobe Steel itself.

Shinsho corporation’s share price was also affected by the Kobe Steel scandal, as they are the distributor and trader for many of Kobe Steel’s products.

Taken from Shinsho’s website:

“Shinsho Corporation imports, exports, and trades iron and steel, ferrous raw material, nonferrous metal, machinery, information industry, and welding products worldwide. The company offers iron and steel products, including half-finished steel, special steel, construction material, casting and forging, carbon steel, wire rod, titanium and nickel alloy, and casting material and cast products; ferrous raw materials, such as materials for making iron and steel, and other products; and nonferrous metals comprising aluminum, cast, aluminum and copper material, copper, and processed aluminum and copper products. It also provides machinery and electronics consisting of chemicals and food processing…”

In the immediate aftermath of the scandal, Shinsho’s share price tanked almost 30%:

This didn’t make sense to me, as the liabilities related to any recalls or lawsuits, would ultimately fall on the shoulders of Kobe Steel, not Shinsho. Exactly how much is Shinsho exposed to Kobe Steel?

Taken from Kobe Steel’s AR17, page 58:

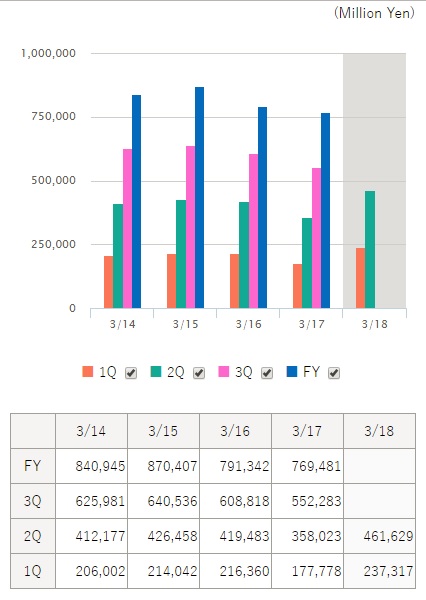

For the year ending March 2017, Shinsho bought ¥184,678 mil of Kobe Steel’s products.

Kobe Steel is a client of Shinsho as well, buying ¥259,479mil of materials for equipment.

Since FY17 Shinsho’s revenue was ¥769,481mil, this means that Kobe Steel accounted for 33.7% of Shinsho’s revenue. That’s significant, but not critical. Assuming that Kobe Steel completely goes under, the maximum effect would be a loss of 1/3 of Shinsho’s revenue. This is a scenario that I consider highly unlikely.

With the massive drop in share price, both Shinsho Corporation and Kobe Steel were trading at a massive discount, compared to their peers.

Kobe Steel is the 3rd largest steelmaker in Japan, being dwarfed by Nippon Steel & Sumitomo Metal Corp (largest) and JFE Holdings (2nd largest).

However, Kobe Steel is a giant in it’s right. They are highly diversified, as opposed to their pure steel peers, they are into several other metals as well, including aluminum and copper products.

As a consequence of the scandal, Kobe Steel scrapped their full year earnings forecast and their interim dividends.

I did a peer comparison on their valuations, using projected PE ratios:

Kobe Steel

Share price: 1,084 yen

For 1H of fiscal 2017, Kobe Steel announced EPS of 108.62 yen / share, which is a 858 percent increase in net profit. (YES! 858% increase! The japanese steel makers are all doing very well now. More on this later)

Executive Vice President Naoto Umehara said the misconduct would likely reduce Kobe Steel’s second-half recurring profit by 10 billion yen, 70 percent of which will mainly come from the steel business.

TTI conservatively estimate 2H earnings to come in at 72% of 1H, that gives 28.8bil yen. (I used 72% of 1H, as that’s the guidance given by Kobe Steel’s other 2 peers, both of which gave 2H earnings guidance that’s approximately 70% of their 1H earnings)

Less the 10bil guidance from the misconduct, given by Naoto, and we have 18.8bil yen in earnings.

So full year earnings will come in at 58.8bil yen or EPS of 159.7 yen.

That gives a projected PE ratio of 6.8 times.

To illustrate how undervalued the shares are, if I take an extreme scenario whereby the company DOES NOT EARN A SINGLE CENT FOR 2H, the full year PE ratio would still be around 10 times currently.

Nippon Steel & Sumitomo Metal

Share price: 2,694 yen

Nippon Steel’s net profit for the April-September period came to 99 billion yen, 9-fold higher than a year earlier. It raised its interim dividend to 30 yen per share, from its earlier prediction of 25 yen, and forecast a 30 percent climb in full-year profit.

(Yes, 900% increase! The industry is booming right now, as I’ve alluded to earlier)

For 1H of fiscal 2017, they reported EPS of 112.34 yen.

For full year, guidance for EPS is 193 yen.

(2H EPS about 72% of 1H)

That’s a forward PE of 14 times.

JFE Holdings

Share price: 2,544 yen

1H EPS: 150.95 yen, forecast of 260.15 yen for full year (FY16 EPS was 117.81yen)

(2H EPS about 72% of 1H)

That’s a forward PE of 9.8 times.

Aside from steel, let’s compare to their aluminum focused peers:

UACJ Corporation

Forecasted earnings of 17bil yen for fiscal year 2017, vs 8.7bil in 2016 (given at end 2016)

As of Q1 results, no change to this forecast (EPS of 352.27yen)

For Q1 2017, earnings of 4.4bil yen or EPS of 9.12 yen, vs 1.4bil yen in Q1 2016

At share price of 3,380 yen, that’s a forward PE of 9.6 times

Nippon Light Metal Holdings

Mainly trades in Aluminum products such as ingot, sheet and extrusions, foil, powder and paste, as well as aluminium products including electronic materials and industrial components

1H EPS of 13.98 yen

Increased interim dividend from 3 yen to 4 yen.

Paid yr end dividend of 5 yen last yr.

Currently forecasting yr end EPS of 29.07 yen

Share price is 333 yen, which gives a forward PE of 11.46 times

Shinsho Corporation

For 1H of fiscal 2017, reported EPS of 322.41yen

(assuming earnings for 2H comes in at 72% of 1H) FY17 EPS of 554.5 yen

At share price of 3140 yen,

That’s a forward PE of 5.6 times

I have a much larger position in Shinsho Corporation than in Kobe Steel, as I believe there are still uncertainties around Kobe Steel, and much of the drop in the share price is justified, whereas Shinsho Corporation happens to be an unfortunate party and the drop in share price was unjustified.

Looking at the 1H earnings, it is clear that the whole industry is booming right now. In fact, part of my thesis revolves around the fact that despite Kobe Steel’s troubles, the industry is doing so well right now that Kobe Steel’s customers cannot switch to their peers even if they wanted to, as all their peers are running at full capacity right now!

UACJ has reported that Kobe Steel’s clients have made enquiries, but they themselves are running at full capacity and are unable to support.

Japanese end users have also been known to be notoriously reluctant to disrupt their supply chain.

To illustrate how well the industry is doing right now, check out Shinsho’s revenue:

(The figures are cumulative)

I believe their revenue at the Q3 mark, will likely match that of full year 17 already.

Shinsho Corporation’s EPS chart:

At the 2H mark, EPS of 322.41 yen already exceeds the 310.11 yen at Q3 mark of fiscal year 17.

As it stands currently, none of Kobe Steel’s clients have reported any major casualties or detrimental effects related to the use of Kobe Steel’s products.

There have been, thus far, zero recalls either.

In the midst of my DD, it is my understanding that although the data surrounding Kobe Steel’s products were fabricated to meet industry requirements, the actual characteristics of the products still fall within an “acceptable” range. In fact, without Kobe Steel’s admission, end clients would’ve continued using the same products without recognizing any difference.

Let’s not forget that this fabrication has been going on as far back as a decade ago!

Of course, it’s not defence for Kobe Steel’s behavior, but I do think media reports have vastly exaggerated the extent of the deception. This also doesn’t resolve Kobe Steel from lawsuits from their clients. At the minimum, several of their clients would’ve run up additional costs from doing additional checks after the break of the scandal, and Kobe Steel would likely have to reimburse them for their costs.

Notice that all these revolve around Kobe Steel though, and do not affect Shinsho Corporation directly.

Coupled with the positive outlook for the industry, I believe it’s a matter of time before the scandal blows over, and the share price recovers to trade at a valuation closer to their peers.

On a separate note, I’ve also initiated a token position in Alliance Mineral Assets and currently own 100,000 shares at $0.365.

All indices worldwide seem to be hitting new highs every other day, so going forward, I’d be very cautious about allocating capital. Finding cases of simple undervaluation is just not enough now, I’d require a clear stimulus in sight. Failing which, I’d be happy to keep cash.

montserrat

LikeLike

https://en.wikipedia.org/wiki/Meteora

LikeLike

Thessaly, Greece

LikeLike

LOL yes

Specifically, it’s Meteora in Greece

LikeLike

Actually I cheated! just right click your picture and go to properties! It reveals as Meteora! But love your articles!

LikeLiked by 1 person

TTI, spotted another steel play in crisis mode from the following Bloomberg article. Looks like a classic turnaround story with a proven CEO installed as management. Read through the article, it does seems like the CEO know what he is doing and has vested interest. In addition, according to google finance, the trailing edge PE is… 0.52 ! Thought this might spark your interest as a contrarian, deep value investor.

https://www.bloomberg.com/news/features/2017-12-05/can-this-107-year-old-steelmaker-be-brought-back-to-life

LikeLike

Hi Botak

Thanks for the link.

US and Canadian steel players would be very different from steel players in this part of the world.

For starters, US and canadian ones always have labor disputes, and those are very tricky, cos their unions are very strong, and strikes are allowed.

Also, specific to this current period, there’s a lot of uncertainty with the trump administration’s policies, and that’s something I am not very familiar with.

This does look compelling. Cheap with management with a track record.

Also, the macro condition currently is ideal for steel players. Steel prices rose sharply since the start of the year, and have been maintained.

I am not that keen at looking at steel players in the west for the simple reason that they are not that easy to assess now. (impact of macro factors)

Cheers

TTI

LikeLike

nice writeup! the power of doing your own judgement instead of following “news”

LikeLike

Hi duckie

Thank you!

Cheers

TTI

LikeLike