It’s been a very very busy period for me, and I’m juggling many balls at once. So I shall take the easy way out and just cut and paste my options transactions in the past 2 months.

Anyway, I am also genuinely interested to know what’s the cashflow like for the past 2 months. I track each transaction, but haven’t been tabulating on a monthly basis and comparing to prior months, like what I have done previously:

A Unique Arbitrage Situation + Results From Options Strategy (3rd Month)

As mentioned previously, I’ve also been more cautious, preferring to skip some premiums that I deem risky, while increasing my cash buffer. I haven’t tabulated the monthly cashflow even as I’m typing this, but my gut feel is that it’d be a substantial drop from the previous USD $16k or so every month.

Also, just to clarify, I’m talking about cashflows. It’s not exactly profit. Not yet anyway. This is because some of the contracts would still be existing, even though I have collected the premiums. In other words, it’s kinda like a “liability” in my balance sheet, until it expires.

On top of that, this doesn’t include capital changes. So there could be a situation whereby I collect premiums and I’m including it in my cashflow records, but the capital changes in the underlying security is greater than the premium collected. (So technically, it’s a loss for that period of time actually)

The longer term plan though, is that if the cashflow records is constantly acceptable on a monthly basis, it’d far exceed any negative capital changes.

OK, so here goes (I’m calculating it now as I create this post. Oooo so exciting.)

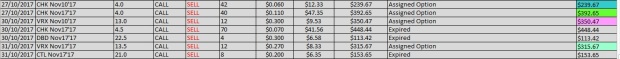

OCTOBER 2017

Premiums collected in October 2017: USD 9,434.26

Wow. What a drop, comparing to the $16k or so previously.

But I was expecting this.

NOVEMBER 2017

Premiums collected in November 2017: USD 14,403.98

Hmmm, so different from October.

Anyway, nothing much to comment here, I’d be happy with a 5 digit USD cashflow every month.

With approximately 9 months or so of data and experimenting and tinkering and implementation, I now feel confident enough that I’ve increased my allocation of funds into my options strategy.

I started out sometime at the start of the year, with an initial token USD 100k to test out my strategies, it went swimmingly well, then I got greedy, screwed up a bit, and now I’m back on track. So now, I’ve increased my allocation and my options strategy has approximately USD 280k to mess around with.

If things go the way they are currently, I’d likely increase my allocation further in 2018, to perhaps… up to 50% of my portfolio. That’d be approximately $500k USD or so. Let’s see.

Part of the fun of Decembers is to make travel plans for the next year.

Years ago, before having the 2 little rascals, it was a much simpler affair. TTI could just go anywhere the heart desires (if the wallet is willing).

Now, each trip becomes a big military operation. The planning! oh my. The logistics is crazy, esp if my parents and the in-laws put their hands up and want to tag alone.

Paying for your parents is perfectly ok. They deserve it. I’m more than happy to in fact. If they wanna go, money is never a consideration. The kids need to spend as much time as possible with their grandparents.

In-laws though… hmmmmm…… heh. That’s another story.

Anyway, in a recent earlier post:

TTI’s New Core Position: Shinsho Corporation & Kobe Steel

The picture is that of Meteora, in Greece

Highly recommended by one of my lunch buddies and colleague.

But alas, looking at the schedule, autumn 2018 is already packed, and it’s not really that fun for the kids, so I’d have to postpone that to spring of 2019, and instead switch to this:

No shit! Look at that!

It looks like a scene from Game Of Thrones! Just need a couple of dragons flying in the background.

This is a real place on Earth. Built in a time and era way before me. Yep. Make a guess where that is. Not that easy huh?!

In fact, we’re planning to stay there for the night. It’d probably be extremely costly for my poor finances, but well, take a look at how it looks like at dusk:

How much is such an experience worth?

I generally like off the beaten track, yet fascinating places.

Like this:

It’s just a library in Stuttgart, but oh my, I’m fascinated by its architecture. So much so that I detoured and made a pit stop in Stuttgart specially to see it. The local Germans must think that this guy is an idiot, taking pictures of their library like it’s a tourist attraction. (It’s not)

Before I die, my travel pics catalog over the years will map out all the most fascinating places on Earth. And perhaps, even out of Earth… if Elon Musk works fast enough.

Well, if you can’t figure out where the earlier pic is, here’s a mega hint. It’s the same country where you find this:

Everybody knows this.

Mont Saint-Michel

Le Mont-Saint-Michel is an island commune in Normandy, France. It is located about one kilometre off the country’s northwestern coast, at the mouth of the Couesnon River near Avranches and is 100 hectares in size.

LikeLike

I have also been selling out of the money put options on general electric this month.

Any thoughts on General Electric?

LikeLike

Hi Gary

I don’t know much about GE, not sure why the share price totally collapsed since the start of 2017 (I only took a quick look)

Tbh I wouldn’t sell OTM put options here unless I intend to build a position anyway at the current strike price

In which case it’s just a Long position, except that you’re slowly building it and collecting premiums along the way

Otherwise, you’d most probably end up having the contracts exercised and end up holding a bunch of shares and with the share price dropping this rapidly, the capital loss would be much larger than your premiums

Unless you sell very far OTM put options, which in my experience is not very productive either, the premiums are not worth it as part of a core strategy

If anything, I think I’d b more likely to sell a small amount of close to the money call options, be in naked or covered calls, and a larger chunk of far OTM calls.

Cheers

TTI

LikeLike

Yup it fell again

But I am happy to hold general electric.

If it get assigned, I will start selling out of the money call to lower my cost basis.

LikeLike

yup if you have done a fundamental analysis and intend to accumulate, and if you are happy with the exercise price as your entry price, then sure, by all means.

Cheers

TTI

LikeLike

Yup, bingo

LikeLike

The place where the tide comes in and you lose your only land connection. Like a natural defensive moat (financial pun intended).

Hope to see your pictures of that place.

Happy holidays!

LikeLike

Yup, which is why after 7pm (I think) it closes n u have to stay there for the night, together with the 100+ inhabitants

Cheers

TTI

LikeLiked by 1 person

Wow ! Nice cash flow from ” option trading ” 👍👍👏🏽👏🏽🍻🍻,,, also great place to visit for your next vacation! Enjoy your holidays !!!

😃😃

LikeLike

Hi STE!

Thanks!

Cheers

TTI

LikeLike

Hi TTI: to trade US options, which broker r u using? local vs international brokers?

LikeLike

Hi

I am using Interactive Brokers

There are no local brokers that offer Options, whether it’s for US or otherwise.

Most other international brokerage houses will offer options for eg. Saxo capital etc

LikeLike

Hi TTI, thanks for sharing your strategies and the process/journey you go through before making your decisions, really enjoy reading your posts.

Btw i’ve been to both Mont St Michel (3 times as I lived a year in Paris) and also Meteora. I highly suggest Mont St Michel more than Meteroa as getting there is a real pain. The train ride will probably be painful as the kids will get restless plus walking between the monasteries is not too easy. Mont St Michel is beautiful at all times of the day and the surroundings will very much appeal to the kids; farms with sheep, cows on the drive in from the expressway, making the whole trip just much more enjoyable as a family!

LikeLike

wow Matt

thanks for sharing this.

It’s important info

I think I’d very much like the french countryside too.

Cheers

TTI

LikeLike

Hi TTI, I’m new to your website and thanks for sharing.

The options you’ve traded tend to be short-term, <30 days, what's the rationale behind it? Would it make sense to sell options with more remaining time to benefit from the heightened IV and time value? In your experience, when does IV become the highest (most option calculators provide a 30-day vol #)?

Would be appreciative for your feedback.

HK

LikeLike

Hi

Mostly about 2-4 weeks out.

Reason being that the shorter the duration, the faster time decay happens.

Time decay doesn’t occur proportionately through the duration of the option; the time decay is the most rapid towards the end of the option.

So if my strategy involves time decay, I want to choose contracts that aren’t too long in duration, for maximum productivity. But choosing too short contracts of less than a week isn’t feasible either, cos the commission fees will eat up a high proportion of the premiums.

So I find that between 2-4 weeks is ideal.

That’s in general.

In some instances, like when shorting volatility using VXX, since VXX has been rather predictable on a downtrend, I’d prefer to have slightly longer durations (3-6 weeks)

TTI

LikeLike

Didn’t see the 2nd part of your question about IV.

I think it’s not very crucial to look at the IV for a bunch of options for the same stock.

It’s more important to look at the IV and compare it across different stocks and find 1 that fits what you have in mind.

Also, an option with a longer remaining duration may give you higher premiums for the duration of the option, but the time decay is lower.

This means that broadly speaking, say if we have 1 option with a remaining time value of 2 months, that may give you a premium of perhaps $1.

But you could also sell 2 options, each with a time value of 1 month remaining, 1 after another.

All other things being equal, this 2nd way could nett you perhaps $1.5 instead. (in total)

Finally, I don’t always find the options with the highest IV and highest premiums. This is for portfolio management reasons. I don’t want a lot of options expiring at the same time, because if you have 1 unpredictable event that causes many options to exercise at the same time, that could create a lot of problems for you, margin wise.

So I may choose time periods that are a bit less ideal, but they spread out my existing contracts.

Which is why if you look at the list, there are options with expiry dates on almost every friday, and each week (thus far at least), has approximately 5-8 contracts.

Cheers

TTI

LikeLike

Thanks. Agreed any option strategy starts with a solid analysis of the underlying security.

As you look at IVs across different stocks/options, how do you judge which option is the one to pick? Looking at IVs in insolation doesn’t really give a sense of value. What metrics/parameters do you use to find the one? Would it be relative a stock’s comparable historical vol? You also mentioned previously of using IV percentile – can you explain how that is used? Where would one find the values of IV percentile (not sure if Interactive Brokers has the calc?). Thanks again for sharing.

LikeLike

Hi HK

I don’t look across many different stocks, I stick to a few that I understand well and/or are in related industries so that the learning curve is gentler. Since my options strategy doesn’t necessarily involve just being long, a falling share price can be just as advantageous… provided I can capitalize on it. So it makes more sense to concentrate and understand a few things very well, rather than understand many things very superficially.

As for judging which option to pick, it depends on the underlying security. I try to pick in the money options (but not too much in the money) or options with exercise prices close to the current trading price. These are some of the most productive options as they give the most premiums. But it’s not always the case.

For example, with Valeant, I judge that the share price is unlikely to drop much from here in the next month.

So I’m more than willing to sell in the money put options, at a quantity that I am able to easily manage if they get exercised.

At the same time, I sell a huge chunk of out of the money put options, as they are highly unlikely to get exercised.

In other words, I have a fairly strong conviction that I should have a long position here, so I’m willing to sell ITM options and several OTM options.

If I have a weaker conviction, I may only sell further OTM options, and no ITM options. It’d be less productive, as premiums would be lower, but I’d sacrifice a bit productivity for safety.

So to answer your question, it all depends on the situation and the underlying derivative. I won’t say there’s a fixed process to choose which particular option amongst the entire option chain.

Cheers

TTI

LikeLike