SG TTI has a new feature!

Right there, at the top bar, under “Latest Corporate News” will be a newsfeed, run by PRNewswire Singapore. Check it out.

It’s not very user friendly right now though tbh, I’m not sure if they can incorporate it into the side bar or something, so that it’s constantly running. (They probably can, but I dunno how to)

Let’s see if they can do it up better for SG TTI.

A long time reader recently emailed me to discuss about my macro views. (I’d leave it to him whether he wants to identify himself in the comments section) It seems I give the impression that I’m pretty optimistic about the macro climate, as “my positions have hardly changed”.

But that’s just not true.

In fact, I’ve liquidated several of my positions, selling into strength in 2017, and holding high levels of cash going into 2018.

I sold all 1,000,000 shares of King Wan and cut my position in BBR Holdings from 2.035mil shares at the start of 2017 to 1.1mil shares at the end of 2017.

Thus far in 2018, I’ve also taken profit on my core positions in Shinsho Corporation and Kobe Steel (Divestment Of Shinsho Corporation & Kobe Steel – TTI’s Post-Mortem), sold out of Boustead Singapore completely (sorry, FF Wong), took profit on 100,000 shares of Geo Energy, and in the coming months, will likely see my stake in LTC Corporation completely divested (“Where Art Thou, White Knight?” – LTC Corporation’s Privatization Offer.)

That’s a shit ton of divestments actually.

In contrast, I’ve only initiated relatively minor positions in Q&M Dental and Alliance Mineral Assets and… well, that’s about it actually. So it’s been a nett liquidation for 2017.

That’s good cos it means I had the liquidity to capitalize on the recent bout of extreme volatility 3 weeks ago.

And this is what this post is all about: how I capitalized, how I structured it, the 1 major mistake I made, and what I’ve learnt.

ok ok enough of the chit chat. I’ve 1 helluva story to share.

The Big Short

In early Feb, global markets were suddenly roiled by sharp declines.

Within 1.5 weeks, the S&P 500 tanked over 10%.

At 1 point, the Dow Jones Industrial index tanked over 1,000 points within a single hour, ending the day as the single worst day in the past 6 years.

http://time.com/5134842/stock-market-dow-sp500-drop/

Clearly, there was a lot of fear in Wall Street, as over leveraged players rapidly took money off the table.

Algo traders probably made it worse by selling out as the fall accelerated. This is the equivalent of a “positive feedback loop” in physiology terms, whereby the reaction gets more and more exaggerated as the signal/trigger for an action or chemical, acts as the signal for more of the same action or chemicals.

A crescendo, if you will.

The trigger was reportedly a fear of excessive Fed rate increases this year, resulting in liquidity being sucked out of the equities market into the bond markets. Actually, I’m not so sure if that’s the cause, but that’s another story altogether.

Anyway, fortuitously, I was sitting on a ton of liquidity because I was liquidating stuff and holding capital to invest in pre-IPO convertible bonds.

(PE Moving On To Pre-IPO; TTI’s Projected Returns: 1,000% Within 10 years.)

As mentioned in the much earlier post, I need to find $500k of liquidity, and that’s pretty much been confirmed. Thus, the liquidation.

As the world seemed to be going to hell in early Feb, I was trying to figure out how best to capitalize on it.

Buying the drops by adding to equities that I’m familiar with, seems to be the most logical, the most common and probably the easiest way too. Yet, I was looking for something else. The drop was too sharp, and I wanted to go for the jugular. Something with leverage involved would suit me just fine, since I had a lot of liquidity to back me up.

Ultimately, I looked around for whatever has been devastated the most by the plunge in the equities markets and decided to capitalize using the volatility index (VIX). I mean, there’s literally fear in the streets right? So what’s better to do then to run straight into the storm and look at the infamous “fear index” VIX itself?

And boy, was there fear in the fear index itself!

But first, a simple and quick rundown on the basics of VIX and it’s numerous derivatives. Cos otherwise, it gets too complex if I just keep going on.

What is VIX?

Taken from wikipedia cos I’m lazy to write my own definition:

“The CBOE Volatility Index, known by its ticker symbol VIX, is a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options, calculated and published by the Chicago Board Options Exchange (CBOE). It is colloquially referred to as the fear index or the fear gauge.”

“The VIX is quoted in percentage points and represents the expected range of movement in the S&P 500 index over the next year, at a 68% confidence level (i.e. one standard deviation of the normal probability curve). For example, if the VIX is 15, this represents an expected annualized change, with a 68% probability, of less than 15% up or down. The expected volatility range for a single month can be calculated from this figure by dividing the VIX figure of 15 not by 12, but by √12 which would imply a range of +/- 4.33% over the next 30-day period”

So basically, to simplify the paragraphs above, VIX is an index that’s calculated based on the call and put options contracts. Essentially, higher premiums (options are more expensive) indicate that the markets think there’s a greater chance of the strike prices of the contract being “hit” or “in the money”, and hence, the markets are willing to pay/assign a higher premium to that particular option.

And if there’s a greater chance of the strike prices being in the money, well, that means the expected or implied volatility is higher.

In short, the higher the premiums on options, the higher the IV, the higher the VIX goes.

For a loooong time, VIX has been kept very stable, as the markets kept trending up. Basically, there was hardly any “fear”. It pretty much flat lined. What volatility is there to talk about if everything’s going just 1 way – UP?

That changed on the 1st Feb, when VIX suddenly spiked up aggressively.

But there’s no way to directly bet on the VIX. The only way is to bet on it via 1 of the numerous VIX ETNs, or via derivative products like options and futures. It’s going to be too lengthy for me to go into specifics, so anyone interested can just read this guy’s explanations. He’s pretty darn good:

https://sixfigureinvesting.com/2010/01/how-to-go-long-on-the-vix-index-2/

For me, I chose to utilize the VXX.

VXX is an exchanged traded note (ETN). It basically trades like a stock, with it’s own set of derivative products like Options. It is supposed to track VIX like how an index ETF tracks an index.

But therein lies the problem. Because VXX tries to track VIX by buying VIX futures, it usually suffers from what is commonly known in the commodities markets as “contango”.

What’s contango you say?

Basically, the price of each futures contract is more expensive further out. (most of the time). So the futures contract for May 2018 for example, would be more expensive than that of April 2018.

This means that as the futures contracts for April runs down towards expiry, VXX sells April futures and simultaneously buys May futures to try to track VIX, and since the futures contracts further out are more expensive, VXX is constantly “losing money” by selling cheaper futures and buying more expensive ones.

All in an attempt to track VIX

This situation whereby futures contracts further out are more expensive than nearer ones, is known as contango.

Now because VXX is constantly losing money from this rollover of contracts from 1 month to another, it has been an incredibly great machine to short.

I mean, this chart says it all:

And even that chart, is after several rounds of reverse splits.

Yet, as with most things in the capital markets, if it’s pretty obvious to you, it’s pretty obvious to pretty much every Tom Dick and Harry in the world.

I myself have contributed to this shorting frenzy by selling call options on VXX pretty much every other week, since early 2017. This has certainly been the most “crowded trade” of the century.

Seth M Golden is probably the poster boy for “shorting volatility” as his story of making untold riches (US$12 million to be precise) went viral at the end of last year. Check it out:

What a story right?

For the poor SG retail investor, constantly hunting for miserly yield and pathetic dividends in the path for lofty financial freedom, this stuff is what dreams are made up of.

Dreaming of retirement with just a measly SG $1mil portfolio target? Oh come on! Mr Golden (lol, his name. Man. Some would say he was born to become rich!) would show u the real way.

It’s easy, it’s peasy. TTI could figure out how to do what Seth Golden was doing just by researching for a couple of hours. So could you.

So at the end of 2017, the shorting volume on the VXX reached dizzy heights. Everyone was clamoring on the short train. I was on it as well, but kept my exposure to a bare minimum. My thought process regarding this is simple: the exposure must be so minimum that it’d render a sudden catastrophic spike in VXX, somewhat uncomfortable for me, but not anywhere near fatal. In return, I’d accept fairly consistent returns (it just keeps going down! Can’t find anything better to go short on!), but it wouldn’t be fantastic.

So for my US portfolio size of just over USD 300k, I get probably around a couple of hundreds USD every fortnight or so shorting VXX. It’s easy, it’s fairly predictable (at least until Feb).

On the 2nd Feb 2018, VIX and the corresponding VXX ETN, suddenly exploded upwards. I quickly covered my sold call options (at a profit too!) and watched intently as the volatility index priced in world catastrophe.

Basically, over the next 1.5 weeks or so, the stock markets plunge so rapidly, and VIX shot up so rapidly, that it seemed like we’re going straight to the Great Depression days.

Personally, I think the major reason for the sudden spike in volatility, is simply due to short covering by the huge number of people covering their shorts. (myself included). When something’s been so good for so long, it inevitably attracts a lot of hungry folks. You add on Mr Seth Golden’s golden story, and it becomes a magnet for retail investors.

Most of whom probably have no idea how VXX works, or study the week on week volumes of both retail and institutional funds.

As volatility spiked up so rapidly, the markets moved from a situation of “contango”, into it’s exact reverse: “backwardation”

As mentioned above, contango is when futures for further out months are more expensive than closer months.

Backwardation is the exact opposite: futures for nearer months are actually more expensive than further out months.

This means that the markets were expecting volatility (VIX) to be worse in the near future, compared to a few months down the road.

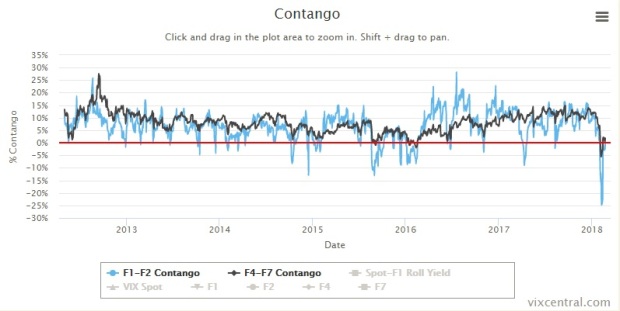

Backwardation is actually pretty rare:

The blue line, (F1-F2), marks the near term futures, while the black line (F4-F7) is for the futures further out.

In short, whenever the lines are above the red horizontal line, the markets are in contango. When they are below, they are in backwardation.

As we can see, the blue line only really dips into backwardation a few times in many years. It’s even rarer for the black line to go into backwardation.

On top of that, the drop into backwardation was so rapid and just so… fierce.

There were only 3 other episodes in the entire history of the VIX where the volatility spiked this fast and this hard!

The Big Short

My hypothesis was that the spike came from a large number of traders, both institutional and retail, who were caught out by the large increase in volatility.

Remember that shorting volatility has been so profitable for so long, ex-Target store managers were turning into expert fund managers.

With this sudden spike, many traders would’ve faced margin calls, and were forced to cover them. This in turn caused a further spike in volatility, and this further spike in turn, resulted in further margin calls, which in turn…… you get the idea.

That’s why I say it’s a positive feedback loop. That’s actually similar to how electrical signals are sent along nerve fibre bundles in our bodies. It’s all a positive feedback loop.

With that, I decided to go against the short term tide, utilize all that liquidity I had, and go short instead. The-big-short style. Everyone’s covering their shorts, so it’s time for TTI to go short.

My bet was simply that there was no way that the drop could be much more rapid from here on. And if it did happen, it basically meant the whole world was going to hell anyway (maybe NK and US got into a nuke throwing match), so it didn’t quite matter if I was wrong anyway.

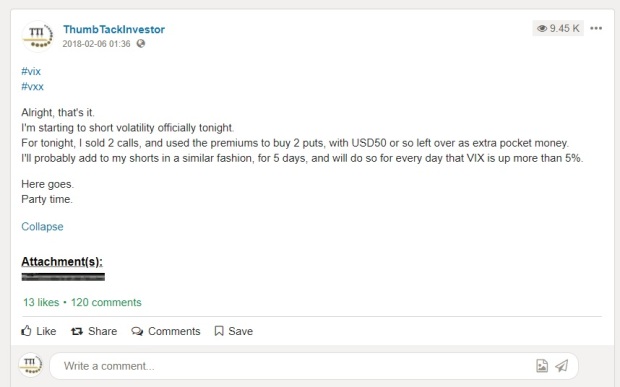

While everyone was busy covering their short positions, volatility spiked up to an all time high, fear was prevalent in the markets…. and on the 6th Feb 2018, I officially started shorting. Yes, the exact thing that everyone was busy covering, and running away from.

(I’m not writing about this with rose tinted glasses from a hindsight perspective. I literally posted it on IN the same night I initiated my short positions on volatility, and kept up documenting my shorts for a few nights after that, complete with screenshots)

Now, because the markets have swung from contango to backwardation, the tide is actually not in the favor of shorts.

Remember that in contango, VXX has to rollover into more expense futures each month, resulting in continuous “leakage”. The opposite happens in backwardation: futures further out are cheaper, so each time the rollover happens, there’s an upward bias for VXX.

Over the next few days, as VXX went up, I continued shorting.

When VXX went over 50, I shorted even more heavily.

I structured my VXX shorts via a somewhat equal distribution of selling calls and buying puts. I tried to buy mostly close to the money puts, and selling OTM calls. In this way, the premiums of my sold calls mostly paid for the premiums of the puts I bought.

TBH, I did worry at 50, that VXX would suddenly go ballistic and this would’ve been one of those black swan events that occurred once in a million years. Aside from that, VXX was in backwardation, meaning that I can’t rely on the constant rollover to suppress the share price.

What gave me confidence though, was this:

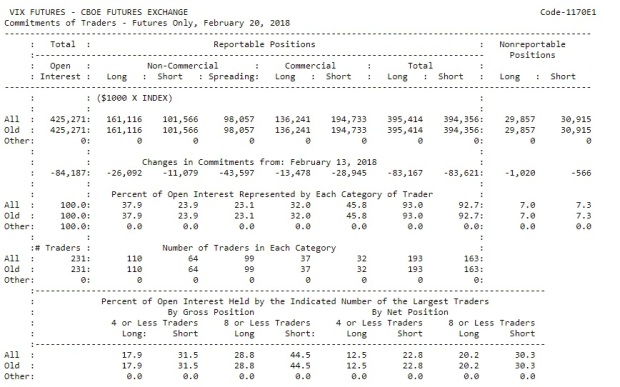

In the midst of my digging, I found something that is little known, but IMO, is highly useful for VIX traders: the weekly COT declarations.

The “non-commercial” refers to retail traders. As we can see in the green box, the retail traders were still mostly long the VIX at that point.

But check out the yellow box. The institutional or “commercial” traders, have all swung to a nett short position!

The swing happened over the course of a single week. Check out the red row and the red oval that I’ve indicated.

Amidst the explosion in the fear index, the smart money has already started swinging to a nett short position. Comparing w-o-w, the institutional traders have increased their short positions and are in a nett short position, whereas the retail traders have actually continued cutting their short positions, and are in a nett long position.

In the rows below, one can also see that almost 41% of the short positions, are held by just 8 institutional traders!

That’s certainly highly concentrated, and definitely strong conviction on the 8 traders.

I’m guessing that most retail investors, and Seth Golden- wannabes, do NOT do their DD at the intensity that I’ve illustrated.

I reckon most don’t even know that CFTC requires institutional traders to declare their positions on VIX, and compiles this data! Much less go dig for it.

Well, that is certainly great for TTI’s brand of deep value, contrarian investing.

With that, I was happily, but yes, somewhat nervously, shorting VXX for an entire week while the world was panicking.

Here comes the synopsis and lessons learnt.

There’s still a twist coming up…

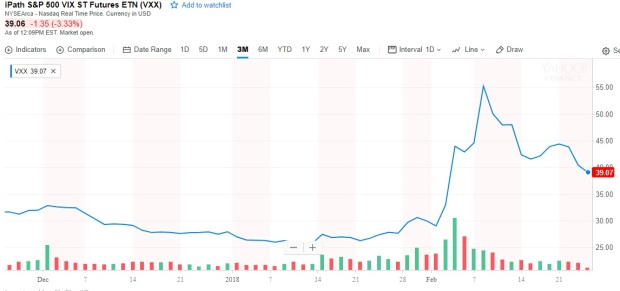

A mere 1.5 weeks later, this is what the VXX chart looks like:

VXX has come down almost 30% from its highs as of the time of typing this.

Almost all my short positions are profitable.

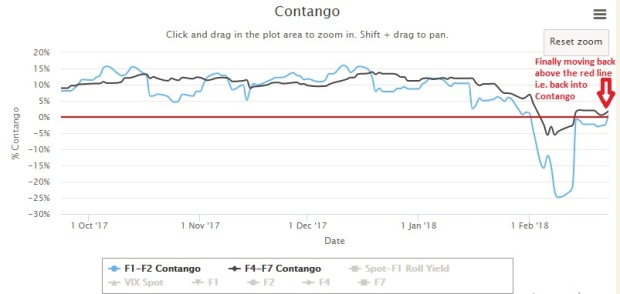

VIX futures for nearer months have also dropped, such that the futures markets are moving back into contango:

Yet… something wasn’t right.

Remember that I structured my short positions by a combination of writing call options and buying put options on VXX.

Since the put options that I bought employed leverage, one would naturally expect the put options to have made a massive KILLING by now.

That’s what I expected too. Hey, that’s how Michael Burry did his massive short right? By utilizing leverage in the collateralised debt securities (CDS).

But it didn’t happen.

I first got an inkling that something didn’t go quite as right as I was expecting it to, when IN user wellhandy congratulated me on my VXX short position on IN:

That brought a slight smile to me… before I quickly realized something wasn’t right.

Most of my put options employ what, 7,8 times? leverage. Some give me a 10x leveraged expoure to a short position (for eg. the premiums cost $5 with strike prices of $50)

So technically, by paying $5, I owned the right to sell at $50.

That means that if VXX has come down by 20%, I should be getting a 200% ROI on my put options!

Yet a quick scan of my options looks like this (as of 22/02/2018).

This is only a partial snapshot. I own 5x the number of options shown, but the list gets too long to display here, plus the font gets too small.

Anyhow, this is reflective enough.

The call options that I’ve sold are in the yellow box above, while the put options that I’ve bought are in the red box below.

And I got really puzzled.

Why are my sold call options showing so much more unrealized profit than my put options???

My put options employ leverage, call options sold do not.

How can the market move exactly the way I structured my positions, yet my options have puny profits? In fact, 1 of them is till negative! (gasp!)

I kid u not, I spent the entire CNY eve trying to figure this out. It just didn’t make sense to me.

I’m supposed to be ABSOLUTELY KILLING it aka The Big Short style by now…

yet all I have to show for it is a couple of grand USD.

(That was then, as of today, it’s looking better as VXX has continued to tank. Still……)

It took me some time to find out. I even checked with a couple of hedgie friends who can’t really explain it to me either. (to be fair, they are not privvy to the exact details)

Finally, this guy on SA enlightened me:

https://seekingalpha.com/article/4145659-time-short-vix

To summarize, essentially, I bought put options and sold call options at the peak of hysteria. I did not take into account the fact that the high fear and volatility, resulted in the high Implied Volatility (IV) of the VXX options itself!

The high IV meant that the premiums of the options were high too. Thus I was sorta buying expensive put options, and selling expensive call options at the same time.

As volatility subsided, the premiums dropped across the board.

Hence, the call options that I sold became profitable very quickly.

The put options that I bought, became more valuable in theory, but because I paid a high premium to buy them, and the volatility aka fear has subsided, the premiums came down too. So these put options that I held, were sorta swimming against the tide, so to speak.

In short, I failed to consider the effects of volatility… on the volatility index itself!

wow. Mindblown?

I was. When I ultimately figured it out.

This is like…. the movie Inception. A dream within a dream. Volatility within volatility options.

Man. Instead of swimming in millions like Peter Thiel, I’m left to rue what was a mistake on my part. Yet, strangely, I feel really really really excited at having figured this out. I can envision this will be a crucial piece of new information that I’ve equipped myself with, in preparation for the next opportunity.

Well, for everyone winner like Peter Thiel, there are many many many others who have died terribly. RIP to them. There’s someone on SA who’s been fanatically commenting on all the VIX posts. Apparently he has lost USD 2 million in that 1 week of crazy volatility by buying the inverse index. (it’s another story altogether, but the reverse index got suspended and redeemed, aka shut down)

So I’m constantly mindful of the big risks here, playing amongst the biggest boys in the world.

As of tonight (I wrote this post over a few days, so in terms of the time line, it may make reference to several different days), VXX sits at $38.9 as I type this, a massive drop from its peak of around $58 or so.

I’ve already taken profits on some of my short positions, but still hold the majority of my short positions. I’d mostly be selling the put options I own first, and let my sold call options just run its course. It’s unlikely that any of them will be exercised, unless we start hitting a massive bout of volatility again.

This is the most recent COT:

Institutional traders are still nett short, although they have mostly taken profit (short positions have reduced w-o-w), based on this latest COT.

Retail investors though, are still nett long. Good luck to them. I think most are just holding on for dear life. There’s still room for VXX to come down yet some more, IMO.

The consolation here is that I’m still going to come out of this with… I guess, somewhere between USD 25K – 40K of profits. Depending on how much it drops further over the next few days. Not too bad for just under 3 weeks.

Not quite the Big Short I was planning.

But the next time…………………..

I’ll be ready.

Thus far, 2018 has started out with a bang for me.

The successful divest of Shinsho Corp and Kobe Steel added nicely to my ROI (Divestment Of Shinsho Corporation & Kobe Steel – TTI’s Post-Mortem)

and that was followed by a surprise buyout offer for LTC Corporation (“Where Art Thou, White Knight?” – LTC Corporation’s Privatization Offer.)

and now this.

I’m still holding on to high levels of cash, and resisting adding to anything unless there’s a damn compelling story that I can envision to support my investing thesis.

On an unrelated note, SGX will be hosting some of us for a CNY dinner this coming Wednesday. I’m bringing an old friend who’s an auditor. She has helped greatly in a lot of Team Thumbtack’s DD. SGX will also be unveiling details of their new website, as well as new initiatives for investor education, so let’s see what they have.

K, that’s about it for this post.

Implied volatility on a volatility ETN! wow. I still can’t believe I didn’t consider that.

LOL, u guys gotta admit… investing is 1 helluva game. 1 massive, complex game of wits, played against people from all over the world.

What a game.

Really informative post!

Hmm quick question; are you worried that given that it was mostly the explicit short vol trades that blew up (covering and what nots), that there might be a lot of implicit short vol trades (i would think a bigger amount) that have not yet unwind? Wondering if that could cause another spike in vol, in the near future.

LikeLike

Hi Homan

Thank you for your comment. Man, I was getting quite a few queries via email, nobody seems to understand fully what I’m talking about. Glad that you do.

Hmmm about your question, I’m not quite sure what you mean by “explicit” vs “implicit” short vol trades. Care to explain that further?

But yes, I do think there’d be another spike in volume in future, and by future, I mean within this year. I don’t know if it’d be of the same ferocity as what we saw in early Feb, but I think when rising interest rates meet with an existing environment of high leverage and high liquidity that’s been around for many many years, it doesn’t end well.

We’d see a lot of panics.

I just don’t know if it’d be like the recent wave of panic that subsides just as quickly.

My guess is we’d see a few more of such panics, before a mega crash.

So yes of course I’m worried about that. Currently, my take is that VIX won’t go back to the “normal” levels as per what we saw last year. VXX was below $30 before this current spike. I don’t think it’d go back to those levels. But I’ve started selling off my shorts and taking profits, if and when it reaches around $35, I’d expect to completely take profit on this short position.

Cheers

TTI

LikeLike

Hi,

Thanks for your information which is enlightening.

Could you guide me to see the latest CFTC data as I only can see historical 13 Feb data.

Thanks a lot!

LikeLike

Hi

I’m almost reluctant to reveal this, cos it took me a lot of effort to find. But in the name of sharing…

here you go:

http://www.cftc.gov/dea/futures/deacboelf.htm

The latest data is all there.

Cheers

TTI

LikeLike

Great trades… !

FYI… i think non-commercial doesnt refer to retail. You need to be of a certain size to register, and be reflected in the COT report, hence retail is probably not involved.

http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm

When an individual reportable trader is identified to the Commission, the trader is classified either as “commercial” or “non-commercial.” All of a trader’s reported futures positions in a commodity are classified as commercial if the trader uses futures contracts in that particular commodity for hedging as defined in CFTC Regulation 1.3, 17 CFR 1.3(z). A trading entity generally gets classified as a “commercial” trader by filing a statement with the Commission, on CFTC Form 40: Statement of Reporting Trader, that it is commercially “…engaged in business activities hedged by the use of the futures or option markets.” To ensure that traders are classified with accuracy and consistency, Commission staff may exercise judgment in re-classifying a trader if it has additional information about the trader’s use of the markets. A trader may be classified as a commercial trader in some commodities and as a non-commercial trader in other commodities. A single trading entity cannot be classified as both a commercial and non-commercial trader in the same commodity. Nonetheless, a multi-functional organization that has more than one trading entity may have each trading entity classified separately in a commodity. For example, a financial organization trading in financial futures may have a banking entity whose positions are classified as commercial and have a separate money-management entity whose positions are classified as non-commercial.

FYI 2, following the reply above, here is a piece on implicit short volatility. not sure if that was what the person was referring to.

Click to access Artemis_Volatility+and+the+Alchemy+of+Risk_2017.pdf

LikeLike

Hi kk

Thanks for your comments.

I saw that explanatory notes.

But my intepretation of this:

“Statement of Reporting Trader, that it is commercially “…engaged in business activities hedged by the use of the futures or option markets.” ” is that it refers to institutional investors.

What other “business activities” could it be referring to?

Thanks for sharing that link!

wow, it’s quite an eyeful.

I zoomed into a particular segment, and yes, I think that’s what Homan was referring to:

The clearest explanation was found in page 6

“Short volatility can be executed explicitly with options, or implicitly via financial engineering. To understand this concept, it is helpful to decompose the key risks. The investor holding a portfolio of hedged short options receives an upfront premium or yield, in exchange for a non linear risk profile to 4 key exposures 1) rising volatility 2) Gamma or jump risk 3) Rising interest rates 4) unstable cross-asset correlations.

Many institutional strategies derive excess returns by implicitly shorting these exact same risk factors despite never trading an option or VIX future”

Thanks for this link.

Now I gotta go sleep on it a bit more.

Good stuff.

Cheers

TTI

LikeLike

yup, that was what I was referring to! (even if i’m not super clear on all the types of explicit vol plays lol). Just feels like there will be another re-test downwards first haha.

LikeLike

Hi Homan

I like the link that kk sent.

when you’re talking about “re test downwards” I guess you’re referring to the indices right? Not volatility right?

My personal view is that 2018 will see several such spikes in volatility similar to what we had in early Feb (aka sharp dip in indices), but we won’t have a major catastrophe…… yet. Not a recession as yet.

Simply because we are still quite nascent in the tightening cycle. As rates rise, the stresses from the drained liquidity will show up, starting from the over leveraged areas.

If the rates are gradual enough, the stresses has time to dissipate, and we don’t get a widespread sudden crash.

So at the initial start of a tightening cycle it’s less likely for a massive crash.

At the later parts, the players who will be massively deleveraging includes those who have finally thrown in the towel after hoping and struggling against the lowered liquidity.

That’s when hell breaks loose.

I subscribe to Andy Xie’s version of how things will turn out.

Can google and read his articles.

Cheers

TTI

LikeLike

That was quite a story. I don’t do options, but I learned a lot, so thank you.

I hope you don’t mind me asking but was there a company-specific reason you sold out of Boustead? Because, as far as I can tell, the same reasons to like it in the past are still in place now.

LikeLike

Hi Miami

glad you liked it.

As for Boustead, it wasn’t really a company specific reason I guess.

The main reason is that I need to increase my liquidity, and Boustead is an obvious choice. I’ve only 40,000 shares, didn’t seem to warrant more time to analyse, so I divested in 2 batches of 20,000 each.

Perhaps the only “company specific” reasons that I considered were that O&G is still looking shaky and unlikely to recover soon. From what I hear from industry insiders, nobody seems to be optimistic, even the 3rd party providers, like the supporting functions for the offshore platforms, are pessimistic.

Also, through my options activities in the US, I was well aware that the USD had weakened considerably, so I was pretty sure they’d get some currency losses there too.

All in, no specific, strong reason to divest Boustead. Just part of overall portfolio management I guess. It was a good investment overall, taking into account the dividend in specie.

If I had to choose right now though, I’d be more inclined in investing in Boustead Projects than Boustead itself.

Cheers

TTI

LikeLike

Quite strange you din know about the 4 greeks that determine option pricing, volatility being one of them. Sentiment also heavily affects

To make a lot you can buy cheap call options during a crash … when rebound, you get many multiples back. Or just buy put options during a bear altho sentiment may be priced in

LikeLike

Hi Henry

Of course I’d know volatility affects the premiums of options, I’ve written about it earlier

I just didnt take that into consideration when considering options on volatility itself I guess.

It may be easy to talk about buying cheap call options, but in my experience, at least for VIX, because of the long durations of low volatility, it’d have been an extremely poor strategy. because of time decay, to buy cheap call options. So some idea of timing is required, and timing is always difficult.

Cheers

TTI

LikeLike

And of course, there’s also Rho, interest rates that would affect option premiums.

So it’s 5 greeks.

LikeLike

Hi TTI, I read your article with great interest and find it rather comforting to see there’s still somebody locally here who takes such due diligence in finding answers from options world, I doubt that many here can comprehend, let alone find those concepts you explained practical.

I came across interesting articles from seeking alpha too, the link below was free until that fateful 6 Feb 2018, it’s become now exclusive for PRO subscribers.

https://seekingalpha.com/article/4139258-cheap-hedge-market?source=all_articles_title

Nobody could have explained better than you did on Contango & Backwardation.

Contango environment is common and happens most of the time, implied volatility (IV) is low in low interest environment while Backwardation is rare, so does high IV. I would think that when IV changes from low to super high, Backwardation follows, if it’s normal Backwardation, super high IV usually being unsustainable will let market go through mean reverting process, IV subsided and net options sellers get survive another day. Otherwise, market crisis happens, most options sellers are done for.

Here goes my true story as a loser, I hope my narrative can help people avoid what I have been through.

In the beginning of Feb (before mini crash), I was trying to do naked (short) puts to finance my (long) puts to be purchases for “free” later on, it turns out there’s no free lunch. If it’s too good to be true, it probably is.

Overall, this position was about constructing a long put back spread (out of the money) in /ES June 18 (Options Futures) as below. The purpose was meant to create a hedge for downwards protection which has gone terribly wrong.

https://www.optionsplaybook.com/option-strategies/put-backspread/

Needless to say, it was a disaster, the short puts imploded and suffered huge losses as VIX went up to 50. Instead closing my naked puts, the worst thing was I create another problem by doing long puts (to create long vertical spread) on a different strike prices in the worst timing imaginable when they became so expensive.

Come to think about it, I was actually selling low initially and buying high later. As for you, you expected to make millions, in the end you made thousands, congrats to you.

To be somebody like Peter Thiel who managed hit the jackpot by no coincidence, we not only need to take the contrarian approach like you do on deep value investing on stocks but also have to speculative in options which are by nature wasting asset if nothing big happens.

Otherwise, it will still turn out to be another crowded trade.

Even the main stream Tasty Trade, a social learning media tells people out there the way to make money is to sell options in high IV, and sell options in low IV. We ask ourselves who would in the right mind go buy options in high IV, and sell options in low IV? Until now, I still have no idea who is right?

Let’s say if the plan you have in mind really works, how do you plan your big shorts after the lessons you have learnt in Feb?

LikeLike

Hi Thick Thin,

Thanks for your comments… all of them.

I had to take some time to ponder over what you wrote.

1stly, I actually think there are many ppl here that do comprehend what I wrote about options thus far, and probably understand it even better than myself. In my previous post, there are some who gave very helpful comments, and I have received some email queries as well.

2ndly, well, I wasn’t really expecting to profit by millions of bucks. It was just written in jest, a play on the Big Short movie. I set aside $50k to short VIX at its peak, so even if I had a few hundred percentage gains, which would be really really really good, it’d still be at best, a few hundred k profit. It won’t ever reach millions.

(Of course, I only ended up with a few k profits in the end)

Finally, what you did with the put backspread, was essentially to double down on shorting VIX right? Essentially, because you sold puts at higher strike prices to finance the puts that you bought at lower strike prices, you’d really need VIX to keep dropping way past your put options exercise price to benefit.

And that’s done at a time when VIX has been at all time lows.

Of course, it’s only on hindsight that it looks like it’s a mistake.

I think shorting VIX is way too much a crowded trade. We should’ve seen the signs if there’s so much retail participation.

I still think if we see those massive spikes in volatility, shorting makes sense, but the issue is, there’s no way to short it efficiently with leverage.

I wouldn’t buy put options then, cos as you pointed out, the high IV would mean you’re paying too high premiums, as per my experience.

LikeLike

*Having said that, we ask ourselves who would in the right mind go buy options in high IV like what Peter Thiel did, and sell options in low IV? Mainstream tells us to do opposite of this statement.

Yes, IV is directly related to and ready to change environment to either Contango or Backwardation and I can’t tell exactly at which point it changes so much so it benefits us, is there?

LikeLike

So my 1st thoughts are that the only logical option plays in this environment right now, with an appropriate risk reward ratio, would be to go long in long dated options, (At least 6 months out), and buy those far OTM calls.

Those would have relatively cheaper premiums (cos they r far OTM), and yet vega would be reasonable because of the longer time frame.

I might finance those partially by selling put options along the way, but ultimately, I wouldn’t mind paying a premium to buy those calls.

Not now exactly, as VIX is still high, the market is back into backwardation, and we should really wait for calmer waters.

The problem with options is that with high volatility, everything’s expensive comparatively to buy, so selling seems to be the way to go during those times.

Cheers

TTI

LikeLike

Sorry TTI, I wrote wrongly again even on my rewrite *Having said that, we ask ourselves who would in the right mind go buy options in low IV when literally nobody thinks they have to buy protection ? Most of us did sell options in “high” IV, not knowing that IV goes even higher up sometimes right after we sell.

Yes, IV is directly related to and ready to change environment to either Contango or Backwardation and I can’t tell exactly at which point it changes so much so it benefits us, is there?

LikeLike