1stly, something unrelated to Dutech Holdings.

I drove down to BBR Holding’s project, The Wisteria to take a look today. Kinda disappointing that the project is taking so long to TOP. I was informed by sources a few months ago that it’s slated to TOP in mid April. So, obviously, they’re late, cos today it still looks like this:

Officially, the given time frame for TOP is announced as Q2, so the project is not considered delayed. (But unofficially, I know it is)

I can see the signboards of the various tenants though, so it can’t be too far away now. The Wisteria is going to provide BBR with some much needed recurring income from mall management, and that’s badly needed right now, seeing that BBR’s FY18Q1 is going to be unprofitable. They just can’t seem to execute on projects profitably. All the years of pumping money into and investing into PPVC didn’t seem to yield any tangible results.

The rental rates are probably highly confidential, so I don’t think I should reveal the exact numbers here out of respect, but they’re pretty much in line with the other malls that I’m familiar with.

The ground level where most of the footfalls are and visibility is maximal (frontage along the main road), commands rent in the low $20s psf, whereas the basement level commands rent in the upper teens psf, both together with the standard nominal few % of GTO of the tenant.

These rates are similar for all suburban malls, and have been kinda frozen in the past 4 years or so, don’t see much difference.

The last I checked, The Wisteria’s occupancy is amost 80%, but since we’re approaching TOP, perhaps the occupancy has increased further.

Having done a site visit and analyzed the surroundings, I gotta agree that this project has been rather successful. Although not directly linked to an MRT station, and facing some competition from the nearby Northpoint, which is now super massive after the asset enhancement, The Wisteria itself will command a certain captive crowd, as the numerous residentials around the area is currently under served.

There are no real retail options in the vicinity, and I can see that once The Wisteria is operational, there’s no reason for the nearby residential crowd to go that little further to Northpoint mall for their needs. The tenants in The Wisteria Mall are all familiar names too: Kopitiam and NTUC Fairprice being anchor tenants.

Being a mixed development also means that the fully sold residential units above will provide an immediate boost to the retail portion, once residents start moving in.

Anyway, this post is about Dutech Holdings. BBR’s management needs to go take some classes on project execution and management from Dutech’s, IMO.

I attended Dutech’s FY17 AGM about 1.5 weeks ago.

I’ve received quite a few requests to write about Dutech’s AGM, and have been procrastinating. But well, here it is. I’d also add on some of my further DD at the end.

As this is not a new holding, I won’t waste time talking about the basics. They can be found here:

Dutech Holdings Investing Thesis

Dutech Holdings – What’s Next? Realize $117k Profit, Hold Or Add More? (Part I)

Dutech Holdings – What Lies Ahead? Part III

For the uninitiated, a very quick summary. Dutech made some quickfire acquisitions in the past few years and that greatly expanded their capabilities, at the expense of their otherwise, solid financials prior to the acquisitions.

DTMT was acquired in 2014, Krauth in 2015 and Metric and Almex in end 2016.

Of these, DTMT has been turned around and was profitable in FY17.

In the past year, the share price of Dutech dropped… I dunno how many %.

Certainly a lot.

As of FY17Q4, the numbers still do not show a successful integration of their most recent acquisitions: sister companies Metric UK and Almex.

Anyway, here are my notes from the AGM. For the sake of brevity, I’d cut to the chase and just put everything down in point form.

- Turn around for their most recent acquisitions, Almex and Metric, is guided to be in 2018 or 2019.

Of course, I’d expect someone to ask about their M&A strategy. Dutech has very cleverly, bought out these businesses when they are failing and going into bankruptcy. Everyone wants to buy successful businesses, but nobody’s selling a successful business for cheap.

The key question when buying failing businesses for a song then, is…. “WHAT NEXT?”

I have full faith the integration is progressing nicely. Each piece of the business is complementary to the others.

Someone asked about the 7.9mil RMB impairment loss. Management’s answer is that the loss recorded is due to an impairment of Almex’s loss of a contract when they declared insolvency and Dutech bought them out. It is a valuation loss, not an actual operational loss. Management feels the impairment is reasonable and extraordinary.

- “Long tail” decline in ATM business

Johnny candidly stated his view is that the traditional ATM business is in a long term secular decline, dropping a bit every year over a long period of time. When pressed, he mentioned perhaps a 10% drop every year for the next decade.

But this doesn’t mean that there’s no money to be made in this sector anymore. ATMs will likely move from the traditional money dispensing functions, into intelligent machines which can provide a variety of functions.

And this is a major reason for Dutech’s acquisitions. The acquisitions allow Dutech to move from being just involved in the assembly portion, into a player along the entire value chain, from planning to assembly to even the software management.

- Still on the acquisitions….

Johnny indicated that the acquisitions are to buy the customer base of Metric and Almex, as well as their know-how and intellectual property, patents etc. It is not based on the companies’ assets. (I’d add my own DD at the end later, so more on this later)

- Margins

Someone queried about Dutech’s declining margins. In FY17, Dutech’s margins for the High Security segment was affected by the drop in the USD vs SGD exchange, and the massive rise in steel prices. Dutech is trying to pass on some of these increased material costs to clients, but it takes some months for the variations in their contracts to materialize.

- Administrative costs

Johnny pointed out that the spike in administrative costs is due to the acquisitions. The core business of Dutech, less the acquisitions, has no change and in fact, a drop in administrative costs.

Also, because the acquisitions were completed in FY16Q3, from a y-o-y perspective, the administrative costs seem to have spiked up because the costs of the acquisitions have had only 3months impact in FY16, but we see the full impact in FY17.

Management also guided that the administrative costs will not increase any further in FY18, and that they’re working on cutting it.

(My own DD says that they’ve cut jobs by 25% at Almex, and at the same time, reassigning personnel within the subsidiaries.)

“Of the original 400 employees, Almex still has 120 employees – another 170 jobs have been retained at the British sister company.”

Source:

- Dividends

This question gets asked every year. Really.

Why does Dutech NOT pay a year end dividend, but only pays 1 after Q1?

This is because Dutech’s funds are in China. After the year end closing of the books, and after auditors have gone through the accounts, they can then declare a dividend and move funds from China to SG to pay out. So it’s always just in time for an interim dividend after Q1, never after Q4. If the company is headquartered in SG and their funds are in SG, they’d be able to pay a year end dividend instead.

- Cash buybacks, increase dividends

Seeing that the share price has declined substantially over the past 12 months, it’s inevitable that there’d be some disgruntled shareholders.

And there were.

1 shareholder pressed on (aggressively) about why the company doesn’t do share buybacks, giving data on it’s utilization of its cash holdings and the ROE to substantiate. Mr Graham Bell took the question, gave some background details on what the BOD deliberates about when considering capital requirements. Personally (his view, not the BOD’s), is that the company needs to hold sufficient capital when dealing with turning around companies. In this aspect, it’s better to be conservative.

The company is in a period of change, as the High Security business of manufacturing of safes is likely to be in a secular downtrend. The BOD has long identified that they need to move up the value chain, and hence, the timely acquisitions. All this would not be possible if they did not have adequate capital to capitalize on the bankruptcy of other companies.

There was a moment of awkwardness when Mr Bell took offence at a strong word the aggressive shareholder used to describe the board. Ah well, it’s all in a day’s work being on the BOD of a publicly listed company.

- Someone asked a question comparing the business dynamics of the Business Solutions segment vs the High Security segment

Business Solutions has not much bigger competition, unlike in the High Security segment. Also, for smaller sized orders, their competitors are either too slow to respond, or are unable to handle sudden orders due to various limitations. Johnny gave an example based on the manpower requirements. Some companies are unable to handle sudden changes in volume, as they would have to suddenly ramp up manpower to meet the demand, but when the project is over, they’d suddenly be stuck with excessive manpower.

Dutech has its own manufacturing facilities in China and hence, more control over production. On top of that, they do hire several contract staff.

(Can’t rem if he actually said this or is it from my own deduction, but in my notes, I wrote that their European competitors have stricter labour laws that make it difficult to hire contract staff in deals that make sense for the company)

- Large drop in margins in BS segment in Q4 of 2017

Quarterly, the margins in this segment range in the 20++ %. In Q4 of 2017, it dropped to 14% (or so), with the reason given as “a change in product mix”

Johnny clarified that some projects utilize middlemen. If they manage to go to the end clients directly and cut out the middlemen, the margins are higher. Longer term, they expect GPM of this segment to be 25-30% and NPM to be 8-12%, without the middlemen.

- General discussion on the company’s prospects

Johnny gave some color on what they’re working on and his experience in the industry.

Dutech is no longer a hardware company, neither are they just a mere safe manufacturer. All the talk about the society going cashless is missing the whole point.

Every human transaction, even without the use of actual cash, requires recording. Dutech’s business is the business of recording these transactions.

Johnny described Almex and Metric’s products, such as the validating machines and the SmartQube machines (not a spelling error ok!)

Also, their clients require the software to analyze commuter patterns for eg, and Dutech is able to provide these services. Johnny reiterated that the acquisitions are done with the IP and knowhow in mind, and these have morphed the company into a player along the whole chain.

Alright. Those are my notes from the AGM. The important ones at least.

There are several other questions that I don’t bother to type out here, as I think they are not very useful, and in fact, some are a bit…. hmmm….. uninformed. Like for eg, 1 not-so-happy shareholder asked why can’t the company write off the entire goodwill in the acquired Almex, instead of just writing down 7.9mil RMB related to the loss of the contract. Johnny replied that the write down is dependent on accounting rules, and verified by their auditors. (But of course.)

Now for TTI’s enlightenment.

I’ve really heard many folks think of Dutech as an “S-chip”. It’s not difficult to see why ppl think of that. Superficially, they do look like an S-chip. No real operations in SG, no office even, with management hailing from China, and manufacturing operations in China too.

But if Dutech is an S-chip, then so is Capitaland.

To illustrate this, perhaps I’d have to give a history lesson of sorts.

Dutech’s most recent acquisitions: Metric and Almex, were bought at bankruptcy for a song. Prior to that, their predecessor is the famed Höft & Wessel, which is recognized as the leader in the field.

https://en.wikipedia.org/wiki/Hoeft_%26_Wessel_AG

Data on wikipedia is a bit outdated though, but u get the idea.

The business solutions segment of Dutech is where the focus is right now.

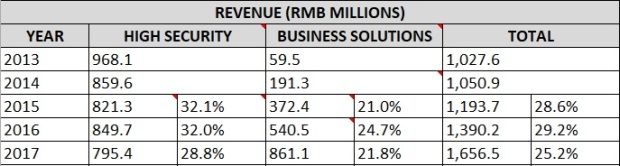

This table compiles the revenue and margins of the segments over the years:

The trend is obvious.

High Security revenue will continue to trend down, with declining margins.

Business Solutions’ revenue grew in 2017, but mostly from the acquisitions.

Going forward, it’s obvious that BS will increasingly form the core of the company’s business, specifically its operations in Europe.

Johnny wasn’t kidding when he said that BS has less real competition. The only real major competitor that Dutech faces in this segment is Scheidt & Bachmann.

https://www.scheidt-bachmann.de/en/

They’re the number 1 player in the ticketing and parking machines sector, followed closely by the integrated Dutech, in terms of market share.

Unfortunately, since they’re privately held, there’s no published financials for me to do a comparison. That’d be so nice. And in fact, I think if their financials are public, it’d immediately correct what I think is the mispricing of Dutech currently, since everyone can do a simple comparison of their financials.

The other smaller competitors include Parkeon Transportation, VIX technology and Ridango. None of which are listed. In fact, I can’t find any single player in this field that’s listed. (Anyone who knows, pls kindly let me know!)

So how large is the European market currently?

The Europe smart ticketing market revenue is estimated to be $1.74 billion in 2017 and is expected to reach $5.38 billion by 2023, growing at a CAGR of 20.69% during the forecast period 2017-2023.

In this growing market, the players are mostly still smaller, fragmented outfits, fighting for market share. By buying Almex, Dutech already has direct access to certain major clients that otherwise, would never consider Dutech.

For example, in end 2017, Dutech won a contract with the all important Deutsche Bahn (DB), to redesign DB’s software for all ticketing machines to make them more flexible in integrating with all future hardware modules:

(DB Vertrieb is a wholly owned subsidiary of DB)

This project has just begun, and is slated to last until the beginning of 2019.

But it’s just upgrading the software to provide more flexibility right? No mention of contract value too, doesn’t sound like a big project?

“The new DB machine platform will be used on all DB existing vending machines as well as on new video machines, which ALMEX GmbH will also supply to DB Vertrieb for a first project next year.”

Now, DB is a helluva important client. If Almex is winning contracts to supply new ticketing and validation machines, it’s certainly very good news, and they’re likely winning market share.

(Travellers who have used Europe’s train system will understand that in Europe, you can buy a ticket, but u need to validate it to prove that it’s being used during that certain time period. So every station has multiple validating machines along the platform)

In fact, Almex already has a long term working relationship with DB, and this relationship is set to deepen as DB continues to refresh their equipment, and ticketing solutions.

For example, currently, DB’s train attendants utilize hand held mobile devices for ticketing, and guess who supplies these devices for DB?

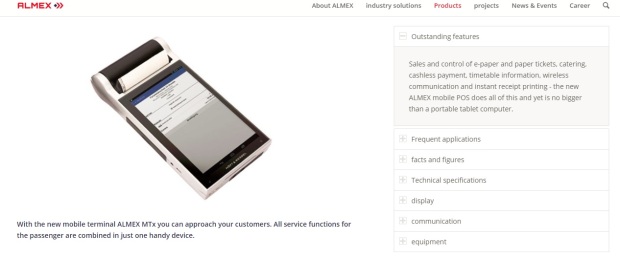

Hmmm look at the picture of the mobile ticketing device from DB.

Yup, that’s in Almex’s product catalog:

Aside from ticketing and car parking solutions, both the hardware and software side, Dutech also supplies inventory management solutions, through skyeye.com, for logistics companies. (Again, both the hardware and software)

I guess this would be self explanatory:

TTI’s Thoughts

Actually, currently, I don’t think Dutech currently has any real, indisputable economic moat so it isn’t a Buffett type of company. But I do think the business is currently completely misunderstood by the markets, and hence, completely mispriced.

Reading the above, does the business still sound like a “S-chip” to you? I kinda roll my eyes a little whenever I hear someone bring up “S-chip” concerns regarding Dutech.

I increased my stake recently at $0.25, and am continuing to add to my already substantial holdings.

Going forward, there’s still many exciting things happening in the industry. Dutech, like all other companies, obviously doesn’t reveal what their R&D is about right now, but my DD tells me that every company is gravitating towards what is known as “Be in Be out” technology. The future of transportation payments will involve commuters carrying a personalized device, linked to an account.

The vehicle is able to detect such devices, and when the commuter hops on and off the vehicle, the device is detected and the appropriate fare is directly deducted. BIBO is what most research is geared towards, and is likely to be the future for the industry. It’s completely contactless, and in future, may even be part of wearable tech.

This technology is still in its infancy though, with minimal real life testing done. Other concerns include privacy concerns, and problems with device detection when carried out on a massive scale.

When I was doing my DD, I can’t help but think that this BIBO mode of payment reminds me of NS guys doing their IPPT. You cross the sensor and it detects your device, and each time you cross the barrier, it goes “beep” again. Should be the same tech I guess.

Looks like SAF has far more advanced tech than all these MNCs combined…

Back to Dutech. I think FY18 will be very interesting. I’d be watching closely for the turnaround to be confirmed in cold hard figures. Right now, the share price is very depressed, but has risen in the past couple of weeks. (Partly due to accumulation by yours truly. Some days, I’m the sole guy accounting for the entire volume that day)

I think signs of a turnaround could come as early as 2 weeks from now, when the company releases FY18Q1 figures. I’m also expecting a slight tailwind with the recent strengthening of the USD, although that impact will only materialize is later quarters.

The company is also naturally very thinly traded, since there are only 20 shareholders/entities that hold >1million shares, and all these top 20 SHs collectively hold just over 90% of the company. Most of them are long term SHs, and this locks up the bulk of the company’s shares. I’ve never been afraid of illiquidity for my core positions anyway.

Currently, I hold (I can’t rem offhand exactly how much tbh) around 740,000 shares or so and would be happy to continue accumulating at the right price.

Alright, that’s all I have, or at least, that’s all I’m willing to write right now.

Peace out.

Thanks TTI for the generous sharing!

LikeLike

you’re welcome Wei Xiong

LikeLike

Thanks for the great and insightful post. I can confirm that during the Q&A, Dr Johnny mentioned that they have partners whom they can hire contract workers from and still perform quality work.

You mentioned that Dutech is currently not the Buffett type moaty company. Does this mean that when it has been repriced close to your estimate of its intrinsic value, you would consider realising this investment, given that it’s generally not easy for a company without strong moat to achieve good returns on capital and growth in operating earnings sustainably in the long term? Thanks!

LikeLike

Hi NomadInvestor

I don’t see a strong moat for Dutech currently, but then again, I’m not privy to what their R&D is about, and the specific IP they have.

Previously, their UEN and UL certifications are moats as they are not easy to attain, I wrote about the process to attain them somewhere in earlier posts. The international clients also demand these certifications, so that’s a certain moat there.

They still have that “moat” in that sense, but seeing that the HS business is in long term decline, the importance of this moat has declined and will continue to decline.

That’s my thought specifically when I mentioned the moat.

Since their business in future will be dominated by the Business Solutions segment, here, I do not see a durable moat. Metric and Almex has a long term working relationship with clients, they have strong reputation from their legacy, and Dutech is now bringing in its financial discipline, and manufacturing efficacy and practices from its Chinese plants.

But do these qualify as durable moats? I think they are certainly good, but I’d consider them as operational strengths, not moats.

In my post, I mentioned some fellow competitors in the BS space. All of them supply similar solutions to Dutech, and as much as I want to, I don’t think metric and Almex has anything that’s drastically different from them, and that they cannot imitate. For eg, I mentioned BIBO tech. All competitors are trying to do that right now, there’s no mention if Dutech is too, but I noted that in the numerous tradeshows, the competitors are showing initial prototypes (not able to implement yet), but Dutech participates in only selected tradeshows, and they were displaying their products instead of some revolutionary idea. These products have been improved upon (for eg, the ticketing machine has a lowered display to meet Europe’s disability laws, the machine allows cashless and contactless payments etc)

Again, my opinion may change if new info regarding their IP is released at a later date.

If I consider their moat has become less important, then sure, yes, it won’t be a buy and hold forever investment for the reasons that you mentioned.

It’s a loooooong way from what I consider fair value though.

But I think the markets will quickly re rate it with a few quarters’ numbers showing that the integration is succeeding.

Cheers

TTI

LikeLiked by 1 person

Hi TTI,

Thanks again for all these information and insights! Very useful and appreciate it!

I think going forward there may be two paths to continue growing operating earnings.

1. Continue to turnaround and integrate the recently acquired companies, which can last for a few years. For these companies, although there is not really a strong moat currently, I think the existing customers are still sticky due to the long working relationship with them and maybe some switching costs, thus this will provide some cash flows for Dutech. If they can find a way to craft out a moat, it’s good.

2. If not, hopefully they would be able to use those cash well and potentially make good acquisitions again few years down the road, as a way to grow their earnings again, although this would not be an easy path too.

I asked Dr Johnny, as someone who intends to be a long term shareholder in this company, what is the greatest risk/concern that I should monitor. But he just keep saying that rest assured they will do their best to take care of us, that he and Liu Bin continue to confidently hold their shares and never sold any, and that they believe they can execute and continue to grow well.

Anyway thanks again. Let’s see what happens in the next few quarters.

Cheers,

Nomad Investor

LikeLiked by 1 person

I don’t think they’d do another acquisition anytime soon.

If you look at the 4 acquisitions: DTMT, Krauth, Metric and Almex, they all fulfill certain roles.

I’d consider DTMT and Krauth “back end” operations: businesses that are acquired to have a presence higher up the manufacturing chain i.e. the designing and the software knowhow etc. I can’t remember right now off hand, but they have a German plant parked under either DTMT or Krauth.

Metric and Almex are acquired for their branding and access to customers.

And now, with Dutech’s chinese operations, they hopefully can bring their lower cost (lower, not low! China is not exactly low cost anymore…) into the operations.

I think the plan is obvious and simple. The execution may be tough.

But the management has had 1 year to integrate the businesses. I’m hoping that within the next 4 quarters of numbers coming out, I can start seeing some results since management guided for a turnaround in 2018 or 2019. (Q4 of 2017 numbers were still showing the drag from metric and Almex)

As for what you mentioned about Johnny and his bro holding their shares…. I think that’s a given. As in the fact that they’re holding, merely tells me that they are in the same boat as the other shareholders. I’d consider that an important point if I’m assessing the company for the 1st time, and I’m concerned about stuff like how much of the minority shareholder’s interest is in the minds of management, of fraud, of the legitimacy of the management.

I’m way past that. I’ve no doubt that Johnny and his team are committed.

I think what’s more important to assess is the competency of the management, and the business. The holdings of the management itself, doesn’t tell us anything about how competent they are.

Cheers

TTI

LikeLiked by 1 person

Why not invest in NCR? 10% FCF yield and much larger company.

LikeLike

Hi

I’ve looked at NCR and Diebold previously as a comparison to Dutech, but now, they are both no longer good comparisons.

Aside from the ATM business, their software division is very different from Dutech’s.

Both Diebold and NCR’s software focuses on the retail sector (amongst other things). They have minimal or zero exposure to transportation ticketing, and to logistics. NCR even less so than Diebold.

Johnny said that currently, Dutech is collaborating with Diebold on several projects, so at least there’s that little bit of symmetry there, but for NCR, it’s quite different. As far as I understand, NCR was never a client of Dutech’s either, as NCR dominates in the North America whereas Diebold has larger market share in Europe, similar to Dutech.

Finally, as for why not NCR as an investment, regardless of Dutech…

I haven’t done DD on NCR to that extent to comment.

It may well turn out to be a stellar investment if its really a 10% FCF yield, but it’d be a complete separate matter from Dutech.

Cheers

TTI

LikeLike

Retired rabbit hopping to buy dutech now…… hope you are not miss coconut clone

LikeLike

…

Don’t buy Dutech pls.

Later Q1 results out in a couple of weeks, if its terrible enough, many ppl may run away.

LikeLike

I went back to investingnote and got chse out again because they foubd the word coconut offensive , what the Coconutitis…..

Passingby bunny. Which branch u at now , i go find u drink cough syrup k

LikeLike

lol.

You’d be back.

More persistent than Terminator.

LikeLiked by 1 person

Investingcoconutnote offically declared their loyalty to queen coconut… GG, at least bunny retired as a martyr, when will u invite me to drink cough syrup at yr office?

LikeLiked by 1 person

Wow heard the queen got a 1mth ban too. Bunny death had served its purpose. Find a day drink cough syrup tgt ok?

LikeLiked by 1 person

lol so it seems. Red carded

LikeLiked by 1 person

Bunny… why you commit suicide in IN?

1 month ban or perm?

Cannot win that lynlyn one lah.. She got immunity from IN

LikeLike

Yes bunny tio Coconutitis by coconut liao…. 对号入座。tsk tsk

LikeLiked by 1 person

Guess its goodbye to you, whoever you are , IN is no longer a place for bunny

LikeLiked by 1 person

Hi TT, am out of town & hv just run thru yr AGM sharing. It fills a vacuum of info for investors. Wish Dutech has more regular communication with market. Anyway, can i republish it this weekend?

On Mon, 7 May 2018, 02:14 SG ThumbTack investor, wrote:

> ThumbTackInvestor posted: ” 1stly, something unrelated to Dutech Holdings. > I drove down to BBR Holding’s project, The Wisteria to take a look today. > Kinda disappointing that the project is taking so long to TOP. I was > informed by sources a few months ago that it’s slated to TOP in ” >

LikeLike

Hi CT

Ah, figured you’re out of town as you’d usually email instead of commenting here.

But sure, feel free to republish.

As always, feel free to edit and/or put a heading to it as you deem fit.

Cheers

TTI

LikeLiked by 1 person

If malaysia can change government through unity, kallangriver can topples coconut empire one day! Right duckie?

LikeLiked by 1 person

Pointing to a deer and calling it a horse.

LikeLike

I beg to differ.

LikeLike