Oh Boy. I really could get used to this.

1 post every mth, “Best ____ Ever” everytime.

I’d let the stats do the talking:

With yesterday’s massive rise, a huge 15.61% portfolio gain in a single day, the ROI has shot up to 37.76% YTD.

NAV sits at USD 606,056.73, crossing the USD 600k mark for the 1st time (For US portfolio), with no capital injections too.

Taking into account a withdrawal of USD16.90, the total net capital gains YTD is… USD 165,001.13!

EDIT: Did math wrongly. With a withdrawal of USD 16.90, the total net capital gains should be USD 165,018.20!

Obviously, the ride hasn’t been 1 way up though.

The 1 day spike yesterday masked a period of a few tough weeks when the ROI kept dropping (see in chart)

The reason for that is my US portfolio’s huge exposure to Wirecard.

With the latest report by the esteemed Rajah&Tan, the markets’ fears were proven wrong, and my wirecard positions jumped a cool 26% in a single night.

The numbers being thrown around prior to this were confirmed in the report, and they are puny. A mis statement of 2mil euros ++ for a company with over 2bil euro in revenue….

That’s 3 decimal places. I don’t even know how they are going to restate that in the financials.

But those numbers haven’t changed. What really happened is that the markets are now reassured that this is just a small insignificant event, and not the worst case scenario of widespread fraud that some doomsayers were forecasting.

Since the position is worth 6 digit euros, it added strongly to the outperformance.

37.76%! I mean, I honestly would’ve taken half of that number and closed out the year if you made me that offer at the start of 2019.

37.76% beats almost every professional US fund manager I track. Even Bill Ackman is a tad behind at 31.9%

I’ve sold several calls yesterday to take advantage of the spike in volatility, but the nett position remains a long one. Very much so in fact.

My take is that the share price will continue to rise (it’s slightly red today as some jittery shareholders take profit after yesterday’s rise).

Yet, it’s not smooth sailing. There’s still 1 hump ahead, and I think that relates to Wirecard’s acquisition activities there. I don’t think that has as much coverage as the supposed few million euro restatement, which is curious, cos if anything, that’s potentially a bigger worry to me than this few million euros worth.

In any case, I’ve been keeping busy by looking for the next idea to put some serious capital to work.

As I’ve said before, it usually takes several weeks, or even months, of due diligence, before I start allocating capital, for large, core positions.

That means that in any given year, I’d probably have only… perhaps, 3-4 core, big ideas and I only need to get these right and it’d be a massively good year.

My next idea though, really comes from a reader of SG TTI. No credits yet, as I haven’t asked the said reader, and also, cos I’m still accumulating. It’s going to be a looooong position though, and it’d take time.

It’s definitely not your typical “value” play here, or rather, I think it is, but the numbers would certainly scare away most “value investors”.

Here’s a teaser.

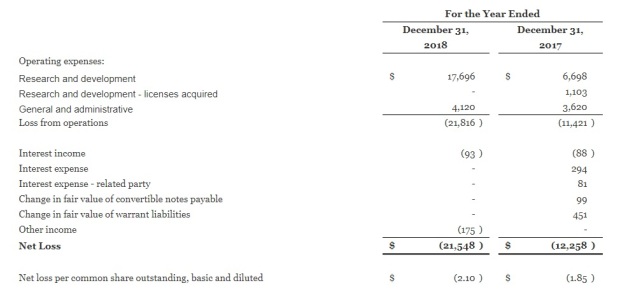

Would you buy a company that reports these numbers?!

Losing money year after year, and more and more too!

Balance sheet is even more horrendous!

Negative equity! My god.

Don’t even get me started on the cashflows. It’s negative operating CFs and negative FCF and negative any parameter you can think of!

Scared enough?

Everybody’s running far away from this! Even Hyflux in it’s current form, looks better! LOL.

But TTI’s accumulating gradually, and I’d continue to do so over the next couple of months until it reaches a sizable position, as long as the investing thesis doesn’t change.

Yes, it is atypical for sure.

But just like Wirecard and GDS holdings (11% Returns In A Single Day. Thank You Blue Orca Capital!) and Shinsho Corporation (Divestment Of Shinsho Corporation & Kobe Steel – TTI’s Post-Mortem), the greatest rewards lie in the most atypical situations.

#Ballsofsteel.

I did invested in the last company you mentioned purely on the mathematical reasoning, as I expect their change of success to be at least 30 percent, with the payout over 13 USD, so the payout still makes sense to me. Would like to make bigger position but cant really force myself as there are so many variables. Looking forward to your reasoning.

LikeLike

sry, which company are you talking about?

Or is this spam?

lol sry, but I receive tons of spam comments everyday, which get deleted, hence the skeptism.

You’d have to b more specific about which company you’re referring to.

TTI

LikeLike

Hi Ondrej Mixa

OH! I get what you’re referring to now.

Sry for the earlier comment.

Yes, yes, I think you got it.

Actually, I think the chances of success would be higher than 30%.

The same product is already approved and widely available in several other countries, including the UK and even here in Singapore itself.

I think it’s still early days though, if we’re talking about USD 13, it’d have to be sometime in late 2020, so I currently have a small position, and will look to slowly accumulate on weakness.

Thanks for your comment.

And yes, I’d write about it when I’m ready to do so.

TTI

LikeLike

Thank you for your comment. Sorry for the confusion, didnt want to give name of the company, since you dont wish so. It is interesting asymetric investment.

I am not sure whether the IV version is approved in UK and Europe, or just the normal version., but I am same as you, just having small investment and looking more into it.

OM

LikeLike

Hi OM

Yes, thanks for not naming the company.

And sorry for the 1st comment I made, I tot it’s a spam comment.

(I get tons of that everyday and they get mostly deleted).

I can confirm that the IV version IS available in Europe, and in Singapore too (where I am).

Where do you reside?

I have since done quite a fair bit of DD, as I always do for anything that I buy.

Although there are similar approvals in many countries, US FDA is quite a unique animal. They may not necessarily approve.

It all depends on the 2nd Phase III trials.

If you really look at the language in the company announcements though, the 1st Phase III trial targets moderate – moderately severe pain patients, whereas the 2nd Phase III targets moderate – severe pain patients.

This means that they’ve ramped up their study group for the 2nd Phase III, targeting a higher pain intensity.

If they are successful, it’s great cos the indications is greater.

If they are NOT successful, for whatever reason, they still have leeway to step down the indication pool and reapply for FDA approval.

So there’s some leeway.

I learnt this from a contact working in a big pharma company, who’s literally doing submissions herself.

There’s too much for me to write in a comment, but I’m optimistic.

Still not a huge position, because like u said, it’s asymmetric.

If we are right, the payout would be huge, I’m thinking that I wouldn’t mind giving up some gains, and waiting till 2nd Phase III is successful.

Also, I like that the potential catalyst here would be independent of market sentiment.

The market can crash all it wants, if this can go all the way to commercialization, the share price goes above USD 13, regardless of what the market does.

Cheers

TTI

LikeLike

Hi TTI,

thank you for your comment and details on the FDA process. I just started to get more into the position, reading and studying and you are right the IV seems to be allowed in UK, thats a big advantage, although of course not affecting the US directly.

I liked the wording of the PR and of course the investments from Indians.

I am from Czech Republic, currently in Prague.

Ondrej

LikeLike

yup.

I’m actually surprised US doesn’t have the IV.

We have that here in SG, and in fact, the oral form is widely used.

I prescribe that myself quite often.

The initial topline data from the 2nd Phase III should be out in mid 2019, so in a couple of months, we’d know if it’s progressing well.

I’ve taken the time to look deeply into the study details, and I’m optimistic.

I did a pubmed search and found other another similar study, so unless the population is so drastically different… I don’t see why they’d fail.

Having said that, because this is 1 of those “high risk high returns” kinda situation, I also don’t think we should go all in.

Google and read “IV meloxicam” and you’d see my reservations. They were successful in both Phase IIIs, but still failed to get the NDA approved.

Many potential road humps ahead, and this is reflected by the huge potential rewards if we are successful.

Good luck to us!

TTI

LikeLike

Good luck to you as well.

Just a note, I cant really add comments. This is like try number 8, it always gives some type of error. Tried it on different computer, same problem, just thought you might want to know.

Ondrej

LikeLike

hmmm really?

So you gotta try it repeatedly before you can add?

Hmmm I’m not really sure why. It’s probably WordPress. Not sure what I can do about it.

But thanks for letting me know.

TTI

LikeLike

Hi TTI,

Do u know how do we as a shareholder get the CVR after the second stage closing?

Are u intending to hold onto it post second stage closing?

Hope u can share ur thots. Cheers.

LikeLike

Hi

TBH, no, I am not too sure myself. This CVR is really unique, cos I haven’t had such an experience before thus far.

I’d think you get the CVRs through the same way one gets dividends. At the point of distribution, they look at the shareholder list and distribute accordingly. If you use a foreign brokerage, it’d probably go through your brokerage and distributed to you.

I haven’t really looked into the CVRs cos it’d be a loooong while, if it ever does, before we reach that stage.

Let’s not miss the forest for the trees.

Getting FDA approval is the key first.

I’m actually in the midst of writing up about it.

Currently, I intend to accumulate, and depending on the share price, probably take some profit (if any! let’s not count chickens before they hatch) after the 2nd Phase III trial, while leaving some to go all the way to FDA submissions.

Reason being that I have very high confidence that the 2nd Phase III will meet end goals, so pretty sure that we can get to FDA submission at the bare minimum.

Whether we get approval or not is another matter altogether.

Cheers

TTI

LikeLike

Hi, I saw you holding 200k alliance mineral shares in your portfolio page. Are you going to keep it or intend to sell it, as it drop alot this year.

LikeLike

Errr WG Web Solutions,

not sure if you’re genuinely asking or is this 1 of those adverts masked as a comment.

But giving u the benefit of the doubt, yes, I intend to keep it.

Not selling anytime soon.

Cheers

TTI

LikeLike