In an earlier post, I posted a teaser for a new investing thesis:

Best. Mar……….. You Know The Drill!

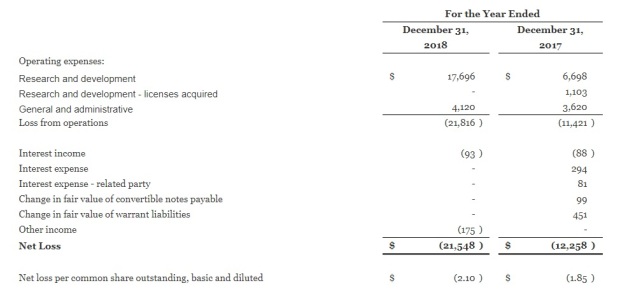

Yup, the numbers look absolutely horrendous:

The company has no revenue, and losses are chalking up y-o-y.

Balance sheet looks terrible too. Negative equity! Ouch.

So why is TTI even bothering to look into this, much less take up a position?

Here’s the story. And it’s going to be a long one.

AVENUE THERAPEUTICS

Background

Now, this investing thesis is likely going to be packed with medical jargon, and as far as possible, I’d try to dumb it down a few notches for the layman. Where that’s not possible, I’d at least try to explain the lingo a bit.

First up, some background on the company.

“We are a specialty pharmaceutical company focused on the development and commercialization of an intravenous, or IV, formulation of tramadol HCl, or IV Tramadol, for the management of moderate to moderately severe postoperative pain.”

The company listed recently in 2017, and its sole purpose is to develop and get FDA approval for intravenous tramadol (IV Tramadol).

Tramadol is a type of analgesic (a collective term for painkillers). Intravenous means it’s given to the patient via a jab directly into the blood stream. (vs taking it orally, or by inhalation, or intra-muscularly aka injected into the muscles etc)

What is interesting here, is that Avenue Therapeutics has an acquisition agreement with InvaGen, which is a subsidiary of Cipla, the India based pharmaceutical giant. The acquisition agreement has already been approved by the majority of Avenue Therapeutics’ shareholders.

Basically, if Avenue Therapeutics is able to get FDA approval for IV Tramadol in the US, Cipla promises to buy out Avenue Therapeutics.

Here are the terms of the agreement:

Cipla (via its subsidiary InvaGen), has already completed the 1st stage closing of the acquisition agreement, paying for 1/3 of Avenue Therapeutics at 6 USD per share.

For the 2nd stage:

“At the second stage closing, InvaGen or its affiliates will acquire the remaining shares of Avenue’s common stock, pursuant to a reverse triangular merger with Avenue remaining as the surviving entity, for up to $180 million in the aggregate, which is currently expected to represent approximately $13.92 per share, subject to certain terms to be outlined in the Form 8-K and proxy statement to be filed by Avenue with the SEC in connection with the proposed transactions. The second stage closing is subject to the satisfaction of certain closing conditions, including conditions pertaining to U.S. FDA approval, labeling, scheduling and the absence of any REMS or similar restrictions in effect with respect to IV Tramadol.”

In other words, if Avenue can meet certain conditions, the key of which is to successfully develop and attain US FDA approval for IV Tramadol, Cipla has agreed to buy over the remainder of the company for $13.92 per share, and on top of that, reward shareholders further with contingent value rights (CVRs) that’s determined by the sales targets and annual profits of commercialization of IV Tramadol.

Let’s put aside the CVRs first, cos that’s variable and hard to determine at this stage. But the $13.92 buyout offer, is massive, considering that as I type this, the share price is $4.57!

That represents a 204% ROI if the deal goes through successfully!

There are other conditions aside from just merely getting FDA approval, but I’d say getting approval is like the big elephant in the room.

“REMS” refers to Risk Evaluation and Mitigation Strategy, and is basically something additional that FDA requires of drug manufacturers, in cases where the drug is assessed to have “high risk” of adverse side effects. It’s basically to assess whether the benefits outweigh the potential risks.

IV Tramadol is very unlikely to require REMS as Tramadol is already an approved drug by itself, it’s the intravenous form that requires approval; I’d illustrate this further later.

FDA Submission Process

So here’s the lowdown: if the deal goes through, shareholders would be in for a big payday.

If the deal DOESN’T go through, well…. seeing that the company’s SOLE objective is to get FDA approval for IV Tramadol, that’d be very bad news.

The company would be basically worthless.

The big premium, 204% of potential returns, would already hint that this is a dangerous endeavor. FDA approval is notoriously hard to predict and uncertain. But if we are able to assess this with a certain level of accuracy, you can see the potential rewards here.

To understand how FDA approval is obtained, we gotta first understand the submission process and how this works.

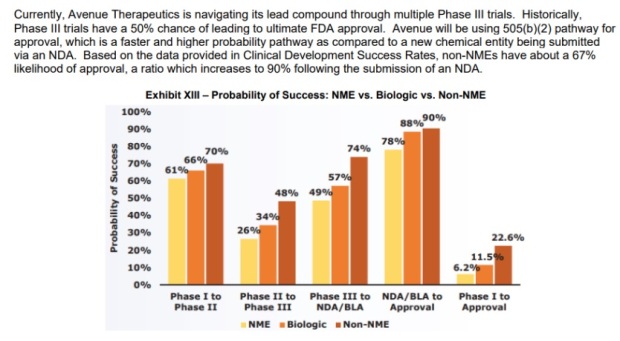

Below is a chart indicating the probability of success of various FDA submissions:

IV Tramadol falls under Non-NME. (NME = New Molecular Entity)

Tramadol is already a widely used painkiller. It’s already approved in the US and widely prescribed in its oral form (tablet), it’s the intravenous form that requires approval.

Hence, it’s “Non-NME” (It’s the mode of the drug that requires FDA approval, the drug, Tramadol itself, is already approved and widely used worldwide)

The company has to conduct a series of clinical studies or Phases, each with targeted results to achieve. (study goals to obtain)

FDA requires that the company successfully conducts 2 Phase III trials that meet its end goals, with the 2nd being a confirmatory study to the results of the 1st Phase III.

Currently, Avenue has already successfully completed the 1st Phase III study, with the 2nd Phase III study ongoing. Results of this 2nd Phase III are slated to be in by mid 2019.

Based on the chart above, this means that there’s a 74% chance of getting from Phase III to submitting a New Drug Application (NDA) to FDA.

If the 2nd Phase III results meet the end goals, the company has guided that they’d submit a NDA to FDA by the end of 2019, with an expected approval arriving not later than 12 months after the submission is accepted by FDA.

Again, based on the chart above, apparently there’s a 90% chance of success after a NDA is submitted and accepted by FDA.

Bear in mind that these are merely statistics, and IMO, do not accurately reflect the likelihood of a successful application by Avenue, which is better assessed by the merits of the case.

Also, as stated in the chart above, Avenue will be using 505 (b) (2) pathway for submission, and this is expected to expedite the whole process.

505(b)(2) pathway for submission basically uses data or study results from other studies NOT conducted by the company. This can be done if the drug is already approved (doesn’t make sense to require the company to conduct more studies if the drug’s safety profile for eg, has already been previously established and it’s already commonly prescribed)

Alright, if you think all this is very confusing, errrrr, we haven’t even started yet.

Basically this chart suggests to us that the project has been somewhat de risked as the earlier, more volatile phases, have already been cleared and the company just needs to get data from the 2nd Phase III, and submit to FDA.

Role Of IV Tramadol In Pain Therapy

There are already several intravenous painkillers that clinicians can give. Why would FDA need to approve yet another IV painkiller? This is an important question to answer, as 1 of the determining factors for FDA approval is a comparison against other existing similar drugs in the market.

There are a ton of factors to compare against: safety profile, level of analgesia obtained, side effects – both the number as well as the intensity, whether it is suitable as a monotherapy (single drug used in the treatment), time taken for the drug to reach the level of analgesia etc

So if IV Tramadol has a real role to play in the market, with a favorable risk-reward ratio, it’d be approved. That’d be 1 of the key considerations that FDA undertakes in its fact finding process to determine whether approval is given.

To proceed further, we next have to understand the options of analgesics available for pain management in post-operative care.

In certain cases, taking painkillers via the usual oral route (gulping down some pills), is not an option. For example, in cases whereby surgery was done in the gastrointestinal tract, or in the throat area. Thus, the analgesic is given directly into the bloodstream (IV).

So what are the current options that the clinician has in the management of pain via the IV route?

- IV Acetaminophen – Also commonly known as paracetamol (or locally, as panadol, which is the brand name). I think we all know what’s panadol. Paracetamol can also be given in an IV form. It is basically 1 of the weakest form of analgesic, and is used in cases of relatively minor surgeries. Although the level of analgesia obtained is relatively low, it is also a pretty safe IV drug to use, with little side effects. However, since paracetamol is metabolized (broken down) in the liver, it’s use is contraindicated in cases of severe hepatic impairment (basically, liver cannot function well)

- IV NSAIDs – NSAIDs stand for Non-Steriodal Anti-Inflammatory Drugs. They are a huge class of analgesics, very commonly given by drs as well. The IV form would give a higher level of analgesia compared to IV Paracetamol. It has more side effects compared to IV Paracetamol, but is still a very effective class of analgesic to use. (There are many types of NSAIDs, each with slight differences. NSAIDs collective refer to all these drugs)

- IV Opiods – Now, this is pretty much the strongest form of analgesics. Opioids, as the name suggests, derives its name from the word “Opium”. This class of drug provides a high level of analgesia, but is unfortunately addictive if used for long periods of time. Heroin for example, falls under this class. It also has other stronger and potentially more fatal side effects. Currently, there’s an ongoing “opioid crisis” within the US, whereby many Americans got addicted to this class of analgesics. It’s a big problem in the US, and this is a key focus of this current investing thesis. More on this later.

So where would IV Tramadol lie?

This chart illustrates it perfectly:

IV Tramadol would form a new class in IV analgesics in the US, sitting right in between IV NSAIDs and IV Opioids.

This is an important selling point by Avenue Therapeutics. If IV Tramadol gets approved, in future, if the patient requires a higher level of analgesia compared to IV NSAIDs, the clinician has the option of giving Tramadol instead of jumping to the Opioids class.

To illustrate the effectiveness of IV Tramadol, I went on PubMed and trawled for a few clinical studies:

This study directly compares the use of IV Tramadol, vs IV Ketorolac in pain management after OMF surgery:

https://link.springer.com/article/10.1007%2Fs10006-018-0700-3

(Ketorolac is an NSAID)

“Although both drugs resulted in significant decrease in pain intensity from the 2nd to 24th postoperative hour, intravenous tramadol always resulted in better pain control than intravenous ketorolac at every postoperative hour (p value < 0.05) except at 2nd hour where changes are non-significant (p value > 0.05).”

This is another study directly comparing the effectiveness of IV Tramadol against IV NSAIDs when used via continuous infusion:

https://www.sciencedirect.com/science/article/pii/S0011393X05806393?via%3Dihub

Comparative study of tramadol versus NSAIDS as intravenous continuous infusion for managing postoperative pain

In this study, the effectiveness of IV Tramadol was compared against several types of IV NSAIDs.

The results:

“The analgesic efficacy of tramadol was found to be greater than that of the three NSAIDs. Tramadol also was statistically significantly better than the other three agents……. “

“The results of this study confirm that tramadol, a central analgesic, is better for controlling postoperative pain than the NSAIDs with which it was compared.”

Yet another study comparing the use of Tramadol in Acute Pain:

https://link.springer.com/article/10.2165%2F00003495-199700532-00007

“Comparative studies have generally shown that tramadol is more effective than NSAIDs for controlling post operative pain. Use of a combination of tramadol and NSAIDs allows the tramadol dose to be reduced and results in a lower incidence of adverse effects.”

In short, there’s a wealth of clinical studies detailing the effectiveness of IV Tramadol. It’s safe to say that at least strictly from the clinical point of view, IV Tramadol has a role to play in providing a high level of analgesic effect, whilst significantly moderating the side effects of comparative analgesics, particularly the addiction of opioids.

There are all these studies available as IV Tramadol is not a novel drug. It’s just novel in the US, but is already available in many parts of the world. More on this later.

Opioid Crisis

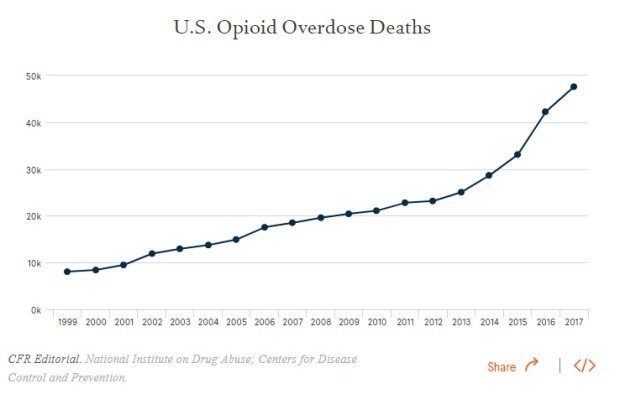

Currently, there is a massive movement in the US against the widespread practice of prescribing opioids, due to the addiction problems.

And it is a HUGE problem right now, with the government going full on crazy in a bid to control what is looking like an epidemic already.

The National Institute On Drug Abuse describes this the best:

https://www.drugabuse.gov/drugs-abuse/opioids/opioid-overdose-crisis

“Every day, more than 130 people in the United States die after overdosing on opioids. The misuse of and addiction to opioids—including prescription pain relievers, heroin, and synthetic opioids such as fentanyl—is a serious national crisis that affects public health as well as social and economic welfare. The Centers for Disease Control and Prevention estimates that the total “economic burden” of prescription opioid misuse alone in the United States is $78.5 billion a year, including the costs of healthcare, lost productivity, addiction treatment, and criminal justice involvement.”

$78.5 billion a year. That’s how big a size this problem is. And btw, that was in 2013, god knows what’s the number right now.

The most recent paper studying this issue was published in 2016, taking data from 2013. Here, it’s available for free on PubMed, and is a pretty good read:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5975355/

How did this crisis of epidemic proportions arise?

In the late 1990s, pharmaceutical companies reassured the medical community that patients would not become addicted to prescription opioid pain relievers, and healthcare providers began to prescribe them at greater rates.

This subsequently led to widespread diversion and misuse of these medications before it became clear that these medications could indeed be highly addictive. Opioid overdose rates began to increase.

In 2017, more than 47,000 Americans died as a result of an opioid overdose, including prescription opioids, heroin, and illicitly manufactured fentanyl, a powerful synthetic opioid.

That same year, an estimated 1.7 million people in the United States suffered from substance use disorders related to prescription opioid pain relievers, and 652,000 suffered from a heroin use disorder (not mutually exclusive).

In short, American drs have been prescribing opioids hand over fist, and America is addicted.

And no, drs are not all saints. Many of these prescriptions are not 100% driven by what’s in the best interests of the patient, but by financial considerations.

https://www.bbc.com/news/business-48143094

Not sure how many of you dear readers would’ve gotten to this point, and how many more would actually bother to click on the link to read it, but I’d just cut out this statement that’s relevant to this investing thesis:

“The court heard that Kapoor – who was arrested in 2017 on the same day President Donald Trump declared the opioid crisis a “national emergency” – ran a scheme that paid bribes to doctors to speak at fake marketing events to promote Subsys.”

“His conviction marks a victory for US government efforts to target companies seen to have accelerated the opioid crisis.”

“The US Centres for Disease Control and Prevention has said that opioids – a class of drug which includes everything from heroin to legal painkillers – were involved in almost 48,000 deaths in 2017.”

In the words of Trump himself, it is a public health emergency.

https://www.bbc.com/news/world-us-canada-41756705

And if that’s not enough for you, this chart shows how big a problem opioid addiction related deaths are in the US:

Credits to National Institute on Drug Abuse (from which, I got a lot of my data during my DD)

In short, what I’m trying to impress on readers who are not medically trained, is the magnitude of this problem in the US. It’s a big problem, and the US government is motivated to contain it.

So the question is…

How “motivated” would the FDA be, in approving IV Tramadol, when it’s going to be presented as an alternative to IV Opioids, the same stuff that’s causing a nationwide health emergency?

You can see where I’m going with this.

Final evidence of how much attention both the government and the American public are paying to the opioid crisis?

John Oliver spoke about it recently.

Nuff said.

If there’s just 1 link that you wanna click on in this post, click on the John Oliver one and watch it. He’s a genius. TTI is a massive fan. I watch, and rewatch all his videos when I’ve nothing to do. (And sometimes, even when I have something to do)

And if you’re wondering why it says “Opioids II”, it’s cos…. there was an Opioids I that he did in 2016!!!

I told you he’s a genius!!! He saw it long ago!

Tramadol’s Mechanism Of Action

Now, is IV Tramadol REALLY going to be accepted as an alternative to IV Opioids?

Cos as we’ve established above, if it is an appropriate alternative, or at least, an earlier line of treatment before Drs reach for the Opioids, then given the groundswell against Opioid addictions, it’s really hard to see how FDA can decline approving it, especially since I’ve already shown earlier that there’s a wealth of clinical studies backing up its efficacy.

How exactly do Opioids work? They work by binding to receptors in the cell membranes of neurons in the nervous system, and thus trigger a cascade of chemicals that ultimately block the transmission of signals along the nerve, so you don’t perceive the pain.

Tramadol, has 2 mechanism of actions (MOA). The 1st MOA is actually similar to how opioids work. In fact, Tramadol is an opioid agonist (has similar chemical structures that resembles opioids), and binds to the same receptors that Opioids bind to. So they work in the same way.

The 2nd MOA is by blocking certain channels and preventing the reuptake of chemicals by the nerve cells at the spinal level, thus blocking the transmission of pain signals.

Because Tramadol is an opioid agonist, it can also be addictive. But because it has a 2nd MOA that doesn’t involve the opioid receptors, the risks of a tramadol addiction are much lower than that of opioids.

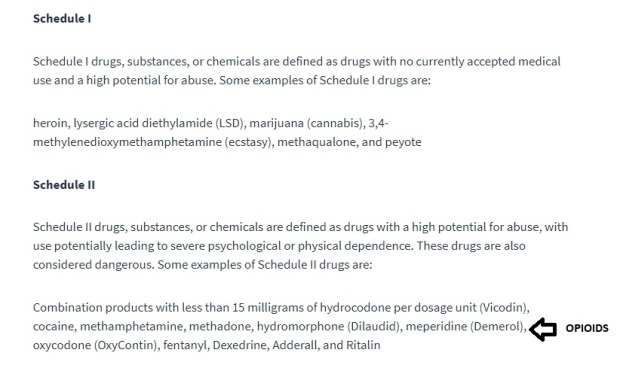

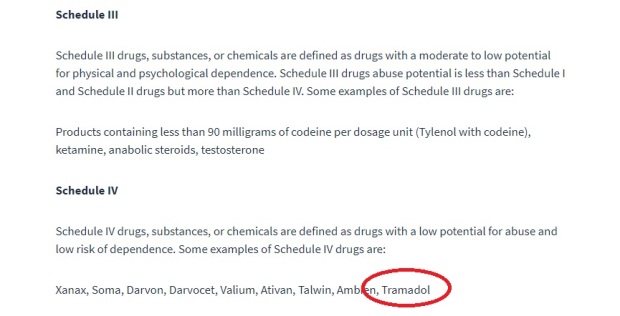

The US Drug Enforcement Agency (DEA) classifies addictive drugs under different “schedules” according to their risk of addiction, with schedule I being the most addictive with no medical use, and schedule V being the least addictive:

https://www.dea.gov/drug-scheduling

Opioids are classified as “Schedule II”

“Drugs with a high potential for abuse, with use potentially leading to severe psychological or physical dependence……”

Whereas….

Tramadol is schedule IV

“….. drugs with a low potential for abuse and low risk of dependence”

In fact, Tramadol is so low risk, addiction-wise, that it’s used as a replacement therapy in the treatment of opioid addicts! (I didn’t know that myself until I did a PubMed search)

Maintainence Treatment of Opioid Dependence with Tramadol

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5602271/

So there. Even the DEA looks at Tramadol a lot more favorably than Opioids.

Avenue Therapeutics has a slide talking about this, I’d include it here:

In TTI’s opinion, I think presenting IV Tramadol from the perspective of a less addictive form of analgesics compared to Opioids, is a pretty compelling case for FDA approval.

Of course, it’d be naive to think that FDA would ONLY look at this from the level of addiction perspective. There are tons of other stuff they use to assess, and it’s very hard for anyone to look into these factors, without being intimately involved in the submissions process. (For example, stuff like the study design, the interpretation of clinical trials data, level of analgesia achieved etc)

And that ties in nicely with the next part. The good news is, IV Tramadol has already been assessed multiple times by the various drug regulatory bodies worldwide, in countries where IV Tramadol is available.

IV Tramadol’s Global Footprint

Tramadol is already widely prescribed all over the world, so you already know there’s this role it plays in the world of analgesics.

Because it’s already widely approved and available, we know that certain parameters like the safety profile and the level of efficacy shouldn’t be a bone of contention for FDA.

There’s a wide body of studies supporting IV Tramadol’s use and safety, as I’ve shown earlier. Here, I’d just include another published study. This directly studies the use of IV Tramadol as an emergency medicine, which is a bit unique as it’d then likely be administered by frontline healthcare personnel and NOT necessarily by doctors.

This further increases the scope of indications for IV Tramadol. Up to now, I’ve only illustrated the role of IV Tramadol as an analgesic in the post-operative setting, but this study highlights a different indication altogether.

https://www.ncbi.nlm.nih.gov/pubmed/10187002

Evaluation of intravenous tramadol for use in the prehospital situation by ambulance paramedics.

Conclusion:

“Pain was significantly decreased by the administration of tramadol. It was safe with only minimal side effects, the major one being nausea. Suggestions are made for areas of further study.”

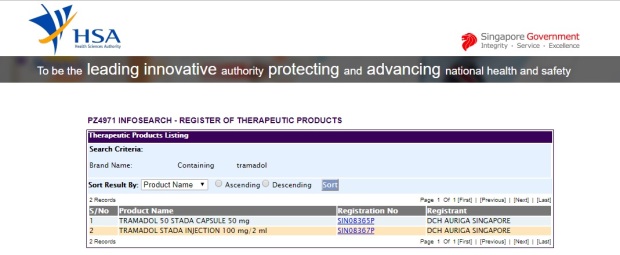

In fact, IV Tramadol is also approved in Singapore.

I wasn’t sure if it was available in Singapore initially, and most of my colleagues don’t know either, so I did a search with HSA:

Yup. So it’s available in the injectable form.

IV Tramadol is also already approved and being utilized in most of Europe, as well as in the UK:

https://www.medicines.org.uk/emc/product/4454/smpc

This table illustrates the results of a survey of drs in South East Asia, and their opinions on how significant a role Tramadol plays in pain management in the following conditions:

“Almost all the specialists treat moderate cancer pain with tramadol, a modality that is supported in the literature. Most of them rated it as significant or highly significant in managing this condition. Important factors influencing their choice of analgesic was tramadol’s efficacy in both nociceptive and neuropathic pain, which often occur concurrently in cancer pain, its position as a step two analgesic on the WHO “pain ladder”, and patients’ preference for it over low-dose strong opioids.”

So yeah, we know now that IV Tramadol is already a mainstream analgesia option in many countries, yet the US currently doesn’t have it.

But a word of caution: Longs shouldn’t get their hopes too high yet.

It might be a tad too simplistic to think that “it’s approved in other countries, so it’d likely be approved in the US too”.

US FDA is notoriously famous for being…. “independent” in their drug approvals. There have been many other instances of new drugs that have been approved pretty much, all over the world, yet FDA rejects it.

They kinda do their own stuff. All other drug regulatory bodies kinda take their direction from FDA. Drug companies/distributors who wanna bring in drugs into Singapore for example, would also need to do the usual submissions with HSA, similar to what they’d do for FDA.

HSA would make their own decisions, supposedly independently of FDA, but if FDA has already approved of the drug, it’s kinda of a home run when it comes to HSA approval.

I got this info from someone who literally does this. (His/Her job)

So in short, the fact that IV Tramadol is approved in many other countries, doesn’t necessarily mean it’s a shoo-in for approval by the FDA, but……. it’s a strong plus point and will surely sway the panel of doctors tasked to assess this. At the very least, it speaks favorably of the clinical factors that FDA would assess.

FDA New Regulations On Developing Analgesics

Alright, thus far, I’ve already shown that IV Tramadol’s clinical use is widely accepted and proven. Don’t think FDA will have any bone to pick there.

I’ve also attached studies showing the safety profile of IV Tramadol. Coupled with its use as an alternative modality of pain management prior to the use of Opioids, I kinda think I’ve covered most bases when it comes to FDA’s assessment.

To top it off, I tried to look into the exact guidelines and the exact protocol that FDA would follow to assess a drug, and see if I could put myself in the shoes of FDA to assess. It took some time to find this, cos if you go to FDA’s website, it’s a huge, massive, non-user friendly mess:

FDA Draft Guidance Analgesic Indications: Developing Drug and Biological Products

Here’s the catch though. If you read the guidelines, a lot of it focused on the study design for the different Phases. This is something difficult to assess as Avenue Therapeutics wouldn’t release specific details of how their study is designed thus far.

Well, they did talk about the broad picture of the Phase III trials, but not to the extent that I’d be able to compare against the FDA guidelines and decide if the study is properly designed. In any case, I think it’s also a waste of effort to do so, as I’m sure CEO Lucy Lu would’ve gotten that right.

On top of that, there’s currently ongoing changes to these regulations.

In August 2018, FDA indicated that they will be withdrawing their current existing guidelines on approval of analgesics, which has been in place since 2014, and will update with new guidelines.

This is in response to the opioid crisis in the country.

Since then, 4 new guidelines have been announced:

The new guidance documents will explore the following:

- Non opioid alternatives. This guidance “will set forth the FDA’s current thinking on how sponsors can demonstrate a clinically meaningful reduction in the use of opioid pain medications when used for acute pain,” Dr. Gottlieb said.

- Charging drug makers with assessing the benefits and risks when new opioid pain drugs are put into development. “This will include an updated framework for evaluating the risks associated with intentional or illicit misuse or abuse of drugs.”

- Developing extended-release local anesthetics, which can serve as an alternative to the systemic use of oral opioid drugs. “This guidance will address the clinical pharmacology, the proper evaluation of safety and efficacy, and the types of studies that may support approval of these products.”

- Assisting sponsors with the development of new non opioid pain medications for chronic pain that can provide therapeutic alternatives to the use of opioids.

Since these are the first 4 new guidelines, (there’d be more coming out soon), it’s safe to say that FDA would be paying particular attention to these guidelines when assessing new submissions.

Let me assess IV Tramadol based on these guidelines.

- Non opioid alternatives. Well, Tramadol is certainly not a pure opioid, but then again, it is also an opioid agonist, so there is still a risk of addiction. However, as shown above, in both the study and as evidenced by DEA guidelines, Tramadol is shown as an effective alternative to taper down opioid addiction, and has a low risk of addiction. I’d think FDA will think of IV Tramadol as an alternative to IV Opioids.

- Since Tramadol is already widely used, this guideline itself is not very relevant. The benefits vs the potential risk profile is already well documented.

- This guideline pertains to ER local anaesthetics instead of analgesics.

- FDA sure can help assist sponsors (“sponsor” is the term describing drug manufacturers who submit drugs for approval) by approving IV Tramadol. 1 of the indications for IV Tramadol is in the use of long term chronic pain management, particularly in cancer patients. This itself, would provide an alternative to the use of IV opioids.

Hence, we can see that the new guidelines, and the attention currently heaped on the opioid crisis, is probably highly favorable to Avenue Therapeutics planned submission.

References taken from:

Comparing Against Other Similar Cases

Now, thus far, I’ve illustrated the clinical uses and safety profile of IV Tramadol with several papers.

I’ve also illustrated how it’s already widely used worldwide.

On top of that, I’ve given substantiation as to why I think IV Tramadol has a role as an adjunct therapy in combatting the opioid crisis. This is Avenue Therapeutic’s selling point to FDA as well.

Finally, I’ve (tried to) reconcile the FDA’s actual guidelines for analgesic approval, in particular, their latest guidelines.

To wrap things up, I thought it’d be instructive to find other comparable cases of similar drugs that have undergone FDA submissions, and see if there are issues/problems that can be applicable here.

Nobody would know FDA’s deliberations when Avenue submits the application, so looking at past cases may throw up some similarities or at least flag up some stuff that I might have otherwise missed.

I’ve looked at quite a few, but I’d just highlight 1 significant one that’s the most similar, and more importantly… got rejected. (Finding rejected applications would be more useful than merely looking out for successful ones that wouldn’t tell you anything…)

Recro Pharma’s FDA appplication for IV Meloxicam got rejected. Now, Meloxicam is an NASID, so it’s a painkiller as well. It’s IV as well, so we can see the similarities between this case vs Avenue’s IV Tramadol:

In FDA’s complete response letter (CRL), it stated that:

“Although late-stage trials of the drug showed statistically significant outcomes on their main goals, it was unable to approve the marketing application in its current form.

Data from ad hoc analyses and selective secondary goals in the trials suggest that the pain-relieving effect of the drug did not meet expectations”

Recro Pharma updated their application, and tried again, only to get rejected a 2nd time.

This time, the 2nd CRL contained a bit more details regarding the reasons for the rejected application:

“The FDA’s comments in the CRL focused on onset and duration of IV meloxicam, noting that the delayed onset fails to meet the prescriber expectations for intravenous (IV) drugs. The CRL also cited regulatory concerns about the role of IV meloxicam as a monotherapy in acute pain, as well as how it would meet patient and prescriber needs in that setting, given the FDA’s interpretation of the clinical trials data. “

OK, for the layman, I’d interpret this is simple words.

Basically, FDA seemed to focus on the slow onset of the perceived effects of analgesia (painkilling property) of meloxicam. This means after the 1st dose of the drug is given, the patient still suffers from pain for some time, before the painkilling effect kicks in.

This delayed onset is of course, deemed to be unacceptable to FDA. My personal industry experience tells me that this is so, especially since there are so many other IV NSAIDs in the market, so it really doesn’t make any sense for FDA to approve something that takes a bit too long to work.

The 2nd concern is, I guess, somewhat related to the 1st. Due to the less than ideal properties of meloxicam, FDA is concerned about how it can be used as a monotherapy. This means that the clinician ONLY gives meloxicam for pain relief, and not in combination with any other analgesic.

Right. So just by studying past cases, even without the actual detailed guidelines outta the horse’s mouth, TTI sorta distill 2 main parameters that IV Tramadol would’ve to prove itself:

- Time taken for onset of analgesia

- Use in monotherapy

What follows next, logically, is to compare the properties of IV Meloxicam vs IV Tramadol right?

I mean, if IV Tramadol is inferior to IV Meloxicam, and Recro Pharma already got their application rejected, then there’s no way in hell I’d be plonking in capital into Avenue Therapeutics, makes sense?

So again, this set off a long series of PubMed research, seeing that prior to this, I haven’t even heard of Meloxicam before.

Turns out Meloxicam isn’t some iffy, useless analgesic. There’s a body of evidence, and several studies have confirmed it’s effectiveness:

https://www.ncbi.nlm.nih.gov/pubmed/8862936

“This study therefore demonstrates that meloxicam 15 mg i.v. followed by oral therapy is both efficacious and well tolerated in the treatment of acute lumbago, and compares favourably with the standard NSAID, diclofenac, in this indication.”

This study though, is the most important to note, IMO:

It’s a double blind, randomized controlled trial, with placebo control. In other words, it’s the gold standard of the gold standards when it comes to clinical trials.

I’d use the data in this study (in blue) to compare against that of IV Tramadol’s, and it’d suddenly get clearer.

“…..meloxicam IV, administered once-daily, showed onset of analgesic effect within 15 minutes after dosing and maintained analgesia throughout 2 sequential 24-hour dosing periods”

In this study, the onset of IV Meloxicam is within 15mins. In the failed application by Recro, the onset was given as “within 30mins”.

In Avenue’s IV Tramadol, 1st Phase III clinical trial, the onset was at the 30mins mark.

This means that thus far, the onset for IV Tramadol is slower than that of IV Meloxicam.

“…. Moreover, an opioid-sparing effect was apparent for meloxicam IV 30 mg, indicated by the significantly longer time to first use of rescue analgesia (P=0.0076 vs. placebo), the significantly lower number of patients utilizing rescue analgesia in each assessment interval (P<0.001 vs. placebo), and the significantly lower mean number of per-patient rescue doses at each assessment interval (P<0.05 vs. placebo).”

Meloxicam has an opioid sparing effect as well. This is similar to Avenue’s selling point in IV Tramadol’s role to play in combating the opioid crisis as explained above.

What does all these mean?

Having delved deeper and having done a comparative analysis, I’m suddenly a lot less optimistic about Avenue’s prospects in getting IV Tramadol approved.

Now that I’ve done the necessary DD and felt sufficiently informed on this topic to conduct an intelligent conversation, I thought the next logical step is to bring my concerns to the company’s management, to see if I could get a response of some sorts. Perhaps there was something I missed.

So I did.

Well, first up, kudos to CEO Lucy Lu for the rapid response. I sent an email at 5am on a Monday, which would’ve been 5pm on a Sunday for her, and got a reply within 2 hours. (and she cc-ed my email and her replies to a bunch of colleagues, whom I later found are colleagues from the major shareholder cum sponsor cum holding company of Avenue Therapeutics)

That’s where the good news end.

Essentially, I was asking extremely probing questions, comparing Recro’s application to Avenue’s, as well as cross referencing key studies that put in doubt, why Avenue’s application would be approved whereas Recro failed in theirs.

The similarities between the 2 drugs are striking.

1st up, onset of action.

As indicated in the study above regarding Meloxicam, the onset was given as 15mins. In Recro’s application, it was given as 30mins, and was 1 of the factors cited in FDA’s CRL in its rejection.

In Avenue’s 1st Phase III, the onset for IV Tramadol was given as 30mins as well. In Lucy Lu’s reply, she stated that the onset was earlier than 30mins, but the 1st pain score measurement was at 30mins.

Hmmm. I’m not so sure that’s a solid enough case for FDA.

As for the 2nd part regarding monotherapy, well, I did some digging around again, and it turns out that just like IV Tramadol, IV Meloxicam is readily available in Europe. This is a list of the countries, in Europe, that is is approved in:

There are like 16 pages of this:

So this right here, is kinda a perfect example of why I said earlier, that FDA is it’s own animal.

Meloxicam is approved and widely used in Europe, but that just doesn’t cut it with FDA.

IV Tramadol’s in a similar situation.

FDA also gave it’s concerns over IV Meloxicam’s use in monotherapy as 1 of the reasons for the rejection in the CRL.

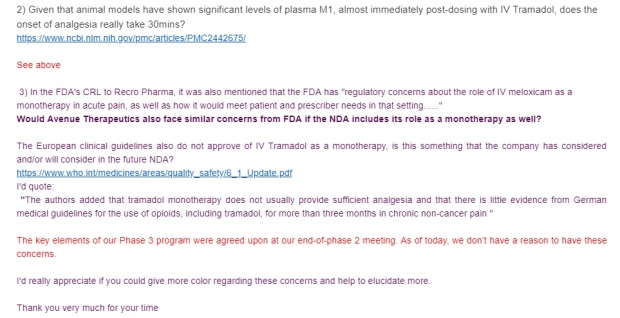

Well, it seems there’s doubt over IV Tramadol’s use in monotherapy as well. This is WHO’s update review report on Tramadol, published in 2014:

https://www.who.int/medicines/areas/quality_safety/6_1_Update.pdf

I’ll quote:

“………tramadol monotherapy does not usually provide sufficient analgesia and that there is little evidence from German medical guidelines for the use of opioids, including tramadol, for more than three months in chronic non-cancer pain” (Page 24)

“Nevertheless, recent meta-analyses show that tramadol monotherapy does not

always provide sufficient analgesia. ” (Page 15)

“The authors added that tramadol monotherapy does not usually provide sufficient analgesia and that there is little evidence from German medical guidelines for the use of opioids, including tramadol, for more than three months in chronic non-cancer pain” (Page 15)

Now, obviously if TTI knows all these, I’m sure the folks at Avenue know this as well.

CEO, as well as some members of the board, are all doctors. Why would they proceed if they know these risks? I got this question answered by a contact within the industry.

It’s sometimes not that straightforward. The board would’ve to assess their sunk costs, and whether it makes sense to at least try (regardless of the odds).

FINAL WORD

Congrats if you got to this point. Like I warned, this is not an easy post to digest, and I’ve already skipped all the technical data, only cutting pasting the relevant paragraphs.

If you’d notice, the tone of optimism at the start of the post, changed into 1 of skepticism towards the end.

In the bar chart I pasted right at the start of the post:

the odds of successfully getting approval seems really good.

This is indeed, also the same sentiment the reader who brought this idea to me, had after seeing this chart.

As I’ve illustrated, it’s really not that easy and major risks remain.

As of the time when I type this, I’m still in contact with Avenue’s CEO with some further queries, so perhaps my thoughts may evolve further.

Currently, I’m vested with a small position of just under 10,000 shares, accumulated at a price of around USD 4.9 or so.

My rationale for a current position is that Avenue’s 2nd Phase III results are likely to be released within the next couple of months.

I’m expecting the Phase III study to meet all it’s end goals, and the relevant data would then support the NDA.

Correspondingly, I’m expecting a bump in the share price upon the successful conclusion of the 2nd Phase III, and a resulting FDA submission.

As for whether Avenue can go all the way to get approval, that, I’m a lot more skeptical.

While it’s not a foregone conclusion that IV Meloxicam’s failure would mean IV Tramadol is not likely to be approved, still, the risks are real.

Lucy Lu didn’t give much away in her replies, but it does seem that FDA’s beef with Recro lies not just in the clinical characteristics of IV Meloxicam, but in the company’s interpretation of the clinical data obtained from it’s trials.

There really is no way I can assess this, seeing that Recro doesn’t release the entire CRL, and I can’t assess where the disagreement lies. So perhaps Avenue’s application would be looked at more favorably if FDA’s interpretation of the data from their trials is favorable.

I’d likely maintain a position, perhaps even add to it, and wait till NDA submission, before assessing again.

I’d leave interested readers with a video interview of Lucy Lu:

I welcome any readers with any questions, and/or some thoughts to share them with me. I actually do have more data and stuff to add, but this post is getting too long and draggy and frankly, I doubt most readers can comprehend, or am interested to, the specifics.

So I’d end the investing thesis here.

Got to the very end. Thank you for the analysis. I took away the kind of questions you would ask in your DD rather than the actual investing idea. It is thought-provoking.

I watch a fair bit of LWT as well. His team of writers do come up with some of the ideas on the show. Credits to them.

LikeLike

Hi Leopard

Thank you for your comment.

Really glad that that’s what you took away.

Cos that’d be at a higher level of interpretation and understanding than merely understanding the actual investing idea. (which itself can be a bit confusing here)

You might then agree with the line of thought, or disagree with it, or agree with only some parts of it; whichever the case, it’s something good to take away.

Yeah, as mentioned, I’m a fan of LWT. Don’t always agree with the controversial points at times, but it’s still funny nevertheless.

Cheers

TTI

LikeLike

Extensive write-up. Nice work.

LikeLike

Thank you for your kind comment.

LikeLike

Hi TTI, excellent write-up I read it–some parts of it more than once–and in my opinion it is an outstanding comprehensive due diligence. Respect!

I’m not a doctor and don’t have much investing experience so maybe my questions are stupid but still… There’s the slide titled “What is the Unmet Need in Post-op Pain Care?”. This slide shows a gap between IV NSAIDS and IV Opioids. Does this accurately describe the current situation in the market?

I’m asking this because this is an IR slide and I’ve seen cases where things in the PPT are very much simplified and beautified versus the reality.

In the Reuters article that you linked to from May 2018 it is said that “The agency may request additional data from trials testing IV meloxicam versus another painkiller, as opposed to comparing it with a placebo.” It looks like in the FDA’s opinion there are some comparable non-opioid drugs out there. Do these drugs sit in the alleged gap that exist in the market? Does the FDA segment and think about the alternative treatments in the same way that the slide on Avenue’s deck suggests?

On a more positive note, it seems like Recro’s shares recovered pretty nicely after each setback and in April they came out with this study:

https://ir.recropharma.com/press-releases/detail/140/recro-pharma-announces-presentation-of-new-meta-analysis

It shows pretty good results but I am really not knowledgeable in this domain and I feel like I could be sold on any argument of either of the sides. Seems like this study addresses the request for more evidence by the FDA.

Also, from Recro’s May Q1 report: “In the Acute Care segment, we continue to believe that IV meloxicam is an important product that can ultimately receive FDA approval and that it is an attractive non-opioid pain management candidate for acute pain. We will continue to pursue FDA approval for IV meloxicam. While we continue to pursue potential approval and partnering of IV meloxicam, the Company and Board are also exploring and evaluating other possible corporate structures, including the possibility of separating the Acute Care and CDMO business segments,”

I seems like Recro still believes in the product. If anything, maybe all we can learn from this is that the outcome here is not necessarily binary in the short term and there could be a successful outcome but on a much longer timeline? I’m not sure how common it is for the FDA to be successfully pressured into changing its stance. Again, my lack of experience. If it’s going through the process more than once is common, then maybe there will be a better opportunity to buy the shares?

It’d be awesome if you could share your views on these issues and also, if you don’t mind sharing the other data that you wanted to add. This is a very interesting situation and I’m sure that many of the readers here would benefit from the opportunity to learn more about this space.

Once again, thank you so much for sharing and enabling me to learn new things!

LikeLike

Hi Yaniv!

Long comment here, so let me break it up to reply, hope I don’t miss out on anything.

You ask very pointed questions, and that truly reflects what I feel too: that the whole issue of FDA approval is really a lot more complex than what most people think. It’s not exactly a checklist kinda process. I’m actually intimately aware of this cos I’ve close contacts that literally do this for a living: drug submissions.

To answer your 1st question on whether there’s truly an “unmet need” or is this a “PR slide”, the short answer is, I think your skepticism is warranted. As with most things, it’s not entirely wrong, neither is it entirely right.

There is a spot for IV Tramadol for the reasons I’ve written in the post: it has lower likelihood of addiction compared to opioids, and is also stronger than that of IV NSAIDs. So in this sense, it does provide an alternative if the clinician needs something stronger than NSAIDs (usually in cancer treatment).

What is doubtful though, is the real demand for it. From my DD, it’s indications and popularity is quite low. Most clinicians don’t really use IV Tramadol. There’s debate surrounding whether it can be used in monotherapy: In Europe whereby it’s approved, it’s also used in combination with other analgesics, for eg. they give a cocktail of IV paracetamol + IV Tramadol.

Since 1 of the reasons given for IV Meloxicam’s rejection by FDA is in it’s expectation as a monotherapy drug, this becomes a concern for me.

So yes, I do think there’s a role for IV Tramadol (otherwise it wouldn’t be approved in Europe and Asia), but it’s not that commonly used. The only situation whereby I know that IV Tramadol is used, is in the pain management in cancer treatment.

LikeLike

As for your 2nd question regarding Recro and IV Meloxicam….

The process of FDA approval is not always straightforward. That is, you might not get approval at the 1st try, but it’s a back and forth process. You apply, FDA requests for more info, you may have to go conduct more studies and provide that info, etc etc etc.

So it’s not unusual that it takes a few “tries” in that sense.

However, despite what Recro says, I do believe that it’s kinda the end of the road for IV Meloxicam. Or at least, the management decided not to pump in more resources and throw good money after bad.

Of course, the company will say they “still believe in the product” and will continue to try and all that. They have vested millions with not a single dollar of returns! They have to keep up the enthusiasm, and possibly hope to offload it to another buyer who thinks he can do better, conduct more tests perhaps, and try again!

It’s kinda like a washed up soccer player: the club will continue to paint a picture of returning health, and a good attitude etc, and hope to offload him to another club and at least claw back something.

But I read between the lines:

Recro cut it’s staff in the acute care segment following the 2nd rejection.

https://www.biospace.com/article/recro-pharma-to-lay-off-50-following-second-fda-rejection-for-non-opioid-pain-treatment/

Cutting staff = not planning on more work in this segment, which is exactly where meloxicam sits in.

So they can say what they want, but I believe, privately, that Recro’s management knows it’s pretty much a dead end here.

As for the share price and how they’re doing financially, that’s a bit misleading as well.

Cos IV Meloxicam isn’t the ONLY thing the company does.

They manufacture a suite of drugs for other companies as well, as a third party contract manufacturer.

It is this segment that provides them with healthy CFs to sustain the other drug submissions etc.

I haven’t spent time to look into that segment of theirs, aside from a cursory look at the cashflows.

But in this sense, it’s different from Avenue whereby they ONLY have this 1 project to work on. Fail, and the company (Avenue) is basically worthless.

Succeed… and we already know the rewards in store (Since there’s a confirmed buyout offer).

Also, specifically for Avenue, the buyout offer is contingent on many conditions being fulfilled, 1 of the being that Avenue obtains FDA approval by the end of 2020.

So there is a timeline in place, Avenue cannot afford to go back and forth and take another 5 years to gain approval.

LikeLike

TTI, thank you very much for the educated answers. Indeed seems like Recro doesn’t have a strong conviction on changing the decision of the FDA.

One more follow-up if I may, on a broader topic. What is the FDA’s infatuation with a monotherapy? If a cocktail of IV paracetamol + IV Tramadol could replace an opioid treatment in some cases, why not approve it and make a step towards reducing the dependancy of the patient population on opioids?

LikeLike

Monotherapy is usually better cos the more drugs you use in combination, the more considerations and side effects u gotta think about.

For example, allergies.

What if the patient is allergic to 1 of the drugs in the cocktail of drugs?

Each drug also has side effects.

Paracetamol has very mild side effects, but since it’s broken down in the liver, patients with hepatic problems wouldn’t be suitable, so your combination is affected.

I don’t think FDA’s rejection is purely based on whether it can be used in monotherapy…

It’s usually a more complex train of thought.

For example, it’s more likely that perhaps, the maximum analgesia achieved is not high enough, and hence, Recro can only apply for approval under the umbrella reason of using it in combination with another analgesic.

Then, that’s when FDA considers that since it’s not appropriate as a monotherapy, whether there are already better alternatives.

So if you apply and say that yes, I know it’s not efficacious enough, but I intend to sell it in combination with other analgesics, then FDA would then look into whether there are other existing combination analgesics that have less side effects, is safer, works faster blah blah blah.

N if you can’t justify that your meloxicam + something else works better, then there’s really no reason for FDA to approve.

So I believe it’s something along those lines.

I wouldn’t know the specific reasoning cos the company didn’t release it, and as I’ve cut and paste in an earlier reply, even Lucy Lu doesn’t know for sure either.

LikeLike

Btw, just a correction of a typo: I meant I don’t have much investing experience in this field.

LikeLike

3rd part of my reply here:

Well, the cutting of staff in the acute care segment, and the “restructuring” and the fact that they said they are considering “separating the acute care segment” already tells me they are mothballing IV Meloxicam, despite whatever the company says.

I spent a considerable amt of my DD focusing on trying to understand the specifics of why Meloxicam was rejected by FDA cos, well, we can all see the similarities here.

Unfortunately, it’s impossible to know FOR SURE, unless you are in the Recro’s team doing the submissions. We know broad reasons, but not the specifics.

I even challenged Avenue’s CEO Lucy Lu on the specifics, and even she admitted she can only speculate, cos she wouldn’t know the exact reasons, since Recro wouldn’t release the exact CRL from FDA.

Hmmm, wordpress doesn’t allow me to attach an image here in the comments section, so I’d just cut and paste part of her reply to me regarding this. (I didn’t include all correspondences in the post above):

“I understand your concerns. Not knowing what really went on during the FDA review, I can only speculate. Fda’s analysis of the data may or may not come to the same conclusion as the company’s; the data from the soft tissue study could be a concern because FDA considers both hard tissue and soft tissue results, etc.

The only thing I can say is that Avenue used the most conservative methods to analyze the data from the bunion study. We are very confident that FDA will have the same interpretation of the data and that the data demontrated efficacy and safety in a hard tissue model. And we dont have data from the soft tissue study yet. ”

I gather that 1 of the key reasons for rejection, is that FDA interprets the data differently from Recro. “Different interpretation” is kinda the worst reason for rejection, cos there’s little wriggle room. It’s a death bell. If the FDA rejects, but the reason is that “more data is needed” or they have doubts about certain parts of the study design etc, that’s still not too bad, cos the company can redo those parts, or do a new study with those corrections and resubmit.

Different interpretation means that we totally don’t agree with what you think the data says, so nope, nothing much you can do here.

You’re also kinda right in saying that it’s not entirely binary.

I just wrote that it’s “broadly binary” because the intermediate scenarios are far and few in between, but it is possible. So there are intermediate situations, but it’s not a broad spectrum of possibilities.

For example, you could’ve submitted and within your indications, submitted that the drug is for “severe pain management” but FDA doesn’t agree and think that the data shows that it’s not sufficiently therapeutic for severe pain.

You could then step down and agree that the indications would be for “moderate – severe” or just “moderate” pain management, and the FDA could approve that.

All this would affect the indications for the approved drug. You know the slip of paper that’s found in the drug packaging when you open it? Yup, so that affects what’s written there, and affects which drug the drs would choose to utilize in that specific situation.

So this is just 1 example of how it might not be entirely binary: you can get rejected, make alterations (as long as it’s not critical), and go back to resubmit.

LikeLike

You clearly did lots of work on this, but I have a few quibbles:

1) Your writeup obfuscates the fact that tramadol itself is an opiod. Here’s a quote from the box warning for Ultram, a oral tramadol mediacation: “ULTRAM exposes patients and other users to the risks of opioid addiction, abuse and misuse, which can lead to overdose and death.” I think it’s fairly clear that tramadol has the same risks as other opiod drugs — it’s only “safer” because it is somewhat less powerful.

2) I disagree that tramadol “has a low risk of addiction.” Prior to 2014 tramadol wasn’t a scheduled drug at all. It was moved to Schedule IV because people were becoming addicted to oral tramadol.

3) I think the whole “onset of analgesic effect ” issue is a red herring. The fact that IV Meloxicam, a NASID, has a relatively slow onset of pain relief is irrelevant to tramadol as their pharmacologies are different. IV opiods are known to start providing pain relief very quickly. I don’t see any obvious reason to think tramadol would be an exception.

LikeLike

Hi Austin,

Thanks for your comments.

here are my replies:

1) I’m not obfuscating anything. In fact, I clearly wrote that it is an”opioid agonist”.

Perhaps the technical term confuses you. An agonist literally means it contains the same chemical structure as that of an opioid, and binds to the same receptors that an opioid will bind to. Of course Ultram has to have that risk warning, it’s mandated cos it contains opioid.

2) Well, this really isn’t up for agreement or disagreement. Cos if it was, I’m not sure why I even bother to research, and attach the links, to all the papers about tramadol addiction.

There’s a body of research about it, in my post, I chose 1 article, and its conclusion. I also said it has a risk of addiction, but it’s a low risk.

The “low risk” is not 1 of personal opinion, you and I don’t get to sit at a round table and argue about what we perceive is low or high.

The study bases it on the number of people on tramadol who end up having an addiction, and based on the number, determine if value p is significant. If you “disagree that tramadol has a low risk of addiction”, I’m afraid you’d have to take that up with the authors of the study, and perhaps the DEA as well.

TTI doesn’t decide that it’s low risk.

Don’t look again now… but if I recall, I literally cut and paste the conclusions from the study.

(And no, study’s not done by TTI)

3) errrr. ok.

Let me try to kinda make it a bit less technical, and explain in a layman fashion.

A “fast” or “slow” onset depends firstly, on the mode of application.

So for example. say a 10mins onset via the oral route, could be considered by FDA as “Fast” and pretty much acceptable.

You take a pill, it takes 10mins to work, that’s reasonable right?

But for IV, 10mins might not be acceptable, cos since it’s injected directly into the blood stream, bypassing the need to go down the GI and get digested and absorbed etc, you’d expect it to work faster, right?

Plus, if it’s a condition that requires very good pain management (for eg in cancer surgeries whereby once the patient wakes up from GA, the pain would be unbearable), the expectations of FDA would be even higher.

In fact, ALL IV analgesics, are expected to work, pretty much instantaneously.

IV opioids work almost instantaneously.

Again, whether you think it’s a red herring or not, is irrelevant.

Cos what’s important, is the data that’s presented to FDA, FDA’s interpretation of the data, and whether they agree with the sponsor (the company submitting the application)

So for example, in the case of IV Tramadol, as I’ve written, the 1st study meets the end points of the study, but it states that the onset is given as 30mins, cos that’s the 1st measurement of the pain score.

I’ve included other articles that show that in animal models, the separation of the drug from the carrier, occurs BEFORE 30mins, which is why, if you could read the email query I sent to Lucy Lu, I asked why it’s 30mins, when the active compound separates before that in animal models.

Her reply is basically that it’s much earlier than 30mins, but 30mins is when they took the measurement.

Now, U might think, in your personal capacity, who cares… I, Mr Austin, KNOW that IV Tramadol works much more rapidly right? So it’s a non event… it works fine! Maybe within 1 sec!

But FDA looks at the data from the study given to them, looks at Avenue’s interpretation of the data in the NDA, and may find an issue with the study showing a measurement at the 30mins mark, and may go back to Avenue and reject based on that.

Avenue MAY reply with the same studies that I’ve attached, showing animal models having chemical separation and presumably, the drug working BEFORE 30mins, but FDA may reject it and essentially ask them to conduct their own studies to show it. Or FDA may decide that ok, that’s good enough data, I agree and accept the onset duration as being acceptable.

Stuff like that.

So… if Mr Austin, you are the CEO of Avenue, what would you do if FDA comes back to you that they think your study’s measurement at the 30mins mark fails to meet the expectations of the clinical requirements of an IV analgesic?

Reply FDA that “IV Opioids are known to start providing pain relief very quickly, I don’t see any obvious reason to think Tramadol would be an exception.”???

Obviously you can’t do that right?

This is why I said your opinion doesn’t matter.

It’s the data that Avenue has to submit.

Look, I’ve anesthetist friends, and from their limited usage of IV Tramadol, the effect is ALMOST IMMEDIATE.

I didn’t talk about it in the post cos it’s IRRELEVANT what they say.

Avenue cannot reply FDA that “oh, don’t u worry, we have clinicians all over the world and they say it’s a red herring, no worries there, it works just fine. And real fast too”

FDA may also, in all fairness, accept Avenue’s interpretation that based on earlier studies, the onset is short enough.

At this stage, I wouldn’t know if FDA may find it an issue, which is why I flagged it up to Lucy Lu.

TBH, She wouldn’t know if it’s an issue either, until Avenue receives a CRL.

If you read through the other replies in the comments, I’ve attached a snippet of a correspondence with Lucy Lu whereby she admitted as much.

Cheers

TTI

LikeLiked by 2 people

I think you’re overlooking the second point Dr. Lu made in her email — their Phase 3 trial design was agreed upon in consultation with the FDA. It’s not like ATXI has to guess at what the FDA is going to want to see. If the FDA were concerned about speed of onset, it would surely have requested timepoints earlier than 30 minutes. It didn’t. And it’s not as if the ATXI trial data are the *only* information the FDA will consider in approving this drug. Animal data and prior human trials will also be taken into account.

You also have to consider the differences between meloxicam and tramadol: meloxicam is a me-too drug that basically does the same thing as previously approved NSAIDs. I don’t know about the details of Recor’s application, but it may have been that they were claiming a more rapid onset than other NSAIDs, and failing on that measure. Tramadol would be a genuinely unique IV drug with better pain relief than NSAIDs and a better side effect profile than conventional opioids.

Finally, when you quote the WHO, they’re talking about using tramadol monotherapy for chronic pain (backaches, arthritis, etc). ATXI’s application is for acute post-surgical use. Apples to oranges.

Disclosure: Long ATXI

LikeLiked by 1 person

Hi Dendrite Research

Thanks for your comments

My reply is late cos somehow, I didn’t get a notification regarding your comment.

Here are my thoughts:

1) Which 2nd point in Dr Lu’s email are you referring to specifically?

Cos at no point in her reply, did she say that the Phase III study design was “agreed upon in consultation with FDA”.

AFAIK, and again, I get this from asking a contact who’s doing drug submissions, FDA has a series of guidelines and I’ve also included the link to the guidelines for the study design in my post.

But FDA does NOT plan and provide consultation for companies doing studies. Logically, if that were the case, then there should be 0 rejections, isn’t it?

The onus is on the sponsor to follow what are vague guidelines, and submit a NDA.

So, while I’d be very happy (remember, I’m vested myself too) if you can point me out to which part specifically states that “the Phase III study design was agreed upon in consultation with FDA”, I seriously doubt it.

And regarding your point on FDA requesting timepoints shorter than 30mins… well, that’s my point in including the Meloxicam study. If it were as you said, then shouldn’t FDA had told Recro that they needed a shorter onset duration during their study?

So I really don’t get your argument at all.

Of course FDA would be concerned about the onset duration. Why wouldn’t it?

Yes, ATXI’s studies are not the only studies they’d take into consideration.

I literally mentioned that in my post, and devoted a whole paragraph on it. You’re literally rephrasing what I said and vomiting it out again.

ATXI is submitting under 505(b)(2) pathway, which allows for previous studies NOT conducted by the company, to be used for consideration in the NDA. So yes, all the other stuff that you mentioned, animal models etc, are all usable.

2) As for your 2nd point regarding the differences between the meloxicam application vs tramadol, yes, I am aware of the difference.

Which is why, I stated that this is the closest rejected application that I could find, and brought this up for discussion.

As for the specifics of why Recro was rejected, well, that’s really up for anyone of us to speculate. I think I’ve included (part of) a 2nd response by Dr Lu somewhere in the comments section, and she doesn’t have any insight on the specifics of the rejection either.

And yes, thanks for pointing out the differences stated in the WHO paper.

They specifically state that it’s not suitable as a monotherapy for >3mths.

Well, I don’t have to do a disclosure cos I’m obviously long ATXI as stated, and have added to my position since the post.

But, I’d be very interested to know how you get the impression that “the study design is done in consultation with FDA”.

Cos that’d fly counter to my understanding of the process that I’ve gotten during my DD.

It seems from your comments, that the only difference between yours and my thoughts, are whether the study design has had direct inputs from FDA.

Cheers

TTI

LikeLiked by 2 people

Dr. Lu wrote, “The key elements of our Phase 3 program were agreed upon at our end-of-phase 2 meeting. As of today, we don’t have a reason to have these concerns.” That agreement is between ATXI and the FDA.

LikeLiked by 1 person

You’re right…

My initial impression (from this reply) was that the discussion of the Phase III end goals was internal and did not involve FDA.

Ive verified that sponsors do meet FDA for discussions regarding the end goals for clinical trials, although FDA doesnt go into the detail of the actual study design. (Which has guidelines anyway)

Thanks for your comments.

Cheers

TTI

LikeLiked by 1 person

Hi good day I enjoy reading this blog which includes lots of helpful information its very interesting, and amazing. And you can also visit us blinds singapore to help you to do more article like this one!. Thank you and God bless!

LikeLike

Avenue Therapeutics Announces Positive Topline Data from Second Pivotal Phase 3 Study of Intravenous Tramadol in the Management of Postoperative Pain

LikeLike

Hi Notniuq

Yep, it’s +21% for today, right now as I type this.

And it’s up about 38% since the $4.57 mark when I posted this investing thesis.

Not bad.

TTI

LikeLike

Hi sir

I read the results, regret am not medically trained. Could u share if the results had any surprises relevations?

Thanks

LikeLike

That’s why I made my post as layman as possible…

one doesn’t need to be medically trained to understand, cos I hardly used any lingo.

I’ve only had a brief look at the data from the Phase III, will take a deeper and longer look later.

But no, there aren’t any surprises.

In fact, they added a comparison to IV Morphine as a secondary endpoint, and achieved that as well.

So it’s as good as it gets.

They are also sticking to their initial timeline of Q4 for a new drug application (NDA)

So everything’s on track.

I think the premium away from the offer price still remains… as the last remaining uncertainty lies in getting the approval, and we’re at least 9 mths away from that.

I continue to like the idea for the favorable risk-reward outlook, and more importantly, the fact that this thesis is regardless of how the market conditions are.

The fed can raise or cut rates, Trump can say what he wants, the trade wars can persist…

but if they get approval for IV Tramadol, all this doesn’t affect the share price 1 iota.

Cheers

TTI

LikeLike

Thanks for replying!

LikeLike

May I know is it right that they can now proceed to work on the NDA draft/submission after today’s positive data from second phase 3 study? Is there any other study to be carried out?

From the AE table results, dont u think that even though IV tramadol has lower % compared to IV morphine but it is not significant?

Would you accumulate more at current price like 5.7?

Appreciate if u can share your thots.

LikeLike

Based on the FDA’s guideline for submission, nope, there’s no other study that needs to be carried out. In fact, ATXI is sticking to their previous guidance of a NDA by the end of Q4 2019. After the NDA though, sometimes, FDA may go back to the company (the sponsor) and request for new data, and the sponsor may have to do new studies, or do a sub-analysis of the data from the previous study, to prove certain points.

So yep, in short, ATXI is clear to go ahead with the NDA now. And if you look at the success rates table in my article, just based on incidence of success, it has shot up now that they’ve cleared 1 more phase.

Yes, IV Tramadol has lower % of AE than IV Morphine. Whether it’s “significant” or not, is not based on you or my judgement of the numbers. It’s based on actual calculation of the stats to determine statistical probability. Aka the “p value”, which is usually set at p = 0.01

I’d just point out the obvious here though:

IV Morphine is approved by FDA and currently already used for acute post surgical pain.

IV Tramadol has LOWER incidence of AEs… so… does it really matter if it’s significant?

Worse case scenario, we say it is insignificantly lower, so they have the same incidence, but still, IV Morphine is already approved.

But yes, I do think it is significant. A 5-7% lower incidence of AE is certainly significant in most studies. In this case, the sample group is 370 participants. A 5% difference means 19 patients reported less AEs than IV Morphine. That’s not a small number.

Perhaps. I’m undecided, cos I’ve already increased my stake substantially since posting the article. (share price dropped after I posted my thesis actually)

I currently own 12,199 shares at an ave price of $4.88 or so.

Don’t think I’d be selling just yet, but not sure if I’m adding. I gotta consider overall portfolio management and capital allocation as well, and it’s not just about ATXI.

I’d probably hold off for a while, and certainly not add today. ATXI is in the news now, and the share price popped. If I do add, I’d wait a while more and see if the share price drifts down. There’s 2 more quarters from now till end of 2019 so yea. If the share price doesn’t drift down, then I’m happy with my current exposure. If it goes down again, then yea, I may deploy more capital here again. Otherwise, there are other stuff I’m currently looking at too.

(We live in exciting times!)

Good Luck!

Cheers

TTI

LikeLiked by 1 person

Hi TTI,

Thanks for sharing your thots. I was too slow on my decision to buy before the positive announcement from the second phase 3 study. Too bad it has gone up. Will see whether there is an opportunity to buy in before Q4 2019.

Anyway really appreciate your ideas and efforts. Cheers :)

LikeLike

Hi

Yea, I was expecting the results to be announced towards the end of Q2, nearer the end of June, so this is earlier than expected.

I think there’s still some room to run up though, cos if we put things into context, we are still looking at a 200% ROI or so if they manage to get the FDA approval.

Cheers

TTI

LikeLike

Also…

don’t need to beat yourself up over a missed opportunity…

there are opportunities always around.

There’s 1 right now somewhere out there, just waiting to be found…

LikeLiked by 1 person

Alright yeah understood what u meant. Haha. Will see whether there is any opportunity to enter at lower price maybe below 6 for ATXI.

I saw your IN post about AVGO as well. Hmm seems a good chance for entry.

Thanks again and appreciate your comments. Cheers.

LikeLike

Recently, there’s a huge block of sell queue for ATXI.

Think someone’s selling out cos the sell queue moves in tandem.

Something you might wanna note.

As for AVGO, there’s a lot of stuff I like about the company.

I don’t have a current equity stake now, but I’m selling lotsa puts and won’t mind if they get exercised.

IV is sufficiently high too, to make the premiums nice and very much worthwhile for my troubles.

Cheers

TTI

LikeLike

Noted on the ATXI.

Roughly what will be the ave price range if all get exercised for AVGO?

I’m sorry I don’t have knowledge on options. So not sure what is IV. But it’s ok :)

LikeLike

Thats quite hard for me to say, cos it all depends on the price of ATXI.

I have sold puts at strike prices $240, $245, $250 and $255. A batch just expired yesterday.

If i include the premiums collected, the ave price should be somewhere in the $240-$245 range i guess.

LikeLike

Hi TTI,

How do u see this? Hope can get an opportunity like what happened previously when they acquired CA Technologies.

https://seekingalpha.com/news/3476077-broadcom-makes-progress-symantec-deal

https://www.cnbc.com/2019/07/05/broadcom-looks-to-symantec-tibco-as-chip-business-declines.html

Cheers

LikeLike

Hi

I’m selling OTM AVGO put options. Have already sold them actually, but none got exercised so I’m just collecting premiums

The IV is not too bad too (30% ++), so the premiums are quite acceptable.

If they get exercised, I don’t mind accumulating AVGO.

I’ve sold puts at between $250 to $275, if they expire, I continue to sell them until I get to accumulate some AVGO.

I think the markets are rightly, worried that it’s the end of a golden era for Broadcom, cos they seem to be moving away from their core chip businesses into supposedly unrelated businesses.

The same thing happened when Broadcom acquired CA. Markets are worried cos CA is a completely different business, and in fact, is a legacy business with next to no growth and no synergy with the existing business.

Yet Hock didnt get to where he is without seeing stuff that outsiders don’t.

He’s capitalizing on CA’s legendary consistent cashflows to smoothen out the contract based, lumpy CFs of AVGO.

TBH, I don’t know much about symantec, except for the specifics of the deal.

Other than that, I don’t really understand Symantec’s business that well, except for a cursory look.

But I think the market’s worry about a long term decline for AVGO’s chip business is overdone.

Anyway, the constant rolling over of put options is providing a really big buffer for me, so if I do eventually accumulate a stake, the actual price would be much lower than the $250-$275 range.

Perhaps even below $250 ave price.

But yea, I’m optimistic and sorta long. (And trying to get even longer by getting a direct stake)

Cheers

TTI

LikeLike

Ah just realized that I’ve replied to an earlier comment about selling AVGO puts.

Yep, I sold them at $240-$255 previously, but as none got exercised, I sold more, this time at $250-$275.

Happy to continue selling if none get exercised, and happy too to pick up the shares if they do get exercised.

LikeLike

hi, a quick question, shamelessly copied from ‘DendriteResearch’ on another forum. If you look at this May presentation:

Click to access Avenue-Slides-MAY-2019.pdf

Page 16, they list respiratory impairment as the first adverse event. However, the subsequent press release on the phase 3 study doesn’t mention respiratory issues at all! Nice numbers for vomiting, nausea, etc. but suddenly no statistics on respiratory impairment. Neither was it mentioned in the conference call. Isn’t that a bit strange?

Also here:

https://seekingalpha.com/article/4087713-avenue-therapeutics-atxi-investor-presentation-slideshow

Slide 10, Tramadol is listed as an improvement for people with respiratory depression / sleep apnea.

Bit strange, at least. Any thoughts?

LikeLike

Hi writser

1) Slide 16 lists the adverse events they’d compare between IV tramadol and an IV opioid, it is NOT in order of occurrence.

Respiratory impairment is actually a very late stage adverse event.

This means that say if we do a errr… non ethical study, and increase the dosage gradually for a patient, the 1st initial signs of adverse events would usually be the usual stuff like headaches, stomachaches, nausea, vomiting etc.

Respiratory depression is right at the end of the spectrum.

IIRC, it’s right at the end actually.

You can easily find it by finding any medical texts, or by doing a pubmed search.

Note that if you look under ORAL tramadol, it’d almost never list respiratory depression cos you must be popping crazy amounts of tramadol to reach that.

But since we are talking about IV here, yep, there’s a potential AE.

I’m guessing that there’s no mention of respiratory impairment cos there wasn’t 1 such AE happening in the study.

2) Ah, This is right up my alley.

I guess you’re confused because… since respiratory depression is an AE with Tramadol, how would using tramadol be an improvement for respiratory depression/sleep apnea right?

The slide is short on detail, hence the confusion.

Basically, patients on opioids for long term pain management are known to be at risk of sleep apnea. Esp the obese patients.

In sleep apnea, the airways are constricted when you are sleeping, cos the muscle tone is not present and the muscles collapse. Essentially, you are suffocating when sleeping.

So you end up “waking up” (arousals) multiple times throughout the night, without having restful sleep. Basically you end up waking up and dozing off again many times.

So in sleep apnea patients, you can imagine that if they are taking opioids, the side effect of respiratory depression would be a real problem.