October 2017 was a busy month for me, in terms of portfolio changes. I made 2 complete divestitures, and feel really good about them.

This is just a quick update, and some of my accompanying thoughts as we go into the earnings season next week.

1. LTC Corporation

I currently own 240,000 shares.

LTC did pretty well YTD, rising a very respectable 26.42%. (In any other year, 26.42% would’ve been a monster year, but this year, the bar has been raised considerably by STI ETF)

I wrote about my thoughts at the end of 2016 after analyzing the FY16.

That post was summarized by Leong CT and republished on NextInsight:

https://www.nextinsight.net/story-archive-mainmenu-60/938-2016/11103-ltc-corp

And here’s the full, boring, long version:

Info That I Have Gleaned From LTC Corporation’s AR 2016

Well, nothing much has changed actually. The year panned out the way I expect it to be, business wise. I guess it’s been acceptable, nothing too amazing, but there’s a certain safety margin incorporated in the wide difference between the share price and the NAV.

A long time frequent reader, mslee888, attended the recently concluded AGM and has some comments on what transpired. You can read his comments in the “Recent Comments” section.

Nothing overly optimistic, perhaps even slightly bearish.

Personally, I’d continue to monitor their FCF generation and cash utilization. All that cash generated HAS to go somewhere. The most obvious place now is their development of GEM residences, which is situated just off the island of Penang. I didn’t write much about it, but that development at least, looks favorable to me when I did my DD.

Linked to what is the largest mall within the vicinity, the site has a lot of potential going for it. Any potential rewards though, won’t be in sight, so some patience is in order.

I have a lot of that.

2. BBR Holdings

The chart says it all:

Being the largest proportion of my portfolio at the start of 2017, a massive 44.44% gain is great. It single handedly helped me keep up with STI ETF, despite the drag by Dutech’s drop this year.

The share price was well supported by a series of share buybacks by the company, as well as by the sudden large increase by Dr Chiu, who is now a substantial shareholder.

I’m not sure what plans he has, but there’s no scenario whereby this is a bad thing.

Would I know at the start of 2017, that BBR would initiate a share buyback program? Nope. No idea.

But I do know the shares were, and still are, terribly cheap.

They don’t even have to do anything right. They just have to NOT do anything wrong, and stop bleeding money each quarter, and the share price should correct substantially.

As the loss making projects are gradually run down each quarter, their financial performance should improve.

I’m optimistic about their newer projects.

And for gods’ sake. Please stop doing all those fancy new technology for the sake of tech. Keep looking at your margins please. I rather you guys do nothing than do a lot of stuff and constantly lose money.

I’ve written about my long history with the management, the old posts can be found in the links, I shan’t repeat.

I do have to say that I’m a lot more pleased with how they chose to return capital to shareholders. A share buy back is much more preferred when the shares are undervalued, vs merely increasing dividends.

It inspires confidence, and the effects are more prolonged.

I did capitalize on the massive rise by taking some profits off the table. (Plus I consolidated my shares from the various nominee accounts in prior years, so if I don’t reduce my stake, I’d most likely end up in the Top 20 shareholder list in the AR17, and I’d like to not be so visible)

I currently still own 1,100,000 shares, having divested about 900,000 shares this year.

3. King Wan

DIVESTED COMPLETELY. ALL 1,000,000 SHARES.

PHEW!

Never felt more relieved.

Just divested the remaining 100,000 shares today at $0.16. I started the year with 1,000,000 shares, and now I own no shares.

I don’t know who bought them from me. Whoever it is, he either knows something I don’t (perhaps increased dividends), or he’s screwed.

I’ve previously written about my disdain for the performance of management… and nothing’s changed.

Oh actually, something did change. CFO Francis Chew left the company “to pursue other interests” (what else? Does anyone seriously give any other reason aside from this generic one?). With the departure of CFO Chew (the one guy who tried his best to answer my queries), the last good thing going for KW is gone.

King Wan is without doubt, my biggest investing mistake thus far. Ever.

I’ve only learnt 1 lesson from this:

Keep your eyes on the game. Nobody’s going to do it for you.

I trusted in the capital allocation prowess of the management and literally just forgot about this company. “Buy and Hold” as Buffett says. Difference here is that the management is not what Buffett would’ve approved.

In my defense, it was a really busy period of my life when I had to devote 100% of my time to build up businesses in my work. Thus I thought I’d just chuck it aside and let these guys grow my capital. Imagine my surprise when I checked up on it 1 big fine day.

They got proud when things were going good, and had to eat humble pie. In recent years, when everything has just gone a single way up, KW has gone exactly the opposite direction.

I mean, just for laughs, check out these earlier articles and “analysts’ predictions”:

LOL @ “special dividend”!

Perhaps the biggest early red flag that I should’ve picked up, was the IPO of KTIS.

That was the peak of KW’s fortunes. I remember clearly that KTIS IPO was done at a PE of 30+ (I’m not checking now, this is written off the top of my head)

I remember clearly thinking that “hey that’s kinda pricey for a sugar producer right? What competitive advantage would a commodity producer have to warrant that kinda PE multiple?”

Yet KW held on to the bulk of its stake post IPO.

I would’ve dumped it all to the hungry and dumb public.

I’ve previously said I’d give my coverage to my mistakes. So there, let me open up old wounds. Go ahead and re-read these. It is a damn good read.

King Wan Corporation – Part II

King Wan Corporation – Part III

Good riddance.

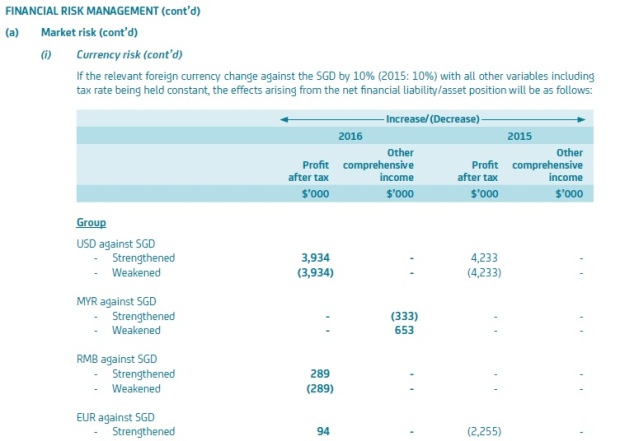

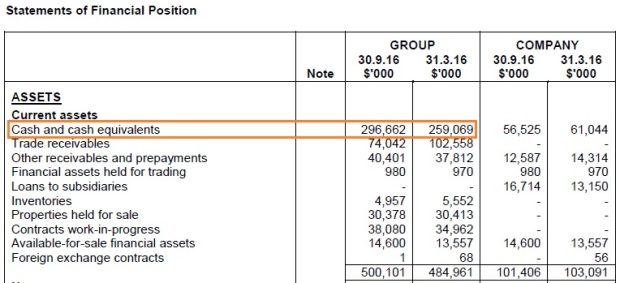

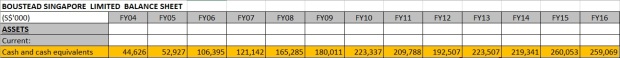

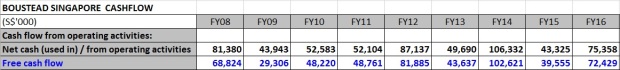

4. Boustead Singapore

A 9.76% ROI (and it’d be higher if we include dividends), is not bad normally, but in light of this year’s monster performance by the passive indices, this doesn’t feel much like a win.

Oh oh and before I forget, all the stated ROIs above do not include dividends, so it’s probably a bit higher. I’m just lazy to do the math right now.

I currently own 40,000 shares of Boustead.

This is a small position.

FF Wong still has my vote of confidence. A genius is a genius.

The only thing that’s bugging me constantly is whether I should buy Boustead Projects directly, or own it indirectly via Boustead Singapore.

I know this opinion is contrary to the thoughts of most other retail shareholders, but I really preferred if FF Wong didn’t hive out BP. Just keep it all together as a mega conglomerate.

I suspect a major part of the reason is just succession planning. He has to elevate and promote so many lieutenants, so better to split it up so that each can become their own bosses.

This just makes it more complicated for me to assess.

Obviously Boustead is in a tough position now, with the situation with O&G.

That’s why I’m keeping it as a small position.

At the 1st sign of a sustained recovery, I’m putting my money on FF Wong again. In a big way.

5. Comfort Delgro

well, shan’t waste too much time here.

Bought at $1.98, Sold at $2.02 barely a month later.

Was hoping to build a large position, but it never really dropped much after I bought. There were only 2 trading days where it went below my entry price, and that’s about it.

Also, further DD made me more cautious about their entrenched position, and the stake was really too small to warrant wasting time monitoring.

On top of that, as I alluded to in the previous post, I’m selling some positions to reallocate capital into a new idea. And I intend for that position to be a big one.

Wealth Destruction Behaviors – TTI’s Personal Anecdotes

6. Geo Energy Resources

Not bad at all.

30.43% YTD, add in a few more % points for the dividend, and it’s turning out to be a fine investment indeed.

Well, anything that beats the index this year, is a fine investment.

I currently hold 500,000 shares, at an average price of $0.168.

I think I’d likely double my money from $0.168 before the year end. In fact, my purchases in July is already starting to look like a stroke of genius. (But the purchases of Dutech…. not so):

TTI Bought >$100K Worth Of Equities In July… Howard Marks’ Memo Better Don’t Come True Right Now!

Q3 results look promising, but unfortunately my DD tells me that their coal production would likely disappoint again this quarter.

I’m expecting them to report total coal volumes mined to be between 1.8 – 2.2mil tonnes.

Which would be a substantial improvement from Q2, yet below that of Q1.

Full year, I find it hard to see how they’d meet their stated 10mil target.

Probably not, even if TBR mine comes online soon.

Results would still be stellar though, as coal prices continue shooting through new highs. In Q3, China’s imports have held up much much better than most analysts were expecting. (Read Philips report on how they expect coal prices to drop in Q3. To their credit, they stuck to their buy recommendation as they believed it’d be transient)

I’m watching this space tightly, it’s going to be an exciting Q3 and Q4 for Geo.

7. Dutech Holdings

Tough year for Dutech:

A -17.78% in a year where STI is up almost 20% (or more, not sure of the latest figures), is disastrous.

I currently own 701,000 shares at an average price of $0.287

I’m keeping faith with Dutech and Johnny Liu though.

Unfortunately, I don’t expect the business to turn around in Q3 or Q4 of 2017.

My analysis of their downstream peers (Diebold Nixdorf and NCR Corporation) tells me that globally, their High Security business is still going to be impacted heavily.

Diebold just reported earnings, and it’s not pretty. Major ATM clients are still delaying confirming orders. On the plus side, they are still expecting orders to be confirmed in the coming months.

I will be watching how Johnny Liu continues to steer the business towards the software intensive “Business Solutions” division, and how they integrate their newly acquired Metric.

It’d be a while yet, but I’m actually comfortable holding Dutech as a core, long term holding. I won’t make the same mistake as with KW though, I’m keeping my eyes on the game this time.

8. XXXXXXXXXXXXXXXXX

As mentioned in an earlier post, I’ve started accumulating a major position in a new idea. I’m pretty optimistic after doing my usual comprehensive DD, and hence, my position will reflect my optimism.

When I’m done, I hope to accumulate at least a 6 digit position.

Already, I’m slightly up, but I intend to continue to average up.

Not ready to reveal it yet, will write about it soon.

This year hasn’t been too bad ROI-wise, yet I’m still finding it tough to beat STI ETF.

DAMNIT.

Banks and Developers.

Those are the ones going ballistic this year.

Also, my US listed equities have not done as well as SG ones. I’ve made some major mistakes in the midst of tinkering and trying out ideas, particularly with options. 1 major mistake was entirely due to greed, something that I never thought I’d do. Damnit. I should’ve wrote about myself when talking about “Wealth Destruction Behaviors” in my previous post. Dumb, greedy mistake.

In fact, SG portfolio ex-US, would likely have beaten STI ETF, but that’s not how portfolio tracking works right.

We have to take in the bad with the good. Cash drags, transaction fees, even holding or margin costs etc, all has to be accounted for to give an accurate picture.

Thus far though, with the insight and the adjustments I’ve made, and the new rules that I’ve implemented, results have been good. I’m still trying it out, but it bodes well for 2018 and beyond.

I believe longer term, my options strategy would be a force to be reckoned with, ESPECIALLY so in down years.

Let’s see.

In terms of portfolio size, 2017 is likely to see a substantial gain, even though there’s been minimal capital infusion. It has been difficult to NOT make money in 2017, looking at how the markets have behaved.

I’ve instead preferred to channel whatever cashflow I have left (after the wealth destructive trail of the 2 kiddos) into my property fund.

Anyhow, I’ve always preferred to watch the ROI figures rather than the actual portfolio size. The quantum can be easily increased by channeling more funds into equities and options rather than into my property fund. The ROI is the fun and challenging part.

That’s all I have here.

Oh, and SGX has sent out emails for race pack collection for those who have received complimentary tickets for the Bull Charge 2017, so go collect them.

As always, Godspeed.