Riddle: What are TTI’s top 3 most favourite letters of the alphabet?

Answer: The letters “A”, “H” and “T”

Yup. My absolute favourites.

But must be arranged in this order “A.T.H”

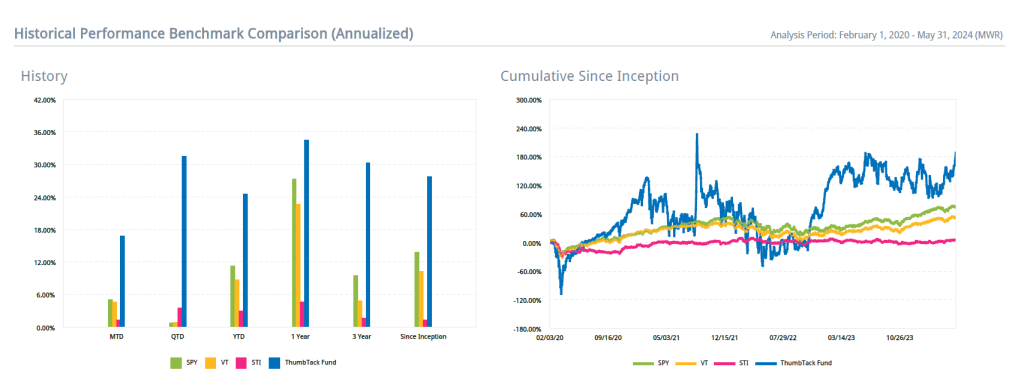

Almost every single parameter of TTF has just hit All-Time Highs: AUM has increased to new highs, zooming past the last milestone; YTD ROI has also shot up to ATHs; and I’ve managed to further increase TTF’s CAGR since inception.

2024 (YTD):

SPY: +11.30%

VT: +8.74%

STI: +2.97%

TTF: +24.51%

SINCE INCEPTION (FEB 2020), ANNUALIZED:

SPY: +13.84%

VT: +10.23%

STI: +1.31%

TTF: +27.71%

Note: Returns are MWRs, all figures in USD

TTF’s NAV: USD 4,126,056.36

Deposits/Withdrawals: USD 2,086,747.26

Net capital gains since inception: USD 2,039,309.10

For reference, the last fund report:

Since TTF was incorporated in Feb 2020, this means that TTF has enjoyed a net gain of USD 2,039,309.10 over a period of 52 months of investment activity, which works out to be USD 39,217.48 every month, or approximately SGD 52.9k per month from Feb 2020 to date.

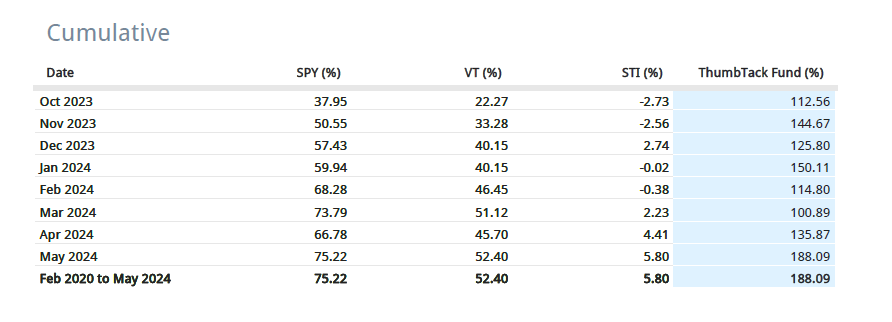

Cumulative ROI (Feb 2020 to May 2024):

SPY: +75.22%

VT: +52.40%

STI: +5.80%

TTF: +188.09%

TTF has generated double digit money weighted returns every year since inception:

2020: +89.83% (https://thumbtackinvestor.wordpress.com/2021/01/02/thumbtack-fund-report-6-rose-of-jericho-2020/)

2021: +24.91% (https://thumbtackinvestor.wordpress.com/2022/01/07/thumbtack-fund-report-10-hello-2022/)

2022: +11.94% (https://thumbtackinvestor.wordpress.com/2023/01/02/thumbtack-fund-report-13-hello-2023/)

2023: +33.81% (https://thumbtackinvestor.wordpress.com/2024/01/04/thumbtack-fund-report-19-macro-thoughts-for-2024/)

2024 YTD: +24.51%

Oh boy, how things can change in a mere 3 months! In my last post (https://thumbtackinvestor.wordpress.com/2024/03/15/thumbtack-fund-report-21-getting-walloped-by-the-markets/), TTF was in the red YTD, losing massive ground to S&P, which started 2024 strongly, and still remains pretty strong. Today, TTF’s ROI YTD is more than double that of S&P’s, and in fact, has even further increased TTF’s long term CAGR.

I feel like TTF is now on the cusp of playing in the big boys’ league. In my early days of investing, I struggled with justifying spending this much time, effort, energy and focus on investing; because despite garnering market-beating double digit % returns, with a relatively small capital, the actual cold, hard dollar profit at the end of the year, simply did not impress me. I could’ve gotten the same amount, or more, if I had used the resources to focus on my work or business.

I don’t discriminate against how dollars are earned: $1 earned through income is the same as $1 earned through business, which is the same as $1 earned through property, which is the same as $1 earned through investing, which is the same as $1 which I picked up on the roadside on my way home.

I have no ego when it comes to how the money is earned; I simply want to earn the maximum amount in the shortest period of time. If I could pick pennies up all day long off the roadside, I’d do just that.

But at that time, I was looking 5, 10, 20 years into the future, and I decided that my capital won’t stay small forever, and at some point in time, it’d make sense to be a top investor. But one does not gain an edge over Mr Market and become a top investor overnight. So that’s my justification to keep plugging away.

Now, TTF is going to really start making sense. It’s simply math. That’s all.

With a long term CAGR of 27% currently, let’s say we round it down to 25%, even without A SINGLE DOLLAR of capital injection from here on, I’d be looking at a portfolio growth of at least $1mil every single year from here on. Well, I ain’t going to have no capital injections, and I ain’t going to sit pretty with a 25% CAGR from here on. So I’d have to expect, even demand, a 7 digit USD gain annually from here on. Now, that does sound a bit more like the big boys’ league, and it does feel like adequate compensation for my efforts.

For now.

OK, so what transpired in the last 3 months?

One doesn’t garner market beating returns without having some level of portfolio concentration and/or some level of contrarianism.

Now, I think most folks idea of “contrarianism” is simply taking the opposite side of what the markets are saying, which is suicidal, and puts a bright neon label on your forehead with the words “Bagholder” written on it.

I try to give Mr Market a lot of respect, and assume he knows what he’s doing most of the time. And only when he’s obviously being retarded, then that’s when I’d be the obvious contrarian.

Also, as I’ve always said, TTF is structured as a long-short fund. At almost all times, I have both long and short positions that are adjusted frequently. That’s how I achieve my 2 long term stated objectives for TTF:

- Never having a single red full year

- Compound at a rate above that of S&P

Now, each of these 2 objectives is, by itself, not that hard to meet. But combined… they are extremely difficult over the long term. But I try.

They are difficult because there is a certain contradiction about them. For eg. I could try to match S&P’s performance for the large part by holding the magnificent 7, and hope that a few other positions outperform, and that’d meet the 2nd objective. But doing so means that when S&P is in the red, it’s almost impossible to not have a red year (objective number 1).

To meet both objectives consistently over the long run, it follows that my portfolio must look like a totally different beast from S&P, and it has to incorporate characteristics that’d do well in the up years, and also do well in the down years. That’s something I’m mindful of whenever I assess an opportunity.

Currently, I’m achieving this by having a 2/3 long position and a 1/3 short position:

Next week, I’m off to the UK for a 3 week holiday. In Feb, I asked random IN buddies for their holiday suggestions, specifically for a “unique experience”. Location and cost are not big considerations, but it must be unique, and it must involve an experience.

Now, of all the comments, this dude’s comment jumped out at me, and I thought, hey, that’s interesting…

So yeah, that’s what I’m gg to do. LOL

Anyone with any other suggestions, pls drop me an email, or comment here. I’d really go do it.

I mean like really unique experiences. Not location. Things that you and your family still talk about after many years, cos it’s memorable. I’ve already done a lot of crazy shit in my life, running out of obvious ideas. Pls share.

’till next post, adios!