I guess I owe Carrie Arndt from ValueChampion an apology.

Having agreed/promised to put up ValueChampion’s post on the rankings of various Robo advisors almost 1 month ago, this post is terribly delayed.

In fact, this post must come as a surprise to Carrie cos I haven’t replied the last email for weeks, which is uncharacteristically rude of TTI.

Truth is, the year end is usually crazy busy for me, so much so that I think everybody can see there’s been a dearth of updates here. Even my health’s taken a beating as a result.

Investing wise has been great though, having made some great strides in most things I’ve touched of late.

Literally anything I want to go down has gone down, anything I want to go up has gone up, and anything I hope would go up and down and up and down but ultimately hover around a tight band for me to sell options on both ends, has done just that:

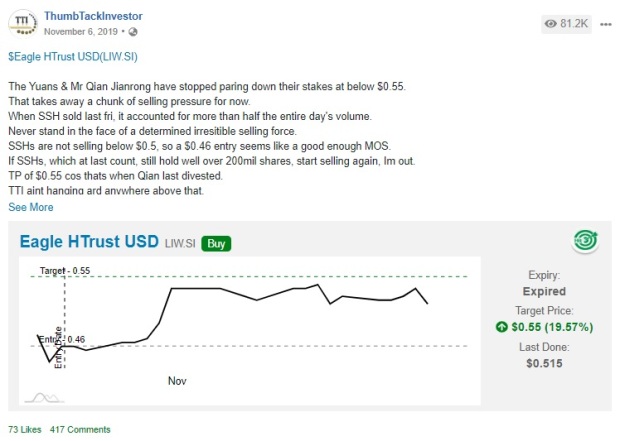

And of course, something for our local readers/investors:

This generated a crazy amount of hype and comments, I guess cos EHT was in the news, and there was a mad amount of fear then, and well, I did put up all relevant substantiations to show my positions.

Ended up making a very neat $25k SGD in just over a week, which is a nice christmas present.

From the comments, many other folks putting smaller amounts to work here along with me also received some early christmas cheer, so that’s nice too. That includes my buddy, so that makes me doubly happy.

As we close out the year, I’m hoping for some luck to push my TWR for the year to cross the 40% mark. Will probably update after the conclusion of the year.

But now, let me not hijack this post.

For the record, this post is NOT an advertorial.

It’s a guest post.

I am not receiving ANY remuneration, of any form whatsoever, for publishing this post by ValueChampion. (Aside from some profuse thanks)

They just contacted me and asked very politely if I would consider posting this, and I decided to be a nice guy.

That’s all.

I’ve summarized the stuff here, but for the full actual details, pls go to:

Best Robo Advisors in Singapore 2020

So here it goes:

Best Robo Advisor in Singapore: Kristal.AI

Consider this if you seek a robo advisor with very low fees

Kristal.AI stands out among the crowded field of robo advisors in Singapore due to its low fees. For example, investors with more than $50,000 (approximately S$70,000) in their accounts are charged a platform fee of just 0.30%, and those with less than $50,000 can invest with Kristal for free. On top of their low fees, Kristal.AI does not charge penalties for opening or closing an account, and there is no lock-in period required by the platform. Additionally, Kristal.AI is a great advisor for those seeking some human interaction, as it offers 24/7 customer support via phone, email and messaging. Finally, Kristal.AI requires an initial investment of just S$10, making it accessible to all investors.

Best Robo Advisor for Large Investments: StashAway

StashAway is the best robo investing platform in Singapore for those seeking to make a very large investment. For investors seeking to invest S$2,000,000 or more, StashAway charges the lowest fees. The platform leverages its trademarked investing algorithm to adapt to economic trends as well as to customise portfolio’s by the investor’s risk appetite. StashAway does not charge fees for withdrawals, transfers or account closure, nor does it require a minimum account balance.

Best Robo Advisor for Investing in Unit Trusts: Endowus

Endowus is the best robo advisor for investors that prefer to invest in unit trusts rather than ETFs. Not only does the platform charge the lowest fees among robo platforms that invest in unit trusts, its incentives are aligned with its users because it only receives payments from investors and does not receive trailer fees from fund managers. The platform also allows investors to link their CPF Investment Accounts. Additionally, Endowus does not charge fees for transfers, withdrawals or account opening and closure. The only downside to using Endowus is that it requires a minimum account balance of S$10,000.

Best Bank Robo Advisor Platforms

Best Bank Robo Advisor for Small Investments: DBS digiPortfolio

For those hoping to invest a small amount in a bank’s robo platform, DBS’s digiPortfolio is a great choice. The bank’s management fee for its Global Portfolio accounts (0.75%) are lower than any other bank for amounts of less than S$50,000. However, it is important to keep in mind that DBS digiPortfolio’s fees are significantly more expensive than the platforms mentioned above.

Best Bank Robo Advisor for Large Investments: Utrade Robo (UOB)

For those seeking to invest a large sum through a bank that they are familiar with, Utrade Robo is the most affordable option. The banks fees of 0.68% for accounts of S$50,000 – S$100,000 and 0.5% for those of more than S$100,000 are the lowest of any traditional bank. Still, investors that are comfortable with any of the non-bank robo investing platforms, will pay even less in management fees.

How to Choose the Best Robo Advisor

When comparing robo advisors, it is important to consider a number of factors. First, it is essential to compare the fee structure of each advisor. Most platforms tend to charge fees of 0.25% – 1.00%, depending on the amount invested. The amount of fees you will be charged is the best way to directly compare each robo advisor. This is because the platforms do not always disclose the details of their investment strategies. For the same reason, it is difficult to know exactly what type of returns you can expect from each robo advisor. That said, most robo advising platforms offer portfolios with a range of risk and return profiles. Finally, it is important to compare the minimum investment requirement of each platform. While several robo advisors have very low minimum account balances (or none at all), others require several thousand dollars, which can be prohibitive for some individuals.

ETF vs Unit Trust

Robo advisors in Singapore tend to use a strategic combination of inexpensive ETFs to provide an affordable alternative to wealth management services. ETFs (exchange-traded funds) track a wide range of indices and are tradable by individual investors. The advantage of investing with robo advisor is that the platform will select a diversified portfolio of ETFs based on your investment goals (e.g. saving for retirement, a new home or university tuition) and economic conditions. On the other hand, other robo advisors choose to invest in unit trusts. There are several reasons an investor might prefer exposure to unit trusts rather than ETFs. For example, unit trusts are actively managed by professional fund managers.

For many individuals, this research and expertise provided by robo advisors is quite valuable and well worth the relatively small management fee. However, those that would prefer to conduct their own research and choose individual stocks, bonds or ETFs should consider investing through an online brokerage instead.

Like I said, if you’re interested in more details, pls go to their site:

Best Robo Advisors in Singapore 2020

I’d close out this post by wishing all readers a very Merry Christmas, and a huat year 2020 ahead!

Adios.