The title basically sums up how I feel right now.

I’m sure many have already read it, as I have, but the said famous memo above can be found here if you haven’t:

https://www.oaktreecapital.com/insights/howard-marks-memos

I absolutely love to read this guy’s memos. Of course, when you’re a billionaire, suddenly everyone wants to hear what you have to say, hoping to glean some secret formula to riches in your writings.

But that’s not really the reason why I love his memos.

The reason is actually very simple: They are easy to read.

Lots of common sense, easy to read and easy to understand, and yet a lot of thoughts go behind each statement. Some times I can think about it while having a shower and suddenly have a flashback on what I’ve read several weeks ago, rush out and re read it to have a new understanding. Yup.

I’ve been a big spender in the past month, adding almost $100k to my positions. (Of course, I sold some other stuff too)

Looking back, I haven’t really added anything significant this whole year. I did trade a little around my Geo Energy position, earning a miniscule $500++ each time, because it was in such a tight and predictable range. I did buy some minor stuff, adding cosmetically to some positions, but nothing significant, quantum wise.

Until now.

Suddenly July opened up a lot of opportunities and I couldn’t resist adding. It’s the problem with sitting on too much cash. You can’t sit still. Inactivity is really the toughest thing to do.

That’s the nature of my SG equity portfolio. Long periods of relative inactivity and peace, but when it comes, it’s fast and furious. In any given year, I’d likely not do too many things, not look at too many stuff either, but probably focus on just 1 or 2 big things. So what has transpired?

DUTECH HOLDINGS

I added 50,000 shares on the 21/07/2017 at $0.37 and another 50,000 on the 27/07/2017 at $0.36. My overall position now consists of 730,000 shares at an average cost of exactly $0.29 (inclusive of all brokerage fees and other related costs)

The share price tanked upon release of a profit guidance.

Nobody really knows how bad Q2 earnings would be, and I suspect the markets are pricing in losses. It’s very much possible. Dutech has everything going against it right now: Rapidly rising steel prices (which benefit my other holding LTC Corporation, so there’s a natural hedge here), global clients cutting back or delaying orders, excess fat and inefficiencies from a new acquisition and rising operating costs.

It’s going to be rough.

But then again, the markets know that. Everybody knows that.

If there aren’t bad news, the share price wouldn’t tank. If it doesn’t tank, I wouldn’t buy.

The funny thing always is… when the share price is rising and keeps rising (presumably on good news and/or expectations), everyone wants to buy it but always laments on the share price not dropping. Yup, that includes me.

But when the share price does drop, there must be a reason for it and now suddenly everyone’s afraid and you hear stuff like “catching a falling knife” or “cut loss level” or “wait and see”. That’s hopefully not me.

So a very rough gauge to tell if you’re NOT participating in the maddness of the crowd, is simply to look at the amount of news, coverage and general “noise” around.

This time last year, the share price was rising rapidly. You’ve news articles, analyses on the company. Financial bloggers tear down the prospects and paint a rosy picture. Analysts look favorably on the company. Everyone wants to get on board, but waits for a little “dip” to do so. Johnny Liu was praised to high heavens.

Dutech could do no wrong.

Fast forward 1 year later, or maybe a bit less, about 9 months later, now Dutech is hated. It’s a company with leprosy. Prospects look dim. I mean, it REALLY does.

Nobody has anything good to say about the company. Actually, nobody has ANYTHING to say about the company anymore. Suddenly nobody’s putting out nice articles about Dutech. Nobody’s clamoring to get on. CIMB ceased coverage citing “lack of interest”. Do a quick check: google and find all articles/posts about Dutech. Tabulate the dates, and plot it against the share price chart of Dutech and you’d see what I mean.

Having said all that… being contrarian simply for the sake of being contrarian is absolute maddness as well. One can get skewered for doing that.

Even if you’re right… being wrong for a long time before being proven right, is no different from being wrong.

So what’s my rationale?

Firstly, I think Dutech’s unfairly beaten down because of the panic right now. I mean, I’ve received numerous emails and comments asking about Dutech. I can literally sense the fear and despair. Even long time value investors whom I know…. are starting to lose faith. The doubt is understandable. I am not spared too. What does the profit guidance mean? Could it be just reduced profits? Or does Dutech sink into losses? And if losses, how bad can it be? How about future quarters? Nobody (Aside from management) knows right now, neither do I.

With higher order thinking, it makes sense that the time to buy is when nobody really knows. When the uncertainty is at its maximum. Of course, whenever I buy something… it always gets cheaper right after I buy it. Always. It was the case when I first initiated my position in 2015 at $0.27. It will be somewhat similar now.

Anyway, IMO, the ones bailing out right now, are mainly the retail investors who have gotten onboard in the past year when the share price was rising rapidly.

Look at the shareholder lists:

Within a year, as the coverage increased and the share price rose, the number of shareholders rose accordingly from 625 to 805. Yet, all the increase came from shareholders with relatively small positions of <1,000,000 shares.

The big buyers with >1,000,000 shares remains the same.

It is the same group of retail investors with relatively small holdings who are scared witless right now. I don’t think the 24 shareholders above are selling.

In fact, perhaps I’ll make it 25 by the time I’m done.

Secondly, I think a relatively quick turnaround is on the cards. I won’t talk too much about Dutech’s “Business Solutions” division. That’s going to be the main focus for the company going forward, and that’s where all the M&A is being done. It just takes time for Dutech to assimilate the newly acquired Metric businesses.

The hardware part, the “High Security” segment is where it gets worrisome. There has been a lot of talk about our society going cashless, with the resulting need for less ATMs and hence, less of the safes that Dutech supplies.

To have a sense of what’s going on, I went downstream in the supply chain to look at some of Dutech’s main clients: Diebold Nixdorf and NCR Corporation.

Just for the sake of brevity, I’ll just quote Diebold.

Diebold’s results dropped as well, following a reduced profit guidance. (Yes, similar to Dutech. So we have a good reflection of Dutech here)

What are the problems Diebold is facing?

In short, banks in most developed countries as well as some developing countries (Except India) are delaying the implementation of new ATMs. With the delay, comes a corresponding delay in service and maintenance contracts for these ATMs. Diebold’s existing contracts are running off, while new ones are not signed and revenue is not recognized.

The good news is that there’s sequential growth in order books, and the order backlog is increasing:

OK, the way this post is going, it’s going to be ultra long so I’ll have to be brief from here onwards.

In summary, Diebold is experiencing more orders, but the actual implementation of ATMs and their service contracts is dragged out over several more quarters. So the order book is increasing (Increased by 6%). Diebold expects a bump in revenue recognition sometime in Q4 onwards. It seems that banks are cautious to commit to big, long term contracts, only to find that there is little mileage as ATMs become under utilized.

And I won’t go into details here, but if you look at even their reduced guidance, it’s really not that bad as to warrant a 17% fall in the share price in 2 trading days.

Which leads me to my next point.

DIEBOLD NIXDORF

I entered a long position in Diebold Nixdorf… after researching on the reduced guidance, because of Dutech Holdings. So 1 thing leads to another.

This is probably a good, quick summary:

http://www.pymnts.com/news/retail/2017/diebold-shares-plunge-on-lowered-sales-guidance/

Upon release of the news, the share price tanked from $28 to as low as just below $20.

I thought the plunge was exaggerated, and decided to go long. My long position was not a pure equity positio though:

Following the plunge, I sold several far out of the money put options (that are unlikely to be exercised), sold some in the money put options at an exercise price that I’d be happy to buy at, and used the premiums to buy an equity position.

And of course, I didn’t buy at it’s absolute lows, but initiated a long position when there’s some sign of a rebound.

The way I see it, such a set up would only be a losing position if the share price suddenly continues to tank, such that my pure equity position loses money and all my put options gets exercised.

This is a scenario that is highly unlikely, since all the bad news have already been priced in.

If the share price even remains flat, it’d be a safe position because the premiums from the expired options would basically cover almost all my equity position.

As it stands, it’s been only 2 weeks since I’m done with my long position and the share price has continued recovering. I’m sitting on a profit of around US$4.3k right now at the time of writing (assuming put options all expire). I’d be looking to exit when the share price reaches the US$24.5 or so thereabouts.

GEO ENERGY RESOURCES

I added 100,000 shares on the 26/07/2017 at $0.24. Right now, I have a total of 600,000 shares at an average cost of $0.182.

Geo Energy is such a headache.

Coal prices have continued increasing unabated as I expected them to, going into the summer months. Yet Geo Energy’s share price has dipped.

What gives?

There are a few factors to consider: The average selling price of the coal it mines & the total volume of coal mined.

I think it’s safe to say that the ASP would be well protected in Q2. Geo is likely to report an ASP that’s not too far away from what’s achieved in Q1 (prob a tad lower), which is really not too bad at all.

For the record, the ASPs achieved looks like this:

2016Q1: US$26.66

2016Q2: US$25.17

2016Q3: US$31.40

2016Q4: US$38.93

2017Q1: US$39.45

I don’t think Geo’s ASP in Q2 would be too far from US$37 or so.

Geo’s ASP is pegged to Indonesia’s HBA index. After a sizable drop in June, the index has since recovered.

At the end client side, Chinese import coal prices at QinHuangDao has continued rising going into summer and is now again out of the range guided by China’s NDRC. They’re having real difficulty keeping prices in check.

So it’s safe to say that prices are still very much well supported.

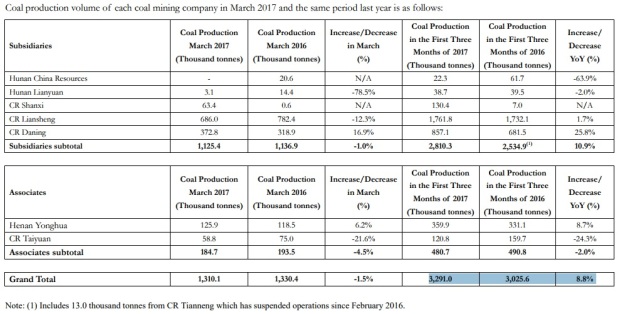

To investigate further, I looked into the major clients/end users of Geo’s coal.

In 2016, Geo delivered 5,510,723 tonnes and in 1Q2017, they delivered 2,212,893 tonnes, giving total tonnage of 7,723,616 tonnes.

Of which, China Resources Power is the end user for 2,189,149 tonnes or 28% of total volumes mined during this stated period.

Fortunately, China Resources Power is a public company listed on HKEx, so it is not difficult to dig into the happenings of the company.

Aside from power generation, the company owns several coal mines themselves too.

I’ve highlighted the thermal plants part under power generation, since that’s what we’re interested in. In Q1 of 2017, thermal power generation increased by 2.0% y-o-y.

During the same quarter, coal production increased by 8.8% y-o-y.

Now, let’s compare it to the 1H results to have a sense of how things have progressed.

In 1H, thermal power generation has increased much more rapidly, by 8.1% y-o-y

It’s more accurate to compare figures for each quarter against the preceding year’s, instead of comparing q-o-q due to seasonal demands. For example, Q2 and Q3’s thermal power generation is always going to be higher than Q1 due to the summer months.

Yet, the total coal production for 1H came in at -3.1%.

So let me give my interpretation of the results:

Thermal Power Generation: Q1 2017 increased from Q1 2016 by 2%, yet at the 1H mark, this same metric has increased by 8.1% y-o-y.

This can only mean that thermal power generation has increased in both 1Q2017 and 2Q2017 vs their corresponding periods last year, but has increased at a faster rate in 2Q2017 vs 1Q2017. So the nett effect is that we know that China Resources Power burnt coal at a faster rate in 2Q2017 vs 1Q2017, and also in 2Q2017 vs 2Q2016.

Coal Production: Q1 2017 coal production increased by 8.8% y-o-y, yet at the 1H mark, this same metric has actually decreased by 3.1%. This can only mean that coal production in Q2 of 2017 has dropped so much vs the corresponding period in 2016, so as to drag down the change from a +8.8% as of Q1, to a -3.1% change as of 1H.

So the overall conclusion is:

Comparing Q2 vs Q1, rate of thermal power generation increased, whilst the coal mined rate decreased.

Logically, this means that they’d have to import more coal in Q2 to make up for the shortfall.

Now, that’s a good conclusion to have for Geo Energy.

Perhaps the best indication of well supported coal prices comes from this profit warning by China Resources Power:

This is not foolproof though. China’s NDRC has been encouraging utilities to lock in long term contracts with local miners. So we don’t know for sure whether the amount of coal taken from Geo Energy has increased or decreased or stayed the same.

In addition, from reports at the QinHuangDao ports, it seems that utilities and coal importers are locked in a standoff over prices. Coal importers are unwilling to lower prices, but utilities are unwilling to buy either. So we have a stasis whereby prices look high as evidenced by the coal indices, but the actual volumes transacted are reportedly very low.

And therein lies the uncertainty. The uncertainty for Geo Energy lies in the amount of coal mined. Prices are going to be ok, but can they deliver?

Add on to these worries is rainy weather that may again curtail mining activities.

Volume though, is not my biggest concern, although judging from comments on IN and other forums, that’s what most people are looking at. As recent as a couple of weeks ago, management has reaffirmed their commitment to a 10mil tonnage target for this year. Q2 has already concluded, so they’d know the figures. Surely they’d revise if they think it can’t be met.

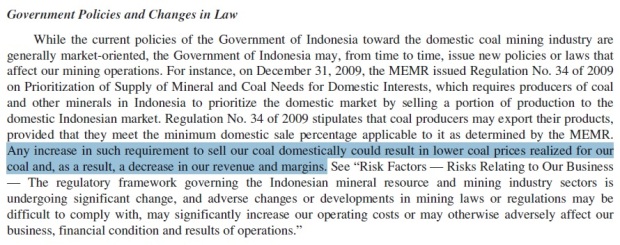

My biggest worry is actually this:

Regulation No. 34 of 2009 and the relevant update: Regulation No. 23 of 2010

For the serious investor, you can read the hardcore version here:

Basically, Indonesia’s government wants to limit both the total coal mined, as well as the volume of coal exported. The rationale is to control the amounts of coal, such that there’s adequate supply for domestic use as part of their nationwide electrification plan starting in 2019.

http://www.globalindonesianvoices.com/30567/government-prepares-new-regulation-to-limit-coal-export/

Any regulation to limit the annual total volumes of coal mined, or to increase the amount miners would have to set aside for domestic consumption, would be bad news for Geo Energy.

As described in their own latest investors update:

So there.

I’m cognizant of the positives for the company and the potential road bumps ahead.

By doing a simple extrapolation of Q1 results, the projected PE ratio based on the current share price is a ridiculous 3.5 times. At these levels, I think there’s sufficient MOS for me to increase my position.

ISHARES BRAZIL ETF (EWZ)

I previously posted about my long position in this in IN, but not here.

This is what I’d classify as a classic “distressed” situation.

On the 17th May 2017, news broke of Brazil’s president Michel Temer being involved in yet another corruption scandal.

I said “yet another” because his predecessor and close ally, Dilma Rousseff, was similarly caught in a corruption scandal which caused her the top job.

I won’t go into the specifics of the scandal, but it makes for an entertaining read. Personally, I think we have the makings of a oscar winning movie right here. Just need a director to pick up the juicy bits, it certainly is more exciting than many other movies:

http://www.bbc.com/news/world-latin-america-35810578

The markets took the news of the scandal hard. Real hard. The iShares MSCI Brazil Index (EWZ) fell close to 20% in 2 days!

I took notice immediately and set out to find out all details of the case, why the markets are reacting the way it did, whether it’s justified (for sure there’s a fear “premium”, but sometimes, the fear is completely justified), and with all the facts, tried to figure out how things would look like 1-2 years out.

Personally, I love mispricing in the markets caused by political problems. This is because these are usually relatively transient in nature, and can be resolved relatively quickly. The one big exception is if it’s war.

War is a different ball game. It can drag on and on and on and while you can capitalize on the increased volatility by buying and selling because of the relatively large drops and rises, within the period of war, IMO it is a tough game to play. I’d rather stay out.

Anyway, back to this.

The brazilian markets took the scandal hard because well, they have had 2 presidencies affected by corruption within a very short period of time. On top of that, his predecessor was forced to step down.

Michel Temer was also in the midst of implementing tough reforms. Reforms that were viewed favorably by the markets. With a prior precedent, it was feared that he’d be impeached, forced to leave and throw all these reforms in disarray.

The share price tanked as low as $33++.

Of course, I didn’t get it at the bottom. Hardly anyone ever does. And IMO, it’s not wise to try to.

When it comes to the international markets, because of the sheer number of participants, moves are much more exaggerated compared to SG markets. I’d usually prefer to wait till there’s some recovery. To top it off, if I’m uncertain, I’d prefer to build positions (both long and short) using options. The premiums involved would give a measure of protection. Of course, the tradeoff is that when it recovers, I might not always get the maximum returns, but that’s ok. I don’t have to win everything.

Anyway, I started building long positions with options when the share price was around $35. As of the time of writing, it was recovered strongly at $37.3.

In approximately 2 months, the price has recovered a cool 13%.

I’m not going to bother to annualize it, but certainly that’d make for some eye popping returns.

My position was built mostly by selling deep in-the-money put options. 2 of which were exercised, and I swung to selling call options, which were also exercised. In short, I’ve benefited partially from the share price recovery, and partially from the premiums from the options.

And why EWZ? I figured that the I really wanted exposure to Brazilian banks, since many of the reforms revolve banking rules. But since it’s difficult to get direct exposure, plus I’d need to get exposure to several banks at the same time (to diversify and spread risks), it’d make much more sense to buy an ETF on the general index. (Anyway, the index’s top 2 constituents consisting of 19% of the ETF is in financials)

It’s been a nice recovery, and in a relatively short period of time.

Too bad I didn’t build too large a position. The returns ROI wise would be great, but the quantum is too small to make a significant impact on my portfolio returns.

Still, it feels great. :)

That’s all I have for this long post.

Next week marks the start of earnings reporting season again.

Life is exciting.