LOL I wish.

But surely the coincidence is uncanny?!

In my earlier portfolio update post a couple of weeks ago (Portfolio Updates – 11/09/2016), I wrote about my options in Chesapeake Energy. Let me quote partially:

“…..The magnitude of the rise has been so damn crazy, that my call options at $7 got exercised…..

Now, I am not overly worried about CHK though, as IMO, the share price will drop again and I have now swung to selling put options.

When markets open on Monday, I really hope CHK drops drops drops, so that I can sell put options again, and hopefully they get exercised <$7, netting me a nice differential in the price, + premiums when my put options were sold earlier, + premiums when my call options ARE sold on Monday.

For now, it’d be really really nice if CHK drops to say… $6 or so. Then of course, please start rising after that to infinity.”

well, literally on the next day (12/09/2016), this guy sold down more than half his enormous stake in CHK at around $7. For tax reasons, he said.

The timing is absolutely uncanny. Either:

- TTI = Carl Icahn

- Carl Icahn is a fan of SG TTI

- TTI lucked out

No prizes for guessing which is the correct answer.

CHK share price has responded accordingly:

So has TTI.

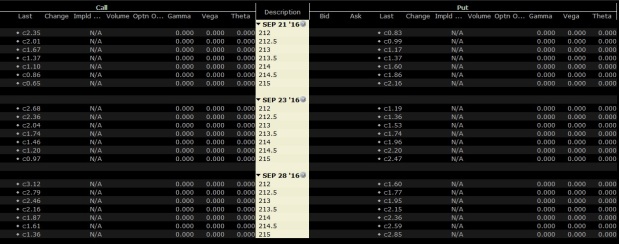

I’ve swung to selling put options like I said I would, and collected fat juicy premiums. 1 bunch of those options got exercised, and I’ve ended up buying back at a lower price, whilst collecting premiums several times (many expired)

That was immensely satisfying.

In fact, the premiums alone paid for my recent family holiday. So…Thanks, Carl. Now, please give me a month or so, then go buy back what you sold.

Ever since I’ve sold my major holdings in Hock Lian Seng and Metro Holdings, I’ve been looking out for a place to deploy capital, partially or fully. In the past week since returning from a long trip, I’ve been getting up to speed on my research.

I’ve come to realize that there’s ALWAYS something more to learn about a company that I’m analyzing. Each time I think I know all there is to know, if I do go back and start asking questions and poking around my thesis, I always come up with more questions, which in turn leads to more questions and more work. Kinda like nuclear fission.

In the past week, I’ve been trying to figure out how a company capitalizes borrowing interests. Thus far in my investing experience, all borrowing interests have always been expensed, i.e. they are recorded in full in the period that they are incurred.

This company that I am researching on, capitalizes them. Nothing wrong with that, just that for someone who is not accounting trained, trying to trace the multi year data in the income statement and balance sheet is a major headache.

I’ve since come to the conclusion that the answers to the questions I have… cannot be found in CONSOLIDATED financials. So unless I am working in the accounts department of the company, there’s no way I’d know.

I think their IR is pretty bemused about this dude asking them weird, micro-specific accounting questions. Or maybe the questions are noob questions, and they feel irritated about giving accounting lessons to a, as yet, non-shareholder.

Still, nothing is ever wasted. I feel like my knowledge got upgraded. I am pretty confident that most of the current shareholders do not know about the capitalized interest costs, much less try to track them. It may not be relevant per say to the investment, but any extra knowledge gleaned that the general markets do not know/bother to know, IMO, is a competitive advantage. It’s use may come later, perhaps much later in a separate situation altogether.

I’ll probably post my investing thesis when I am done accumulating. The problem is my work spans several months, and my thoughts are in depth. Putting all that in a coherent way for others to read easily, simply takes time to organize. It’ll probably be awfully long too.

I’ve had feedback that I shouldn’t break up my investing thesis into “parts”, as some readers who have read part I, feel frustrated at having to wait for part II. Or maybe when they read part II, they would’ve forgotten part I and have to go back? Anyway, I’ll keep that in mind.

I’m just awaiting some answers, and then I should feel confident enough to accumulate. I’ll probably allocate something between $100k-$200k to this, pending the liquidity. I’m in no hurry to accumulate, cos my view is tending towards the bearish side for the rest of the year. Anyway, the liquidity ain’t that high for me to accumulate quickly.

In the past month, I’ve made some cosmetic, small divestments in my existing holdings, whilst still retaining the main bulk.

Reason for that is simply portfolio management. Some holdings are disproportionately large, and I’m taking some profit off the table to trim it down. For another holding, it’s taking some losses off the table.

Anyway, I think it’s time to move on to another company to analyze. (Like I said, each time I go back, I always find more things to find out about). This is actually a fairly easy/ non-complicated company to study and I took 3 months. Gotta buck up.

I’m open to suggestions / requests to analyze companies. Please feel free to drop them my way. But of course, please make sure it at least remotely fits the bill of “deep value”. For eg. if it’s P/B is >3, I don’t usually bother to look further.

Oh, and if there’re any accounting experts who’d be kind enough to lecture me about the capitalization of borrowing costs, please drop me a mail.

Lastly, I’ll end with a pic of the amazing library I said I’d visit in Stuttgart.

Oh for those who’d be in Austria, I’d highly recommend this:

Eisriesenwelt Ice Cave – The largest Ice Cave in the world.

It’s a crazy climb up to reach just the entrance as you can see, and this photo is taken AFTER a 20 mins drive uphill, a 30 mins hike AND a steep cable car ride up, and there’s another 1hr+ of climbing inside the caves, so don’t plan on doing this during retirement. Your wallet may permit it, but your body sure as hell won’t.

No photos are allowed inside, but here’s the wiki link about it:

https://en.wikipedia.org/wiki/Eisriesenwelt

With regards to travel, I always tell my friends:

When you’re young, you have the time and the energy, but no money

When you’re middle aged, you have the energy and the money, but no time

When you’re elderly, you have the money and the time, but no energy

There’s just no ideal time, (unless you are born wealthy), so you just have to start ticking off your bucket list NOW.