I’m taking an ass beating from Mr Market of late.

After what was prob 1 of the greatest start to the year (https://thumbtackinvestor.wordpress.com/2024/01/16/thumbtack-fund-report-20-500k-usd-in-2-weeks/), TTF has lost all the stellar gains, and more, all in the span of 1 month.

My troubles started literally right after CNY, and since then, what can go wrong, has gone wrong, what cannot go wrong, has also gone wrong and what is already wrong, has gone more wrong.

Here are the numbers:

2024 (YTD):

SPY: +8.31%

VT: +6.37%

STI: -3.29%

TTF: -4.99%

SINCE INCEPTION (FEB 2020), ANNUALIZED:

SPY: +13.93%

VT: +10.25%

STI: -0.15%

TTF: +19.07%

Note: Returns are MWRs, all figures in USD

TTF’s NAV: USD 3,126,486.21

Deposits/Withdrawals: USD 2,053,609.26

Net capital gains since inception: USD 1,072,876.95

For reference, the last fund report: https://thumbtackinvestor.wordpress.com/2024/01/16/thumbtack-fund-report-20-500k-usd-in-2-weeks/

Since TTF was incorporated in Feb 2020, this means that TTF has enjoyed a net gain of USD 1,072,876.95 over a period of 48 months of investment activity, which works out to be USD 22,351.60 every month, or approximately SGD 29.8k per month from Feb 2020 to date.

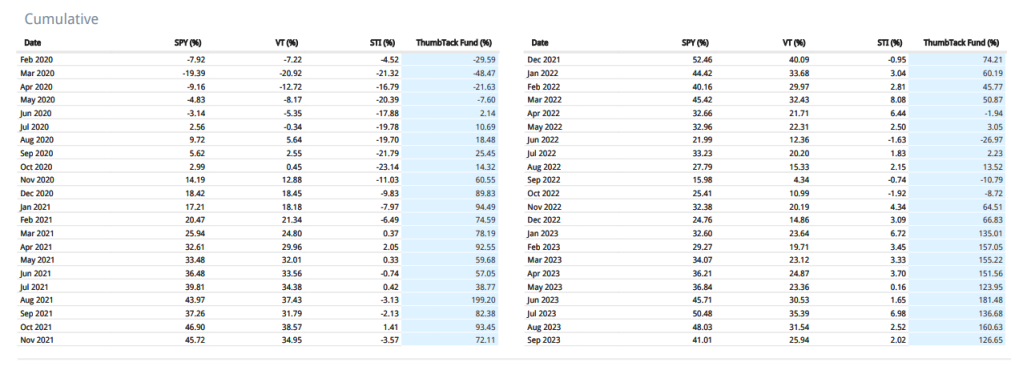

Cumulative ROI (Feb 2020 to Mar 2024):

SPY: +70.51%

VT: +49.08%

STI: -0.63%

TTF: +104.31%

TTF has generated double digit money weighted returns every year since inception:

2020: +89.83% (https://thumbtackinvestor.wordpress.com/2021/01/02/thumbtack-fund-report-6-rose-of-jericho-2020/)

2021: +24.91% (https://thumbtackinvestor.wordpress.com/2022/01/07/thumbtack-fund-report-10-hello-2022/)

2022: +11.94% (https://thumbtackinvestor.wordpress.com/2023/01/02/thumbtack-fund-report-13-hello-2023/)

2023: +33.81% (https://thumbtackinvestor.wordpress.com/2024/01/04/thumbtack-fund-report-19-macro-thoughts-for-2024/)

2024 YTD: -4.99%

Thus far, I’m able to write that “TTF has generated double digit money weighted returns every year since inception”.

Maybe I won’t get to write this after this year.

It’s an uphill task to turn this around, after a disastrous start. 1st quarter of 2024 is almost over, which means I have another 3 quarters to turn around a -5% YTD MWR and make it double digits. Tough.

So what went wrong?

Almost everything man.

But I’ve analyzed and recognized that most of the losses came from several short positions (which I shall not name), as well as a sizable long position in natural gas futures. And right this instant, natural gas is un-naturally unwanted.

Within the span of 1 month (since the last report), TTF’s AUM has dropped from about $3.7mil, to the current $3.1mil or so. That’s a huge $600k usd reversal in the span of 1 month! Damnit. I should’ve liquidated everything before CNY, and gone on a 1mth sabbatical leave and go travel into the far reaches of the planet, staying off the grid, and I’d now return to SG, 1 month later, and $600k usd richer.

It’s crazy.

And hmmm. Not very fun, to be honest.

But then again, neither am I hitting the panic button. Cos this isn’t my 1st rodeo. Not the 1st, won’t be the last time either.

Furthermore, when times were good, I’ve already mentally prepared that there’d be 1 such tough period coming up anytime. In fact, I’d be surprised if this didn’t come.

OK, I’m gg to bunker down and fight my way outta this rough patch.

Afterall, a $600k reversal is just merely 1x concentration into a really good idea, OR average positioning into 2 or 3 moderately good ideas. And historically, I’ve been able to get a least a couple of moderately sized ideas successfully.

The gauntlet has been thrown.