Warning: Picture intensive post ahead

I took my family, in-laws included, on a 10 day holiday to Sri Lanka recently. This was my 77th overseas trip that I have documented, excluding all the travelling done as a kid, before digital cameras were a thing. Which sounds like a lot, considering I’ve existed for only 41 yrs.

Anyway, in those days, we didn’t get to do much travelling as money was tight. The furthest and fondest memory I had was going to Bangkok by coach. Yes, by coach. Like I said, money was tight then. And budget airlines were also not a thing yet.

So now, as an adult, I’m doing revenge leisure travel and adventure. It’s really my 1 only major expense indulgence anyway.

So here’s a mini photo bomb, I’m just throwing in pics without faces:

Chilling by the Laccadive Sea. Those little things sticking out in the sea are fishermen on their rudimentary boats doing their thing.

Some local fish market by the beach. The local fishermen literally sell their wares right by the shore when they return, so this is as fresh as it gets. The catches were still jumping around when displayed.

Elephant sanctuary

My favorite photo of the trip. Dambulla Cave Temple. This place is so serene and surreal. There’s a little climb up though, not exactly accessible for elderly folks.

2000 yr old half asleep Buddha. Eyes not closed yet so I asked him to bless TTF with continued mind blowing returns.

I think it kinda worked.

Word of caution: when you go to certain places, do EXPECT to be scammed. Some temple guide came to show our entire group around without us asking. I’m not dumb, I expect to have to pay, hence I asked for the price. He quoted us a price, and I just accepted it without negotiating. It’s not a big sum, and maybe I was in a good mood, or maybe Mr Market made me feel generous recently. But it was only at the conclusion of the tour, when we exited, that I saw a sign quoting the rates, and said temple guide whacked me a 400% markup from the actual listed price!

Ah well. Expect to be scammed. Go out to play is like that one. Most important is that everyone had fun, and there were memories created.

Also, funny thing is, it says you’re not supposed to take photos at certain areas. But when we pay a premium for the temple guide, suddenly he’s all smiles and super enthu to take photos for us, anywhere. Money works wonders.

Top of Sigiriya Rock. As luck has it, it was a national PH that day, and the locals turned out in full force to climb with us. On hindsight though, it’s not such a bad thing either. Would be scary to climb it alone without so many bodies “bracing” you along the way.

TTI pondering where to fire my proton cannon at.

Now, because of the protests last year, tourists still haven’t returned to the country en masse. The country desperately needs tourism dollars, so they’d treat you like semi kings. All the different fancy 5 star hotels we stayed in were almost practically empty.

TTI being TTI, I like to go where nobody else wants to go.

Food is great. Food is very good in fact. But having buffets every single meal just gets kinda sick after a while. Too much of a good thing can be terrible.

Accidentally sniped a korean chio bu in the dessert room.

Gems and precious stones. The country is rich in all precious stones (Except diamonds). Such a pity that they’re in this state despite being blessed/cursed with natural resources.

Buddy of mine actually bought this. Solid, carved from a single trunk table like this costs USD 9.8k, and that’s before shipping.

Chanced upon locals playing cricket while doing some evening self exploration. 1 of them jio-ed my kids to join in cos they were so interested. Playing cricket in the highlands, with the setting sun as the backdrop, with the locals. Look at that gorgeous backdrop. What an experience.

9 arch bridge and it’s surrounding tranquility:

Morning view from my window:

Yala National Park Safari:

See if you can spot the croc hiding in the waters, just waiting for the sambar deer cooling down in the shade below the tree to get up and take a drink in the water…

Entire safari is about 5hrs long, and towards the end, it got a bit boring as our guide tried to search for the elusive leopards. Now, we read online reviews, and everybody says they didn’t find the leopards. So much so that it seemed like a scam. Our guide says he saw leopard prints in the sand, and went around searching for an hour. We were just circling around and around and the kids were dozing off when suddenly…..

Not only did we find the leopard, we caught it just right before it was starting a hunt! The leopard started chasing a wild hare, which escaped by darting below our jeep and across the dirt road! Everything happened so fast that I couldn’t even capture it on camera. My kids screamed cos the leopard literally came right beside us in the chase, almost smashing into the side of the vehicle.

Leopard resting after a failed hunt.

Guide told us that this is the 1st leopard sighting after 25 expeditions, and the 1st ever that the leopard came this close.

Salt brine pools:

This dude is a paid actor. Only started “fishing” when our boat got near, and I didn’t see him catch a single thing all day.

Live baby croc for you to touch.

This turned out to be 1 of the highlights: Turtle conservatory and hatchery

You could pick up and handle these live 2-4 day old turtle hatchlings. That was 1 of a kind experience for the kids.

You could also pick up 1 of the adult turtles. The flippers are actually damn strong, and when the turtle flaps, it actually hurts when the flippers hit you.

Rare albino turtle which cannot be released because it’d stick out like a sore thumb and get eaten.

Maimed turtle from fishing nets / boat propellers

Overall, this is really highly recommended, esp if you have young kids. We almost skipped this cos it didn’t look like much, but I am so glad we didn’t.

Time for some adventure:

Of course, can’t miss the Sri Lankan crabs:

China owned ports:

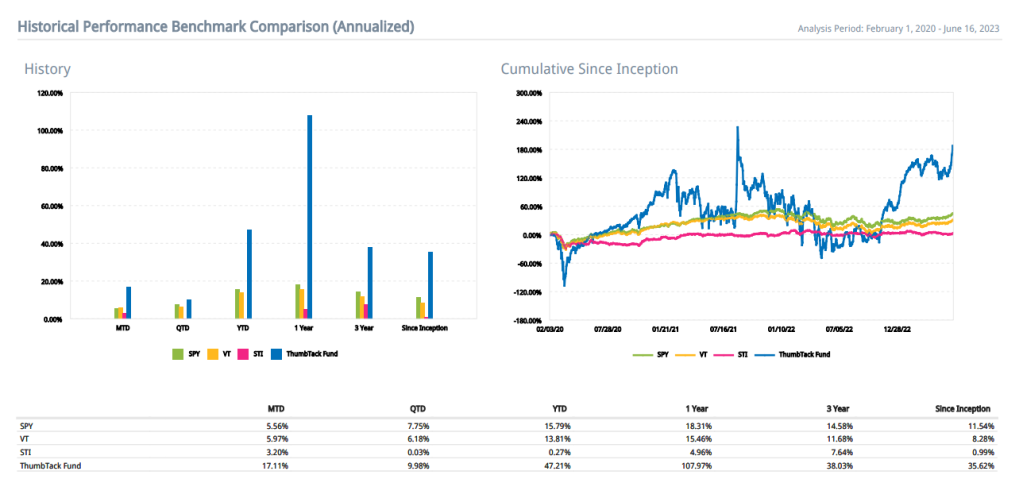

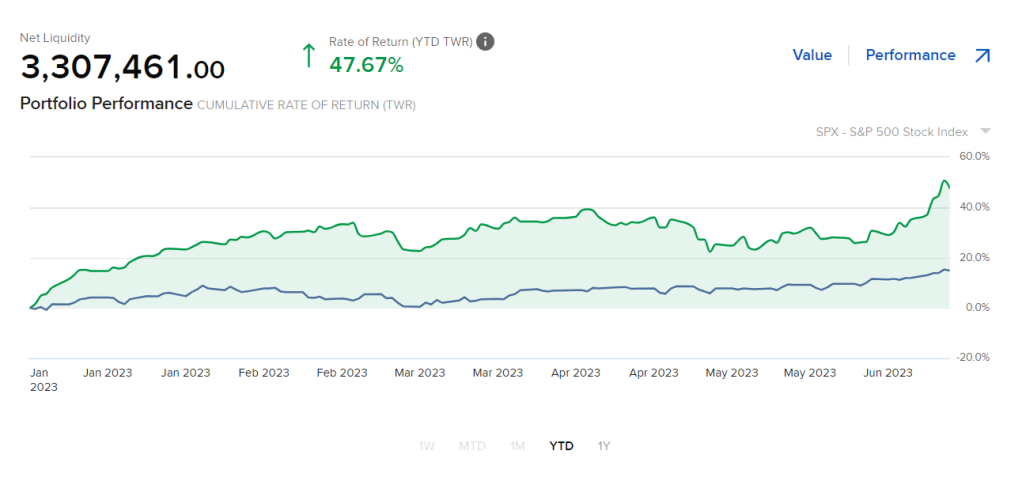

YTD 2023:

SPY: +15.79%

VT: +13.81%

STI: +0.27%

TTF: +47.21%

SINCE INCEPTION (FEB 2020), ANNUALIZED:

SPY: +11.54%

VT: +8.28%

STI: +0.99%

TTF: +35.62%

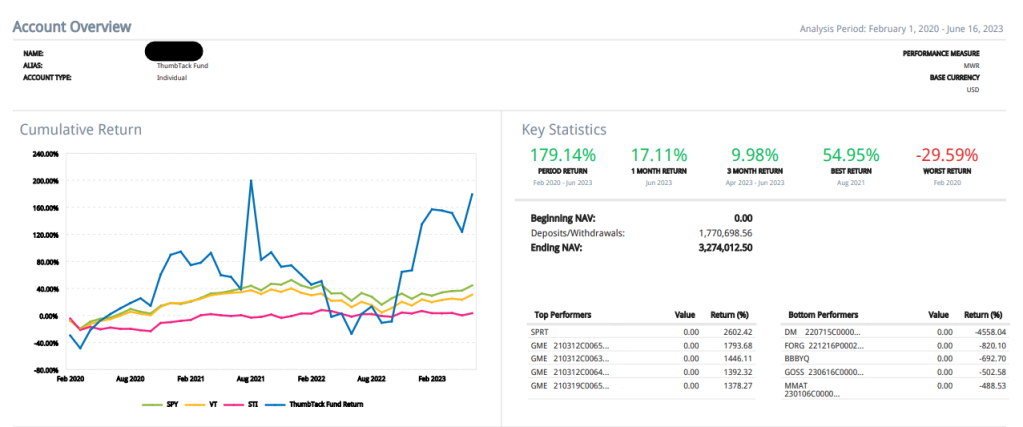

Note: Returns are MWRs, all figures in USD

TTF’s NAV: USD 3,274,012.50

Deposits/Withdrawals: USD 1,770,698.56

Nett capital gains since inception: USD 1,503,313.94

For reference, the last fund report: https://thumbtackinvestor.wordpress.com/2023/04/06/thumbtack-fund-report-16-caught-a-falling-knife/

Since TTF was incorporated in Feb 2020, this means that TTF has enjoyed a nett gain of USD 1,503,313.94 over a period of 40 months of investment activity, which works out to be USD 37,582.85 every month, or approximately SGD 50.3k per month from Feb 2020 to date.

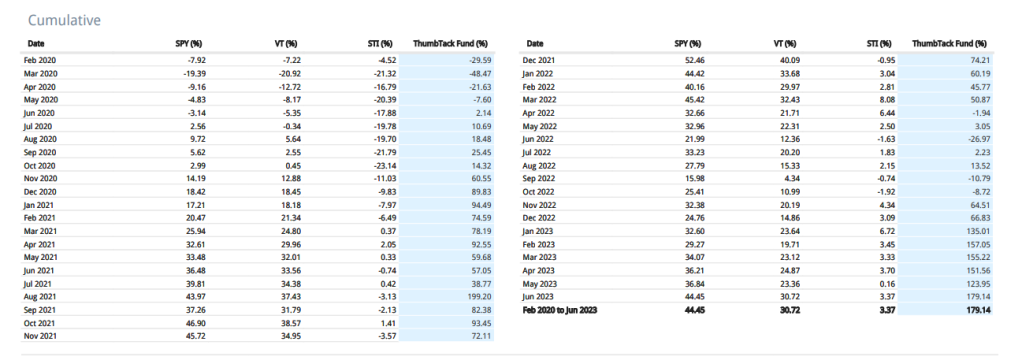

Cumulative ROI (Feb 2020 to Mar 2023):

SPY: +44.45%

VT: +30.72%

STI: +3.37%

TTF: +179.14%

TTF has generated double digit money weighted returns every year since inception:

2020: +89.83% (https://thumbtackinvestor.wordpress.com/2021/01/02/thumbtack-fund-report-6-rose-of-jericho-2020/)

2021: +24.91% (https://thumbtackinvestor.wordpress.com/2022/01/07/thumbtack-fund-report-10-hello-2022/)

2022: +11.94% (https://thumbtackinvestor.wordpress.com/2023/01/02/thumbtack-fund-report-13-hello-2023/)

2023 (YTD): +47.21%

Markets have rallied strongly this year, off the backs of a tough 2022.

SPY has done well, and is up double digit % in 1H 2023. TTF has done well too, continuing to outperform SPY significantly, never spending a single day below SPY thus far this year. I continue to find a lot of opportunities of short term mispricing to exploit.

The recent strong alpha generation comes from the top 2nd largest and 3rd largest positions playing out. I’m still waiting for the largest position to succeed, and if so, I’d really hit the pay dirt.

Inflation has trended down, and with that, comes a wave of optimism in the markets as participants expect the Fed to cut rates in response to a downturn. I am less optimistic, but then again, my positions are independent of my macro views.

I’d also point out that inflation measures prices y-o-y, meaning it’s a lowered rate comparing against the prices that have already risen this time last year. It also means prices are still rising, and not falling. All this against the backdrop of a stressed american consumer laden with household debt, and facing potentially job cuts in a slowing economy.

The key to long term outperformance lies in staying in the green during tough years, and yet, not missing out on the market gains during green years. This beats having some red years, and then having some very very green years.

I read a post on IN talking about compounding sometime back, and that reminded me that I did a comparison before years back: https://thumbtackinvestor.wordpress.com/2017/11/05/tti-is-banking-on-the-eighth-wonder-of-the-world/

That post was written in in 2017, so that’s 6 years ago.

It’s mind boggling to think of it, but check out the 2 tables for comparison.

In short, a consistent CAGR of 20%, beats a return of 10% in most years, with a massive +60% in 1 year, but also a -10% in 1 year. Once we understand this illustration, we’d understand how important it is to avoid losses.

I wrote about a similar strategy employed by my buddy, the famous hedge fund manager Chua Soon Hock: https://thumbtackinvestor.wordpress.com/2023/04/01/seeking-to-improve-the-art-of-money-management-within-the-science-of-probability/

Do whatever you want, just don’t lose money.

Also, based on the table of compounding 20% per annum, TTF’s AUM is now closer to the “Year 8” mark, whereas that post was written 6yrs ago, so I’m ahead currently. Another 27yrs of 20% CAGR and I’d hit the $600mil mark….

6 yrs on, TTI is still banking on the 8th wonder of the world.

2 comments