I’ll try to do a comprehensive analysis on this company, it’ll be in 2 parts:

- Background and history of the company, qualitatively and quantitatively.

- Fundamental analysis, projections and my conclusion

Here goes.

LTC Corporation was previously known as Lion Teck Chiang. The company has 4 main divisions:

- Steel Trading – Supplies steel for the construction industry in Singapore. This is the major division, accounting for the bulk of the revenue of the company. There are 2 factors involved here: the prices of steel as well as the tonnage of steel delivered by LTC Corp.

- Property Development – Develops properties for sale in Singapore (Teck Chiang Realty), Malaysia (Che Kiang Realty) and China, mainly in Shenyang city (Kairong Developments)

- Property Rental – Owns and rents out 4 blocks of freehold industrial property at Arumugam Road. The company HQ is located there as well. Conveniently situated just outside an MRT station.

- Retailing – Recently acquired 50% of USP Equity Sdn Bhd, which in turns owns 90% of SOGO Departmental stores in Malaysia

LTC Corporation (formerly known as Lion Teck Chiang), is actually part of a complex web of companies known as the Lion Group, linked to the Cheng family. Several of the companies within this web are listed in the Malaysian stock exchange and they are diverse in nature, ranging from construction to retail to investment holding to construction material suppliers.

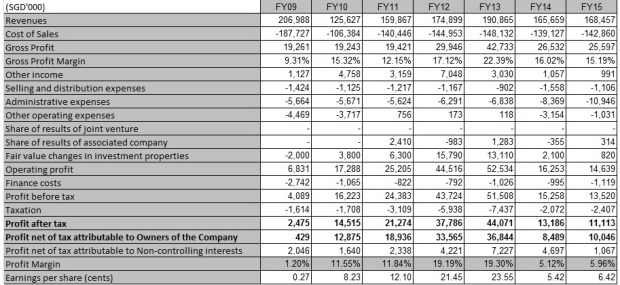

Let’s look at the income statement:

At 1st glance, one can already tell that FY12,13 were bumper years for LTC. As they derive most of their revenue and profits from the steel trading division, the property construction boom during those 2 years really added to their margins. Revenue, GPM, NPM and earnings were all at multi year highs.

GPM is broadly in the mid-teen range, except for the 2 bumper years when it was higher at 17.12% and 22.39% respectively

The NPM though, has really fallen off a cliff in recent years. In FY10, it was 11.55%. In FY11, it’s 11.84%, and 19%+ for FY12 and 13. Since FY14 onwards though, the NPM is barely 5%+.

Why is there a discrepancy between the relatively stable GPM, whereas the NPM has tanked?

The answer lies in the “Fair value changes in investment properties”.

LTC owns 4 blocks of freehold industrial buildings along Arumugam road, It’s conveniently located just outside an MRT station, and LTC has enjoyed stable occupany rates for several years. Even their own office is located there.

Every year, LTC gets this property valued professionally, and books any gains or losses in the income statement such that the property is marked to market in the balance sheet. Except for FY09, LTC has recorded such gains every year. The gains are especially significant in FY12, 13 as they are about a third of net profit. That’s a significant boost to earnings.

In line with the more subdued property market, the “investment gains” has been tempered down greatly, being only $820k in FY15.

When property prices are rising, the mark to market gains are great. When they start falling though, LTC then has to start recording losses.

To get a more accurate picture of earnings, we can strip away any extraordinary gains (such as gains from mark to market manoeuvres) :

Still not a pretty picture. But at least the earnings volatility has been greatly reduced.

So aside from the “Extraordinary gains”, what’s the reason for the fall in earnings in the past 2 years? Answer: Steel price.

The breakdown of the profit looks like this:

In FY15, profit from steel trading has dropped drastically. This is despite higher tonnage delivered. The fall has been so drastic that margins are now a measly 1.76%.

I shan’t post the full compiled balance sheet here, as there’s just too much figures and it clutters up everything. But here are some of the related ratios:

At the current share price of $0.53, LTC is trading at a ridiculous 66% discount to book value. The dividend has been cut in the most recent quarter in FY16. This discount reflects the myriad problems facing steel players currently. LTC has always traded at a discount to BV, but such a wide discount is unusual.

Let’s look at the condensed cashflow statements:

Somewhat surprisingly, LTC is free cashflow generative pretty consistently. This is my experience with previous steel stockists as well. The steel trading business is generally straightforward and boring, but it is a stable business in terms of generating FCF.

Alright, now that we have the data, part II is where the fun begins.

3 comments