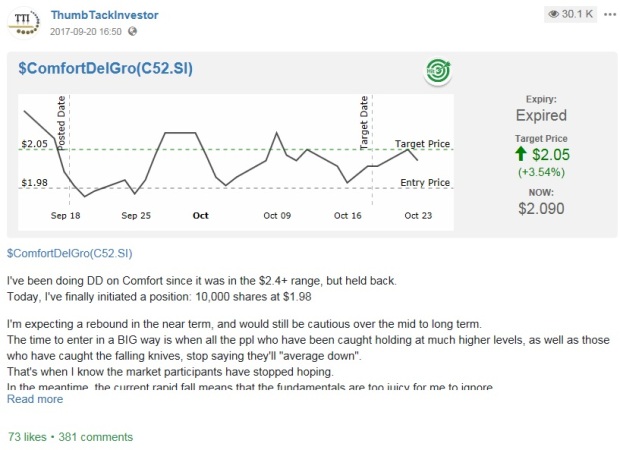

My style is to normally have some frivolous stuff at the start, before jumping into the hardcore investing stuff.

But since I’m here paging for some deep pocketed white knight to look at unlocking the value for LTC Corporation (further), I’d better just get into it right at the get-go.

Last Friday (I think it was the 9th Feb), was one of those rare days whereby I literally bounced around with a spring in my step. EVERYTHING went well for me that day. Like everything. But I’ll just talk about 1.

It was 1 of those days whereby I could play tennis with a brick wall… and win. In short, invincible.

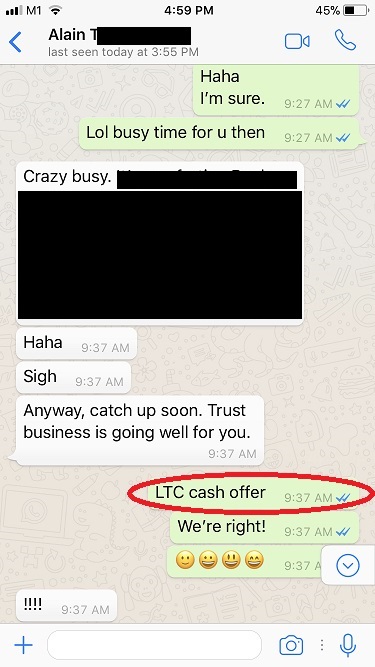

The day started with a barrage of text messages from some fellow investors:

For the uninitiated, Alain T is a fellow value investor, and I’ve previously published (with permission of course), his work on LTC & S i2i:

As you can see, here we are, postulating about a possible privatization offer. We wouldn’t dare bank on that, but one can certainly hope. And the story continues:

Then 15 mins later, we’re high-fiving each other:

And it wasn’t just text messages. It was emails as well. Emails such as these put a smile on my face. Always nice to hear from fellow drs:

So there we are. I took my own sweet time and only just got around to really looking at the offer documents yesterday (After my hot valentine’s day date, of course). Let me break it down right now.

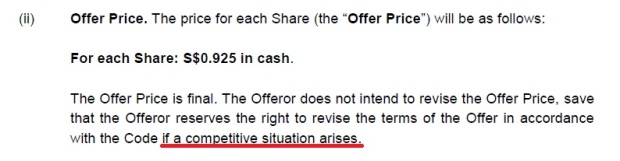

LTC’s family dominated management is offering a buyout of all minority shareholders at an offer price of $0.925. At 1st glance, it’s a great deal. For starters, it exceeds the highest share price LTC has ever reached, since the year 2000.

This means that any shareholder who has bought shares in the past 18 years, would’ve made money. That’s pretty much everyone.

For me personally, since my ave. price is around $0.72, this would give me a ROI of about 28.3%. Not great, but not too bad either. Especially since it’s coming at a time when I’d like to liquidate something. So timing’s good.

Since the offer price is also a massive 45% gain from the last traded price before the trading halt, it’d also give a massive bump in portfolio values compared to the start of the year, so I’d really like to see how STI ETF beats me this year.

But the Chengs fail to illustrate how fantastic a deal they’re getting as well.

So let TTI illustrate it.

1. Offer price is at a steep discount to book value

As of the mrq, LTC’s book value is a massive 164.51 cents. This means that the offer price is a mere 56% of the book value. The Chengs are buying 164.51 cents worth of assets per share, for a mere 92.5 cents.

2. Steel prices are rising

As I’ve illustrated in previous LTC posts, LTC’s inventory is booked via a weighted ave cost method. This means that in a rising steel price environment, their profits are MAGNIFIED.

LTC Corporation & Asia Enterprises Holdings – What Are Investors Missing?

under “Inventory Accounting”

3. Solid Balance Sheet, FCF Generative

The Chengs are offering 92.5 cents… for a company’s whose book value is 164.51 cents, of which 28.6 cents are held as cold hard cash. The company has next to zero debt. ($4,000 of debt. LOL, yes! $4k!)

As I’ve illustrated in earlier posts as well, the company is also FCF generative, year in, year out.

4. Project Pipeline & Future Potential

I’m sure the Chengs know this.

LTC’s residential property development in Penang is proceeding well (Gem Residences).

Their SG industrial properties (Lion Buildings) has previously been written down, and with it’s central position just beside an MRT station, as well as a backdrop of recovering demand for industrial spaces, there’s great potential for upwards revaluation of the property, even without redevelopment.

5. Lowball Offer Price

Perhaps, even the Chengs know this:

The thing is, I can understand how hard this must be for a potential white knight to come and make a higher bid.

The Chengs control just under 50% of the company. Any offer price would’ve to extend to the shareholdings of the Chengs as well. And if the white knight is not looking to operate the company as a private entity, they have to worry about getting into a war and eventually having the Chengs sell out to them instead.

Although I think that’s a highly unlikely scenario.

The Chengs WANT this. They just want it cheap.

Hell, I think even at $1.10 per share, they’d snap it up in a jiffy!

Cos even at $1.10, it’d represent a mere 67% to book value. That seems fair, since we do have to give a discount to book value for acquirers. (Again, I wrote about it some time ago. Steel players have to be acquired in it’s entirety, at a discount, since their book value mainly comprises rebar steel. It’s kinda like a “bulk discount” if you’re buying a lot of inventory at 1 go)

Remember the book value, the cash holdings, and the fact that their inventory would be inherently revalued upwards in an environment of rising steel prices.

What Next?

The acquisition offer is such that the offer will only be valid if the offerer receives acceptances resulting in the offerer owning at least 90% of the company.

That’s the threshold required to compulsorily delist the company. (Cos anyway, if it’s not, SGX will suspend trading in the company if the public float falls below 10%)

In other words, as it stands now, if the final result is such that the offerer does NOT own 90% of the company, this offer may cease to be valid.

They do reserve the right to lower the acceptance rate to 50% though, although they won’t be able to delist the company then. (They’d just acquire more shares)

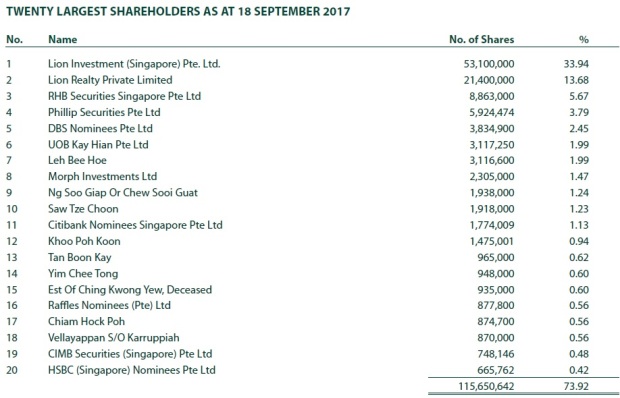

Although the Chengs now collectively own just under 50% of the company, trying to get 90% acceptance is not that easy. We just need a few larger shareholders dissenting and holding out. And for all we know, that might be a real possibility.

Bunch of secret shareholders hiding their holdings under nominee accounts in banks and brokerages.

Plus there’s the highly respected Morph Investments. Those guys are long term value investors, showing up in top 20 shareholder lists in various deep value situations, and they’re certainly extremely patient guys.

It’d be certainly interesting to see if they’d agree to let go of their substantial stake at a discount. I wish they’d let me know their thoughts. I’d be happy to vote the same way they do.

So it’s certainly not impossible for the Offerer to fail to own 90% of the company. The holdings of the nominees alone would account for more than 10%.

Right now, the share price trades at a puny discount to the offer price, indicating that the markets generally do not think there’d be a competing offer, and that there’s a high likelihood of the offer succeeding.

So for minority shareholders, this presents a conundrum.

You see, it makes sense to just accept the offer right now. Simply cos if there’s a higher competing offer and LTC Corporation is forced to raise it’s offer as well, the new, higher offer price will be offered to those who accepted early as well.

But accepting the offer right now, also increases the odds of LTC Corporation reaching that 90% threshold, thus putting off any white knight from making an offer.

It kinda reminds me of the prisoner dilemna in game theory.

This is from Wikipedia, about the prisoner dilemna:

Two members of a criminal gang are arrested and imprisoned. Each prisoner is in solitary confinement with no means of communicating with the other. The prosecutors lack sufficient evidence to convict the pair on the principal charge. They hope to get both sentenced to a year in prison on a lesser charge. Simultaneously, the prosecutors offer each prisoner a bargain. Each prisoner is given the opportunity either to: betray the other by testifying that the other committed the crime, or to cooperate with the other by remaining silent. The offer is:

- If A and B each betray the other, each of them serves 2 years in prison

- If A betrays B but B remains silent, A will be set free and B will serve 3 years in prison (and vice versa)

- If A and B both remain silent, both of them will only serve 1 year in prison (on the lesser charge)

So the most logical, best case scenario for the general good of both, would be for both to remain silent. Yet, remaining silent, runs the risk of serving 3 years if the other party betrays you.

Alright, so that’s where it stands with LTC Corporation.

Shareholders should be expecting offer documents to reach them sometime next week or the week after.

WHERE ART THOU, WHITE KNIGHT?

So guys, have a great Chinese New Year ahead!

Peace out.