This is my detailed analysis of BBR Holdings, current as of June 2016.

BBR Holdings currently makes up about 29% of my portfolio, it is a sizable portion (2,056,400 shares) and I have been adding to my stake in the past 6 weeks, mostly at prices between $0.165 – $0.174.

BBR Holdings (S) Ltd (“BBR”) is a construction and specialised engineering group with a swiss history. They are currently part of a “BBR network” which supposedly provides the latest engineering technical know-how. (I’m skeptical about this and think it’s just for paying royalties).

It currently comprises four core business segments spanning across General Construction, Specialised Engineering, Property Development and Green Technology. This chart provides a broad overview:

The Specialized Engineering is involved in civil engineering projects such as the building of bridges. Moderna homes (now 100% owned. The 75% in the chart is not updated), is involved in Prefabricated Prefinished Volumetric Construction (PPVC) projects. More on that later.

General Construction, as the name suggests, is involved in the actual building and construction of projects.

Property Development division is the developer of a few residential projects, and currently, a mixed development in Yishun. Although BBR is vertically integrated (meaning they are able to be the main con as well as the developer for residential projects), the company has proceeded cautiously in property development by joining forces with other partners to form consortiums to develop properties. I view this favorably.

Green Technology is the newest and latest arm of BBR. It involves mainly the installation and management of solar panels. They also own Angels Medical (now 100%), which is involved in home solutions for the elderly, such as movement monitoring and alarm systems.

Share price

At the current price of $0.165, BBR Holdings is trading at multi-year lows. From a technical perspective, the 50 and 150 MAs have also started to converge, and are on a slight uptrend, although I’d add that this is on very low volumes so it cant be taken too seriously at this point. (On some days, I alone accounted for 100% of the volume)

At the very least, we know that an entry at the current price, is already substantially lower than any price it has been at in the past 5 years.

Financials

Do note that the EPS figures may not be exactly the same as what the company gives in previous years, as BBR had some outstanding performance shares to be awarded in some years, and I prefer to be more conservative and include the full dilution from the performance shares. They’ll be vested sooner or later anyway. The sum is not significant though.

A quick look at the income statement would indicate why the share price has fallen off a cliff in the past year. Earnings, which was fairly consistent before FY13, has really been decimated in the past 2 FYs, dropping to 3.66 cents in FY14, to 0.76 cents in FY15 and as of the latest FY16Q1 (not in the chart), BBR recorded losses.

Correspondingly, the GPM and NPM has also tanked, and the pathetic NPM in the past 2 years has not given shareholders any joy.

In FY14, the reason given by management for the subdued performance is:

“Certain general construction projects sustained losses from cost overruns for some key construction materials, work performance issues by subcontractors and higher manpower costs to expedite project completion so as to minimise liquidated damages by clients. (FY14Q3)”

This is certainly not a pretty picture.

But then, if it’s a pretty picture, it wouldn’t be at this current price. Let’s go into detail and breakdown the revenue:

At the heart of it, General Construction forms the main bulk of the revenue for BBR. Engineering projects (like bridges, walkways etc) is the next largest revenue contributor.

To effectively predict how BBR’s revenue would look like in the coming years, it goes to say that we’d need to have visibility on each of the projects in these 2 segments, how they are progressing and when the revenue starts getting recorded.

Back to the consolidated income statement. The “Other operating income” is derived from rental income of premises and equipment, training fee, management services fee, interest income and gain on disposal of PPE. This has been fairly constant throughout the years, except in FY 14 when the company recorded $9.3million. This is because of an extraordinary gain from the disposal of a leasehold property and of FOSTA Pte Ltd, a subsidiary at that time, so we should not consider FY14 to be the norm.

“Share of results of an associate” has always referred to income from the joint ventures that BBR undertakes in property development. Prior to FY13, the income is derived mainly from the sale of a residential project, 8 Nassim. Since then, there has been minimal income recognized as the project is completed and TOP is reached.

“Share of results of a joint venture“. In 2010, BBR formed an unincorporated and fully integrated jointly controlled entity, Takenaka – Singapore Piling Joint Venture (“JV”) with Takenaka Corporation (“TAK”) in Singapore to undertake restoration works to the former Supreme Court and City Hall buildings. The percentage of participation of SPACE and TAK in the JV is 25% and 75% respectively. Pursuant to the terms of the JV agreement, the Group’s liability is capped at $5,000,000, although it has an obligation for up to 25% of losses in the project. Accordingly, the Group has accounted for its share of additional losses of $4,000,000 in FY13, (2012: $1,000,000) based on the expected loss in the JV.

In this instance at least, the company is smart enough to cap their liability. In the end, this whole JV was a failure, resulting in losses to both parties.

The take home message here is that BBR is exposed to potential losses. Not all their projects are profitable. My opinion is that BBR’s project management capabilities are rather weak. They either fail to incorporate larger margins when tendering for projects, or are just trying to gobble up any work that comes their way, over extending their capabilities.

The -$984,000 recorded in this segment in FY15 relates to the company’s mixed development in Yishun: The Wisteria. It is not a loss per say, but it’s an investment in a JV. More on this later.

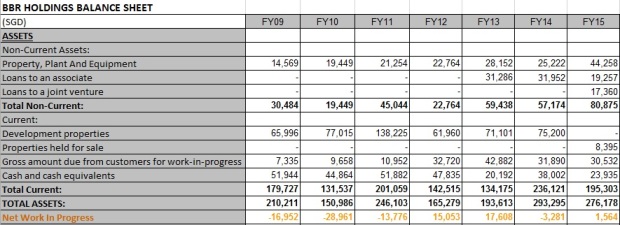

This is a simplified version of the asset side of the balance sheet. 1 thing that I track closely is the “net work in progress“. This is something calculated by myself. It’s basically the difference between the gross amount due from customers for work in progress, and the gross amount due to customers. I prefer it if the customers “owe” BBR for some work in progress rather than the other way around.

The company has recently purchased the building that it’s office is in, hence the PPE has shot up to $44.3mil in the balance sheet.

“Loans to an associate” refer to loans given for the Lakelife EC project. As of FY15, the associate has paid back a portion of the loans and hence this loan has dropped in the balance sheet. This is significant as it tells me that Lakelife is indeed doing well. In fact, the lakelife project forms the core part of my investing thesis in the short – mid term.

“Loans to a joint venture” refer to the Wisteria project. A mixed development in the Yishun area. I’ll discuss in depth about these later.

The “Development properties” refer to the Kovan condo project. Since it has TOP-ed, the remaining units are transferred to the “properties held for sale column.”

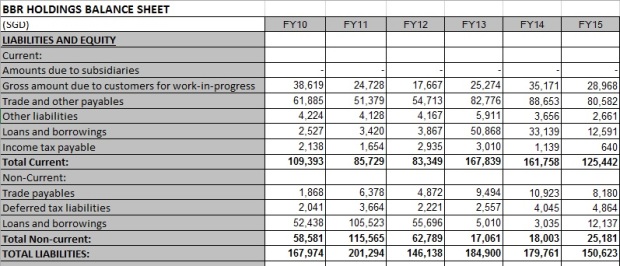

Now let’s take a look at it’s liabilities carried in the balance sheet:

BBR has spent the last 2 yrs or so paying down some debt. It is not unusual for the debt for construction companies to fluctuate greatly as the nature of construction is such that the company has to have capital to invest in the project, and only get returns at certain milestones of the project.

In fact, the total loans and borrowings, both current and non current, it’s the lowest (about $24.5mil) it has been in the past 6 years, and can almost fully be paid off with the cash on hand.

In the latest FY16Q1 results (attachment below), the cash has continued to shoot up to $41.5mil.

BBR’s balance sheet is financially strong.

This is BBR’s most recent financials (FY16Q1):

BBR_1Q2016_Results_Announcement

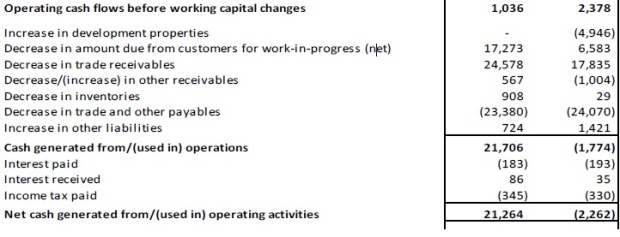

And this is the reason why BBR’s cash has shot up in the past quarter:

BBR collected $17.3mil of cash from customers for work done or work about to be done. Correspondingly, the “Trade receivables” under “Current assets” in the balance sheet has dropped from $113.6mil to $91mil.

I believe the bulk of this comes from the Bliss@Kovan project. The project received TOP in 2015, and hence recognised earnings then. The receivables are now collected upon expiry of the defects period in 2016.

Let’s look at some multi year data:

Note that the FY16 refers only to FY16Q1 results.

As mentioned earlier, I tend to use the total shares including the performance shares awarded under the BBR Share Plan.

The book value growth has slowed in the past 2 years, and has even dropped in FY15 and in FY16Q1.

ROE has also really dropped very substantially.

Dividends has always been erratic, and in FY15 the dividends has been cut in line with the overall poor financial performance.

At the current price of around $0.17:

Discount to book value is 60%, PE is 22.4 (this is artificially high as I’d explain later) and the dividend yield is 2.4%.

Recap

So what do we know thus far?

We know that BBR is going through a rough patch in the last 2 FYs, and in the most recent FY16Q1 it’s getting worse, slipping into losses.

We also know that BBR’s management of projects isn’t fantastic. They had a history of cost overruns, and even a complete write off of a project before. So much for the technical expertise and know-how of the “BBR Swiss network”. My opinion is that management has not focused adequately on their margins, instead, just trying to get their hands on as many projects as they can and completing them.

But we also know the share price reflects current conditions. It’s currently at or close to the lowest it’s been since 2008.

The bulk of BBR’s problems arise from their general construction activities and specialized engineering activities, (property development arm has been executing just fine) so going forward, my thinking is that to understand the prospects of the company, one has to have visibility on BBR’s ongoing and future projects and how they’d likely perform.

General Construction & Specialized Engineering Projects

Let’s delve into an in depth look at it’s projects. I have lumped projects under “General construction” and “Specialized engineering” together as many of these projects involve both these divisions.

These are the completed projects in recent years:

Completed General Construction and Specialized Engineering projects

Uncompleted/Ongoing projects:

Mixed-use development at The Springside at Jalan Ulu Seletar/Sembawang Road – Completion scheduled in 1H2016. A contract for the construction and maintenance of a 4 storey development comprising 1 storey shops and 3 storey apartments

755 HDB flats at Kallang Whampoa C28B – S$102.8 million. Completion in 2Q2016

The Wisteria and Wisteria Mall – to construct Wisteria mall and The Wisteria for $116 million. Construction to commence in 4Q2015, and will take approximately 32 months to complete (2H2018).

BBR is actually the developer (part of a consortium) as well as the main con for this project. We’ll analyze this in greater detail under property development later.

Two bridges in Terengganu and Sarawak in Malaysia (Pulau Sekati Bridge) – due to be completed at the end of 2016. Currently on schedule to complete on time (Delayed, previously was end 2015 and mid 2016). Worth RM286 million

I am watching their Malaysian specialized engineering projects closely. Unfortunately, these projects carry currency fx risks, as well as political risks. I have substantiated reasons to believe most of BBR’s problems and losses in prior years stem from these specialized engineering projects in Malaysia.

It doesn’t help that the announced completion date has been pushed back quietly in the past few financial statements. No official announcement that there has been a delay, the completion date just miraculously got postponed to a later date.

Anyway, here’s the google map view of the above mentioned bridge. The thinner grey line on the right is just a wooden plank jetty, apparently popular amongst fishing enthusiasts. The large steel structural beams all lined up neatly is where the bridge is getting built. Some progress there, but it’s getting me worried because it doesn’t look like it’s nearing completion. Can’t see it getting completed by end 2016.

2 projects awarded by Class “A” Bumiputra Contractors to BBR Construction Systems (M) Sdn Bhd (80% owned) – Both worth RM335 million in total

1) Design and construction of a new marina base at Pulau Poh and the bridge connecting Pulau Poh to existing Pengkalan Gawi jetty in Kenyir Lake in Terengganu (Targeted for completion in June 2017)

Here, we can see that the marina base is getting constructed, and there’s some sort of bridge connecting it to the existing jetty. There’s still a year before completion though, so I’ll be monitoring to see continued built up activity.

2) Design and construction of a 362 metre long precast girders bridge to connect the village of Dusun to the village of Dura in Kuala Berang District, Terengganu (target date of completion is February 2016.)

It’s no surprise why they need a bridge there pronto:

Driving from 1 kampung to the other involves 25mins, through the town centre, when you can pretty much see the other village across the river.

It says “unnamed road” because I changed it cos googlemaps labelled Kampung Dusun inaccurately. The residences and village centre is right there on the map where I put it.

Here, there’s some sort of a bridge being built across the river. It’s definitely not completed though. When you zoom in, you can even see what I presume, are the precast girdles lying near the eventual bridge:

I’ve been monitoring though there doesn’t seem to be any activity in the past few weeks.

This makes me very worried because according to the most recent announcements, this project is supposed to be completed in Feb 2016. Unless there’s some delay that’s not announced, or announced and I missed it.

Hence, I emailed BBR’s contact for BBR Construction Systems (M) Sdn Bhd to clarify, but there’s been no reply. I also emailed BBR’s IR contact (via their website). Also no reply.

Like I said, BBR’s management and IR leaves a lot to be desired. At best, they’re poorly organised and incompetent. At worst, this is some deliberate move to hide delayed projects.

I’m in the midst of writing direct (snail mail) to the CEO Andrew. I don’t think I’ll get a response, but that’s what needs to be done so that I can question this lack of response at the next AGM.

Pre-fabricated Pre-finished Volumetric Construction (“PPVC”) contract at Nanyang Crescent, Nanyang Technological University to supply and install PPVC units

Main con:main contractor Santarli –Zheng Keng JV

PPVC is basically a building technique whereby units are pre-fabricated in a site away from the construction site, then transported to the actual site and “assembled” together, much like stacking lego bricks one on top of the other.

Here, there’s some good news finally. PPVC is a competitive advantage of BBR. BBR’s subsidiary, Moderna homes, is one of the few accredited to provide PPVC units in Singapore. BBR just recently acquired 100% of Moderna Homes.

At the point of acquisition, Moderna Homes is actually losing money. The book value of assets acquired amounted to a net lability value of S$510,221 and the net loss attributable to the assets acquired amounted to S$688,683. There was no open market valuation performed for the acquisition, and the acquisition of the remaining 25% in Moderna Homes was done for S$898,500.

BBR’s focus on PPVC is paying off though. SG government is currently placing emphasis on utilizing PPVC for certain projects, due to the lesser on site time needed, and the resulting less noise and air pollution.

This project is to be completed in 1st quarter of 2017.

Residence Hall for NTU

Again, using Prefabricated Prefinished Volumetric modular Construction (PPVC). Project size: $196million. Scheduled for completion in the 3Q of 2016.

A point to note about these ongoing PPVC projects: BBR is likely to have razor thin margins and perhaps even losses from these projects. There are many advantages to PPVC that are often touted: Faster building time, less on site noise pollution, less dust and correspondingly, higher productivity.

However, there are also downsides to PPVC. The individual units are bulky, and require large spaces for storage. Transporting these units to the actual site is also challenging and involves substantial costs. In the initial phases though, I’d expect a steep learning curve for BBR for such projects.

Walk2Ride programme (Singapore Piling & Civil Engineering 51% stake)

To construct covered linkways within 400 m radius of MRT stations, $80.3 million, to be completed in 2018. A Singapore Piling – Shincon JV.

Property Development Projects

The 8 ongoing projects above relate only to the general construction and specialized engineering divisions. BBR has some ongoing property development projects as well. In fact, this would be the bright spark going forward, and forms the catalyst for my investing thesis.

Firstly, the recently completed property development projects:

BBR has 2 ongoing property development projects, both as part of a consortium.

Lakelife EC

An Executive Condominium project with 546 units, 5 blocks of 20 storeys. 99 yr leasehold HDB site, 217,300 sq ft site. BBR’s effective stake as part of the consortium is 35%.

This project was very well received when it was launched, largely because there was pent up demand for an EC project in that area. Coupled with the fact that there’s a very nice lake view from the Chinese Garden and Lakeside region. Many HDB upgraders jumped at the chance for this project, especially since the consortium cleverly placed the project at reasonable price points and the quantums were generally relatively low.

The site was won at $418 psf. ($90.83 mil) . The estimated breakeven price is $727 psf.

In fact, it’s likely to be lower than this but I like to incorporate a bit of margin for calculation inaccuracies.

Sales launch in 4Q 2014, Expected TOP in end 2016

Of the total 546 units, 533 units are sold at an average of $870 PSF. Gross Floor Area: appr. 653,000 sq ft. The 533 units sold is data derived from URA’s website.

I contacted a few property agents and learnt that there are actually only 6 units left for sale. I’m expecting this EC to be fully sold within a short time frame after TOP.

Some simple arithmetic: The profits (ballpark figures) from this project (Assuming fully sold) is

$(870 – 727) x 653,000 = $93.38mil

Let’s take away a very generous 20% from this figure to account for taxes and provide some margin of safety as the breakeven price is obviously a rough estimate. We end up with $74.7mil after tax. After paying off the loans from BBR of $19.2mil, we have $55.5mil of equity to be shared amongst shareholders.

This means BBR’s share of profits would be approximately 6.31 cents / share!

This is a total game changer. Just to recap, the EPS in cents in the past 5 years (from FY15 backwards) are: 0.76, 3.66, 7.10, 4.21, 6.55

So obviously 6.3 cents is a big deal.

Now here’s the deal. Since the EC project has HDB rules attached to it (Such as income restriction), the delivery of the units to the buyers upon TOP is contingent on the buyer having fulfiled these obligations.

This means that accounting wise, this entire Lakelife is accounted for via the “Completed Contracts” method of accounting.

In a previous post (https://thumbtackinvestor.wordpress.com/2016/06/10/post-mortem-of-hock-lian-seng-divestment/), I have talked briefly about how this sort of accounting works so I shan’t repeat it here but for the uninitiated, basically this means that all the costs and earnings (or losses for that matter), will be recognised and consolidated into BBR accounts upon TOP.

What this means is that upon TOP, which is sometime in the end 2016, we’d expect a nice, big, fat, 1 time off extraordinary earnings of 9 cents per share (estimated), under “Share of results of an associate” in the Income statement.

Since Lakelife is developed by a consortium, we are unable to examine real verifiable data in BBR balance sheet as yet, as all the earnings and payables and receivables and blah blah blah will not show up in BBR’s accounts yet.

But as I mentioned earlier, Lakelife has started paying back the loans that BBR extended for this project. This, plus the proven sales from the caveats lodged, means either way you slice it, Lakelife has been a roaring success for BBR and their consortium partners.

Hence, somewhere above, I said that the PER is now artificially high. This is because the earnings has been artificially depressed as BBR has been investing in this project for the last few years without seeing an actual return in it’s financials.

Now if I take the average of the past 3 years’ earnings (inclusive of this FY16), and assuming Lakelife contributes just 6 cents and EVERYTHING else this year contributes a total of 0 cents, this adds up to an average of 3.47 cents per year in the past 3 yrs.

Based on the current share price of say $0.17, that gives a PE of only 4.9!

I have checked and re-checked and re- re- checked these figures. From the time I initially vested in BBR, I have on several occasions, checked the ongoing sales and tabulated the average sales PSF. Kinda like how my son keeps peeping at his christmas presents under the christmas tree. I have also posed as an interested buyer to track the progress of the sales of units. (My apologies to the agents involved!)

I think the markets have under estimated how much this project will contribute to earnings and hence, has generally under priced BBR Holdings.

The Wisteria and Wisteria Mall

This is a mixed development, with a shopping mall below and a residential private condo above. Developed by a consortium of Northern Development Pte. Ltd., Santarli Venture Pte. Ltd., MUSE Capital Pte. Ltd., AHPL (Investments) Pte. Ltd

It is kinda complicated, but in short, BBR holds an effective stake of 25.05% in this project.

The site is 99 years leasehold, awarded for $185,090,000. Area of 9,759.8 sq metres.

The project consists of 216 units of residential (The Wisteria), with a total saleable sq ft of approximately 171,153 sq ft for the condo. The commercial units (Wisteria Mall) will be held by the consortium as the single strata owner (sole owner and not sold to multiple owners), and will be rented out.

Construction to commence in 4Q2015, and this will take approximately 32 months to complete (by end 1H2018)

Here, BBR’s competitive advantage in PPVC shows. 65% of this project will require PPVC and PBU (prefabricated bathroom units), and this will be supplied by Moderna Homes, a subsidiary of BBR. BBR is not just part of the consortium that develops this project, they are also the main contractor as well. The main construction is for a quantum of $116million.

I like deals like these. This leverages on both BBR’s vertically integrated capabilities (Developer + main con), as well as BBR’s expertise in PPVC.

With BBR’s prior experience in the NTU hostel project, I think they should have conquered the learning curve in PPVC projects.

So how is The Wisteria doing?

The land bid price is S$185.09 million. Since the development is 60:40 residential:commercial, we’d assume (simplistically) the portion for residential is $111.05 million.

This translates to S$629.24 per square foot per plot ratio. Expected breakeven price of approximately $950 psf. Total saleable sq ft of app. 171,153 sq ft for the condo.

Interestingly, the winning bid price is a mere $3.6mil higher than the next higher bid submitted by Koh Brothers. This at least tells me that the consortium did not overpay for the land.

Based on URA data, to date, 133 units have been sold, leaving 83 unsold units. Total sq ft sold: 88,162 sq ft for a total quantum of $96.8mil, giving an average selling price of $1,098psf

Now I know theres still 83 unsold units, but it’s early days and esp with mixed developments, I am optimistic that eventually all the units will be sold. Sales would be greatest at the launch, and towards the end nearing to TOP. The location has also natural local advantages, which I’d discuss soon.

Assuming all units are sold, I’d expect the residential portion to contribute about $25mil in profits, which is approximately $6.3mil or about 2 cents/share (for BBR’s share)

That’s just the residential portion.

This is The Wisteria’s location:

Now, the commercial units will be held for rent. There will be a total of 72 retails units and 33 f&b units including supermarket and food court. That’s pretty sizable. What’s imperative is the outlook for the demand for these commercial units. If the commercial units have adequate demand, BBR and it’s partners will enjoy recurring income from the rental.

Wisteria Mall is surrounded by BTO HDB flats, all of which have yet to TOP. Upon TOP, there’d be certainly latent demand for the mall facilities. (Vine grove TOP dec 2016, Angsana Breeze TOP Mar 2017, Oleander Breeze TOP September 2016)

The mall has also gotten anchor tenants, one of which is NTUC Fairprice Finest. NTUC has always been a major pull for the family crowds, esp on weekends when families do their grocery shopping.

Aside from the immediate vicinity, one can also see a few other condo projects within walking distance: Signature at Yishun & The Criterion. All these residential areas have no other malls to serve them that is within walking distance.

The project is also within walking distance of Khatib MRT, and that certainly adds to the accessibility of the mall to residents a bit further away.

All factors considered, it is safe to say that there is latent, local demand that will be generated from these residential areas. I think the commercial units will be in large demand and it makes sense to start marketing the commercial units when more of the residential units in the vicinity are occupied.

I am rather pleased with how this particular project has progressed thus far, I would be monitoring to see continued sales activity for The Wisteria, and the subsequent tenants for Wisteria Mall and the net realised rent.

Green Technology Division

Alright, now for the latest and smallest (in terms of revenue contribution) unit, the green technology division. This is mainly the solar panel business of BBR. As of FY15, this division contributed only $118,000 to revenue.

Thus far, 2 contracts have been secured:

Solar leasing contract from HDB, Ang Mo Kio Town

20-year solar leasing contract; design, installation, operation and maintenance of a 5MWp grid-tied solar photovoltaic system.

The Ang Mo Kio Town Council will undertake a power purchase agreement over a 20-year tenure to pay for the solar generated electricity.

For this particular project at least, HDB will offset up to 30 per cent of the start-up costs, and, in turn, buy the electricity for 20 years at a 5 per cent or greater discount off the prevailing market price. This electricity would power lights in corridors and common areas, lifts and water pumps, among other things.

Expected completion in 2Q16

Solar leasing contract from GKE Warehousing & Logistics Pte Ltd

25-year solar leasing contract; design, installation and maintenance of a 490KWp grid-tied solar photovoltaic system at Pioneer Road, Singapore

Project to be commissioned in the first quarter of 2015. Subsequently, GKE will purchase power from BBR at a preferential rate that is not higher than retail electricity tariff rate.

This project started contributing to earnings in FY15Q3

I am not optimistic about this division. The dynamics of the solar energy business is just not favorable. The business works this way, BBR is in charge of installing and maintaining solar panels, collecting and converting the energy, as well as recording how much the client actually uses. The client then pays for the amount of energy used, according to the prevailing electricity tariff rate, or perhaps even lower.

There can be a hundred and one things that go wrong with this whole process, and BBR is on the hook for any costs relating to this. Just generally a poor business to be in. Margins are likely to be very tight, although I’d admit I have no evidence regarding the margins.

On top of all these, the electricity tariffs is rather volatile. How does one predict energy prices? Many “experts” have tried and fallen flat on their faces, yet even more do.

I think such a business requires enormous scale to be truely profitable. For eg. BBR can then purchase solar panels in bulk, it makes sense to hire a team for panel installation, maintenance etc. Unfortunately, I don’t see how BBR can get scale. They are not the biggest player, nor are they even close to being the largest. (The largest if I am not mistaken, is Sunseap)

Also, the solar leasing project for HDB has already ran into some project delays (2Q16 instead of 1Q), and there has been “additional costs incurred” in this project. Again, the whole projection of investment required and management of projects have been disappointing.

I’d also note that since the above 2 mentioned solar projects have been announced, there has been no new solar contracts won. It could be that the energy prices have fallen so much so fast that it is no longer viable to do so. Whichever the reason, it just goes to show BBR has no business in this field.

This is another example of management wasting precious money doing stuff that has no returns. They seem to like to do stuff for the sake of looking good. Expanding into things they are unable to do well. The last part of this division illustrates this perfectly

Angels Medical

Please. For God’s sake, BBR, what are you doing with this.

This is one of the most asinine things BBR has done IMO. Angels medical is a loss making venture that is recently fully acquired by BBR. Well it costs only $27.8k but even that is money well and truly wasted. This is taken from BBR website:

“In early 2014, as part of the Group’s growth strategy in this division, the Group acquired a 49% shareholding interest in Angels Medical Pte Ltd, a healthcare system integrator service provider that caters to the medical care and needs of patients and elderly in nursing homes or their private residences through diverse range of services. Angels Medical offers seamless and personalised home medical care and innovative technology to patient who would otherwise require prolonged stay in the hospital or nursing home.”

I shan’t talk about this at all. It’s too asinine to describe. For the un-invested, pls go look at the website and see if you agree with me that BBR has absolutely no business buying this business (that’s losing money at the time of acquisition).

Additional Point

Here’s a comparison of the 2 most recent top 20 Shareholder lists

FY14 TOP 20 SHAREHOLDERS

FY15 TOP 20 SHAREHOLDERS

In the past 1 yr or so, some of the top 20 shareholders have been increasing their stake in BBR.(highlighted above). Collectively, they own 56.58% of the outstanding shares, up from 55.33% in FY14.

Since I value my anonymity, my stake is nestled somewhere within the Hong Leong Finance Nominees, so I wont appear in this list directly.

MY THOUGHTS

As always, there are obvious pros and cons to BBR. If it’s that obvious, it’d be easy. As I mentioned in an earlier post: https://thumbtackinvestor.wordpress.com/2016/05/20/case-study-michael-burry-caterpillar-inc/, one of the things I’ve realised is that the winners are seldom that clear cut.

Doing an in depth analysis is actually the EASY part. Interpretation, judgement, execution and finally holding on to your convictions is by far, the hardest part for deep value, contrarian investors.

The cons are obvious. Management is less than stellar. I have no assurance that the ongoing projects won’t suddenly throw up surprise losses.

The pros are obvious too. There is a clear catalyst to earnings, BBR is vertically integrated and thus far it’s property development division is promising.

My bet on BBR is a bet that the bad news has already been priced in, there are no more bombs in future financials and that future projects will proceed smoothly. Basically hope that management at least try to be mediocre. No more screw ups.

The bar has been set pretty low. As long as the other projects just proceed normally, I believe the property development will spur BBR results much higher 6 months from now. At the current share price of $0.165 or so, I believe the downside is capped.

I’m long at these levels.

From a portfolio management point of view, as stated in several earlier posts, I generally have a dim view of how the global economy is going to play out. The risks are building, and the likelihood of a GFC type of event is growing by the day.

Still, I’d be happy to invest if I can find the right opportunity, but I’d require a huge MOS, as well as significant catalysts. I have deployed only a fraction of my capital from earlier divestments into BBR and S&P 500 shorts, and will continue to hold some cash.

Hi TTTI,

The reason for cost overrun is most probably the collaboration with Swee Hong on the NTU project. After Swee Hong finances screw up, BBR holdings are required to fully take over the project. Therefore, cost overrun.

Regards,

TUB

LikeLike

Hi TUB

Are you referring to the statement in FY14? Yes, that is probably one of the reasons. After Swee Hong, BBR bought 75% stake in Moderna Homes to provide the PPVC units for the NTU project. But I don’t think it’s just that 1 project. They said “certain general construction projects…..”

And aside from construction materials, there were cost overruns due to manpower, work performance issues too.

LikeLike

Hi TTTI,

May I know how did you get the estimated breakeven price of $727 for the Lakelife Ec project?

Regards,

TUB

LikeLike

Hi TUB,

I took the average of 3 estimates:

1) There was a BT report a few yrs back when it was first reported, and the article gave an estimated breakeven price

2) (not sure if I’ll get anyone into trouble by revealing this…) I spoke to one of the contractors working on-site when I visited the area.

3) From my past experience analyzing previous projects, a gd way to estimate is to add approximately 70-80% of their bidding price for the land. It has to do with the way the developers do their projections prior to bidding too.

Of course this is not a precise way. There is no precise way. Even the developers do not know exactly what is their exact breakeven psf until the end, as things change along the way. (material costs, miscellaneous unprojected costs, marketing costs, agent fees, manpower costs, taxes etc)

But in my experience, this breakeven point should be fairly close. In any event, the whole exercise does require quite a bit of projections as there are many moving parts. Some overestimation should hopefully cover the underestimation, if any.

I’d also incorporated a large MOS to be a bit more safe.

LikeLike

Thanks TTTI for the explanation.

LikeLike

Hi TTI,

Thank you for the wonderful writeup. Further to Anonymous’s question re: breakeven costs, I would like to query a little further as there is significant sensitivity to that one input (incremental EPS could end up being as low as ~2c by my calculations as opposed to the cited 6.5c).

I believe the BT article that you incorporated into the average was the following: http://www.stproperty.sg/articles-property/singapore-property-news/lake-life-releases-pricing-brings-public-viewing-date-forward/a/186508 which cited a roughly $800 psf breakeven cost and “single-digit” profits.

Could you kindly help gel the discrepancy? I’m thinking it could be:

a) For PR reasons, the consortium may represent to the public a conservative cost basis to make the project appear to be a bargain (note timing of the article)

b) The figure is out of date (~1.5 years), and more timely estimates are lower than initially indicated

c) Your $727 figure is an average, and I should just try to internally adjust for a margin of safety

Just concerned about the high degree of sensitivity to this one input given the cornerstone – in my eye – nature of the earnings surprise to the thesis. Once again, great writeup. Keep up the good work.

LikeLike

Hi A.T.

Thank you for your comment.

The core of my investing thesis is actually the severe undervaluation by the markets, even for a construction company. The Lakelife project is meant to be a catalyst, but not the core reason for my investing. For that reason, if BBR just shows profits in the coming quarters, I believe that alone will cause the share price to rise.

With regard to your question about this BBR catalyst, the article I’m referring is not this one that you linked to. I guess there’d be several related such articles.

If we use the $800psf as the breakeven point, based on an ave selling price of $870psf, the earnings boost based on this 1 project would indeed be around 2 cents. I think that’s what you based your calculations on.

This means that upon TOP, BBR would suddenly get:

– 2 cents added to earnings

– Increase in CF of ($19.3mil + $6.2mil), the $19.3mil being repayment of shareholder loans and the $6.2mil being it’s share of profits.

Either way, like I mentioned in the article, the core thesis is the severe undervaluation. The earnings from Lakelife, and the impending cashflow, hopefully acts as the catalyst.

To put it another way, I think if the upcoming quarters show no losses from the general construction sector and improving earnings, that alone will increase the share price rather substantially. On the other hand, if the upcoming quarters show poor performance in the general construction sector, the lakelife earnings boost may not have much of a positive effect.

Lets not forget that this “earnings boost” is something of an accounting procedure. The cashflow from the project is as real as it gets of course, but the earnings have already been there, it just hasnt been recognised yet.

Again, I’ll repeat that the actual breakeven price is not an exact science. The developer themselves wouldn’t know it exactly as so many things can change. IMO, the earnings will be higher than your projected 2 cents because:

1) the $800 psf breakeven is deliberately made as high as logically possible to make it seem like the buyers are not paying too much of a premium (Getting a fantastic deal). Notice that it’s given by Evia themselves. In the other article that i referenced, the breakeven is given by an analyst.

2) The selling price psf has risen slightly as the project progressed.

3) I have over projected the tax. In reality it wouldn’t be 20%

Hope this helps.

LikeLike

Hi TTI,

Thank you for clarifying. I take your point on the catalyst vs core to thesis distinction. Also noted on how continued losses in the coming quarters could offset any earnings surprise from the Lake Life project at year’s end.

For what it’s worth, the ~2c projection is not my base case estimate either, merely a stress test of possible outcomes, and on balance I expect a figure closer to your estimate.

Thanks for the great analysis and prompt reply. Enjoy reading your blog and look forward to further entries.

LikeLike

Hi A.T.

Thanks for sharing your thoughts.

I think the next upcoming earnings (due in a couple of weeks) will be highly instructive on how 2016 will turn out. It’d be a big plus if the general construction projects in malaysia don’t show any losses. Interestingly, the share price has actually moved up quite strongly in the past month.

When I wrote the article, I had just accumulated at $0.165 and it is now $0.188. I am not aware of any news that would account for this, so I’d think it’s just following the general market sentiment.

Thanks for reading.

LikeLike

Great analysis again TTTI. Enjoy learning from you.

LikeLike

Thanks for the compliment

LikeLike