I get quite a bit of interest from readers regarding stock options, so here’s a simple guide on stock options, and my experience thus far with them.

Stock options are derivatives, meaning their value is derived from something else. You can have options on… well, stocks, on commodities, on indices, on almost anything under the sun as long as there’s a tradable market in it.

An option is exactly that. You either get (if you own the option) the option to buy or sell something at a certain price, within a certain time frame. If you sold the option, you are giving the counterparty the option to do exactly that.

Broadly speaking, there are 2 types of options you can enter into: CALL options and PUT options.

Call options are a bet that the underlying derivative value will go up, while put options are a bet that the underlying value will go down. An easy way to remember is to remember that you CALL UP somebody, while you PUT DOWN the phone.

So there are a few parameters to every option:

- The underlying derivative.

- The price at which the option is exercised

- The time frame/period during which the option is valid

- Call or Put option

- The premium or price of the option

So for example, if I bought/own a call option for company ABC at a strike price of $30 which is valid till say 23rd Dec 2016, the option will look something like this:

ABC Dec23’16, $30 Call

ABC is (1.) the underlying derivative

Dec 23’16 is (3.) the time frame

$30 is (2.) the exercise price

Call is (4.)

and (5.) is simply the price at which this option is trading at.

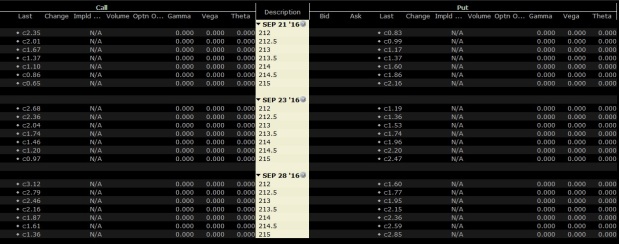

So as you can probably tell by now, there are many options depending on the various variables. These are listed in an option list. This is an example of an option list:

So basically if you are bullish on ABC, you could either: BUY call options, or SELL put options.

And if you are bearish on ABC, you could either: SELL call options, or BUY put options.

Confusing?

Let’s use the example above. Assuming ABC is at $20 now, the premium for the above call option is $1. I think ABC will go much higher by the 23rd Dec 2016, so I decide to buy this call option.

On the 23rd Dec 2016 (btw, options expire on Fridays usually), my option gives me the right to buy ABC at $30. If ABC is now at $40, I still get to buy it at $30, while it’s market value is $40.

So my profit would be $40-$30-$1 (the premium I paid earlier to buy the call option) = $9.

There are a variety of different combinations to work out because of the numerous variables. There are also correspondingly, several options for each derivative.

This is a very very simplistic way to put it, in reality there are several other variables like delta, sigma etc. I spent a long time understanding them, but in reality, I don’t think they’re very important at all.

Perhaps the only other variable that’s important is the Implied Volatility (IV).

The IV tells us how volatile the price of the underlying derivative is. Generally, the greater the IV, the greater the premium for the option, since theoretically, there’s a greater chance that the exercise price will be met (since the price jumps around so much)

My Experience

Most of my option activity revolves around selling.

I sell both Call and Put options, but never naked calls. (Naked calls = selling call options when you don’t actually own the derivative)

So what does that mean?

Say you like company ABC and would like to buy shares at $20. It is now at $25. You can key in an order and hope that the share price drops to $20 right?

Alternatively, what I do, is to sell Put options at $20. Basically, it’s a contract that gives a counterparty the right to sell the shares to me at $20. That’s the price I want to buy it at anyway right?

So at the end of the period, if the price is at $20, great. I buy it. And keep the premium of the option.

If the price is ABOVE $20, the contract expires and becomes invalid, and I get to keep the premium that I sold the contract at. I am free to sell another contract and keep the premium again.

Both ways, I keep the premium. This means that the actual price that I bought the shares at, is not really $20, but rather ($20 – premium of the option that I sold at)

Selling call options is the exact opposite. If you own shares in ABC, and you think a fair value to sell at is $40, you could sell options with exercise price at $40. If the premium is $2 for example, you get to keep this $2 if the price is below $40. If the price is above $40 when the contract expires, you sold your shares at $40 + $2 = $42.

Now obviously there are many variables at play here. That’s what I actually like about it. With this many variables, there will be bound to have mis-allocations in value in the options market. If there aren’t that many variables, the market gets pretty efficient and it becomes hard to find any opportunities.

In options, I can find instances where the premium is ridiculously high for the particular contract, when the contract perfectly plays into my investing thesis. This is because the premium is affected by so many factors such as the IV mentioned, and of course, the “demand and supply” of the contract, the sentiment revolving around the underlying derivative etc.

IMO, this is really as much of an art as it is a science.

My Results

It is hard to measure the results EXACTLY, since some options get exercised, while most do not. The exercise price vs the actual price varies, and this gap changes all the time.

If I look simply at the “cashflow”, based on an invested sum of approximately $160k USD, I receive approximately $1.5k USD worth of premiums each week.

That means that every Friday, if nothing gets exercised, I pocket $1.5k. Not too shabby.

Assuming 52 weeks a year, that works out to a yield of 48.75%!

Of course, that is a rough estimate as like I said, sometimes they get exercised.

Because of the numerous permutations, I don’t rely on the broker’s system to keep track of my options. I keep track of them separately on an excel sheet, complete with the cash holdings (it gets complicated when forex is involved)

A snapshot of a part of my recordings in 2015 looks something like this:

It’s colorful because I use colour to indicate when the same option gets covered.

Sometimes the yield is really delicious when there is misallocation of risk. For eg. During the Greek debt crisis last year, when there was constant talk of Greece leaving the EU, the options on “GREK” (Greek stock index ETF) gave very good yields due to the very high IV. There were some instances where I could get 15% yield in a single week!

Kinda ironic that just a year later, it’s Britain who actually left EU while Greece is still hanging around.

I’ll end this simple guide by trying to explain something that I have gleaned from my personal experience. Hang in there as it gets a bit messy and complicated here.

Assuming you think company ABC’s share price is going to drop, and you decide to buy put options on it’s share price. Let’s say the share price is currently at $8, and you decide to buy put options with a strike price of $1.

This means that you have the right to sell the shares at $1, in other words, the option would be profitable or “in the money” only if the share price drops < $1.

Because when it is <$1, you can buy shares from the open market at <$1, and exercise your option to sell at $1.

Logically, as the share price drops towards $1, the premium for the option increases, as it is increasingly likely that the option becomes “in the money”.

Assuming you are right, and the share price started dropping, and it looks like the chart below:

Question: At which point would the premium for the put option be higher? When it is $5 or when it is $3?

Again, logically, the premium would be higher when the share price is at $3, as $3 is closer to the $1 exercise price, whereas $5 is further away.

BUT in my experience, there are many instances where it is actually higher at $5!

Why is that so?

This is because as the share price is dropping steeply, at the point where it is $5, the general participants of the market have no idea how the share price would behave. They worry that it’d continue it’s steep decline, and maybe even hit $1 on that same session.

At $3, the share price has started leveling off, and the panic has subsided. Perhaps the technical guys determine that that’s a floor for the share price.

The corresponding demand for put options when there’s panic at $5, results in higher premiums for the option, even though it makes more sense for the premium to be higher at $3 than at $5.

This is just 1 of the example where I think there’s some mispricing to take advantage of. Of course, in the above example, we didn’t take into account many other variables such as the all important time factor.

If the option is about to expire say tomorrow, the option will behave very different from an option which is about to expire in a month.

Addendum

Most recently, I’ve sold a bunch of put options on Wells Fargo (WFC), with strike prices of $45, $44 and $42. The share price has been beaten down greatly with the recent multiple accounts scandal, which I view as temporary.

I used to own WFC in the midst of the GFC back in 2009/2010. I got it then at a measly $9, and sold at $14 and was really proud of myself… well, not too long ago it was around $50 so I guess I really missed the boat on this.

Anyway, having done rigorous analysis on WFC earlier, it allows me to capitalize confidently now in the midst of all the hype, which I consider to be temporary.

If the options do get exercised, that’s fine with me. If not, the premium is nice and fat and juicy with the volatility.

The options all have a short expiry date of between 1-2 weeks, and I’ll considering rolling them over for more premiums when they expire.

I’ll end this simple guide with a nice scenery pic. It’s really surreal to be writing about options in such a place. Also a bit amazing that I get excellent internet connectivity here, right in the middle of wilderness.

Multiple valleys surrounded by multiple mountains.

As always, have fun hunting for value.

Hi TTI,

Thanks for sharing the detail of Option trading ,,, great post ,,as well as the photo !!

Cheers ..

LikeLike

Hi STE

I copied your idea of posting nice scenery travel pics… haha

LikeLike

👍👍👏🏽👏🏽😃😃 ,,, more nice photos please !! Enjoy your holidays!

Cheers!

LikeLike

Hi TTI,

Thanks for the post, I certainly would like learn more.

Your simple guide is not so simple….it must have taken you a fair bit of time to master this. Is there any books or materials you recommend for further reading?

Thanks

LikeLike

Hi millionfaith

I read quite a few books on this a couple of years back, nothing particularly good that I’d recommend. I think picking up just 1 or 2 good books on this and reading it will be enough.

It is a lot more complicated than what I wrote as aside from the various variables that I mentioned, there are also many strategies that I think true option traders employ. Stuff like “collars”, “long straddles”, “iron condor” etc.

I know what they are, but in reality, I don’t think it’s really necessary to remember or understand these strategies. Most times, IMO, what works is simple common sense and anyway, the strategies are just fancy names for multiple options that collectively, serve a purpose. Common sense will guide you to do something similar, minus the fancy, kungfu like names. LOL

LikeLike

Hi TTI, which broker do you use to buy/sell options?

LikeLike

I personally use Interactive Brokers. There are several reliable ones, personally, I havent had much trouble with IB, except that sometimes transferring funds to my account isn’t immediate.

I am also in the midst of looking at switching to Saxo Capital as with Saxo, you can buy SG listed equities with minimal brokerage fees (only 0.11% vs twice the amount for other local brokerages)

Bear in mind though, that these are all not SGX linked so your equities purchased are held by Saxo actually, not in your personal CDP account

LikeLike

Are there any options for SG equities (or even STI) that can be sold? Noticed that the ones you have dealt with are all US equities options.

LikeLike

nope, there aren’t.

SGX too small, no tradable market for options.

There are options for US, HK, Shanghai, Japanese and European equities.

LikeLike

whats the brokerage costfor IB?

and how does it work for Saxo, when the counters you have , have rights/ PO/etc?

btw, nice pics!

though its a financial blog, but i think you shld post more pics too!

LikeLike

HI Foolish chameleon

The brokerage cost is 0.08% of trade value, with a min of SGD2.50

Here’s a link to their brokerage fees page:

https://www.interactivebrokers.com/en/index.php?f=1590&p=stocks1

LikeLike

TTI,

thanks for that! but i understand that we cannot buy SGX listed shares, if our residence is in SG. so if we buy on the NYSE, it should be 0.5% , min 1usd?

LikeLike

yup thats right

LikeLike

Hello TTI,

Thanks for the awesome and compherhensive coverage of option. Actually lately after going for Daniel Loh’s talk on selling options for income ive done huge research on option selling as a strategy. Hmm But i see that ure using it exclusively as a strategy to enhance your value investing framework right? Have u considered using it as a trading for passive income framework on maybe a smaller account?

And do you watch IV percentile than just IV?

LikeLike

Hi Zandelicious,

Thanks for your comment.

Now, I dunno who’s Daniel Loh or what the talk entails… and this is really just my personal opinion.

The danger for options, is that many MANY people think it’s something simple, and it can be done effortlessly and yet generate nice income regularly.

This cannot be further from the truth.

In fact, you’d notice in my post I’ve mentioned candidly my entire journey, from the intial massive losses. And it takes years of experimenting and learning and studying. Plus I’ve stated right from the start, that any option position, has to be grounded and backed up research and analysis.

Think about it logically, if options are derivatives, their value is derived from the underlying stock. And if stocks need analysis, why wouldn’t their derivatives need?

I think those who trade options with a sole purpose of “Getting passive income”, and don’t bother to research the underlying company, would have some success initially. Then when the market moves against their position, the losses would more than cover the gains. OR they’d get their option exercised and hold stock with large “unrealized losses” and maybe fool themselves by thinking ok they got some cashflow and these losses are “unrealized” anyway.

But I can see how such a strategy is attractive to many people.

It’s very unattractive to tell someone “look, there’s no easy way out. Spend 3 hours a night analyzing this. You have a knowledge gap, go find out and learn it. Do this for 3 months. Then come and sell your first option.”

So in short, the only difference between “selling options for income” vs my supposed “strategy to enhance your value investing framework”, is that one is the lazy way out.

In life, the lazy way out hardly ever works repeatedly.

I look at IV percentile. Sorry I wasn’t specific on this in the post, but it’s widely taken that IV = IV percentile these days. IV percentile is useful cos it gives you a hint of how it is relative to the stock’s volatility. If you are talking about the options for the particular company, it makes no sense to compare IV percentile across different companies.

There are all these complicated parameters like delta etc, plus all the fancy “kungfu” terms that I’ve mentioned in the 1st post. Stuff like naked collars, iron condor blah blah.

I don’t believe retail guys should even look at those.

Retail investors should use a simple subset. Logical, overlooked, and controllable.

So all I look at is the expiries of all my contracts (spread out preferably to reduce volatility and risk. You don’t want a sudden large amount exercising on the same day, however remote the possibility).

The spread between the number of put and call options I hold if it’s an existing position that I think won’t change much.

The IV since that hints at the premium

And ultimately, most importantly, the value of the underlying derivative.

In many ways, you’re right in saying it’s still grounded in value investing, but I see the value in utilizing options to generate CF while I hold my deep value positions.

TTI

LikeLike