Since my previous post on Dutech (Dutech Holdings FY17’s AGM), the company has released it’s FY18Q1 results and I’ve had time to peruse it. I feel pretty much vindicated, although the headline news don’t quite describe it as such. Anyway, maybe I’d write about some new findings in the next post.

Of late, markets have been on a tear. US earnings season is well underway and in fact, near completion. Judging from how the S&P index has been performing, it seems like the general consensus is that good times are back, and that the earnings thus far, have met the market’s expectations.

My US options and equity portfolio have also done immensely well the past couple of months. Too well, in fact. I get cautious when things rise too fast, too soon.

I don’t know exactly how well is well, but I withdrew $50k USD from the US portfolio to put into the bond markets, after taking profit on some positions such as CTL and CHK.

Yet, today, the net liquidation value (As calculated by Interactive Brokers), is basically the same as before I did the withdrawal. So the gains in the past month++ or so must’ve equaled this $50k USD.

I’ve since swung to the slightly bearish side, and loaded up with some protective shorts as hedges. So where do we stand right now?

This is the S&P chart YTD:

Personally, I don’t think we’d ever see or cross the high (circled out in red) of 2,872 reached in end Jan. I don’t even think we’d cross the other high (2nd circle in red) of 2,786, although that seems more probable.

In just under a month from now, the Fed meets again, and it’s pretty much expected that the Fed will raise interest rates again from the current 1.75%, to 2%.

Not too long ago, as the Fed was loosening and pumping liquidity into the system, the excess liquidity pulled global markets from the brink of depression. Now that we are doing the reverse…… the same massive force that was at our backs, will now be in our faces.

This is the financial equivalent of Newton’s Third Law.

Ah, it took me sometime to find this link, I knew I just watched this not too long ago.

https://www.cnbc.com/2018/05/11/fed-is-about-to-deliver-a-punch-in-the-face-peter-boockvar-says.html

This pretty much sums up what I feel are the likely risks ahead. Of the few US companies that I followed closely enough, the earnings season wasn’t that fantastic. Not sure why everything seems to be rallying of late.

The “punch in the face” is coming, and it’d hurt no matter how forewarned you are. In fact, the markets probably pre-empt is all, as treasury yields have risen, bond yields have risen and the yield curve has flattened of late. All of which hints of tightening conditions.

I’ve chosen to add on protective short hedges via what I think, is a creative sorta way.

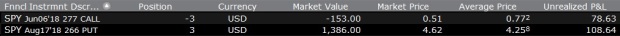

I’ve sold far OTM call options on the SPY, and used the premiums to partially pay for some of the put options that I’ve bought.

I’ve also gone nett long on volatility, by loading up on VXX, and at the same time, selling far OTM call options on these same VXX positions. The rationale is that volatility can spike up and I’d make a lot of money from these positions, but I don’t think we’re going into a great depression and volatility will go absolutely crazy. If it does, I’d end up forgoing the largest portion of profits, but will still sit pretty with a sizable profit.

I prefer to add on to the positions gradually over multiple days, and only add on a small 3 lot position each time. The above is just a small snapshot, the actual list is quite a fair bit longer.

In short (pun intended!), I really wouldn’t be complaining too much if the markets start turning south right about now.

I think my previous experiences dealing with volatility derivatives, and some new found insight, made me somewhat confident of building up these short hedges.

The Big Short: TTI’s Version. But Where Are My Millions?!

An In-depth Look Into Volatility By TTI

Another reason for going long VXX right now, is that of late, there’s been a divergence between the fortunes of SPY and VXX. The “fear index” doesn’t seem very indicative recently.

For many days in the past fortnight or so, whenever the SPY drops, VIX drops along with it, instead of rising.

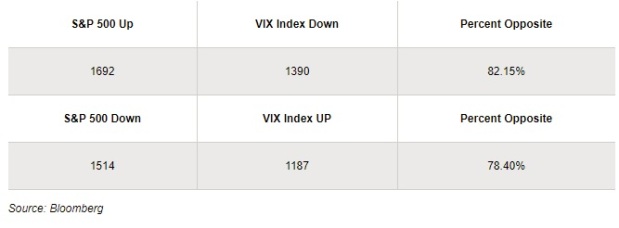

Now, since VIX is calculated based on prices of S&P options, I’d expect some form of correlation. As it turns out, they ARE fairly well inversely correlated, as this table shows:

Although this correlation is imperfect, the odds are pretty much in the favor of an inverse relationship:

When S&P move down, VIX moves up in 78.40% of the instances, which is pretty well inversely correlated.

Yet, the recent breakdown of this inverse correlation that I’ve noticed in the past couple of weeks, indicates to me that something must change soon.

Either the VIX must start moving up very strongly when the S&P is down, or the S&P must start moving up dramatically (less preferred for me).

Since we’ve seen earlier that S&P has already been trending upwards strongly in the past week, I’d think that the odds are in my favor that the S&P starts coming down, and VIX starts moving up again (there’s a 78.40% chance that that happens)

And since I’ve pretty much been observing the scenario of S&P and VIX moving in tandem, which is only a 21.6% probable scenario, it seems logical to bet on the 78.40% scenario coming back pretty soon.

So let’s see what happens from here.

Just a small comment about the VIX/S&P/VXX: Note that the value of VXX is not a direct function of the VIX. VXX is made from a blend of two VIX futures, currently the futures for June and July. You can see these futures in IB TWS and they are the two components that determine the value of the VXX ETN.

So the relationship between VXX and VIX is indirect through the VIX futures market. This is why sometimes it feels like there is a temporary disconnect between SPY and VXX… When you go long VXX in this time, the futures market is in contango mode (spot to the June forward) so the decay in the the value of VXX is a headwind that you will have to face when SPY starts to decline. In addition, you have a positive roll yield which is the “contango” between the first (June) and second (July) futures that also makes the VXX ETN lose value as it rolls the futures every day.

It is only when fear will be built into the VIX futures market that the contango will turn into backwardation and you will make good money on your VXX long. As long as the contango and positive roll yield exists you will feel like its hard for VXX to advance as much as you would expect by looking at the VIX spot price.

Just my two cents…

LikeLiked by 1 person

Hi Yaniv

Ah yes, contango.

I knew I missed something out in the post

Meant to talk about that too.

Contango is indeed working against my VXX positions right now, but that’s why they’re intended as hedges (as per the title) They’re not large core positions and I’m fighting against contango by selling further out call options on these positions

If we go south n VXX shoots up, these calls will loop off a part of the gains, but they’re sufficiently far out so that the hedging function is still valid.

Because the function is to hedge, if things do go south here, I reckon these positions would neutralize drops in my Long positions, but no more.

As for your other comment about VIX n VXX, yea I’m aware they don’t necessarily track each other exactly for the reasons you mentioned. Which is why my last paragraph talks about the correlation between VIX and SPY, not VXX and SPY.

I also have some puts on VIX, but these are all small, minor positions.

I think at this juncture, the cost of hedging (time cost, contango etc) still makes it worthwhile to own some protection and as mentioned, I find that I can still keep costs low enough by selling call options on the VXX positions

Cheers

TTI

LikeLiked by 1 person

Do you mind sharing what is the expiry/strike of the calls that you are writing to counter the contango’s headwind? it is an interesting strategy.

LikeLiked by 1 person

Hi Yaniv

I’ve calls expiring every week, from now till about 3-4 weeks out from here. So generally, I write calls that expire in about 3-4 weeks. I think for VXX and other VIX derivatives, because those who buy these calls are betting on a sudden event of volatility, the premiums are relatively high somewhat independent of the duration of the calls. (Calls that are about to expire still hold substantial value) So calls that expire further out, doesn’t add much to the premiums. So I try to keep the duration short.

For those that expire, I’d write more calls. I try to write more calls on days when the underlying derivative goes up for higher premiums.

The strike prices for VXX calls are all in the range of $44 to $50, and the premiums I get for these are $0.75 (the lowest) to $1.1 (highest).

So if VXX shoots up from here (around $34) till somewhere around $50, I’d have some hedges but anything above that, I wouldn’t.

But I consider a recurrence of Feb’s sudden sharp volatility to be unlikely.

Hence the writing of the calls.

Cheers

TTI

LikeLiked by 1 person

Brilliant, thanks.

LikeLiked by 1 person

Hi Thumbtack

It looks like u hit the nail on the head again!

Markets are red today, and it’s starting to trend downwards

At what levels of the S&P would you consider taking profit on your shorts?

How did you short the SGX companies?

Thanks for sharing

LikeLiked by 1 person

Hey mate,

TBH, I dunno exactly when I’d cover my shorts. I got a bit lucky here, timing wise. It’s usually not the case.

I was focused on adding them last week… not so much on when to cover. I guess it won’t be all at 1 go, in a single day. Probably a bit every day that it’s really red. In the next month to 2, I’m expecting we’d go test or approach the lows for the year again. Maybe at that point, I’d cover everything.

I didn’t short SG companies.

As written in the post, I’m nett long. These are hedges.

I’ve SPY put options, sold SPY call options, own VIX puts, VXX puts and sold VXX calls etc.

Stuff like that.

But nothing short in SG.

Cheers

TTI

LikeLiked by 1 person