No, silly. That’s not my performance. I wish.

As my posts get far and infrequent, each would naturally be a mish mash of several stuff that’s unrelated. So, of course, I’d choose the 1 with the most attention grabbing headline. It’s not scammish though… I’m featuring a friend’s performance.

More on that later…

@Homan (From the comments section)

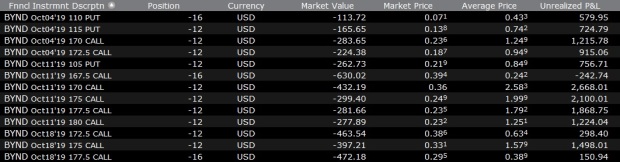

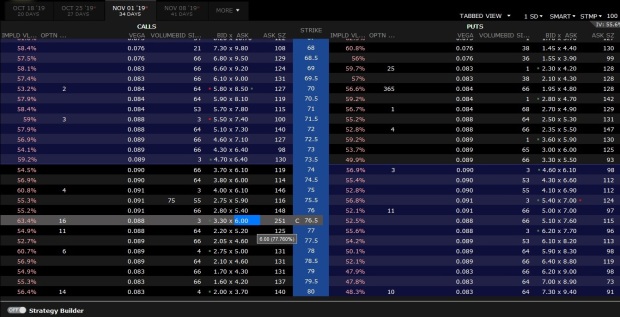

Here’s the screenshot that I couldn’t attach to the comments section then. So I’m attaching them here for you:

So yea, pretty far OTM. All obviously expired now. (In fact, I could’ve doubled my premiums earned if I was a tad more adventurous and sold nearer to the money options, but I prefer to sleep better.)

At the point of typing this, the following are the current outstanding options. I’ve rolled over several, and unless a mother-of-all miracle happens, I’d be taking these off the “liabilities” column of my “balance sheet” in a fortnight. There are now considerably less options, cos the lock up expiry is fast approaching, and the markets know what I know, so yea, the premiums aren’t fantastic, and I’m not that keen on picking up tiny pennies, so it’s a no-go if the premiums aren’t worth the risk. (Although at this point, I think the risk is pretty negligible). Anyhow, my thesis in BYND has played out beautifully, and provided a nice fat cashflow every week for the past 8 weeks or so.

2019 YTD Performance

Hmmm, I’m kinda in 2 minds about whether to write about this, since the last report was only a mth ago (To Infinity & Beyond? Nah!) and I don’t really like to spend so much time tracking. But since IB does up all these reports nicely, so I’d just mostly cut and paste here.

SG Markets

Total portfolio value in SG markets is SGD 243,092

Comprising mostly stakes in Dutech, Q&M and Venture Corp, I haven’t done any work here aside from some cursory tracking.

Bonds

Again, nothing much to talk about here, the bond portfolio is approximately SGD 550,000. It’d be another 1-2 yrs before the fruits ripen here. I’m possibly being too conservative here, and this portion might balloon when they are due in a couple of years, depending on the market conditions.

US / Global Markets

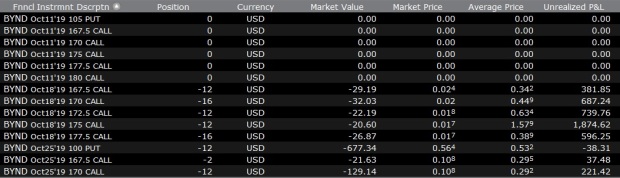

I wouldn’t mind ending 2019 with a 34.95% return.

(Assuming S&P stays at a +20% return, thereabouts)

NAV dipped a little since the last report (To Infinity & Beyond? Nah!) cos I withdrew a lump sum of $50k SGD to stuff into my property fund. I’ve been doing lots of work here, and feel that I can now be a better property agent than most other agents out there. LOL. Maybe I’d write about it in another post.

Using USD-SGD of 1.37, total portfolio value is now SGD 2,196,369

That’s a slight dip from the last report 1mth ago, mostly due to the cash withdrawal of about $50k SGD, which I’ve taken out of the investing portfolio and channeled into the property fund instead.

Global portfolio portion is pretty much the same as last month, nothing too much has changed. Trade wars on, trade wars off, whatever. Doesn’t quite affect what I do too much actually. More volatility is good for me actually, IMO. If there’s no volatility, that means there’s no uncertainty, and if there’s no uncertainty, that means there’s little mispricing to take advantage of.

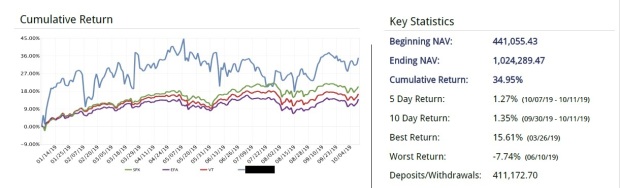

HKEx listed Future Land, which has since become 1 of my core positions, has been recovering steadily:

Since the last post, I’ve gone into tracking their various land banks and developments, some partially completed, some ready for sale. This is no mean feat as there are like 27 PAGES worth of listed projects at various stages within its AR!

I’ve zoomed into those that are partially or wholly in the sale phases, the main reason being that I’m concerned about being blindsided by any sudden write downs in valuation.

Now, although Future Land is HK listed, it has ZERO holdings or developments in HK. Most of their projects are in the tier 2 or tier 3 cities in China. As of now, most of the completed projects are in Chong qing. I’m confident that if anything, there should be revaluation GAINS instead, as Chong qing’s residential index has risen substantially when comparing y-o-y, esp in the 1H of 2019. Since June though, the market has cooled considerably, as the local governments are mandated to tame runaway prices and new local measures have been put in place.

Some substantiation here on Chong qing’s residential property prices:

(Note that the article is written in April this year)

https://www.ceicdata.com/en/china/nbs-property-price-monthly/property-price-ytd-avg-chongqing

Although we are talking about non-cash items here, I think in the short to mid term, the earnings will drive the news and the share price, so it’s key that I don’t get caught out by suddenly revaluation changes. (unless they are positive ones!)

Although my estimate is up 17% currently, I’m still looking to add to my substantial stake on any dips. This may not happen though, as the markets are probably going to react positively to the Trump partial trade deal on Monday, so prices may run away. Anyway, my current stake is enough to move the needle.

On a different note, I’ve sometimes been asked about the specific “inefficiencies” in the options markets. I’ve screenshotted 1 a couple of weeks ago, so let me illustrate a very simple to understand, straightforward example here. It’s a very simplistic example, and in all likelihood, there are other factors at play, but yea, this should be easy for readers to comprehend:

This is the options chain for STMP a couple of weeks back. (in which I hold a moderate position, and have previously put up an estimate for)

At the time of the screenshot, the share price was around $73.8 or so, as we can see in the chain.

The further out the calls (calls with strike prices further from the current share price then), would in theory, be less likely to be exercised than the nearer calls, and hence, should IN THEORY, command a lower premium right?

Yet as we can see in the option chain above, the bid prices for the $76.50 option are much HIGHER than the other options below them (the $76, $75.5, $75 etc)…

If we examine further down the option chain, at various intervals, there are sometimes higher bid prices for further out options, and correspondingly, narrower spreads.

They’re mostly just a reflection of the demand for these option contracts at these strike prices. Simple as that. It may not necessarily be logical.

I’ve also observed on several occasions, that options with strike prices that are whole numbers, tend to have greater liquidity than those with odd numbers or not whole ones. Like for eg, $80 contracts would be more “popular” than say, $81.50.

Which doesn’t make sense mathematically to a robot, but we are humans and humans have a preference for nice round numbers yea?

So there we go. That’s inefficiency right there, as a result of human bias and preferences.

Real Estate

Looking back at some old posts, I’ve been accumulating a property fund for over 2 years now.

TTI’s Portfolio Updates – End July 2019 + The Thanos Of Global Macro Funds Is Coming Back!

TTI’s Portfolio Performance – May 2019 + Avenue Therapeutics Updates

Right now, the property fund has about SGD 600,000 worth of liquidity.

Which I realize, isn’t too much more than what I had in the fund back in May 2019.

So somewhere along the lines, I took out some funds, probably to invest in the US markets. Which is why now, I took out some funds and re-inflated the property fund back to around $600k.

Despite hunting for deals for over 2 years, they are really hard to come by. The 1 time I came across a REAL firesale deal, it got snapped up within a week and I failed to capitalize cos of a lack of liquidity.

If there’s a real firesale, you can’t then go to the bank to get pre-approval and all that. Speed and financial firepower are of essence. These are the real deals that I’m looking for, and I’m incredibly patient here.

At various points, I’ve been tempted, and still am, to put this $600k ++ to work harder in the financial markets. Imagine giving up a simple 5% additional yield on this $600k… That’s an additional $30k every year.

Not a game changing number, but not really negligible either.

Yet, I prefer to forego this, and keep my gunpowder dry, cos of my previous experience (I prob wrote about it somewhere in a long forgotten post)

Most of the property fund is kept in FSMOne’s MMF, which gives me a low-no risk kinda return. I don’t know how much. Probably around 1-1.5% I think.

I used to just keep everything in my UOB account, but the large number attracts “relationship managers” who keep cold calling me, and it’s super irritating. UOB’s RMs have a high attrition rate, and I get a letter followed by a determined caller every few months, often asking to “catch up over coffee” so that they can “serve my needs” and you know, all that lingo.

Truth is… I’ve only really needed their services ONCE.

And they didn’t come through for me.

Yep, once, for the very 1st time, I gave my faceless RM a call. I remember clearly, it’s right after meeting CEO Tung of Geo Energy. I called my RM while sitting in my car cos I was just so excited about spotting a good opportunity.

Their Jan 2018 maturing notes were trading at a crazy YTM yield then, and I could’ve easily raked in a 60% ROI for a BBB rated bond that was maturing within less than a year! (Edit: an earlier post erroneously wrote that the bonds were maturing in Jan 2019)

After talking to Tung, I realized that there’s certainly mispricing here cos the company certainly had enough funds to redeem the notes. When 1 of the company’s own directors bought 1 (or was it 2?) of the bonds (they were $250k per pop), I figured that it’s pretty safe. I mean, surely the director isn’t going to throw away $250k of his own money if he wasn’t sure the company could redeem them in 9 months.

I asked Tung why didn’t the company buy back their own bonds then, since they were about to mature within less than a year, and were trading at such a deep discount. His reply was that they couldn’t buy it efficiently in the open market. There was too little liquidity, and nobody was selling. I checked, and true enough, nobody’s selling on the bond markets.

To illustrate his point, Tung pointed to a lady in a bright red dress, who was seated just beside us as we were chatting, and said “why don’t u ask her if she wants to sell? She’s holding a lot of the bonds!”

And the lady just looked at us and smiled dryly without saying a word.

But since their own director could buy 1 of the bonds on the open market, and since UOB was the underwriter for the bonds then, I thought to ask my RM if he could help me or at least refer me to someone who could sell me 1.

The phone call lasted all of 3 mins.

When the RM realized that I’m not asking about some financial product that he could sell me, man, the cursory tone was emanating across the call. He just wasn’t interested to even continue the conversation. He wasn’t even interested to TRY.

“This 1 ah, I not sure. You ask your broker better la ok.”

So there.

So much for “finding out how he could be of service over coffee”.

I don’t know what’s the use of a “premium account” with UOB. I didn’t ask for it. They just upgraded my account automatically when they realized there’s a high 6 digits sitting in it doing nothing for years, and not buying their financial products.

As I’ve found out, I certainly don’t need the “personalized relationship manager”, and since I hardly physically go to the bank, I don’t need a priority queue either.

It’s probably just for them to classify and figure out who amongst their clients, are best targets to push more products to.

Alright, let me get to the main course now.

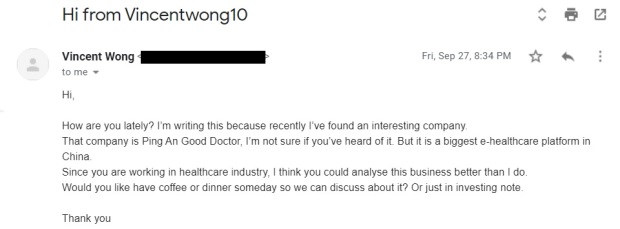

Some weeks back, I received an email from a fellow investor that I’ve on occasion, spoken to on an investing public forum:

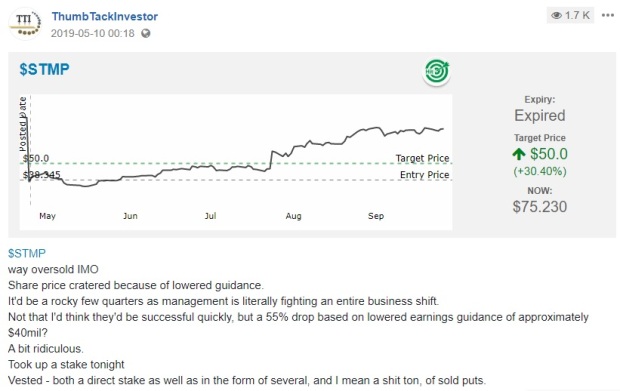

I readily agreed to meet up (and it’s not often that I do), cos Vincent’s quite an interesting character with 1 helluva track record (that’s verifiable. Not some junk make believe, con job return that anyone online can generate)

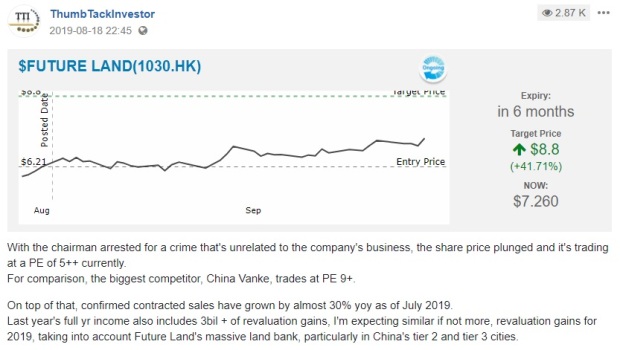

Here, check out Vincent’s track record:

YTD:

Since inception (I dunno when that is, I think sometime in 2016):

Normally, I’d view someone hawking such figures, with a healthy dose of skepticism.

But Vincent readily discusses his ideas, and posts about his positions in real time. (or almost real time.)

Plus it’s not just about posting about entries and exits or whatever.

It’s the strength of his ideas.

And I’ve a hack of an ability to sieve out the real masters from the fake dudes.

We met up and spent almost 5 hours discussing both our positions and ideas, until I had to excuse myself abruptly as I was very much late for another appointment.

I’d say the best way to describe his style, is that of the old school value investing, but with a very heavy touch of realism and practicality. Throw in a big chunk of industry knowledge and qualitative analysis to the usual quantitative touches.

In that aspect, we have quite a fair bit of similarities here. Main difference being that Vincent is 100% in the HK and Chinese markets only, whereas I’m mostly in the US markets.

This doesn’t mean that we see eye to eye on everything.

For example, Vincent told me straight up, no holds barred, that he wouldn’t short BYND. But even then, the reason he gave is really unique, and this is the 1st time I’m hearing someone describe it as such.

Vincent thinks that there are now many rich family offices and part of their mandate is to allocate funds into companies that have a “social impact”. And since there are very few companies that can fulfil this criteria, there’d always be excessive funds looking to park themselves into such companies. Like BYND. Supply and demand.

I’ve never heard of such a reason given with regard to BYND. But yea, it perfectly illustrates what I mean.

Value investing, but with a healthy touch of realism and practicality.

I wouldn’t say I totally disagree with him, which is why my options have a wide moat, instead of trying to sell close to the money options, but my reasons are certainly different from his.

At least we both can agree that there’re no fundamentals to talk about here.

Looking at the performance the past 2 months, and esp the past week though, I’d have to claim victory here. hahaha! yay.

I’d add a disclaimer here. Although Vincent knows beforehand that I’d be writing about him in this post, he has no idea as to what are the contents, and neither am I running the content through him prior to publishing this. Read: This is my honest, un-edited opinion. (yes, of course I gotta ask for permission to talk about our discussion first. It’s basic courtesy.)

We also discussed, at length and in detail, about Ping An Good Doctor, and Vincent’s ideas are pretty interesting. They mostly focus around finding industry leaders (quality companies), for which, he is willing to pay a reasonable price, or even a slight premium.

Since our discussion a mere week or so ago, Ping An GD’s share price has popped over 10% or so, and unfortunately, neither of us initiated a position.

Good ideas will always exist though, so I’m excited to see what other stuff he has up his sleeve.

Vincent is currently working as a cook (Yes. A cook.), while studying accounting part-time. I’ve blocked out his email address above, but anyone who wants to have it, can either drop me a mail directly, or ask him yourself if you are on InvestingNote.

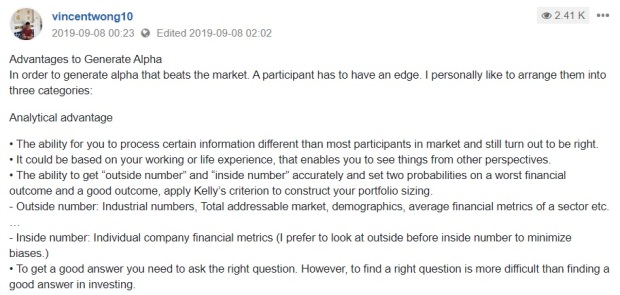

I’d end this post by giving Vincent some coverage here.

This is an old post that he wrote, that I really liked a lot. Prob the best investing philosophy stuff I’ve read in IN.

I don’t know if he plagiarized it from elsewhere or he came up with it himself, but personally, I think there’s a lot of insights to be gleaned from every line.

The fact that it has “14 likes” whereas some other useless junk stuff talking about nonsense lines and intersections or counterparty stuff can have like a 100 likes tells me I’m in rarified company.

Which is a good thing.

For me, that is.

Hi TTI,

Could you share briefly your views on PA GD?

Thanks!

LikeLike

Hi kk,

I’ve only started doing DD on it for <1 week, so may not be the best person to talk about it. But IMO, they are serving a real need and solving a real problem in China: giving the masses real access to healthcare affordably.

As with many things, I'm not sure how the execution will proceed though. Many times, the story sounds good, but the execution is poor. Their membership (a reflection of take up rate) has shot through the roof in a very short period of time though, shooting up over 80% in 2018, to reach 2.3mil plus.

The company is still loss making, but if u do the math, at the rate they are growing, they can turn over very quickly.

They have strong partnerships too though, and I think the chinese have a very strong affinity for adopting such new tech.

So if we combine a new tech solution, supported by a widely used payments/social platform, and a real life problem (strong demand), it does seem that they have all the ingredients to succeed.

Note that they have partnered with GRAB here in SG, although I think SG would be a poor market for them (small country, with medical clinics widely accessible.

My only issue is figuring out an appropriate valuation to pay for a loss making company, with high growth, and a good chance at becoming entrenched as a leader in its space.

I may start accumulating if the price comes down again…

Hope Trump and Xi help me out a bit here.

Cheers

TTI

LikeLike

the BYND stuff sounds like ESG investing which I recently saw somewhere else..

(and thanks for the screenshots!)

LikeLike

The bynd stuff sounds like ESG investing that I recently saw somewhere else…

(and thanks for the screenshots!)

LikeLike