The last time I updated this blog was actually before the Covid storm started. That’s how long it has been.

Here’s an update of what transpired, my current portfolio composition and my outlook.

Back in March, the world’s markets were frozen in fear as we witnessed the steepest drop since the 1930s Great Depression, with some of the largest single day declines since then. The markets were falling so steeply that many folks probably saw large chunks of their portfolio NAV vaporize in a very short period of time.

On hindsight, the overall drop, from peak to trough, wasn’t really that much. S&P index fell approximately 34% from peak to trough, which is of course significant, but not exactly that massive. Rather, it’s the rapidity of the drop that caught many folks off guard. Also, and this is just my personal opinion, in this age of uber high liquidity swooshing around the markets, we should expect extreme volatility that works both ways. Any drops would be exaggerated, matched equally by aggressive rises.

As they say, fortune favors the brave.

And Lady Luck is probably a close companion of Fortune too.

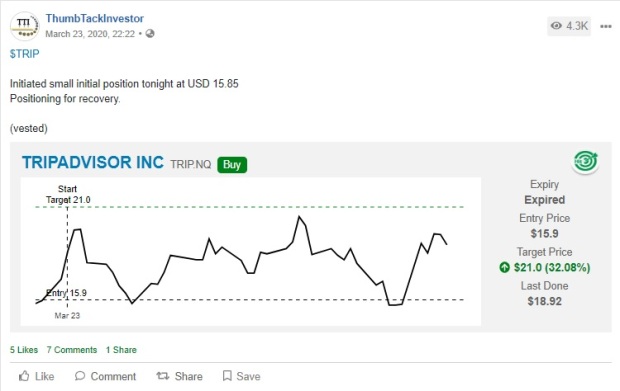

Right near the troughs, I started getting aggressive and deployed serious capital near the bottom of the trough.

As evidenced in the flurry of estimates then, all long, all date and time stamped and locked in:

As it turns out, the bulk of these bullish estimates were literally smack at the bottom of the trough (1 trading day from the absolute bottom!), but oh boy, it sure didn’t feel so great at that point though.

20th March 2020:

Now, the subsequent recovery and bullish thus far, sure caught me by surprise.

These positions were entered with a long term view. They’re mostly positions in companies that I’ve previously analyzed and written about:

Since the market lows registered on the 21st March 2020, S&P index has rallied about 32% or so, and currently sits a mere 12.7% below it’s all time highs.

This sure has been unexpected to me.

Taking advantage of the aggressiveness of the recovery, (or the dead cat bounce, depending on which camp you’re in!), I’ve since lightened up most of my positions.

Well, I’d be perfectly happy holding most of them, but the thing is, I sold very far OTM calls and wasn’t expecting them to get assigned. With this massive +32% rally though, most positions have since been sold, with some giving me RECORD annualized gains, considering the short time frame.

As seen in the estimates I’ve locked in, most of the positions are in the “5 generals” companies that I’ve previously written about. So let’s see how the 5 generals have fared through the crash and how they’ve recovered.

I’d also be benchmarking their relative performance to the S&P 500 index, “SPY”.

1st up, VISA.

The top general out of the top 5 certainly did not disappoint, dispatching of SPY with relative ease:

YTD, Visa returned +1.58%, vs SPY’s -8.21%.

As seen in the chart, even during the drop in March, Visa’s performance consistently outperformed SPY. Their subsequent recovery has thus far been much sharper too.

In fact, despite guiding for some impact in coming quarters due to Covid, Visa’s metrics across the board has totally justified it’s position as my number 1 general.

Q2 net revenues actually increased 7% yoy, and transactions volumes increased as well. EPS beat estimates as the results surprised almost every analyst.

The dark clouds are not clear though, as the company guided for some impact in subsequent quarters, and abandoned their previous full year guidance.

This is going to be a common feature everywhere. Almost every company’s earnings call in the past 2 months that I’ve seen, involves a statement saying their previous guidance is now no longer valid and they’re not providing a new one. It’s hard to tell how business will turn out in the coming quarters. Nobody seems to know for sure.

Anyhow, despite Visa being my top general, I currently do not hold any more positions in Visa, having just sold the last tranche of shares.

It’s kinda a weird feeling. Like sweet and sour pork. It’s sweet and it’s sour.

It’s sweet cos… well, it’s always going to be sweet locking in a 30% ROI in less than 2 months.

It’s sour cos… I don’t really want to sell out completely. Calls vested, and I sold mostly around the USD 185-190 mark. I’m probably going to swing to sell puts here and hope to get back my position. (And profit from the premiums)

Anyhow you slice and dice this though, Visa has certainly deserved it’s position as the top general.

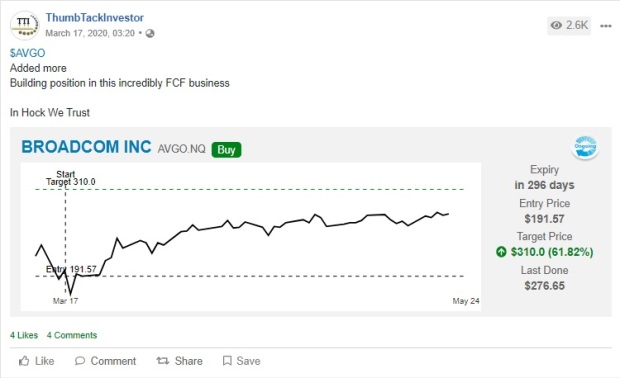

2nd on the list is another of my favorites: Broadcom (AVGO)

YTD, AVGO has actually underperformed SPY. I think this will probably be a common feature for many many non-tech companies, as S&P’s outperformance is mostly due to the major tech companies that have continued to go ballistic. Just look at the NASDAQ man.

Anyhow, the underperformance sure didn’t feel like that to me, cos it’s all about timing and the price you get it at.

Since my entries on the 20th March, AVGO has rallied a massive +43.92%!

Ah hah. The chart above is deceiving right?

The reality:

What a monster!

AVGO’s like the Messi of soccer. Or the Armstrong of cycling. Or the Undertaker of WWE.

FCF generation continues unabated. Long time readers would know I love FCF generative companies. I just think there’s a lot of room for error if your businesses generates FCF quarter in, quarter out. Can’t really go wrong there.

And of course, the above would illustrate how important it is to get a good price for the value that you’d like to buy.

Well, just like in Visa’s case, I’ve seen sold and taken profit for the bulk of my AVGO positions. Not everything, and I’d hope to hug on to the remaining shares. But I’m a realist and I’ve long learnt that if something shoots up almost 45% in a month or so, regardless of how hunky dory I think the days are ahead, it’s always wise to at least take something off the table. (OK, OK, and plus, I’d admit… some shares were assigned away by calls that I sold. LOL)

3rd on the list is BHC.

The ONLY general outta the top 5 that has thus far, disappointed.

Actually, relative to the 20th March, BHC hasn’t done too badly:

Returning +25.69% vs SPY’s +22.84%, it has even managed to outperform SPY.

Yet, this has been disappointing to me since I’ve positions in BHC that were entered earlier, around the USD 20++ mark, pre-covid, and these are still in the red right now.

Which I guess by itself, shouldn’t be too bad a thing since the entire market is still below it’s all time high anyway, and approximately 9% or so down YTD.

The company’s latest earnings came in largely the way I expected them to. FCF generated is used to chip away at the block of debt that continues to weight the company down.

The balance sheet is in a much stronger position now though, as they’ve since refi-ed and the nearest debt due is sometime in 2022. I continue to hold a long position and have not sold any shares (sold calls though). The thesis remains true: FCF generation and continued strength from Salix will chip away the debt every quarter. Joe Papa has clearly indicated that’s his intention, and thus far, the plan is executed.

There’s market talk of Salix being sold, and if so, I think that’d be a massive unlocking of value. Right now, the sum of BHC’s parts, is clearly not equal to it’s individual components. Having said that, I’d think that’s highly unlikely to happen. Salix, together with their legacy ophthalmology Bausch brands, will continue to be the mainstay for BHC.

While I continue to consider BHC 1 of my 5 generals, I will say that increasingly, I’m comparing it to other opportunities (many in my reserve list in the previous post have done very well too).

4th on the list is Tencent.

Need I say more? Tencent has broken through and recorded all time highs.

It’s like Covid never happened!

Listed in HKEx, Tencent has consistently outperformed SPY. (Yes, I’m just using SPY as a benchmark even though Tencent is listed in HKEx. More consistency, plus SPY is really quite a beast when it comes to returns)

The share price has dipped with the recent news of unrest in HK, but I’ve already sold out all my positions.

Currently, the only long exposure I have in Tencent, is in the form of shorted puts, that are going to expire next week anyway. They’re highly unlikely to be assigned, unless Armageddon happens in HK on Monday.

Tencent has deserved it’s 4th position in the top 5, garnering a +30% ROI for me in less than 2 mths.

I don’t want to be seen as gloating over HK’s troubles… but truth be told, an involuntary broad smile spread across my face when I read about the new unrest. The timing couldn’t have been better.

I was intending to replace Tencent’s 4th position with Berkshire Hathaway B shares, and in fact, have started selling puts on the BRK B. With this new development… hmmm, probably will hope to start picking up Tencent shares again.

Come back to me please! (At a much lower price ok. Yes, I’m cheap)

5th on the list is Agilent Technologies.

Yet another ultimate beast.

Agilent has returned approximately +28% since the lows in March, and they’d likely continue to outperform IMO.

And yes, this time round, I’ve not sold a single share, not taken anything off the table here.

YTD, Agilent is actually flat, which is by itself, a massive outperformance seeing how SPY is -9% or so YTD.

Since the march lows, it’s up about 28% or so, but I’ve not taken anything off the table.

No calls to be assigned, nothing. Will be happy to hold.

(And in fact, maybe Agilent deserves a promotion…)

So that’s it, that’s the performance review for the core, top 5 generals positions.

What’s next?

Since the +33% rally off it’s march lows, the markets have cooled a little somewhat. I think nobody would disagree if I say that the most important, key reason for the rally has been the Fed’s money printing, backstopping of debt, jumping in to buy bond ETFs and all that government intervention.

The real economy is as dead as it can be.

On the ground, businesses have more than suffered. I see that intimately in my own businesses. I’ve already previously written (and complained) about it umpteen times in IN, so I won’t regurgitate all that here now.

But the reality is, the stock market doesn’t reflect the reality.

There’s a wide chasm between what the markets are saying, and what business owners are seeing on the ground.

Until we have a safe vaccine that’s widely available and implemented, it’s hard to see how all this uncertainty will subside. The argument for the long side is that US can print unlimited amounts of money and nobody can stop them.

On top of that, because of the record high unemployment rate, which is slated to exceed even the Great Depression’s 25% or so, suddenly we have bipartisan support for all this money printing.

Both parties may superficially disagree on the timing of further stimulus or the form that may take, but no politician wants to be seen as the guy standing in the way of the electorate receiving cheques in the mail, however unwarranted or damaging those cheques can get.

My view is best summarized as one of controlled pessimism. I don’t think Covid and it’s effects are anywhere near over. I am certainly not as optimistic as most market participants. Yet, because of the unprecedented money printing, it is unwise to completely sit out of the markets, or to attempt to short it.

You could get some spectacular gains… possibly. Even probably.

But the risk of being wrong is not negligible, and the consequences, too great.

So this outlook explains why most of the top 5 generals have been either pared down, or sold out completely. I think I’ve been really fortuitous in terms of timing the market lows in March.

No, there’s no technique behind it. I didn’t draw any lines, I didn’t look at any data sets, I didn’t enter cos of any special indicator.

The prices just seem attractive at that point relative to those companies’ value.

They probably still are actually, just much less so.

With that, I’ve decided to continue to keep a core portfolio revolving around these top 5 generals. Tencent is out currently, but I’d be happy to add it back in. (Fighting for a position together with BRK B.)

Instead, I’ve been very cautious in deploying capital, raising cash holdings to a level that I’ve never had for a looooong time:

Currently, cash holdings sit at an all time high of around 880k USD, comprising approximately 40% of the portfolio.

The measly EUR is a result of selling puts on Wirecard. Wirecard tanked recently with the release of their audit findings, and the findings spooked the markets and injected a ton of uncertainty. I took the chance to sell puts as volatility spiked up. Won’t be writing too much about this cos I’ve already discussed it on IN.

HKD is just some remaining chump change due to small differences in forex, after selling out of Tencent and swapping it back to USD. I just don’t like to handle too many different currencies and prefer to change it to USD immediately if the positions are closed.

Then there’s the main currency positions in SGD and USD.

USD is likely to remain strong against the SGD for some time to come, very much ironically in fact. But it is what it is, so I’m reluctant to change SGD right now, preferring to keep it as it is. If USD-SGD rates come down below 1.4, then I’d swap all the SGD into USD.

I actually can’t remember when was the last time I held this much cash without deploying it in the markets.

The cash isn’t exactly sitting around doing nothing though, as I’ve option positions that need to be backed by cash… you know, just in case.

Lastly…

Just thought I’d take the chance to close the loop here. In my last post, I wrote about shorting volatility in the midst of the crazy fear:

Shorting Volatility In The Midst Of Fear

Obviously, “fear” has come down a lot since then, and in fact, if we can have “negative fear”, that’s probably what’s happening right now. The markets have swung from extreme fear, straight into unrealistic exuberance.

Even if you didn’t manage to short it right at it’s peak, even if it’s only say just halfway, you’d still have a 40% return or so from there.

But of course, this is VIX. You can’t directly short VIX, you can only short it’s derivatives, but whatever it is, it’s still healthy profits.

I still have some VXX shorts, in the form of a short sale of VXX units, but will likely be covering them next week.

Finally, I was actually planning to talk about property/real estate too, and give an update on that in this post. (I keep the property segment separate from the equity portfolio)

But all that chart cutting and pasting is making me tired, so I’d leave it here. Sides, I’ve only just written a long private post about property and REITs on IN yesterday, much of it will probably be repeated. Maybe it’d be in the next post, if I get down to it.

I’d end off here with the same way I started:

“Never Let A Good Crisis Go To Waste” – Winston Churchill

TTI, I agree with you on your view as “one of controlled pessimism.” and also your other post on SG REITs.

There is far more probability of an adverse shock than a further upside which will make the numbers stupid silly.

Like you, my warchest has been swelling whilst I still have some core holdings.

LikeLike

Yea, all that free money doled out across all levels of the economy: lenders, consumers, the unemployed and businesses, will inevitably lead to misallocations.

Fed is disrupting capitalism now in a bid to avoid Armageddon, but itd only postpone it.

Problem is, we dont know when the party ends, so its best to keep 1 foot in the door, and eyes peeled on the clock…

TTI

LikeLike

Hi TTII’ve been following your blog with great interest but didn’t manage to see the recent few postings. Eg

Where can I find this so that I don’t missed out on your next piece ?

Rgds,Kean

LikeLike

Hi keanho

Are u referring to the estimates?

They’re from:

https://www.investingnote.com

Its like a forum for investing and they have this feature where one can post estimates, which are time stamped and you cant alter them thereafter.

You can go sign up and get free account.

Cheers

TTI

LikeLike

Hi TTI,

You mentioned “Well, I’d be perfectly happy holding most of them, but the thing is, I sold very far OTM calls and wasn’t expecting them to get assigned. With this massive +32% rally though, most positions have since been sold”

If you sold far OTM calls wouldn’t you be at a loss if the market rallies? Also, do you sell naked or are these covered positions?

LikeLike

Hi

These are obviously covered calls.

Ok, so as described in my estimates, i bought direct equity positions and sold far OTM calls.

When the calls get assigned, I profit from the difference between the strike prices and my entry prices, plus the premiums on these calls that i sold.

So thats the definition of covered calls.

If I had sold naked calls, that would be a short position, not a long one.

Cheers

TTI

LikeLike

Thanks for sharing your outlook :)

LikeLike

Hi YJ

No prob, good luck.

TTI

LikeLike