Since my last report, I’ve now added some new fellow ThumbTack mates into the team, not sure what they will be doing exactly tbh, but they seem pro enough. LOL. Certainly more than me at least. Hmm, I should host some get together meet up soon.

Tony Stark can’t be fighting Thanos without meeting Dr Strange, Hulk and Black Panther first right?

As we approach the end of 2020, December is the curious period of the year whereby the institutional guys do weird stuff sometimes, perhaps to lock in profits, perhaps to recognize losses for tax credits etc.

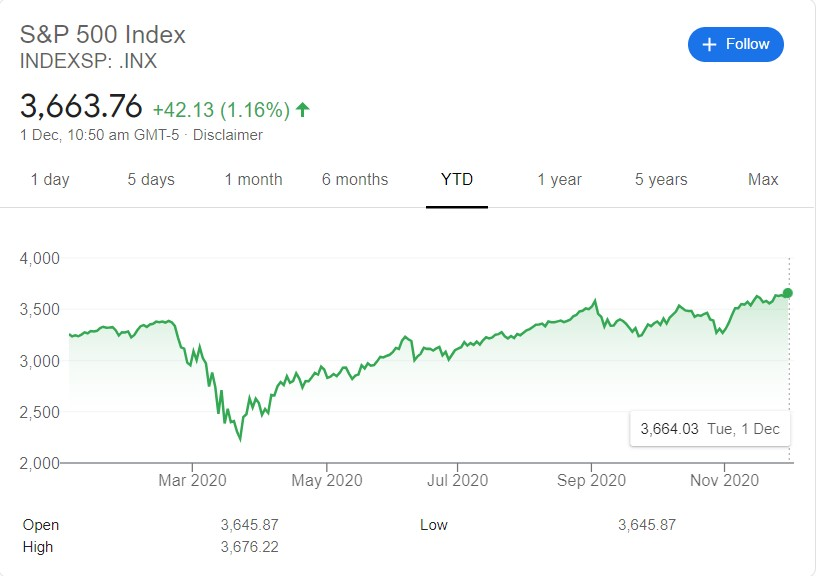

US markets have been roaring ahead, hitting all time historical highs, even as I type this.

In this climate, the absence of gains itself, is a loss. Back in March/April, anyone predicting that the indices would end the year at all time highs would surely have been mocked. This shows the unpredictability of the markets, and the madness of the crowds.

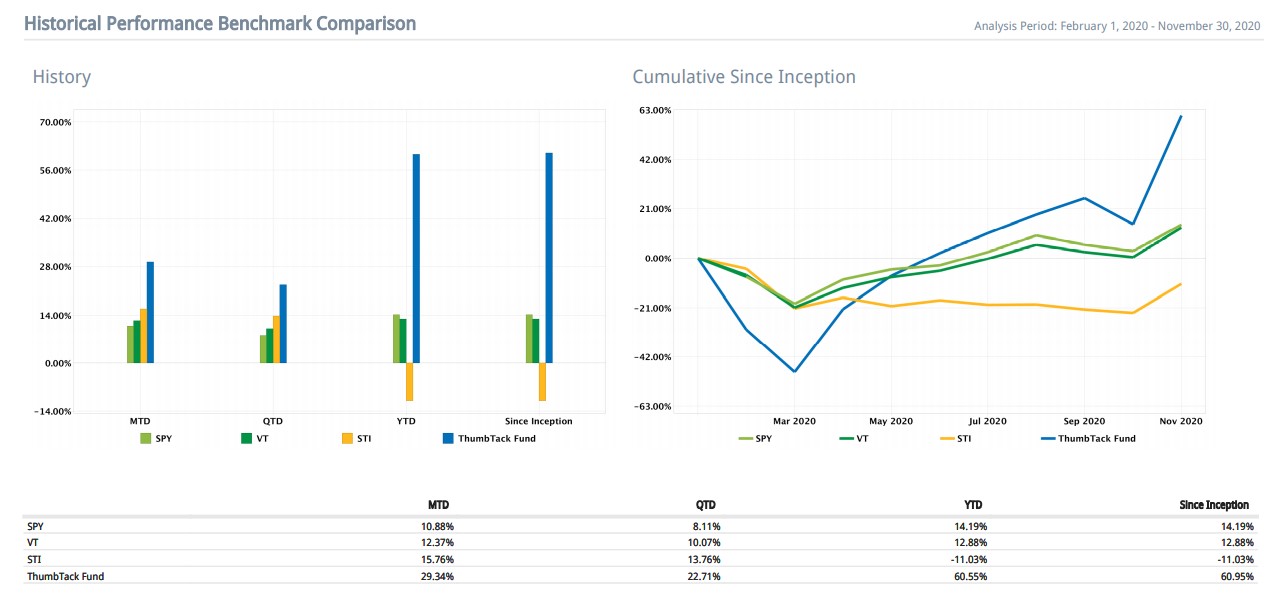

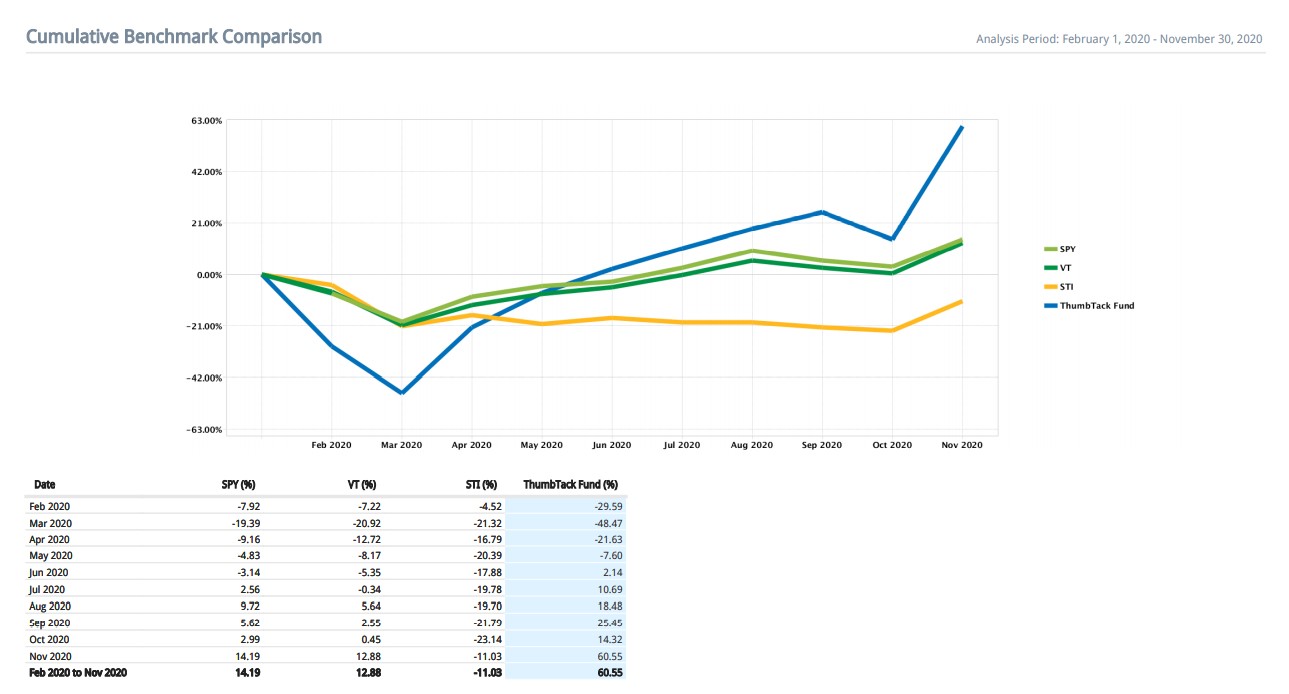

November 2020 has been a good month for TTF.

And that’s an understatement.

Take a look.

YTD, TTF’s MWR exploded as though I just tossed a bunch of mentos into coke.

MWR reached a high of +60.55%, with Nov 2020 being the best month YTD with a +29.34% gain.

Current NAV reached USD 267,833.08, which is a substantial gain from the last report’s NAV.

Total capital injection: USD 191,684.53

Nett gain: USD 76,148.55

YTD:

SPY has returned +14.19%

VT has returned +12.88%

STI has returned -11.03%

TTF has returned +60.55%

As of the end of Nov, TTF remained largely vested in equities and equity derivatives, with approximately 16% in liquid cash equivalents. I don’t think one can afford not to be largely vested in this climate, if one wants to have a shot at beating the indices.

As the indices churn ahead, day in, day out, missing out on say, just a week of market gains alone, would set u back severely and make generating full year alpha an impossible task.

Yet, my thoughts currently mainly revolve around playing defence. I don’t think I’ve a problem with offence… but I don’t want to be playing like Brazil. I’d give up the chance of winning 8-0, if it means I can avoid the risk of losing 0-8. It’s still 3 points anyway. I rather grind out the 1-0 wins, and let the points add up. Yes, I’m an admirer of Mourinho. And this may be an analogy, but really, you can apply a lot of Mourinho’s tactics to investing actually.

I wasn’t kidding when I said the Generals were firing on all cylinders in my last report:

As of end Oct 2020, the cumulative returns for TTF was at 14.32%, which by itself, would’ve been stellar compared to SPY’s 2.99%, VT’s 0.45% and STI’s -23.14%.

Yet, by the end of Nov, this return went crazy, adding on to the last report’s +47% or so, to end Nov with a +60.55%.

No additional dividends were collected since the last report, so I shan’t paste that chart here.

In the last report, the 5 general list was:

- Broadcom (AVGO)

- GameStop (GME)

- Bausch Health Companies (BHC)

- Frontage Holdings (HK listed – 1521)

- Alibaba Group Holdings (BABA)

As the blog post name suggests, I’ve since taken profit on BABA, and swapped the 5th general to LUMN (Lumen Technologies), aka the old “CenturyLink”

Thus the new general list current looks like this:

- Broadcom (AVGO)

- GameStop (GME)

- Bausch Health Companies (BHC)

- Frontage Holdings (HK listed – 1521)

- Lumen Technologies (LUMN)

I do still hold positions in BABA currently, but these are only in the form of options, and no longer any direct stake. BABA was always going to be… the black sheep. I was analyzing and comparing between APD and LUMN, when the news about ANT’s troubles broke. The rapid descent was just too juicy to pass up. I thought it was a market over reaction, and capitalized significantly. In fact, the subsequent recovery in Nov was 1 of the key reasons for Nov’s strong performance.

Let me briefly talk about the top 2 generals.

Broadcom (AVGO)

Errr, I think, I’d let the chart do the talking:

Holding a concentrated portfolio of 5 names means that you simply cannot get your top few generals wrong. You just can’t. Cos if you get those wrong, it doesn’t matter what the rest do, it’d be hard to recover from that. AVGO has hit all time highs, and consistently outperformed the market this year.

1 of the biggest concerns amongst shareholders, is that some big names and institutional holders have sold out. The CEO, Hock Tan himself, has been selling shares at regular intervals throughout the year. Most recently, David Tepper’s Appaloosa has sold substantial chunks of AVGO in their Q3 filing.

Now, it surely can’t be a good thing that insiders (esp the CEO himself!) and very very respectable investors like Tepper are selling out. Yet, it may not necessarily be BAD either. And that’s the problem with the markets. The markets tend to treat every piece of news with a certain amount of extremism. Things are either good or bad for the company. In reality, IMO, it’s usually a neutral to a bit good… or neutral to a bit bad…. kinda situation. One must not over react or we’d be easily swayed. I note that the share price is substantially higher than when Tepper sold, and much much MUCH higher than when Hock himself sold.

We may sometimes give too much credit to the insiders or large shareholders’ actions. IMO, sometimes, they may not know better, compared to smaller holders. Case in point: As I’ve written about recently, regarding the aftermath of ATXI’s FDA rejection, even the CEO/executive directors themselves, did not comprehend the market adequately. If so, they’d have anticipated the rejection as per the reasons I’ve stated early on in my emails. Actually, I’d think they did know of the potential problems, but choose to attempt to submit and hope for the best, cos the alternative may not be possible. (https://thumbtackinvestor.wordpress.com/2020/10/24/thumbtack-fund-report-3-aftermath-of-avenue-therapeutics-atxi/)

It doesn’t mean that we ignore the news when we see big movements among the big boys… we should pay attention of course. But a certain amount of discretion and personal judgement is needed. Now, as an example, 1 of the minor reasons for taking profit this quickly on dear general no.5, BABA black sheep, is that several institutional and big holders are either lightening up their stake, or selling out completely. Again, that’s not necessarily a bad thing… but BABA’s situation sure as hell is different compared to AVGO’s. So we have to take this selling out in the right context.

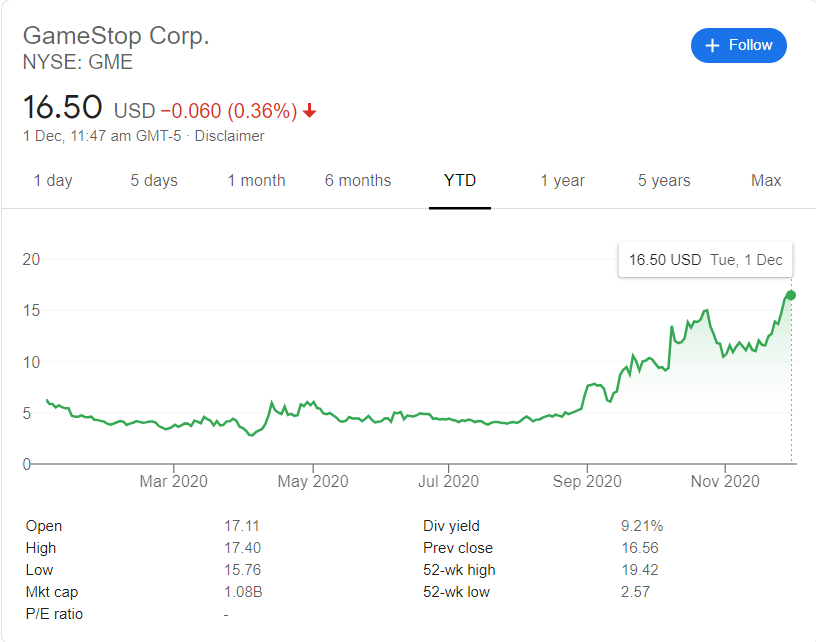

GameStop (GME)

Again, GME has reached YTD highs.

This is a turn around story.

Now, usually, generals don’t get to jump up to TTF’s No. 2 spot on day 1.

They start from no.5, and if I like the opportunities, I add to them accordingly, and they move up the list, relative to the other generals. Makes sense right? You work your way up the list, like everyone else! LOL.

Yet, GME jumped straight to no. 2 on the top 5 general list when I initiated a position, for a good reason.

Turn around stories can be violent. The share price can swing up (and down too!) very aggressively, as it is illustrating the market’s surprise (or shock) at the latest developments. I wouldn’t have given GME the number 2 spot without some serious DD.

Even then, I considered very very carefully how I’d structure a long position in GME. It’s important to be cautious because even if a turn around takes place, even if there’s record console sales, even if the digitalization strategy shows results, even if Cohen bumps up his stake over 10%, even if more partners come onboard and work with GME…… the mere fact that there’re so many fan boys jumping in with each piece of news, makes me a tad concerned.

In most investing forums, you see ppl looking for validation from other forumers. I never really get that. These folks probably won’t know much more than me, unless they are nut cases like TTI.

I generally don’t have lousy judgement either. At worst, u could say I have mediocre judgement. If so, then why would the validation from a bunch of unknown folks with no track record, make me feel better or more secure about my positions? They know less than me, they have the same or worse judgement than me.

If anything, I genuinely get more and more worried if more and more people start high 5-ing me, start proclaiming that they “share” my views, start patting me on the back and start agreeing with everything I said.

That’s not a good thing. That’s a sign for me to be careful.

Yes, I’m weird like that.

So, I won’t be surprised if GME tanks from here. Like a -30% in a single day.

Now, I don’t say “won’t be surprised” lightly. It’s not just being “not surprised”. I mean, I’ve structured my positions such that based on my back of the envelope math, even with a sudden sharp drop, my gains are mostly protected, I’d have time to react, and most importantly, it won’t come as a shocker to me. Of course, nothing is free. Structuring it this way also means that I’d have to give up some gains, if the share price goes ballistic. As it has recently.

But as I’ve shown, hey, a +60% gain is good enough for me. Maybe if I’d thrown caution to the wind, and it all works out, the +60% would be a +90% right now. But that’s not a risk I’m willing to take. I’d rather get uber rich 5 years later than planned, than become pauper poor.

I won’t be writing about the latest general, LUMN, except to say that this is a company I’m very familiar with. Back when it was still CenturyLink, prior to the Level 3 Communications acquisition, I’ve vested in CTL aka LUMN at various periods of time. Some were profitable, some were painfully unprofitable. I do think that after 2 years of integration, the company is on the cusp of turning things around.

LUMN has approximately about $6.2bil worth of operating losses from the previous years, and this will provide a nice big fat tax shield for them in the coming years. I’m thinking 2021 and 2022, maybe even 2023.

Nothing much has changed for the other top 4 generals, except that in line with the overall increase in NAV, their corresponding sizes have, of course, increased as well.

Alright, I’m ending this report here. It’s getting late.

What is the STI benchmark?

LikeLike

Yup, as per the reply by the other reader.

I’m guessing you must not reside in SG.

STI is the equivalent of S&P index for Singapore.

Cheers

TTI

LikeLike

Straits Times Index

Basically Singapore’s stock market index (SGX), I guess, because the author is from Singapore.

LikeLike