I hosted a fellow member of Team ThumbTack last weekend for lunch. It’s been an uber exhausting start to 2021, and also, since it’s going to be CNY soon, I thought we should go somewhere fancy, eventually settling on Cantonese food from Summer Palace at Regent Hotel.

Here’s what Michelin 1-star for 3 consecutive years Summer Palace looks like:

LOL. U gotta admit, the starter does look kinda… underwhelming. But it gets better real fast.

Lobster noodle is da bomb. I kinda wished it was served earlier though, was already 99% full by then.

<Forgot to take pics of the fancy desserts…>

Anyhow, said fellow ThumbTacker was coincidentally, 1 of the early employees of InvestingNote. He was also heavily involved with the previous post, doing most of the heavy lifting in fact:

In that post… GameStop (GME) was referenced multiple times and quoted as an example.

Now, all these mentions of GME here were way before GME made financial headline news all over the world, particularly in the past week.

It has occupied the no.2 spot on the top 5 general list for the longest time:

https://thumbtackinvestor.wordpress.com/2020/12/02/thumbtack-fund-report-5-ba-ba-black-sheep/

I held 55,000 of GME at an average price of approximately USD 8++ at the start of 2021, way before Chamath even knew the company existed (just sayin). As it spiked, I finally sold everything at around USD40 – USD45, recognizing a 450% or so ROI for General no.2.

Big mistake (on hindsight of course!)

The share price continued to rise violently, spiking way above USD 400 even, and this looks set to continue next week.

At the last count, my 55,000 shares would now be worth approximately USD 22mil!!!

<Insert emoticon of someone puking blood pls for the full cinematic effects>

Talk about leaving the party early!

Gosh.

OK, OK, I did do the hypothetical calculations just to have a sense of how much I left on the table, although truth be told, I don’t really feel… … that it’s a waste. I guess that’s the price to pay if my strategy is focused on assigning intrinsic values to the share price.

On hindsight, there are of course, many things I could’ve looked at. Even in my early mentions of GME on IN, I’ve already stated a short squeeze as a potential scenario, and that’s way before most people spoke about it.

So I guess this ends up being 1 of the scenarios whereby my rationale was right, my timing was fortuitous, I did benefit from what would otherwise have been eye popping returns… but left the vast bulk of the gains on the table as I under estimated the insanity of today’s markets.

As a buddy told me: “You’re too smart to be filthy rich.”

Think about that statement. It’s true. It really is.

To capitalize on extreme scenarios, and I mean like EXTREMEEEEEEE…… you can’t be just smart. Cos being smart implies a degree of judgement and rationality. Doing the sensible thing.

But those who have capitalized on extreme situations to become filthy rich, usually include an element of irrationality. Craziness. Doing things that normal people would think is insane. Just plain, outright illogical.

Jobs was sleeping in his friend’s dorm for a period of time. He didn’t graduate cos he didn’t bother to pick up the relevant credits needed to do so.

Tesla was expected to fail for the longest time. Musk himself said so, he himself thought that they’d go under.

Many billionaires dropped out of Ivy League colleges and took huge risks before they made it big. That’s not the “smart” way of doing things. The “smart” way was to graduate, get a cushy consulting job, and bank in half a mil of comp annually, and work your way up.

So there. I did the “smart” thing. Banked in a 450% ROI in 3mths. (but not the 4,500% ROI)

And as long as I remain “smart”, I’d never be able to capture the next 4,500% ROI opportunities that I manage to dig up. Cos that’s not what rational people do.

The excitement doesn’t stop there.

U see, on InvestingNote, I tend to reference drinking Teh Bing (iced milk tea) once in a while:

LOL, u get the idea…

Of course, I didn’t really mean it right? Everybody’s just a random stranger to everybody else. I don’t expect to know anyone irl, possibly in this entire lifetime. We are just all random folks, of course, linked by a “investing commonality”, but would otherwise just have a fleeting impact on each other’s life.

But apparently, some dude decided that he meant what he said, it’s not a figure of speech, it’s not a joke; and really treated me to teh bing by sending me a Grabfood voucher via email! I legit don’t even know you can do that.

Since then, that set off an avalanche of folks who decided to errr…. fulfill their promises despite everybody knowing that it’s probably a joke!

LOLOL! Kid u not, I’ve been receiving GrabFood vouchers, Starbucks, Capitastar$ (or something like that), Cold Storage vouchers etc literally everyday since then.

It made me smile.

Like really. We’re not talking about massive sums of money, but it’s… kinda cute, ain’t it?

I think I should ask if Guinness Book of Records if this is a record for “most number of gifts received from complete strangers”. I tried to google it and it only shows some “Secret Santa” record, so hey, this might really be a record.

So now, aside from Teh Bing, I can on occasion, get the Ackman sanctioned western version:

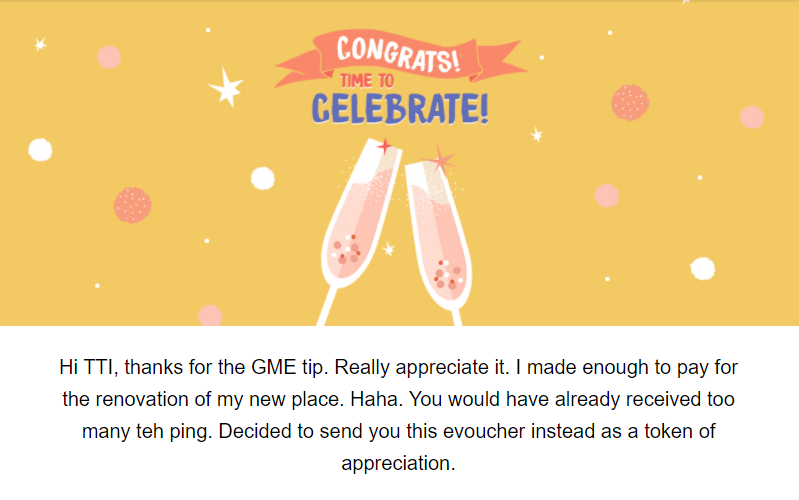

This is by far my favorite message: GME paid for his renovation! :)

Who’d have known? An American legacy video game retailer paid for some dude’s house reno halfway around the globe in SG…

Anyhow, the main purpose of this post, is really to just say thank you.

I can’t reply the Grabfood email, so I guess I just have to say thank you to everybody as a group here.

It’s greatly appreciated, I’ve saved each and every one of your emails, I know who you are (online persona at least), it’d be my treat next if I get the chance to.

If I drink 1 x teh bing everyday, back of the envelope calculations tell me that I’ve enough for around 2 years. LOLOL!

To put things into perspective, if TTI is a company, and daily 1 x teh bing is an operating expense, as of now, my balance sheet has enough teh bing assets to last till… Q4 of 2022.

That’s longer than how long AMC can last at their current cash burn rate, despite having just done a capital raise and having a bunch of debt converted to debt! (https://seekingalpha.com/news/3656164-amc-entertainment-exploring-raising-new-capital-with-stock-surge-cnbc-says)

So I’ve enough, don’t need to send me teh bings anymore pls, I greatly appreciate it. SEC can’t come after me for saying that funding IS secured, thank you, thank you, this IS kinda the closest to having an actual teh bing truck.

Gum xia. Gum xia.

Probably no new posts for a while, so I’d end off by wishing all readers a great Lunar New Year ahead.

Huat ar!

Hey TTI, that was one helluva mama drama, and glad that you folded the bet with a big win even if the next few guys got more. I have shared & spread yr story here: https://www.nextinsight.net/story-archive-mainmenu-60/944-2021/14008-singaporean-investor-says-he-left-us-22-million-worth-of-gme-on-table

LikeLike

Hi CT

Ok sure.

TTI

LikeLike