Firstly, let me start off by making a correction. A reader brought this to my attention some time ago actually, but I haven’t addressed it here yet.

In an earlier post I wrote back in May 2016 :

I worked out how the acquisition of the 50% stake in USP is an asinine move based on a company net profit of $3.144mil and a purchase price of $24mil, the PE ratio is 15+, which is really high for a retail operation in Malaysia.

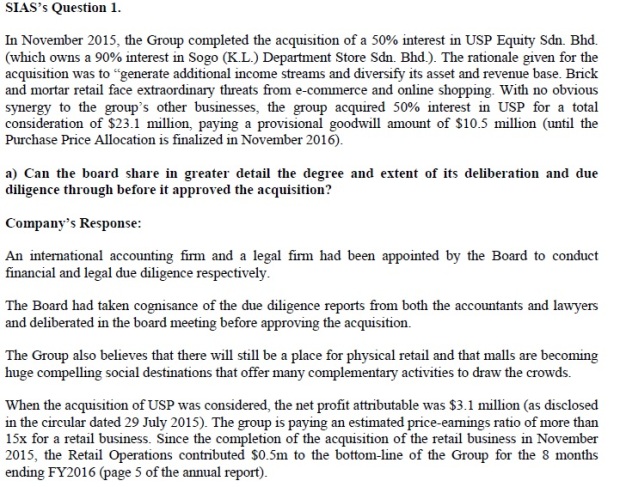

Well, SIAS (which stands for Smart Investors Always Succeed, cool name) must’ve either read the announcement and made the same mistake as me, or they read my report and fired off the same question to LTC’s management. I’m inclined to think it’s the latter.

Anyway, bless the guys at SIAS for asking. Seriously, can you guys look at some of the companies that I own and ask more of such hard questions please?

The company has since clarified that the $3.1mil profit is already attributable to the 50% stake, not the whole company.

This cuts the PE ratio paid for the stake by half, to about 7.6 or so.

This makes the valuation paid for the acquisition more reasonable.

That’s the good news part.

The bad news part, is that the lowered valuation doesn’t make the acquisition any better in terms of forward results.

This is the amount of profit LTC has achieved with the 50% stake since the completion of the acquisition:

FY16Q2: $460k

FY16Q3: -$631k

FY16Q4: $677k

FY17Q1: -$642k

So based on ttm, the net profit attributable to the 50% stake in USP is…

-$136k.

Uh huh. Suddenly, even a much reduced PE of 7.6 looks to be way too expensive. PE is actually negative!

In my last analysis, I’ve already flagged up the USP acquisition to be a poor one (I did include a caveat that the business is newly acquired and that we should give management some time to prove themselves.)

So naturally, when FY17Q1 results came out, I was interested to see how USP would perform. Afterall, it is the start of the 1st full official year since it came under (partly) LTC’s fold.

(Under “Share of results of a joint venture”)

I was rewarded with a -$642k loss attributable to USP. Ouch.

Imagine there isn’t this $642k loss. The profits would be much more impressive isn’t it?

To SIAS: If I may be so bold, the next qn you guys should ask, is obvious:

Why was the profit attributable $3.1mil in the year prior to acquisition, and now, it’s a fraction of that? In fact, YTD it’s -ve. Not even a fraction.

But then, I can already envision how the company would reply. Business conditions have changed, they’re working on a turnaround blah blah blah.

In their reply to SIAS, LTC did mention that the GST implementation in Malaysia in 2015 did impact greatly on the sales. They didn’t mention this, but obviously the steep fall in the ringgit vs SGD is a big factor as well.

So unfortunately, my gripe still holds true: LTC paid too rich a valuation for the USP stake.

It’s better than PE15+, but ask yourselves this simple question: Would you pay 7.6 times previous year’s earnings for a business that is subsequently going to be loss making IMMEDIATELY after you acquire it?

Sure, the management can give a ton of excuses for why the profits literally tanked right after acquisition, but isn’t all this stuff supposed to have been discussed, deliberated on and incorporated when bargaining for an acquisition price?

The GST implementation is not new. It has been raised in the media way before the acquisition so I find it hard to accept that as a reason.

In my earlier analysis, I’ve described how FY17 is an interesting turning point for the company. The company has long been FCF generative, but has used the $$$ for debt repayment.

Info That I Have Gleaned From LTC Corporation’s AR 2016

LTC Corporation & Asia Enterprises Holdings – What Are Investors Missing?

I also described how we’ll be expecting to see an increase in FCF, and a reduction in overall debt, since LTC’s Seven Crescent properties were divested.

Thus far, no surprises in FY17Q1 results. All my previous predictions were reflected in the results.

Cash and cash equivalents has risen from $34.4mil to $52.1mil in the last 3 months!

That’s an increase of $17.7mil in 3 mths.

The company has largely paid off debts and borrowings as of last quarter, with only a mere $47k outstanding. This means that any future FCF generated will accrue to the FD and cash balances.

I’ll expect the cash holdings to increase in the upcoming quarters, although at a significantly slower pace than this Q1.

So what’s next going forward?

As the cash holdings accrue from the generation of FCF, I’m interested to see how management utilizes the cash. It’s obvious that the bulk of it will go into trying to turn around the USP business.

If they’re successful, that’ll be a nice growth area for LTC in future. If they’re unsuccessful, the consequences would be just terrible for shareholders. We’d simply be pouring money into a really deep pit for nothing, spending precious FCF on expensive acquisitions, on maintaining and running operations for a retail business where the general environment is against the industry.

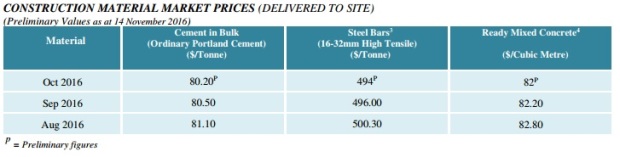

Aside from the utilization of cash, I’d be monitoring the steel prices. There’s no point monitoring the international steel price index. LTC’s clients are mostly local, so the key parameter to look at is BCA’s steel price index.

Here’s the latest BCA rebar steel price:

The rebar steel price is important because as I’ve explained in an earlier post, the way the inventory is accounted for (average weighted method) results in “magnified” profits when steel prices rises, and losses when it falls.

As it stands currently, the valuations are just too attractive. I am unlikely to accumulate though, as my position sizing for LTC is just about right currently. I’ve said repeatedly, as far as in my initial thesis way back, that the downside is limited from here, and thus far it’s been true. LTC’s share price wouldn’t go under $0.5.

If management can utilize the cash that the steel business generates going forward efficiently, the company is going to do very well. The effect of good capital management for LTC cannot be emphasized enough.

Every quarter as the FCF accrues, the effect of good OR bad cash management is applied to this newly minted cash. For this reason, I think the key parameter to look out for is the ROI figure.

LTC traditionally has a low ROI (Steel business is asset intensive), but we can focus on the ROI specifically for the USP JV, not LTC itself, by considering the profits it generates for LTC, as a function of the price paid by LTC ($24mil SGD thereabouts)

I’ll be watching what LTC does in the coming quarters with its cash.