In medicine, clinicians have to practise evidence-based medicine.

What does that mean?

It means you can’t just carry out a procedure or a treatment, based on your mood, your personal beliefs or what you personally think will work, even if you have strong personal grounds to believe it’d work, or even if you have good intentions.

You get into trouble for doing that.

Good intentions, no matter how pure, is not a defence.

Everything must be evidence based, that is, based on literature from research work done by heroes who devote their lives to doing research, all for the betterment of mankind. (I say heroes and I genuinely meant it, cos most research work is actually relatively poorly remunerated, with a lot of hard work. It’s just shitty work IMO, despite how much the gov tries to promote it and all the life sciences nonsense.)

Amongst the different levels of evidence, there’s the gold standard at the top, the double blinded randomized controlled trials (RCTs). That’s like the strongest evidence.

Then there’re also the case reports, which are great for learning from fellow colleagues, but may not provide very strong evidence. Still better than relying on your personal beliefs.

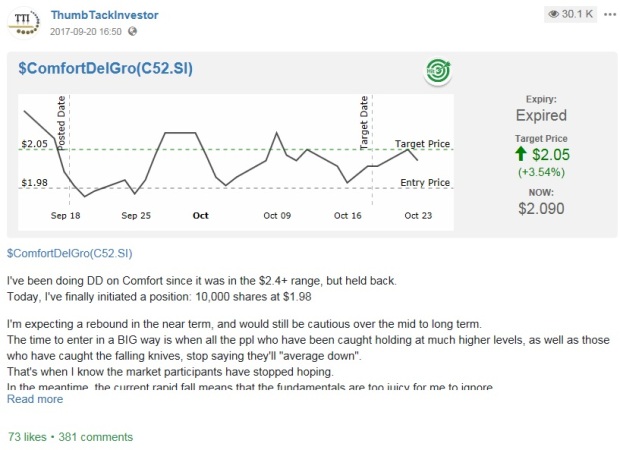

Anyway, here’re TTI’s case reports for my brand of deep value, investigative, no-nonsense digging type of contrarian investing. (And here I’d help InvestingNote by promoting them a bit)

Over at IN, I have made 5 estimates:

And the cumulative result of these 5 estimates are:

(Please don’t bother to join IN to follow me, I don’t think I’d be making estimates that often anymore.)

Now…. of these 5 estimates, 2 have hit, 2 are ongoing, and 1 has been widely off the mark.

Of the companies that the 5 estimates involve, 4 of the estimates are done with lots of loving care, due diligence, seriousness and are evidence based.

The last 1 was done somewhat as an experiment, with next to zero research, with callousness and I think I spent a grand total of 15mins looking at it.

Hazard a guess, which is the one with no effort put in? No prizes for guessing.

TBH, I don’t really know what BlackGoldNatural is doing right now. I roughly know they’re in the coal industry from my work with Geo Energy, but that’s about it. I made the estimate after reading 1 solitary article about them winning some contract.

And THAT, is why casual, read-the-news-and-invest, is suicidal.

(well, my estimate for Geo Energy hasn’t hit the mark, but for all practical purposes, I’d consider it has, since it rose as high as $0.31, just barely below my $0.32 estimate. Plus I’m deeply in the money on this one, having gotten in right from the start when it was unloved)

Geo Energy Resources Investing Thesis – Part I

Geo Energy Resources Investing Thesis Part II

Finally, let me give just 1 more “case report” as evidence.

Sometime in Nov (2 months ago), I posted my investing thesis for Shinsho Corporation:

TTI’s New Core Position: Shinsho Corporation & Kobe Steel

In my most recent post, I said that this week is exciting, as the major steel makers would be posting results.

Experts In WEF Davos + Updates On Shinsho Corporation

And THIS, is what Shinsho Corporation did today (at the time of typing this):

With this, my large core position is looking real pretty today, with an approximately 24% gain or so in the past 2months++.

And that’s not taking into account Fx gains, which has fortunately, worked out in my favour as the JPY strengthened of late. That’s gonna add a few more % points to that 24%.

I think Shinsho Corporation was a classic case of contrarian investing: Having the balls to take a position when the world says no. Right after I built my position, even more of the world said no. And as late as just a few weeks ago, naysayers continue to think that there isn’t much value left to capitalize on.

Today, things have swung to my side, as a bit more of the world is starting to recognize what I saw 2 months ago.

Yet the difficulty in contrarian investing, lies in truly believing that you’re right while the general market is wrong. That’s something very difficult to do, especially if the share price continues to move against you. Afterall, we validate our investing prowess by the share price.

IMO, the only way to really stand firm in the barrage of dissenting information and opinions, is to know what you’re investing in, and know it better than the other guys.

Even with the massive jump today, Shinsho’s share price is still a tad below what I deem to be fair value. But I’d have to reassess it again tonight or over the weekend, cos global markets are looking shaky of late, there may be some better opportunities thrown up elsewhere that’d warrant deployment of capital.

I’d like to see how STI ETF can beat SG TTI this quarter; I’d really have to screw up big time for the next 2 months for that to happen.

Hi TTI

congrats!

Now I am kicking myself because I read your earlier post, loved your comparison and reasoning but because it’s not on SGX, I couldn’t buy it.

but well done!

LikeLike

thank you.

There’s always another opportunity around the corner, we just have to look hard enough

Cheers

TTI

LikeLike

Thank you for sharing.

LikeLike

Thank you for reading

LikeLike

Hi TTI,

Was reading your blog and suddenly recalled this incident. Will you be leaving it to fate or will continue to chiong? Any thoughts?

http://www.asiaone.com/health/late-millionaire-surgeons-last-words-money-ferraris-and-true-joy

LikeLike

Hi Botak,

The late Dr Richard Teo is famous in the industry.

Towards the end of his days, he still spent time going back to NUS to talk to the undergrads about his journey.

My junior who was one of the undergrads whom he gave a talk to, said that his speeches were very heartfelt and everyone was very touched. When he spoke, he did so with great difficulty then as his voice was hoarse from the chemotherapy and he had to stop repeatedly to drink water (it knocks out the glands that lubricate everything, making you feel like you constantly have a terrible sore throat). He was about to go, yet he went about his business like a man on a mission.

As for your question:

“Will you be leaving it to fate or will continue to chiong?”

Are you specifically asking about insurance? (or my lack thereof)?

Regardless of how unfortunate this is, the incidence is still very low. Insurance is just a means of protecting against the very worst of scenarios, like this. And that, I am covered. Personally, I don’t like insurance as I think the whole insurance is over hyped. My thinking is that the sole purpose of insurance is to ensure a catastrophic event’s effects are negated. So aside from a simple term insurance protecting against death and TPD, I think everything else is unnecessary.

Cheers

TTI

LikeLike

Hi TTI,

There is no doubt that you are a very successful and hardworking individual, but that seems to come at an expense of time and health? Sleep 4 hours everyday and having a meal a day etc. When is enough wealth enough? Was wondering if Dr Teo will evoke some thoughts in you. Or perhaps things like health and death really boil down to fate.

Quote:

“But in March last year, Dr Teo, a light smoker, was struck down by terminal lung cancer. And his attitude changed.

When the “music’s over”, Dr Teo realised that happiness didn’t come from enriching oneself.

Joy comes from celebrating life with those around you, whether with laughter or sorrow. Now it is his message, not his riches, has become his legacy.

“Chinese New Year… I would drive my Ferrari, show off to my relatives, show off to my friends, do my rounds, and then you thought that was true joy?” Dr Teo told dental students at a talk early this year.

“In truth, what you have done is just to elicit envy, jealousy and even hatred… In my death bed,

I found no joy whatsoever in whatever objects I had – my Ferrari, thinking of the land I was going to buy to build my bungalow, having a successful business.””

LikeLike

Hi Botak

Ah, that’s what you were referring to.

1stly, I don’t think I’m very successful. (not yet anyway) I guess it’s relative, I know of many individuals who have accomplished a lot more, so that, over time, raises the benchmark for me.

2ndly, I don’t drive a Ferrari, and I don’t show off to anyone either (nothing to show off anyway).

Finally, actually, I don’t think Dr Teo’s message was that we should just take things easy; neither is it about not bothering about accumulating wealth. Rather, for him personally, he went to the extremes of wealth accumulation, and at the end, belatedly found that it didn’t bring him much joy. I don’t think my situation is anywhere similar to what he described.

But yea, aside from that, you’re absolutely right, I also think my schedule is impacting on my health. I can literally feel the difference compared to say… just 5 years ago. Irregular meals and inadequate sleep are my 2 greatest sins, and I have tried to address them. Perhaps its the environment I’m in, but I think irregular meals is common amongst my colleagues, and even some friends I know.

Of the 2 vices, inadequate sleep is probably the more detrimental one, and I’ve even started keeping track of the number of hours on a daily basis, accruing it if I “under slept”. I started with a min of 9hours /day, cos I read a paper that says that’s the ideal for my age group. But that’s now reduced to 7hours/day, cos that’s the requirement by SAF. They got this figure probably by looking at the existing literature and combining it with the practicalities of life.

OK, I haven’t been very successful in that aspect, 1 month into 2018, I currently have a sleep debt of approximately 28 hours. LOL!

Yea, I’m still working on it…

haha

Regards

TTI

LikeLike