Just realized that my last overall portfolio performance update was back in June 2018, and I haven’t been updating it for the past 10 months.

The page is now updated and revamped. I’ve added in a line chart of the portfolio size, going back to 2011 since I’ve started tracking. Note that this includes any capital injections or withdrawals. (Mostly injections, except for 2015 and thus far, in 2019).

I’ve opted not to add to the portfolio thus far in 2019, as I’ve shunted some capital into the property fund instead. Hopefully, there’d be some firesales that come up soon. Thus far, all the “firesales” that I’ve seen, are not really firesales but just marketing ploys.

I’ve only really seen 1 true blue firesale a couple of years back, and I was too slow (problems with not having liquidity on standby), and missed out on it. You know it’s a true firesale when the unit gets a confirmed offer and the whole deal is tied down less than a fortnight from the time it got listed. The buyer got real lucky there, as he/she is sitting on at least $550k in gains, and it’s only been 2 years.

(Yes, that’s TTI’s lantern flying away)

SG Markets

Total portfolio value in SG markets is $384,033.

I’ve hardly had any activities in the SG market in 2019, only transactions being to lighten my stake in Geo Energy Resources, a stake I’ve held since 2016:

Geo Energy Resources Investing Thesis – Part I

Geo Energy Resources Investing Thesis Part II

My current SG portfolio comprises Alliance Minerals Assets, Geo Energy Resources, Dutech Holdings, Venture Corp and Q&M Dental.

I’m not currently evaluating anything new on SGX, and so, correspondingly, will not be likely to add anything on SGX. If anything, further divestments are likely.

Dutech Holdings just concluded their AGM, and although I didn’t attend, I was given a comprehensive account of what transpired by a friend who attended. In short, it doesn’t seem to hold very good news. I’m still holding, and optimistic about my stake though. The last earnings report was very satisfying to me, and I believe Johnny has made more progress on the integration of their acquisitions. AFAIK, Metric continues to be the 1 bleeding arm, and I hope 2019 will finally show a turnaround there.

Bonds

Nothing much to talk about here, the bond portfolio is approximately $550,000. The intention is to leave all coupons to compound, with next to zero activity here.

US / Global Markets

This is where I’ve focused all my attention on, with stellar results.

Results that have way surpassed what I was expecting myself.

Current portfolio value here is USD 649,167.44 or SGD 884,230.97.

As a continuation of these updates:

Best. Mar……….. You Know The Drill!

I should’ve titled this post Best. April. Ever……

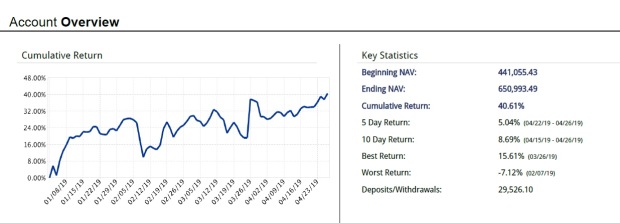

Hitting a new YTD high of 40.61% ROI, this has been the best start to a year that I’ve ever had.

NAV increased from USD 441,055.43 to USD 650,993.49, inclusive of a capital injection of USD 29,526.10.

NAV gain is USD 209,938.06, and net capital gains YTD is thus USD 180,411.96.

My strategy in the global markets is an extension of what I’ve always been doing.

It’s 2 pronged.

Using options, I try to generate regular positive cashflows by capturing premiums on contracts that I think are either unlikely to get exercised, and/or contracts that I’d be happy if they get exercised.

Using the cashflows from these options, which can take several weeks or even months to expire/exercise, I look for unique situations whereby there’s potentially a huge return, relative to the present risk. Of course, these situations would usually crop up in instances of severe duress, and that’s when I love to commit large amounts of capital to. Wirecard being a most recent case in point.

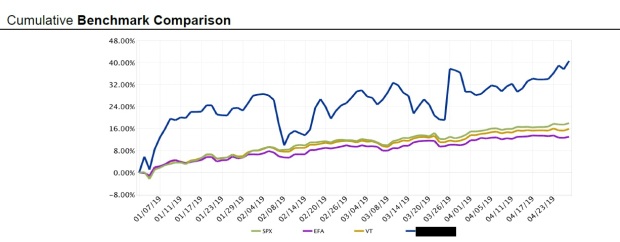

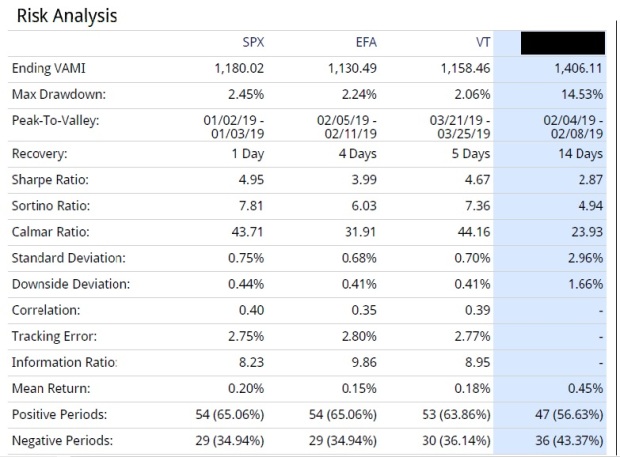

YTD 40.61% means I’ve managed to completely trash the passive indices thus far this year, by taking on asymmetrical and contrarian positions.

What strikes me is that the global passive indices have actually done very well too. SPX (which is an S&P500 index ETF), has exceeded 16% ROI YTD, which in any other given year, is a very VERY impressive return in itself, considering it’s only been 4 months.

I don’t believe beating the passive benchmarks can be achieved without significant volatility though, and my portfolio hasn’t been an exception:

The volatility sure looks crazy.

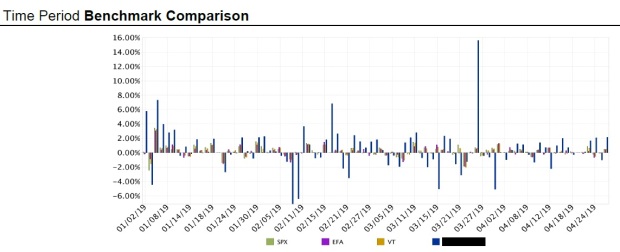

On good days, TTI’s portfolio wildly outperforms the global indices by a mile. I mean, just look at that straight blue line somewhere around the 27/03/2019 mark.

The reason for all this volatility is the large, concentrated, contrarian positions. If the position does well, the impact on the overall portfolio is very much significant. If it does poorly, the reverse is true as well.

There are also several blue lines well into the negative territory, and many times, the blue line has gone the opposite direction of the global markets, whereas the green, purple and yellow lines have moved in lockstep.

Perhaps this is most instructive:

Despite returning more than DOUBLE that of the next best passive index, TTI’s portfolio had only 47 positive periods, whereas the other 3 indices had 53 – 54 positive periods.

TTI’s portfolio also had 36 negative periods, which is way more than the 29-30 negative periods for the benchmarks.

This can only mean 1 thing:

I’ve been making the “positive periods” count, while trying to ensure the “negative periods” hurt that much lesser.

Which is actually, an extension of a lesson I’ve learnt from Stanley Druckenmiller (I’m sure I’ve already quoted this before somewhere in this blog):

“I’ve learned many things from [George Soros], but perhaps the most significant is that it’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

I’ve taken some profit off the table on my wirecard positions, but still hold a significant stake in the form of 1,500 shares held directly, and several put options sold.

I’ve had time to evaluate their most recently released 2018 full year results, and there hasn’t been any surprises there. Even their guidance for 2019 hasn’t moved 1 bit. The shares are pricey though, and I generally don’t share the level of enthusiasm as most analysts that are positive on the company.

Nothing grows forever.

Yup. It’s pretty amazing that this is so logical, but the markets, and human psychology, always expects the most recent trend to continue indefinitely. My layman explanation for this is that the markets would always have new entrants and exits, so for those who have just bought into a growth story, the story always seems to have “just started”.

Currently, I’m assigning a PE of around 45, and a forward EPS of 3.8 euros, giving a fair value of around 170 euros. But since I believe in leaving something on the table, I’d look to sell calls with strike prices of around 160 euros.

Thus far, my total profit, both recognized and unrecognized, sits at around 58k euros, and that accounts for a big chunk of the YTD capital gains.

On average, every year, I’d put serious capital to work into just 2-3 big ideas, after evaluating tens of ideas. I know that I only need to get these 2 or 3 right. The rest are just the sugar icing.

If these concentrated positions pan out, the returns would likely beat the markets handily. If they don’t… well, I try to make sure I realize it soon enough, and don’t let the mistakes be fatal.

Having assessed several ideas, some of which are brought to me by my readers actually (thank you for that), I’ve decided to start deploying serious capital into the next company.

It’s a really interesting situation here, and I’ve already started building up a sizable position, but as the liquidity is low and the spread is at times, humongous, it’d take some time before I can finish accumulating a position that I’m happy with.

I’ve previously hinted at this in my last post:

Best. Mar……….. You Know The Drill!

Apparently, it’s not very subtle cos some folks already figured out what I’m talking about (Look at the comments section)

Which is pretty amazing considering that I’ve done nothing except to cut and paste some financials, out of the thousands of companies out there.

Maybe I’d post up my due diligence next, it’s rather comprehensive and intense though, as this is an industry that I’m very familiar with, and the industry jargon isn’t exactly easy to understand for the layman. I’ve had correspondence with the management too, and although the CEO has been very cautious in not revealing any information that she isn’t allowed to, reading between the lines has allowed me to glean tidbits of information that has been useful.

That’s all I have for this post.

Investing is a really long and tedious journey, and the best investors are usually the ones who are not afraid to walk it alone, and in fact, wouldn’t have it any other way. I leave you readers with this photo I took recently.

Godspeed.

Godspeed.

Dear TTI, any take on Geo Energy resources as coal price declined again and share price rotting as well?

LikeLike

Hi Michael

I think Tung has to answer to shareholders why the company borrowed all that money, and paid USD 26.5mil, and did absolutely nothing with that money.

In a briefing last yr, he said that if the company borrows all that money and does nothing with it, then he must be very dumb.

So there we go.

In SGX, I’ve only transacted in 1 company thus far in 2019, and that’s to take profit on 250,000 shares of Geo Energy at close to $0.2.

I don’t plan on selling my remaining 550,000 shares anytime soon, at the current prices cos I think they’d be announcing at least an acquisition this year.

Also, the new volume guidance given by the company looks terribly low, so I really don’t see how they can’t meet this guidance.

It’s deliberately set low to beat.

From my experience with Tung and Geo Energy, he’s certainly not conservative, always pushing the boundaries when giving forecasts, and preferring to round up instead of round down.

I just think that there’s little downside risks from here on, and the div is still pretty attractive.

Cheers

TTI

LikeLike

Hi TTI,

Mind to share if u have any views on Alliance Mineral in general and also its coming EGM resolutions?

Cheers

JohnnyDepp

LikeLike

Hi JohnnyDepp

I think the management is taking the shareholders for a ride.

Issuing share options and performance shares??

When Li prices shot way past their offtake price then, Mark said hes very comfortable with it cos they get predictability in return for sacrificing some margin.

When prices dropped below offtake agreed upon price, suddenly the company had to renegotiate.

So much for the predictability of an offtake.

The management should all be shot IMO.

TTI

LikeLike

Hi TTI,

There is some rumours going around that takeover is happening. Mark Turner has just disposed 500k shares in today’s announcement. If takeover is coming, why bother to change company name then. What is your view on this?

There is this statement in the EGM notice:

ANNEXURE A – SUMMARY OF THE EQUITY INCENTIVE PLAN RULES

k. Change of Control: In the event that a change of control event occurs all of the Eligible Participant’s Awards (whether vested or unvested) will immediately vest on the date on which there is a change of control event, regardless of whether or not the employment, engagement or office of the Eligible Participant is terminated or ceases in connection with the change of control event. The Board may also determine another way in which the unvested Awards will be dealt with if a change of control event is likely to occur.

Cheers

JohnnyDepp

LikeLike

Hi

My view is that we cannot base an investing thesis on rumors. It’s just futile.

There may be a takeover, there may not be.

You and I are not privy to the news, and by the time we are, it’s a done deal and the market would reflect that.

The Li market is currently in the doldrums though, and China is reducing it’s subsidies and support to the EV industry, so correspondingly, I’d think there’d be less interest downstream in acquiring such mining assets.

As for Turner’s divestment, well, it’s really peanuts (quantum is something like $80k) and on top of that, it’s not a direct stake, but a disposable of his spouse’s stake.

There can be a million and 1 reasons for doing so, all of which has nothing to do with a rumored takeover.

Yes, I cannot think of a reason for a name change, but tbh, I’m not that interested.

Cos if you’re banking on a takeover and delisting, it’s pretty much just throwing a dice and gambling at this stage.

There are SOOO many other arbitrage plays with higher certainty, more visibility and better returns… why risk it at AMA?

Let me share one:

I currently have a small vested position (newly vested) in Spark Therapeutics (ONCE)

Go check it out.

If the Roche takeover is approved, it’d be a very nice ROI within a very short period of time.

Cheers

TTI

LikeLike

Hi TTI,

Agreed with u :) thanks

Cheers

JohnnyDepp

LikeLike

Hi TTI,

Are u still holding on Alliance Mineral or have cut loss?

Cheers

JohnnyDepp

LikeLike

Hi JohnnyDepp

I’m still holding unfortunately, but wouldn’t mind cutting loss here. I’ve only briefly followed up on what’s happening, and Mark as usual, makes tons of promises, but execution is really poor.

The only silver lining for me is that this is a puny position; any 1 of my US positions would dwarf this.

Sometimes… we have to trust our gut. I wrote tons of negative stuff about AMA in IN 18mths ago, but believed the company’s story on under explored assets and high quality lithium spodumene.

Big mistake.

Both are true, but the execution of the management has been disappointing.

Cheers

TTI

LikeLike

Hi TTI,

Thanks for your reply. Appreciate it. Unfortunately it’s not a puny position for me. Sigh not sure whether I got the guts to cut loss. The whole market sentiment is bad with lithium supply glut. Yea agreed on their poor execution.

Cheers

JohnnyDepp

LikeLike

Hi JohnnyDepp

Hmm, sry to hear that.

Not sure when you got in, or how much your portfolio is affected % wise, but there’s a guy Luan Boo, who’s like AMA’s number 1 investor/friend. You can perhaps chat with him, he went on the site visit and stuff, so may know a bit more.

My main gripe with the management is that they had an offtake agreement when the prices were rising, and Mark is on record then, saying that they are very comfortable not being able to participate with the rise in Lithium prices as the offtake locked in their prices, but in turn, they can visibility in terms of their production.

When prices tanked, they had to renegotiate the agreement and changed the offtake price into a floating market price!

I mean, what the hell is the use of an offtake agreement then, if you can’t participate on the upside, and when things go south, it gets scrapped?!

They are incredible lousy negotiators, and have the cheek to ask SHs to approve their generous remuneration.

Bleh.

Real glad I kept my position small enough to not lose sleep over, but this doesn’t make me feel much better.

If you are managing a commodities market, and you cannot predict the direction of the demand-supply, well, it’s not great, but you can make excuses for that.

But if you have an offtake and you can negotiate it away for next to no benefits, then go ask SHs for approval for generous remuneration…

the cheek these guys have!

LikeLike

Hi TTI,

No worries. Thanks for suggesting Luan Boo. Yea I read his blog too. Both Alita and Geo are in my portfolio. Have to hold it through. Alita recently got hammered down even more. Their cashflow not looking good.

Cheers

JohnnyDepp

LikeLike

I took profit on Geo since the start of the year, as part of my plan to divest out of SG markets.

Still holding onto just 100,000 shares currently.

LikeLike

Yes u are shifting to US/Global markets. Thanks for sharing.

LikeLike