You guys have no idea how often I get asked non-investing questions about my schedule, so here’s TTI’s life on a Sat, coupled with some exciting commentary to entertain you.

7AM: RISE AND SHINE

8AM – 1PM: WORK

Yes, I work on Saturdays. Actually, some Sundays too, if there’s nothing recreational that I have on. My wife jokes that our helper gets more off days than me, which is true. Unlike most employees who are on a 5 day work week now (and there’s talk of a 4 day one), I don’t fit the mold of most people.

No, I don’t feel angsty, neither do I feel that I lack “work life balance”, and neither do I feel stressed or like I’m going crazy or whatever it is that most people that are unhappy with their working lives, feel. And on that rare occasion when I do feel that way, well, I just take time off to recharge and re-energize.

I can understand why most salaried employees distinguish between work and personal lives clearly, and feel they need their own “me time” though. It’s cos most folks are just a cog in the entire machinery, so work is really very much time based. They don’t see the results of their labor, and maybe, don’t even have much impact on the overall results. And perhaps, the results also don’t give them adequate returns in terms of compensation. Or at least, that is what they feel.

And if work is just time based, then you’d be inclined to judge and think of your work in terms of days. I don’t. My work is goals/results based. I want to achieve certain self imposed targets, and if this is what’s needed to get the job done, I’d do it. With a big smile. Just let me achieve what I set out to do.

All work and no play really would make TTI a dull boy though, so I compensate by taking a lot more long overseas holidays than the average dude would take in any given year. Yeah, travel with family is my 1 vice.

So when I’m not having fun, I’d like to get back down to the serious business of getting work done.

That’s just how it is with me. I don’t like to sit around in restaurants on a lazy sunday for long brunches, I don’t like to walk around in malls aimlessly window shopping, I don’t like to go cafe hopping, I don’t like to go to the movies (unless it is a movie treat for my kids, in which case, that’s different), I don’t like to lie on the couch and watch Netflix, I don’t like to do a lot of things that the average Singaporean does at weekends. The only Netflix I ever had was their shares. All those activities are a waste of time in my opinion, and my time is very valuable and costs a lot of money.

Work hard, Play hard. Don’t just work gently, play gently. Do it… hardcore. Go all out when working, but go all out when playing too. That’s maximum productivity, even in the business of fun.

1.30PM – 3.30PM: LUNCH WITH INVESTINGNOTE SUPERSTAR INVESTOR VINCENT WONG

Hosted IN buddy Vincent Wong to lunch, and we had a good catch up. The last time we did a physical meet up was a number of years back, definitely pre-pandemic.

I’m really pleased to hear that he has made tremendous progress in his personal career and development in the years since we last met, and Vincent is now a research analyst. The last time we met, Vincent was a cook in Apple HQ, and I remember he was telling me his plans then. Since then, it’s almost perfect execution as he did what he said he would.

So in future, if anyone tells me something can’t be done, I’m going to cite this dude as an example. If something is a key priority for you, you’d move mountains to get it done. If something is not a priority, even if God moves the mountains for you, you still won’t get it done.

It’s as simple as that.

I like to hear of buddies and people around me who have done well in their lives and careers. It genuinely makes me feel happy. Why? Well, cos 近朱者赤,近墨者黑, 近财者huat.

Also, I think SG desperately needs more go-getters. The current populace, and the direction of society in general, makes me… very disappointed. I think we have become victims of our decades of success, and a lot of folks have lost the energy, responsibility, enterprise and invincibility of the past. Or rather, they just never had it in them because good times is all they ever knew.

For a long while, we were the Spartans. Now, we have finally reached the Battle of Thermopylae moment.

As a research analyst, we can soon expect to see more research pieces from Vincent. I’m told that his 1st piece will be landing soon on Monday, and it’d be on Geo Energy. So look out for it. This is a company that I used to own, so I’m pretty familiar with it, albeit with data that’s at least 6, 7 years old. Still, we had a good chat and shared tidbits of info with each other.

I think some of the more seasoned InvestingNote users would know Vincent Wong, cos he’s 1 of the higher profile, rare superinvestors, with a verifiable, fairly long term track record of success in the investosphere. Note the word in bold.

It was a Greek restaurant, but I just had the craving for some carbonara. Can tell I’m in the Greek mythology mood eh.

4PM – 5PM: TRACK KID’S PROGRESS

I don’t necessarily execute on some of my plans for my kids directly… but I do track and monitor progress and set goals. If required, I make changes to drive results.

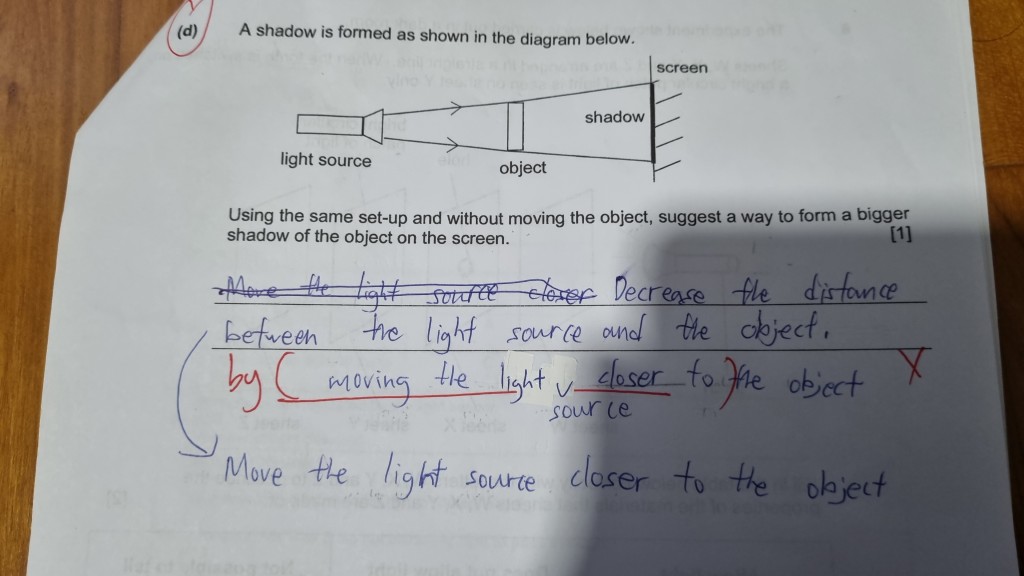

Also, I don’t agree with a lot of the stuff ongoing in our education system currently. For example, check out this question:

Now, isn’t “decrease the distance” essentially the same as “move the light source closer to the object”?

OK, I get that “decrease the distance” could also refer to moving the object and not moving the light source, but the question already said “without moving the object” right?

The essence of the reply shows that the concept is understood, and it’s really just a matter of phrasing.

If this was done in real life, like say, if it was a conversation between 2 people, this answer would be easily understood. But it’s marked wrong simply cos there’s an “answer key”, and the answer didn’t match this answer key.

If real life works based on “answer keys”, then all of us would be rich already, by just keying in some company metrics in a spreadsheet and investing based on fixed rules.

Nonsense la. But it is what it is, so the kids have to learn how to reply not just based on logic, but based on what is EXPECTED.

530PM – 630PM: SOCCER

Compared to 20years ago…

Speed -80%

Stamina -60%

Ball Control -20%

Pass Accuracy -10%

Aesthetics of boots +50%

7PM – 8PM: DINNER + BIRTHDAY

Self explanatory. LOL.

I’m low-key a bit impressed that my daughter can write “May your birthday be every bit as lovely and delightful as you”.

Her ang moh is not bad for an 8 yr old.

Result of being a voracious reader.

8PM – 10PM: TRAVEL PLANNING

After much planning, my 2023 travel plans are pretty much cast in stone.

Last year, I polled a bunch of random strangers to decide where I’d go: (https://thumbtackinvestor.wordpress.com/2022/11/27/thumbtack-fund-report-12-no-longer-a-teenager/)

This year, it’s going to be:

April/May – South Korea

June – Sri Lanka

December – Hokkaido, Japan

And for 2024 Summer, I’m thinking of going to kick around in what is the dubbed the chioest soccer pitch in the world. Guess where?

Hint: It’s somewhere in Scandinavia.

10PM – 1AM: PORTFOLIO UPDATES/MANAGEMENT

Finally, when everybody goes to bed, this is when I sit down and assess what has transpired to TTF 1 & TTF 2.

Last week has NOT been a fun week, investing wise.

Although I don’t have any direct exposure to Silicon Valley Bank, TTF 1 alone tanked 200k USD. The significant drop was due to 1 stupid mistake I made, so I can’t even blame it on the market sentiment. Basically, I look out for some specific conditions, and if I find it, I then verify against the financials of the companies and start doing my due diligence.

The problem this time around was that I found the same conditions, in a company that I previously invested in, but this time around, I assumed the conditions and numbers wouldn’t have changed much since it was just a few months ago when I did my DD, so I didn’t really verify and rethink it again.

Big mistake. In short, I got sloppy.

It happens when you’re working at 3am after a long day.

Of course, some of that drop has to be chalked up to general market weakness on the back of SVB’s abrupt failure too.

What’s more worrisome is that the loss of depositor monies is real. https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/silicon-valley.html

“All depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.”

This means that only the $250k would be paid out immediately as part of the insured deposit. But $250k is a really pathetic amount for businesses. Selling assets and trying to go for an orderly liquidation is a tall task for FDIC, especially in the current climate. It’d possibly take several months, if ever, to get this done.

I’m sure FDIC is already working overtime over the weekends to try to secure buyers for bit and pieces of Silicon Valley Bank.

After FDIC manages to liquidate the bank, the depositors would probably be paid first, followed by the bank creditors, then the preferred shareholders, and finally, the shareholders.

Read: Shareholders probably get nothing in the end.

Personally, I don’t think there’d be widespread systemic contagion, cos the FDIC seems to be trigger happy these days, but there would certainly be pain to be felt in certain sectors and certain companies. And though there won’t be contagion in my opinion, I don’t think we get back to hunky dory, “risk on” days anytime soon.

Despite TTF dropping a freaking 200k USD last week, it’s really a mere annoyance to me rather than anything fatal. TTF is still up a massive +23% YTD, and still boasting a CAGR of over 30% over multiple years, and across good and bad markets.

I’m also quietly confident that my competitive edge still exists, and it’s getting sharper by the day as I hone it repeatedly, so I’m going to violently snatch this $200k USD back from Mr Market before 2023 is over.